Imagine you’re cruising along, looking at rental listings for around $2,300, which is close to the top of your budget. You click on an apartment you love, but it’s asking $2,377, just slightly over what you want to pay. But look — the listing description says something about “net-effective rent on a 13-month lease.” What does “net-effective rent” mean, and what’s the deal with a 13-month lease?

What Is Net-Effective Rent?

Essentially, “net-effective rent” is the total gross rent for the entire term of a lease divided by every month period, including free months or other promotions. Net-effective rent figures arise from rent concessions, such as one or two free months on a lease. They’re a way to attract tenants to a listing — but they can be one of NYC’s rental gotchas.

New on StreetEasy: Simpler Pricing on Rentals With Concessions

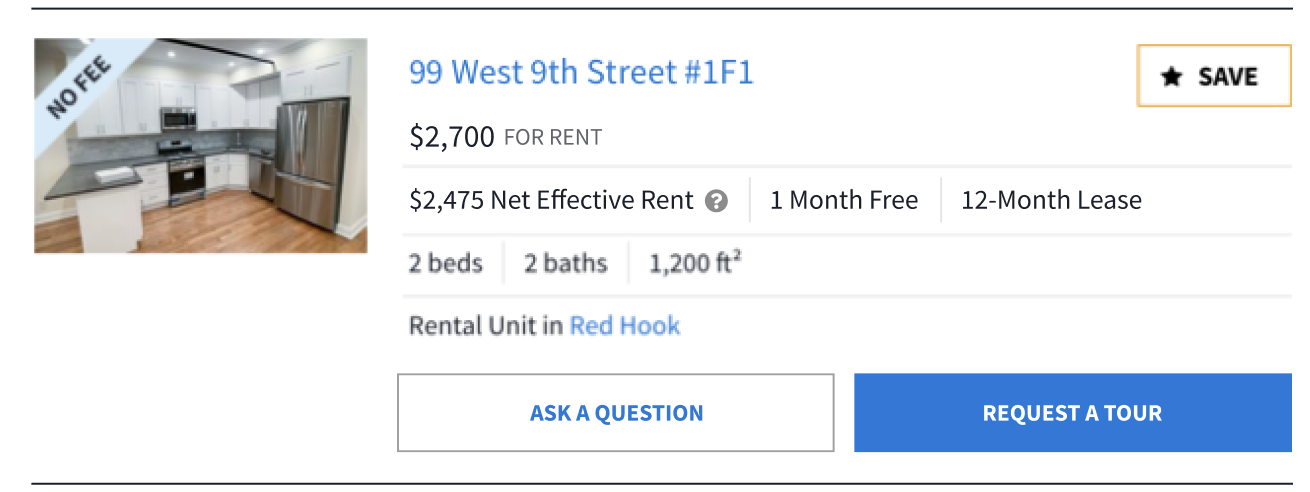

Landlord concessions and net-effective rents can be confusing. That’s why StreetEasy listings now show transparent pricing for any rentals with an offered concession. Beginning September 2, 2020, new rental listings on StreetEasy will plainly state whether the unit includes any concessions, such as one or two months free on a given lease term. The listing will also show the gross rent — aka the “real” rent — along with the net effective rent, as calculated based on the specific concession. This way, you’ll know whether a special offering applies, and what that offer means for how much you’ll likely pay.

StreetEasy’s new transparent pricing shows the gross rent (here, $2,700), the net-effective rent ($2,475), and the exact terms of the offered concession (one month free on a 12-month lease).

You’ll Likely Pay More Per Month Than the ‘Net-Effective’ Rate

The main thing to know is that the number displayed as the “net-effective rent” is very likely lower than the amount you’ll write a check for every month.

Net-effective rent is calculated by dividing the total cost of a lease with a concession across all the months of the lease, even if one or two of those are free. See the math below for an illustration of how this works, but basically, the “net-effective” rate distributes the discount from one free month of rent across all the other non-free months of a lease. Again, the total lease amount is accurate, but with one of those months free, the rent bill for every other month will actually be higher than the net-effective rate.

The other issue with net-effective rents is that the concessions that create them usually only last for your first lease. If you renew your lease on the apartment without another concession, you’ll be paying the higher monthly rate for good, and your total annual spending on rent will go up. If you’re not on guard, you can find yourself paying significantly more than you may have expected.

How to Calculate the Real Rent From a Net-Effective Rate

Say the unit you like offers a net-effective rent of $2,377 per month on a 13-month lease with one month free. The total cost of the full lease would be $2,377 per month times 13 months, or $30,901.

But the actual rate for that apartment on a standard 12-month lease, with no concession, would be $30,901 divided by 12, or $2,575. Depending on the terms of your lease, you may have to write a check for $2,575 every month, not $2,377, and skip one month altogether.

To find the actual rent for any apartment advertising a net-effective rate, multiply the net-effective number by the total number of months of the lease. Then divide that figure by the number of paid months of the lease.

Let’s say there’s an apartment offering a net-effective rent of $1,977 on a 12-month lease with one month free. To find out how much you’d likely be paying, do this calculation:

$1,977 per month times 12 months total equals $23,724

then:

$23,724 total for the lease divided by 11 months paid equals an actual monthly rent of $2,157

Yes, it’s confusing, and it makes apartments seem cheaper than they’ll likely feel month-to-month. Some landlords may allow you to write a check for the net-effective rate, but more likely, a net-effective rent means that your actual monthly outlay will be higher.

Manhattan Rentals Under $2,700 on StreetEasy Article continues below

What Happens to a Discounted Rent When the Lease Is Up?

When your first lease on the apartment is up and it’s time to renew, the landlord likely will not offer the same concession of one or two months free. So in the first example above, you’d be paying $2,575 per month — or more, if the landlord hikes the rent — for the next year.

If you can’t afford the new cost, this means you’d need to move at the end of 13 months, and would therefore incur moving charges, potential deductions to your security fees, and so on. That is, unless you can negotiate a deal with your landlord — because after all, they will also need to scramble to find a tenant, risking an empty apartment and no income for month or two.

Brooklyn Rentals Under $2,500 on StreetEasy Article continues below

Read Your Lease Before Signing and Be Clear About What You Owe

Read every lease closely to understand what the actual monthly rent payment is and when any rent concessions end. If you are a good tenant in a building owned and operated by a small company or a family, the landlord might consider keeping the rent at the same rate or close to it. If you’re in a building operated by a larger company, it wouldn’t be wise to expect that. However, it’s in the best interest of all landlords to keep their apartments filled and reduce costs for cleaning, repairs and advertising the property.

[This article has been updated and republished.]