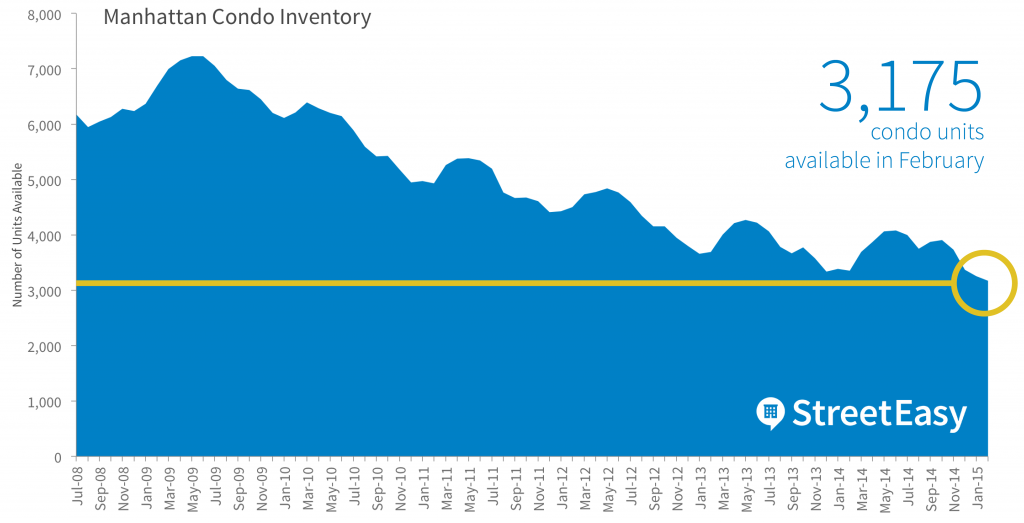

It has been a steady downward slide for Manhattan condo inventory since the market experienced its peak level in June 2009. Since peak, the number of units available on the market has fallen by 56.1 percent, and as freezing temperatures and ice pounded the New York region in February, the market didn’t get any relief and condo inventory continued a 4-month decline. Total units available fell 2.4 percent from January to the lowest level recorded by StreetEasy (3,175 units). It is typical to see seasonal boosts to inventory during the busy spring months, but none of these annual boosts have resulted in a long-term increase.

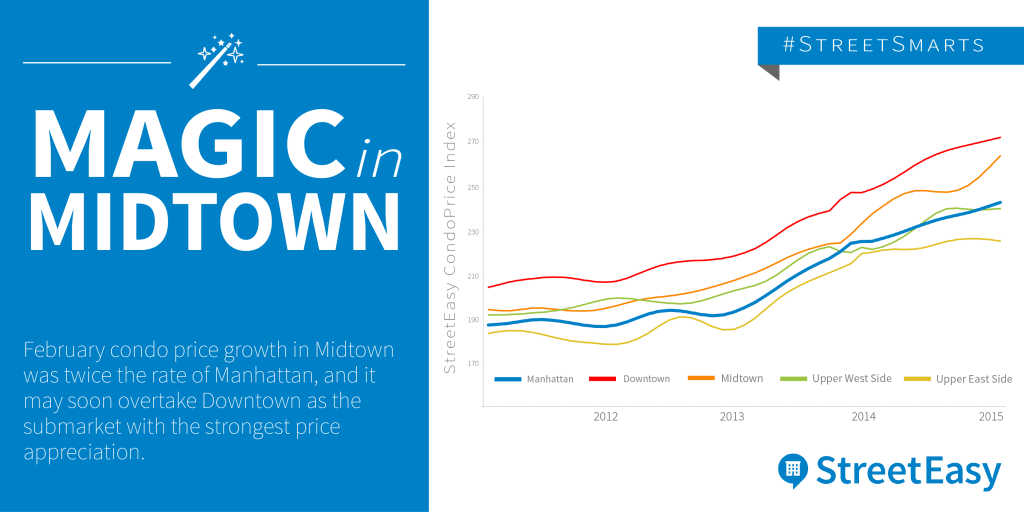

February condo prices grew by 7.8 percent from last year, according to the StreetEasy Condo Price Index (SECPI). Buoyed by ever-shrinking supply, condo prices closed the month 12.6 percent above previous peak prices set in September 2007. February was the 27th consecutive month of monthly price growth, pointing to the strength of the market amid constrained supply and resilient demand for Manhattan real estate.

Condos in the Midtown submarket showed the greatest monthly price growth in February (1.9 percent), more than doubling the Manhattan growth rate and closing the month 11 percent higher than last year. Midtown also outperformed the rest of the borough in inventory growth. Whereas all other submarkets saw inventory declines in February, the number of condo units in Midtown increased by 10.5 percent.

Condo prices in the Downtown submarket continue to be the highest at 12.1 percent above the Manhattan-wide level. According to the StreetEasy Condo Price Forecast, condo prices are expected to grow by 3.9 percent in 2015 – significantly less than the 2014 growth rate (7.1 percent) and the robust growth rate of 2013 (16.6 percent).

As mentioned above, pending sales activity defied the cold weather in February. Monthly sales volume surged 27.5 percent over the course of the month, rebounding from the market freeze in January, typically the slowest month of the year. Condos that went into contract sold at a brisk pace, taking a median time of 62 days to sell. This was a reduction of 20 days from January, the largest one-month reduction in 12 months.

February was an early ‘spring cleaning’ for the condo market. With a healthy increase in pending sales activity and a significant decline in time on market, inventory fell to a record low level (3,175 units). Historically, the spring boost in inventory begins in earnest in March.

Download a PDF of the full report here.