The Manhattan and Brooklyn sales markets emerged from the slower winter months slightly more expensive than last year, according to the most recent market data by StreetEasy. While inventory grew slightly in Manhattan, it continued to fall in Brooklyn, allowing prices to grow at a considerably faster pace there than in Manhattan. As affordability looms heavy over New York households, relatively lower-priced homes in East Brooklyn and Upper Manhattan led the two boroughs in annual price growth in the first quarter; a strong sign that a growing number of buyers are seeking value in these areas of the city.

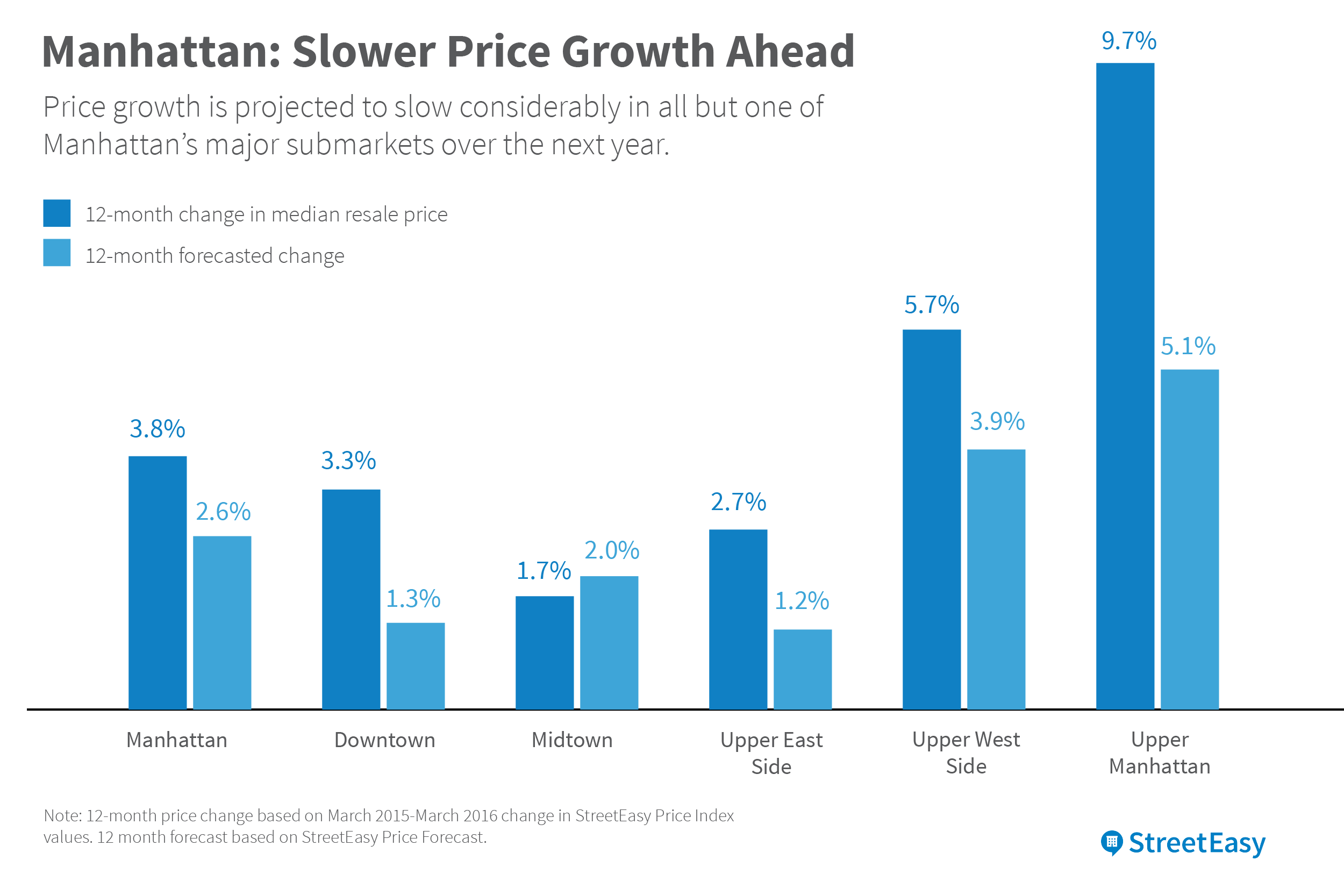

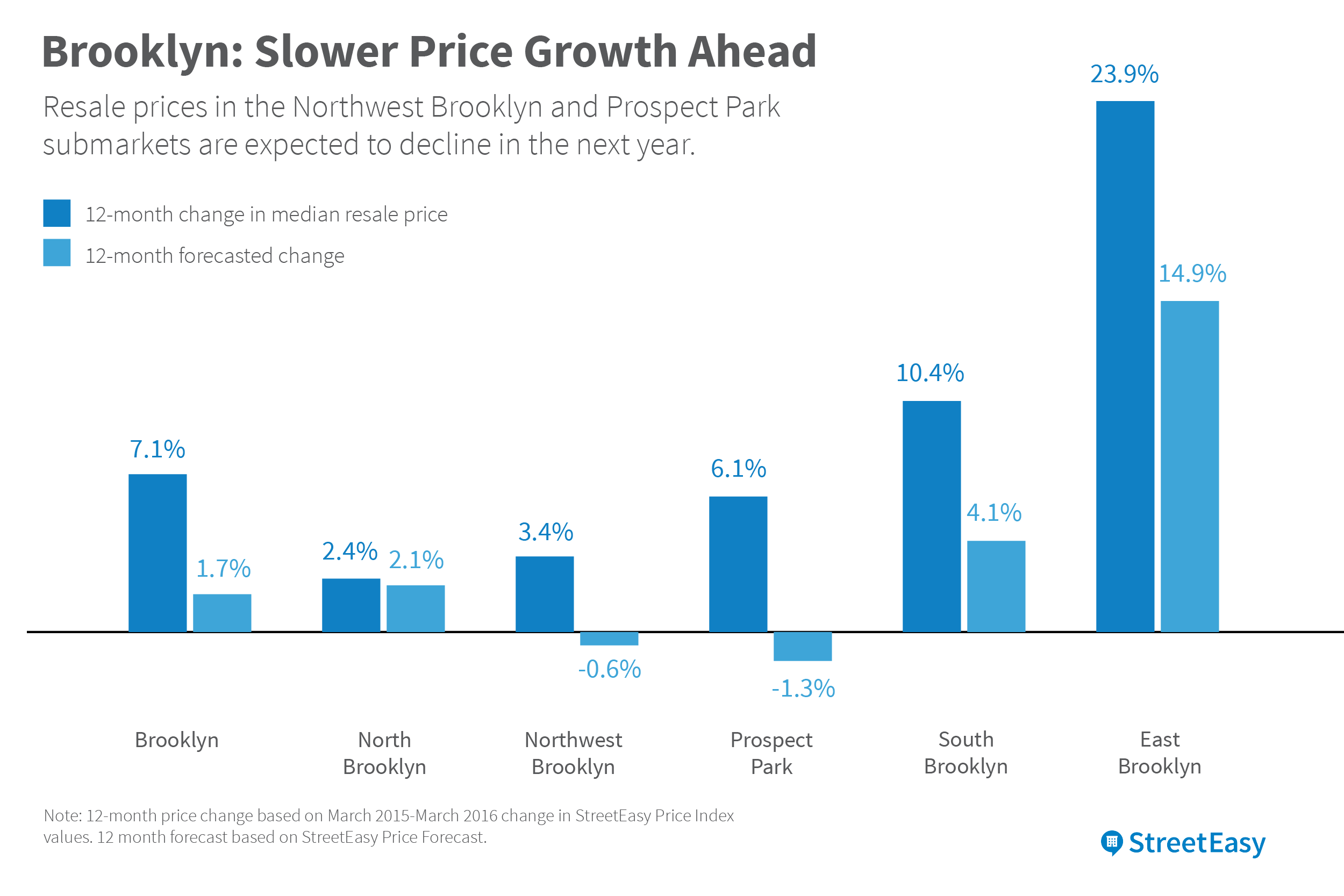

Despite the competitive nature of the sales markets in both boroughs, price appreciation continues to lose steam. According to StreetEasy projections, all major submarkets will experience lower price growth over the next 12 months, some even experiencing negative growth, as we move past the cyclical peak of sales prices.

Luxury Sales Market Continues Decline in Manhattan

The median resale price in Manhattan increased 3.8 percent from last year to $978,765, according to the StreetEasy Price Indices[1]. The strongest growth was once again in Upper Manhattan – which has shown the highest annual increase since October 2014 – where the median resale price increased 9.7 percent from last year to $629,383 in March 2016. It was followed by Upper West Side (5.7 percent), Downtown (3.3 percent), Upper East Side (2.7 percent), and Midtown (1.7 percent).

The median resale price in Brooklyn increased 7.1 percent from last year to $545,330, according to the StreetEasy Price Indices. The strongest growth was in the East Brooklyn submarket, which includes Crown Heights, Bedford-Stuyvesant, Brownsville and East New York. The median resale price of all homes within these neighborhoods increased 23.9 percent from last year to $481,25 in March. It was followed by South Brooklyn (10.4 percent), Prospect Park (6.1 percent) Northwest Brooklyn (3.4percent), and North Brooklyn (2.4 percent).

Price growth was considerably lower within the luxury tier in both boroughs than in the overall sales market[2]. In Manhattan, the median resale price of homes within the luxury tier grew by just 0.2 percent from last year to $3.25 million. These homes took more time to sell as well. Homes within the luxury tier that went into contract in the first quarter typically spent 113 days on the market, an increase of 22 days from last year. By contrast, all Manhattan homes that went into contract in the first quarter typically spent 63 days on the market, an increase of 5 days.

The trend was also seen among Brooklyn luxury homes. Homes within the luxury tier that went into contract in the first quarter typically spent 73 days on the market, an increase of 24 days from last year. By contrast, all Brooklyn homes that went into contract in the first quarter typically spent 58 days on the market, an increase of 5 days from last year.

