In 2012, Hurricane Sandy brought unprecedented flooding to New York City, destroying homes, property, and infrastructure and racking up $19 billion in damages. Residents who had never considered buying flood insurance incurred hefty costs to repair and rebuild. Hurricane Ida’s record rainfall in September 2021, as well as the September 2023 flooding caused by the remnants of Tropical Storm Ophelia, reinforced the reality that NYC is not immune to the unpredictable dynamics of climate change.

These events probably have you thinking about how you can protect yourself, and your property, from the next flood that hits the city. Let’s talk about flood insurance, and what New Yorkers should know about it.

Flood Awareness and Flood Insurance Are Important

In a city where concerns about extreme flooding were once reasonably low, the past decade has forced us to enter a new and critical era of flood awareness. In October 2021, the NYC Mayor’s Office of Climate & Environmental Justice released The New Normal: Combating Storm-Related Extreme Weather in New York City, a landmark report describing a new reality for the Big Apple. The bottom line: it’s crucial for all New York City residents to understand their current and future flood risk — and consider purchasing flood insurance.

Manhattan Rentals Under $3,000 on StreetEasy Article continues below

Do You Need Flood Insurance in NYC? How to Know Your Risk

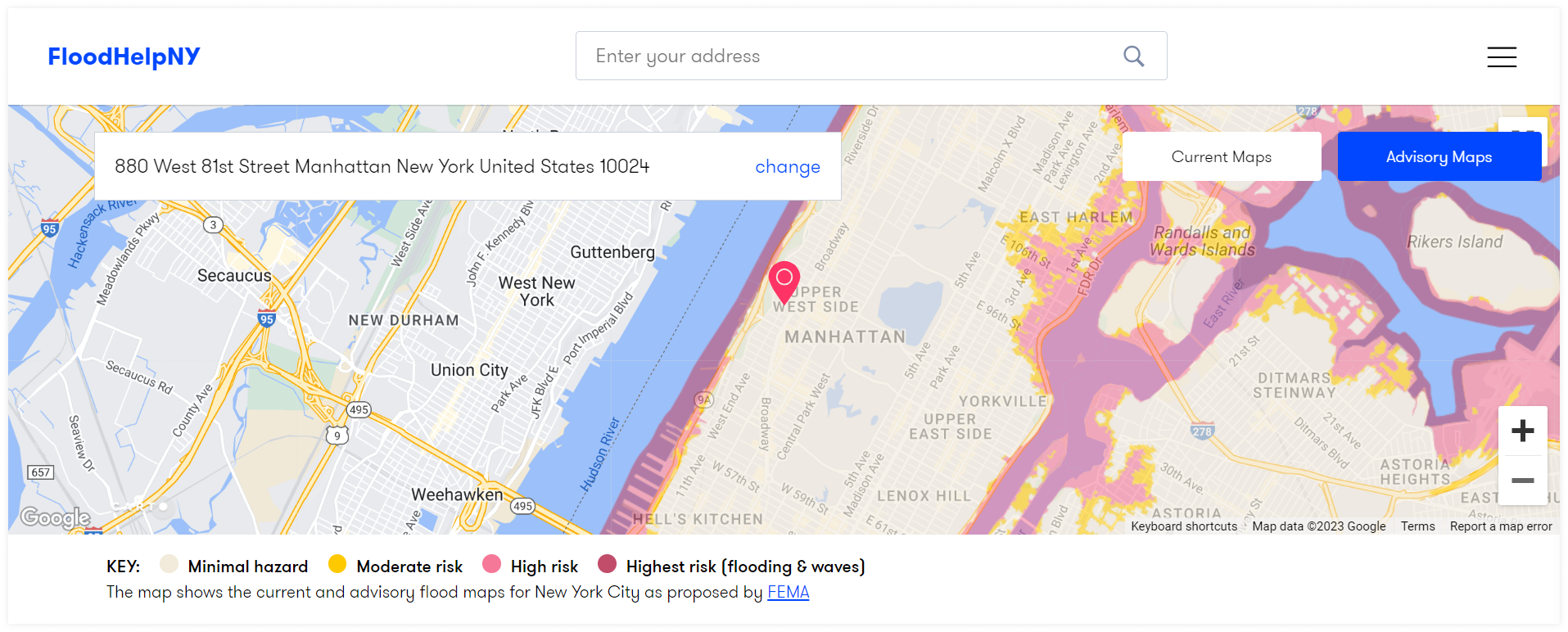

How can you find out what your flood risk is? A great place to start is at Flood Help NY. The site outlines in clear language how New Yorkers can assess their flood risk and insurance requirements, and what you can do to be “flood-safe”. Type in your home address to access an interactive map that will indicate your flood risk: minimal hazard, moderate risk, high risk, or highest risk.

Assessing the flood risk for your NYC home, whether it’s owned or rented, isn’t merely an educational exercise. It tells you if you need, or are even required, to have a flood insurance policy. For instance, if you own a home in a high-risk or highest-risk flood area and have a government-backed mortgage, you’re required to have flood insurance.

Manhattan Homes Under $800K on StreetEasy Article continues below

What to Know About NYC’s Flood Maps

The Federal Emergency Management Agency (FEMA) is in charge of drawing the nation’s flood maps. These maps are used to determine flood risks and set premium standards for flood insurance, and FEMA updates its maps as more information becomes available. The release of new, adjusted flood maps over time is likely to result in expanding New York’s flood zones, which means even more New Yorkers will be required to purchase flood insurance.

