The New York City rentals market was bustling during the third quarter. Citywide, rent prices continued to trend upward with the median asking rent reaching $2,699 — about $100 short of the pre-pandemic highs around $2,800. Talk of massive price hikes and bidding wars is discouraging for renters. But our Q3 Market Report data shows that there are still many neighborhoods with great deals and prices well below what they were before the pandemic. Calling all bargain hunters — here’s where there are still affordable rentals in NYC.

The Most Affordable Rentals in NYC Are Staying Affordable

The city’s most affordable rentals (the bottom 20% of the market, asking around $1,950 per month) have seen the slowest rate of rent increases over the past year. According to the StreetEasy Rent Index, prices for the most affordable rentals in Manhattan were still 9% lower than pre-pandemic levels during the third quarter.

Manhattan Rentals Under $2,500 on StreetEasy Article continues below

NYC Neighborhoods Where Rents Have Exceeded Pre-Pandemic Levels

The most expensive rentals (the top 20% of the market, asking around $6,333 per month) are nearly back to pre-pandemic prices, though. Their Rent Index is only 2% lower than where prices were in the third quarter of 2019. This data is reflected on the neighborhood level as well. Some of the most expensive neighborhoods in the city, like Flatiron and Williamsburg, have already reached (or nearly reached) their pre-pandemic highs.

Manhattan Neighborhoods Where Rents Are Still Below Pre-Pandemic Levels

We see a different phenomenon in other areas, though. For example, affordable NYC rentals are still available on the Upper West and Upper East Sides of Manhattan. Rents are still relatively low in these neighborhoods compared to two years ago (during the third quarter of 2019, before the pandemic). On the Upper East Side, the median asking rent was $2,600 during Q3 2021. In Q3 2019 it was $350 higher at $2,950. Similarly, on the Upper West Side, the median asking rent was $3,200. That’s $200 lower than it was in 2019.

Those aren’t the only popular Manhattan neighborhoods where deals still exist. Here are a few other great areas where rents are cheaper now than they were before the pandemic:

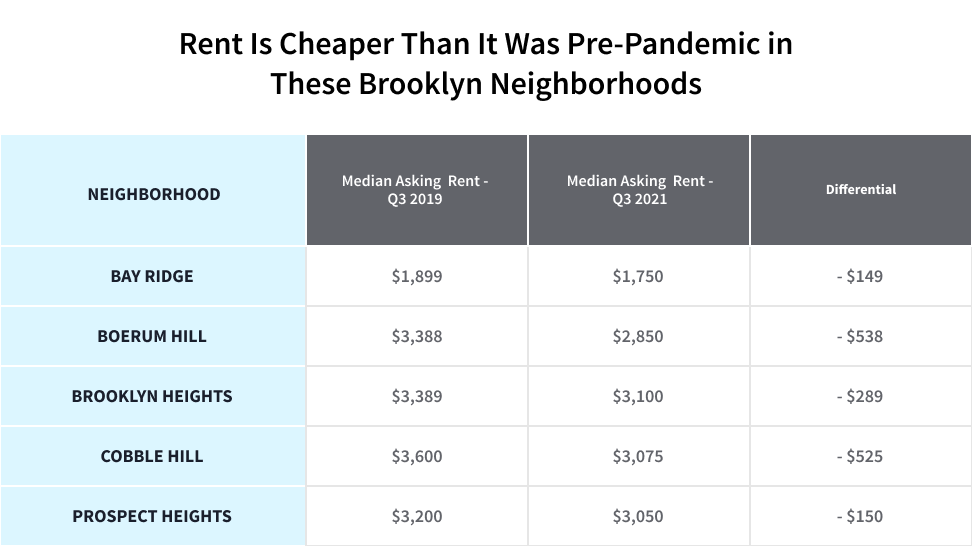

Brooklyn Neighborhoods Where Rents Are Still Below Pre-Pandemic Levels

The Brooklyn market has been hot all year for both rentals and sales. Apartment hunters should expect prices to keep climbing, and potentially reach pre-pandemic levels soon. However, outside of some of the most expensive and popular areas mentioned earlier, like Greenpoint and Williamsburg, renters can still find great deals in many areas of Brooklyn.