[tableau server=”public.tableau.com” workbook=”priceIndices” view=”StreetEasyPriceIndex” tabs=”no” toolbar=”no” revert=”” refresh=”yes” linktarget=”” width=”600px” height=”770px”][/tableau]

Although Price Growth Slows, Sellers Get More Disciplined with Price

Although the pace of price appreciation has slowed across Manhattan and Brooklyn, sellers were able to get more of their initial asking price in the first quarter than last year, all while conceding fewer discounts. The median sale-to-list price ratio in Manhattan was 98.5 percent in the first quarter, meaning Manhattan sellers received 98.5 percent of their initial asking price. This is an increase from 97.7 percent last year. In the red-hot Upper Manhattan submarket, where growing demand has put upward pressure on prices and competition among buyers, the median rent-to income ratio was 100 percent. In an additional sign that sellers exerted more price discipline, the share of all sales inventory that saw a price cut during the first quarter declined from 31.2 percent in 2015 to 27.6 percent. The typical price cut also declined from 6.9 percent in 2015 to 6.7 percent.

In Brooklyn, the median sale-to-list price ratio was 98.2 percent in the first quarter, unchanged from last year. In the East Brooklyn submarket, which experienced the highest annual growth in resale price among all submarkets in Manhattan and Brooklyn, the median sale-to-list price ratio was 100 percent, indicating sellers typically received all of their initial asking price. The share of all sales inventory that saw a price cut during the first quarter declined from 24.1 percent in 2015 to 22.7 percent. The typical price cut was 6.0 percent, unchanged from last year.

Rental Markets Remain as Competitive as Last Year

The Manhattan rental market was just as competitive in Q1 compared to last year amid strong rent price growth across the borough. The median rent price increased 2.5 percent from last year to $3,226, according to the StreetEasy Rent Indices[3]. Annual growth was the strongest in the Upper West Side submarket (4.1 percent), followed by Upper East Side (3.3 percent), Midtown (2.9 percent), Upper Manhattan (2.7 percent), and Downtown (1.6 percent).

While rent prices continued to climb, Manhattan apartments typically spent the same amount of time on market as last year. The median time on market for all rental apartments was 29 days, unchanged from last year. The share of all rental inventory that saw a price cut during the quarter increased from 31.4 percent in 2015 to 32.2 percent, while the typical price cut fell from 5.3 percent in 2015 to 5.1 percent.

The Brooklyn rental market was also just as competitive in Q1 compared to last year. The median rent price increased 0.7 percent to $2,834 at the close of the first quarter, according to the StreetEasy Rent Indices. Annual growth was the strongest in the Prospect Park submarket (2.4 percent), followed by Northwest Brooklyn (2.0 percent), and North Brooklyn (1.7 percent). The median rent price saw an annual decline in the South Brooklyn and East Brooklyn submarkets, according to the StreetEasy Rent Indices, declining 2.6 percent to $1,630 and 1.4 percent to $2,453, respectively.

The median time on market for all rental apartments was 24 days, unchanged from last year. One notable exception was North Brooklyn, where apartments typically spent four days longer on market than last year in a possible sign that uncertainty around a possible L-Train closure is impacting the desirability of Williamsburg rentals. The share of all Brooklyn rental inventory that saw a price cut during the quarter increased from 26.7 percent in 2015 to 29.0 percent, while the typical price cut fell from 5.6 percent in 2015 to 5.3 percent.

12-Month Outlook: Price Declines in Store for ‘Brownstone Brooklyn’

Sales prices are expected to slow considerably over the next 12 months across most submarkets in Manhattan and Brooklyn and decline modestly in parts of Brooklyn. The median resale price in the Northwest and Prospect Park submarkets, which include many neighborhoods in so-called “Brownstone Brooklyn,” is expected to fall by 0.6 percent and 1.3 percent, respectively, according to the StreetEasy Price Forecast[4]. Price growth over the next 12 months across all of Brooklyn is expected to slow to 1.7 percent, considerably slower than the 7.1 percent growth seen in the last 12 months. Growth will be led East Brooklyn (14.9 percent) followed by South Brooklyn (4.1 percent) and North Brooklyn (2.1 percent).

The median resale price in Manhattan is expected to grow by 2.6 percent over the next 12 months, compared to the 3.8 percent annual growth posted in March. Growth is expected to be led by Upper Manhattan (5.1 percent), followed by Upper West Side (3.9 percent), Midtown (2.0 percent), Downtown (1.3 percent) and Upper East Side (1.2 percent).

[1] The StreetEasy Price Indices are monthly indices that track changes in resale price of condo, co-op and townhouse units. Click here for full methodology.

[2] The luxury tier is derived from a 12-month weighted moving average of recorded sales prices at the 90th percentile (the top 10 percent of homes).

[3] The StreetEasy Rent Indices are monthly indices that track changes in rent price within all housing types. Click here for full methodology.

[4] The StreetEasy Price Forecast predict the change in resale prices 12 momths out from the current reporting method. Click here for full methodology.