The month of May resulted in a tempered finale to the busy spring selling season for the Manhattan condo market, as total inventory fell unexpectedly from April, allowing prices to remain high.

The total number of condo units available for sale in May declined 2.8 percent from April to 3,778 units. The decline in inventory was due in part to a significant reduction in newly listed condos over the course of the month. There were 748 newly listed condo units in May, a sharp 19.9 percent decline from the record number of newly listed units that entered the market in April. May’s decline in inventory was unexpected since the market posted modest monthly growth in each of the previous four May periods.

Manhattan condo prices remained high despite the pace of price growth slowing in recent months. Prices among condo resales grew by just 0.1 percent from April according to the StreetEasy Condo Price Index. Price declines in Manhattan’s two largest submarkets, Downtown and Midtown, pulled Manhattan-wide price growth closer to zero despite healthy price gains in the remaining submarkets. Condo resales in the Downtown and Midtown submarkets saw price depreciation in May, declining 0.7 percent and 0.4 percent from April, respectively. The Upper East Side and Upper West Side markets, by contrast, saw resale prices grow by 0.3 percent and 2.4 percent, respectively. Manhattan-wide condo resale prices are expected to post no growth in June, according to the StreetEasy Condo Price Forecast, which projects a 0.0 percent growth rate.

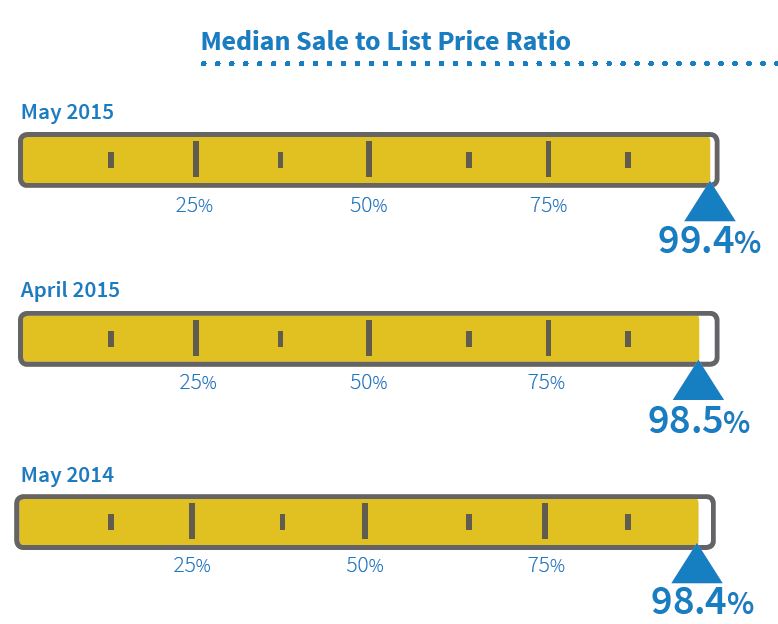

New to the StreetEasy Manhattan Condo Market Report this month is the sale-to-list price ratio, which provides insight on the relationship between asking prices and final sales prices. The median sale-to-list price ratio in Manhattan was 99.4 percent in May, meaning the typical sale price among condos that closed in May was 99.4 percent of the initial asking price. A constricted supply of condos has helped sellers to get a greater share of their initial asking price as buyers vie for a smaller pool of available units. Midtown West and Lower East Side both had sale-to-list price ratios above 100 percent in May (100.1 percent and 104.9 percent, respectively), indicating that the vast majority of sales that closed in those neighborhoods sold at prices above the initial asking price.

Pending sales volume in May declined 6.7 percent from April and closed the month 9.4 percent lower than last year. Despite the contraction in sales activity, demand remained high as the median time on market fell sharply from April, indicating that buyers are still moving quickly to close on available units. The median time on market in May declined six days from April to 43 days, which was also one day less than this same time last year.

The May monthly numbers point to a condo market that is increasingly expensive and difficult to enter. Home buyers in Manhattan can expect fierce competition as the supply of units continues to shrink and sellers maintain the relative bargaining power. As we enter the relatively slow summer months, lower inventory may help to keep prices at or near their current levels, but the recent trend in deceleration may help to bring prices down slightly.

Download a PDF of the full report with additional analysis and graphics here.