Here are a few popular neighborhoods with median rents that are deals compared to before the pandemic:

Queens Neighborhoods Where Rents Are Still Below Pre-Pandemic Levels

In addition to areas in Brooklyn and Manhattan, Queens still has plenty of affordable NYC rentals as well. Even Northwest Queens, the most expensive submarket and home to Astoria and Long Island City, has not seen prices return to pre-pandemic levels just yet. In Q3 2021, the median asking rent was $2,300. That’s still $200 short of the pre-pandemic high of $2,500.

Some Landlords Are Asking for Lower Rents

Of note, the median asking rent does not incorporate lease renewal prices. Some landlords are using the market recovery to their advantage and raising prices where and when they can. But that’s not the case for every apartment. In fact, there are still a number of affordable NYC rentals being offered for less now than they were the last time they were listed.

For instance, this 1-bedroom Yorkville rental right off of First Avenue is asking $2,250. That’s even lower than back in 2014, when the asking rent was $2,295. And this 1-bedroom in Cobble Hill was asking $3,300 per month in 2019. Currently, it’s listed for $2,800 — a $500 difference.

“Interest in living in New York City is stronger than ever,” says StreetEasy economist Nancy Wu. “And the highly mobile renters who can afford the most expensive areas are doing everything they can to snag a lease in the neighborhood of their choosing. The strong demand for these areas is driving rent prices up, and will continue to do so until winter, when fewer renters typically enter the market.”

But don’t be discouraged. “Those with a lower budget should not be deterred from searching right now, even among talk that the market is busier than ever,” Wu says. “But do keep in mind, with the demand we’re currently seeing, renters should always assume there is someone else vying for the same apartment. Use all the tools at your disposal to your advantage during the rental search to help save you time and money.”

Read on for more about the rentals market in Manhattan, Brooklyn, and Queens.

The Manhattan Rental Market Is On Its Way to Recovery

- The median asking rent in Manhattan was $3,050 in Q3 2021 — still down from $3,400 in Q3 2019.

- The rental Inventory was down 44% from its peak last summer, with 20,377 rentals on the market.

- The share of apartments with a concession was at 22.4% in Q3 2021, down from 42.8% in Q1 2021.

Brooklyn Rents Are Only $95 Short of Their Pre-Pandemic Peak

- The median asking rent in Brooklyn was $2,600 in Q3 2021 — just $95 below the pre-pandemic peak set in Q3 2019.

- The rental inventory was down 36.3% from its peak last summer, with 34,636 rentals on the market.

- The share of apartments with a concession was at 17.5% in Q3 2021, down from 24.9% in Q1 2021.

Queens Has the Lowest Share of Concessions

- The median asking rent in Queens was $2,200 in Q3 2021 — $100 short of the pre-pandemic peak set in Q3 2019.

- The rental inventory was down 16.2% from last year, with 13,356 rentals on the market.

- The share of apartments with a concession was at 17.1% in Q3 2021, down from 26.8% in Q2 2021.

View all StreetEasy Market Reports for Manhattan, Brooklyn, and Queens, with additional neighborhood data and graphics. Definitions of StreetEasy’s metrics and monthly data from each report can be explored and downloaded via the StreetEasy Data Dashboard.

Editor’s Note: In March 2020, New York City’s housing market temporarily froze as the COVID-19 pandemic began in the U.S. in earnest. Stay-at-home orders were widespread. Year-over-year data comparisons over the next few months will be made against both the COVID freeze of the spring, and subsequent housing recovery that began last fall. Assuming 2021 is more typical of a “normal” year in housing than 2020 was, with little to no activity in the spring and summer, we expect many of our year-over-year measures will show large gains over last spring and summer. We urge you to use caution in extrapolating too much from year-over-year measures in coming months, and we will always try to provide appropriate context to anchor reported changes in metrics to what is normal or expected.