“The impetus for NYC residents to obtain flood insurance is to provide them with a means to rebuild if their home is subject to flooding. As we saw with Hurricane Ida, where it rains, it can flood. Flooding is the most common and costly natural disaster in the United States. One inch of water can cause $25,000 in damage,” says Michael Foley, Chief Risk Analyst for FEMA.

More New Yorkers should consider flood insurance regardless of whether they’re in a high flood risk zone. According to FEMA, more than 20% of National Flood Insurance Program (NFIP) claims happen in areas not designated as high flood risk areas. Also, flood insurance will pay claims regardless of whether there is a Presidential Disaster Declaration. Lastly, the average flood insurance claim is nearly $30,000, and does not have to be repaid.

Brooklyn Rentals Under $3,000 on StreetEasy Article continues below

Where to Purchase NYC Flood Insurance

FEMA manages the National Flood Insurance Program (NFIP), a network of over 50 insurance companies and the NFIP Direct, which provides flood insurance to homeowners, renters, and businesses. The program’s website offers a helpful tool to find participating providers in your area, from which you can buy a flood insurance policy.

In addition to flood insurance via the NFIP, many private insurers have started offering flood insurance. New York-based brokerages like Coastal Insurance can provide guidance and quotes for private flood insurance. Other private insurers like Neptune, Chubb, and National General are some of the top choices for New Yorkers, and may provide more coverage than an NFIP policy.

“Some private market insurers simplify the definition of flooding so that your coverage is seamless, leaving no space between your home insurance policy’s exclusions and where your flood coverage begins,” says David Clausen, CEO of Coastal Insurance.

Clausen adds that coverage for your home’s contents could be provided at replacement cost with private flood insurance:

“That means you won’t have a deduction for depreciation in many cases. Deductibles may be higher with private flood insurance, however, and for some homes, the safety of a FEMA-backed policy may be a better fit. Fortunately, homeowners in many areas now have a choice,” Clausen says.

Why You Should Take Precautions Now

If you do, in fact, need flood insurance, it’s better to get it sooner rather than later. First, locking in your flood insurance rates could help cap your exposure to future rate increases. That’s not the same as having existing rates “grandfathered in,” as previously allowed.

“Grandfathering (lower rates) is being phased out,” Foley says. “The Homeowner Flood Insurance Affordability Act of 2014 limits annual premium increases. This means, for existing policyholders, if their risk-based premium is higher than their current premium, annual premium increases will be capped at 18%. If a policyholder’s premium goes down under the new pricing methodology, their premium will go down immediately at renewal.”

Secondly, it takes 30 days from the time of purchase for flood insurance to take effect — meaning you can’t find out a big storm is coming and then go buy coverage in a hurry.

What About Homeowner’s Insurance? Does It Cover Flooding?

Most NYC home buyers know that to close on a home loan, banks or lending institutions require purchasing homeowner’s insurance. This is how banks protect their investment against fire and other damage.

However, homeowner’s insurance will not protect against flooding due to a weather event. For example, a burst pipe or overflowing bathtub is likely a part of a general homeowner’s insurance policy, but damage from a storm like Sandy is not. That’s why buyers with federally-backed mortgages on homes in high-risk flood areas are required to buy flood insurance — and why it’s a good idea regardless of the requirements.

Renters Need Flood Insurance, Too

Flood insurance is not just for homeowners and businesses. If you’re a renter and live in a high-risk flood zone, you can purchase a policy from the NFIP to cover contents of up to $100K. Visit floodsmart.gov for all the essential information, and to buy a policy from a participating provider. Private insurers will offer coverage for contents over $800K.

Similarly to homeowner’s insurance, a traditional renter’s insurance policy won’t cover your personal property and contents during a weather-related flood event, but an NFIP policy will. The cost of the policy is based on several factors, including the flood risk of the building in which you live.

Parisa Afkhami, an agent with Coldwell Banker Warburg, affirms that renters need to be proactive, whether they’re buying flood insurance or adding coverage for wind-driven rain or other water damage.

“Every person, whether they’re a homeowner or renter, should have adequate flood insurance. Often renters overlook this or don’t think this is necessary for an apartment building,” Afkhami says.

How to Find Out If You Live in a Hurricane Evacuation Zone

To find out if you live in a hurricane evacuation zone, head to New York City’s interactive Hurricane Evacuation Zone Finder and enter your address.

Zones are color-coded and labeled 1 through 6, with Zone 1 being a “red zone” where flooding is most likely to occur. The site also provides information on the closest evacuation center, including the distance and time you’ll need to get to safe ground.

The city recommends sheltering with friends or family located out of the most dangerous zones (aka, having a “hurricane party”). However, information about evacuation centers is provided, including their capacity, services, and handicap accessibility.

What to Do If Your Apartment Floods

Up-to-the-minute information is critical for dealing with a flooding emergency. If you live in New York City, take a moment right now and register for Notify NYC, the city’s official emergency communications program.

Other preparations include assembling a “go bag” with a change of clothes, prescription medications, and anything else critical to your immediate needs. It can also be helpful to have a battery-operated AM/FM radio tuned to a local station to receive emergency alerts and announcements, should you lose power and/or cell service. See more tips on being prepared and staying safe during a flood.