New Yorkers are famously competitive, but one title we’re happy to lose is being the country’s least affordable housing market. According to a recently published report, California cities take the gold, silver, and bronze medals among the least affordable home buying markets, with the Big Apple coming in fourth.

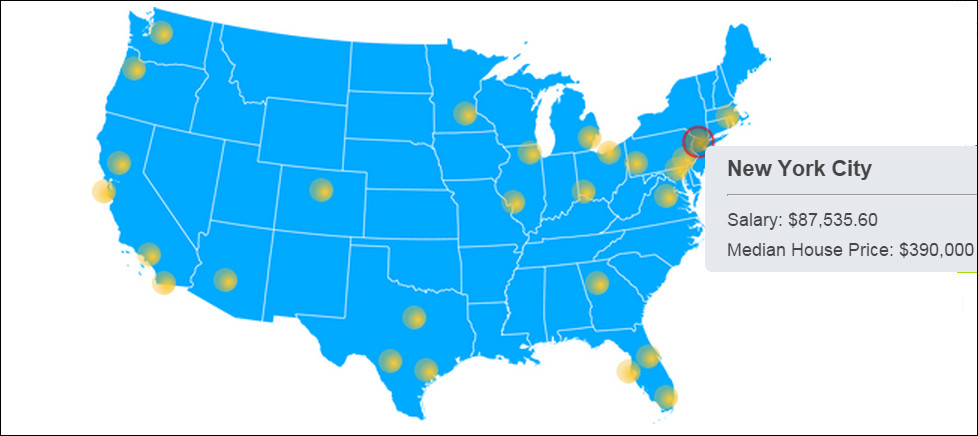

The report calculates that a household in New York would need to make a salary of $87,535.60 to afford the mortgage principal, interest, tax and insurance payment each month on a home with the median sale price of $390,000.

These findings likely overstate the affordability of purchasing a home within New York City. The report uses New York metro-wide data, where the median home sale price is lower than in the city proper. Since demand to live in New York City is quite high, home prices tend to be higher here as well. According to the New York City Department of Finance, the median sales price of homes in 2014 was $492,000, which is considerably more than the referenced metro median of $390,000.

Incomes are just as important as home prices in the affordability equation, and here too New York City comes up short. The median household income in New York City was $52,223 in 2013, compared to $63,982 across the greater New York region. According to StreetEasy estimates, the median household income in New York City will grow to $55,303 in 2015, roughly 37 percent less than the report’s metro-level income.

Whichever way you view the data, the reality is that homeownership is unaffordable to the vast majority of New Yorkers. Flagging income growth and high real estate prices are the key reasons why homeownership will remain out of reach for many New Yorkers who wish to buy a home.

Affordability will likely be impacted by a rise in interest rates, which is largely expected to happen later this year. An increase in rates is a double-edged sword for home buyers. On the down side, even a slight increase in borrowing costs could put homeownership even more out of reach to some hopeful buyers who were on the fence. On the upside, banks may be induced to lend more and lift the tight credit standards that have been in place since the collapse of the housing market in 2008. Should the Fed announce an interest rate hike – however slight – expect competition for homes to be particularly fierce this spring as home buyers rush to lock in financing before the revised rate goes into effect.

The same forces that make the for-sale market unaffordable are at play in the rental market as well: slow income growth, rising housing costs, and a significant imbalance between housing demand and available supply. StreetEasy estimates that the typical new renter in New York City will spend 58 percent of their income on rent in 2015, with new renters in Brooklyn bearing the highest rent burden at 60 percent.

The key to solving the city’s unaffordability is to promote and encourage the development of additional housing supply. In some ways, New York City is a victim of its own success as people with big ideas young and old want to move to New York City. This constant churn of new energy is the lifeblood of the city. Without enough apartments to house them, however, housing prices will continue to rise and more and more people may find that if they can’t make it New York City – they can make it elsewhere.