In 2023, a typical white household could afford five times as many market-rate rental listings in New York City as a typical Black household, and seven times as many as a Hispanic household, according to StreetEasy® data combined with the Census Bureau’s American Community Survey (ACS) data.

We define “affordable” homes as rentals that cost less than 50% of a household’s combined income, a commonly accepted threshold of “severe” rent burden by federal and local housing agencies. NYC has traditionally been a tough market for all renters. Nearly one in three renters (32%) spent more than half of their income on rent in 2021, a slight increase from 30% in 2011 according to the NYC Housing Vacancy Survey.

As asking rents set new records in March of this year at $3,344, even fewer homes were within reach across the city. About one in three citywide market-rate rental listings (37%) between January and March this year were affordable for a typical household earning NYC’s combined median income of $70,663. During the same period in 2019, about one in two rental listings (51%) were affordable to New Yorkers.

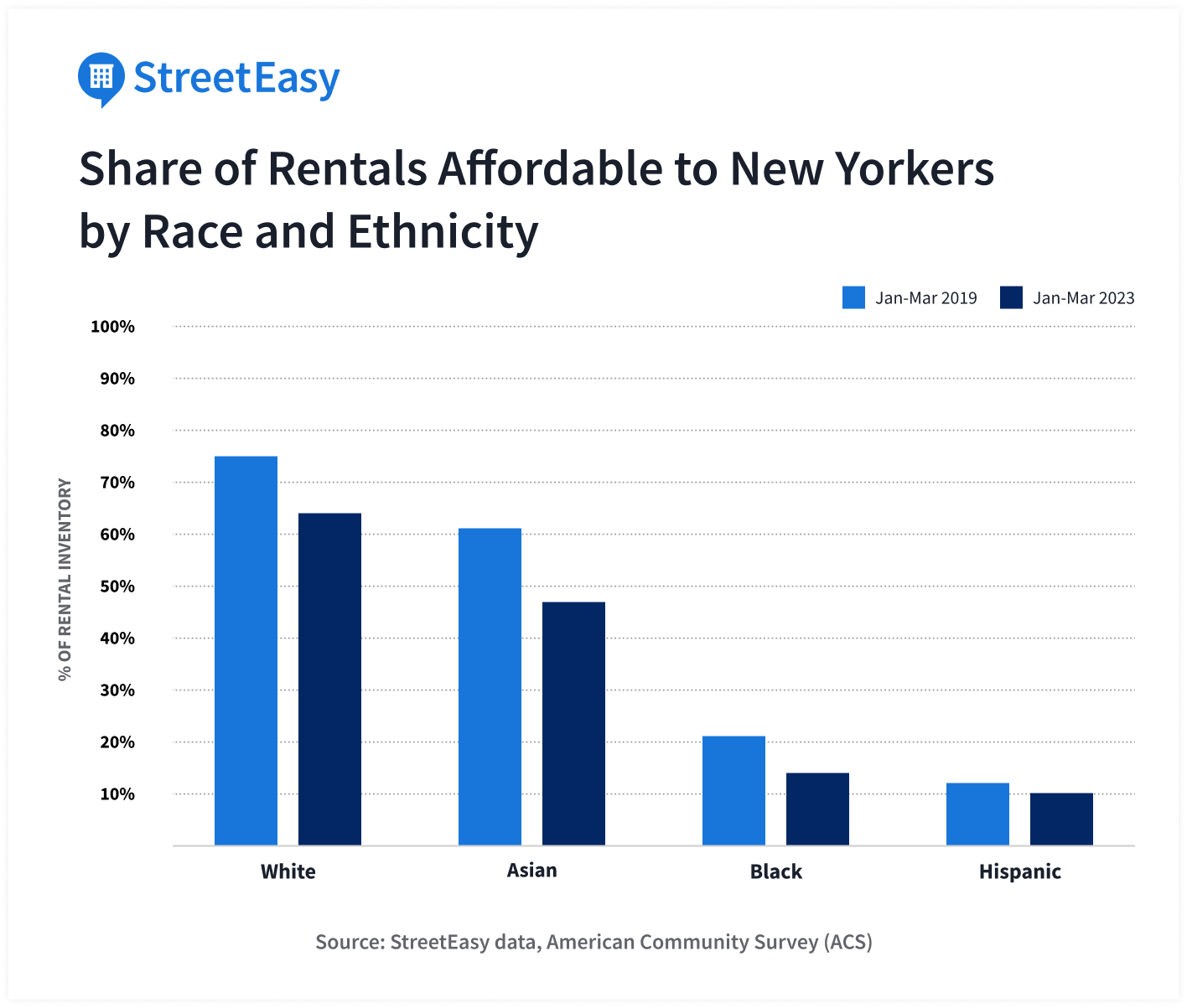

Due to wide disparities in income, the effects of rising rents have not been felt equally across races and ethnicities. This year, New Yorkers earning the median white household income ($93,919) can afford 64% of the city’s rental inventory, a decline from 75% in 2019. Those earning the median Black ($53,075) and Hispanic ($49,275) household income can afford only 14% and 10% of the market-rate rental inventory this year, respectively. This is a decline from 21% and 12% in 2019. Those earning the median Asian household income ($76,832) can afford 47% of available inventory, a decline from 61% in 2019.

The decline in rental affordability has been more severe for Black New Yorkers earning the median Black household income, with rents taking up a higher share of their income. Based on the median household income, for every 10 apartments that are affordable to white New Yorkers, only two are affordable to Black New Yorkers without spending more than half of their income on rent. This is down from 2019 when three apartments were affordable to Black New Yorkers for every 10 affordable to white New Yorkers.

Based on the median income for Black households in NYC, only 1% of rentals were affordable to Black New Yorkers this year in Downtown and Midtown Manhattan neighborhoods without spending more than 50% of their income on rent. Many of the more affordable apartments to Black New Yorkers and other renters of color earning the median household income are located in neighborhoods with longer commutes to Manhattan, such as Bay Ridge and Flatbush in Brooklyn and Briarwood and Flushing in Queens.

Elevated Rent Burdens Set Back Renters of Color on Their Journey to Homeownership

The racial gap in rental affordability is rooted in decades-old disparities in wealth and income. Based on median income, typical Black and Hispanic households in NYC earned 57 cents and 52 cents, respectively, per every dollar a white household earned between 2017 and 2021. Sadly, this earnings disparity has changed little over the past decade. As a result, soaring rents last year disproportionately affected non-white households in the city, leaving them with less funds for other necessities like food, healthcare, and utilities, and limiting their ability to save for long-term financial goals such as higher education and a down payment.

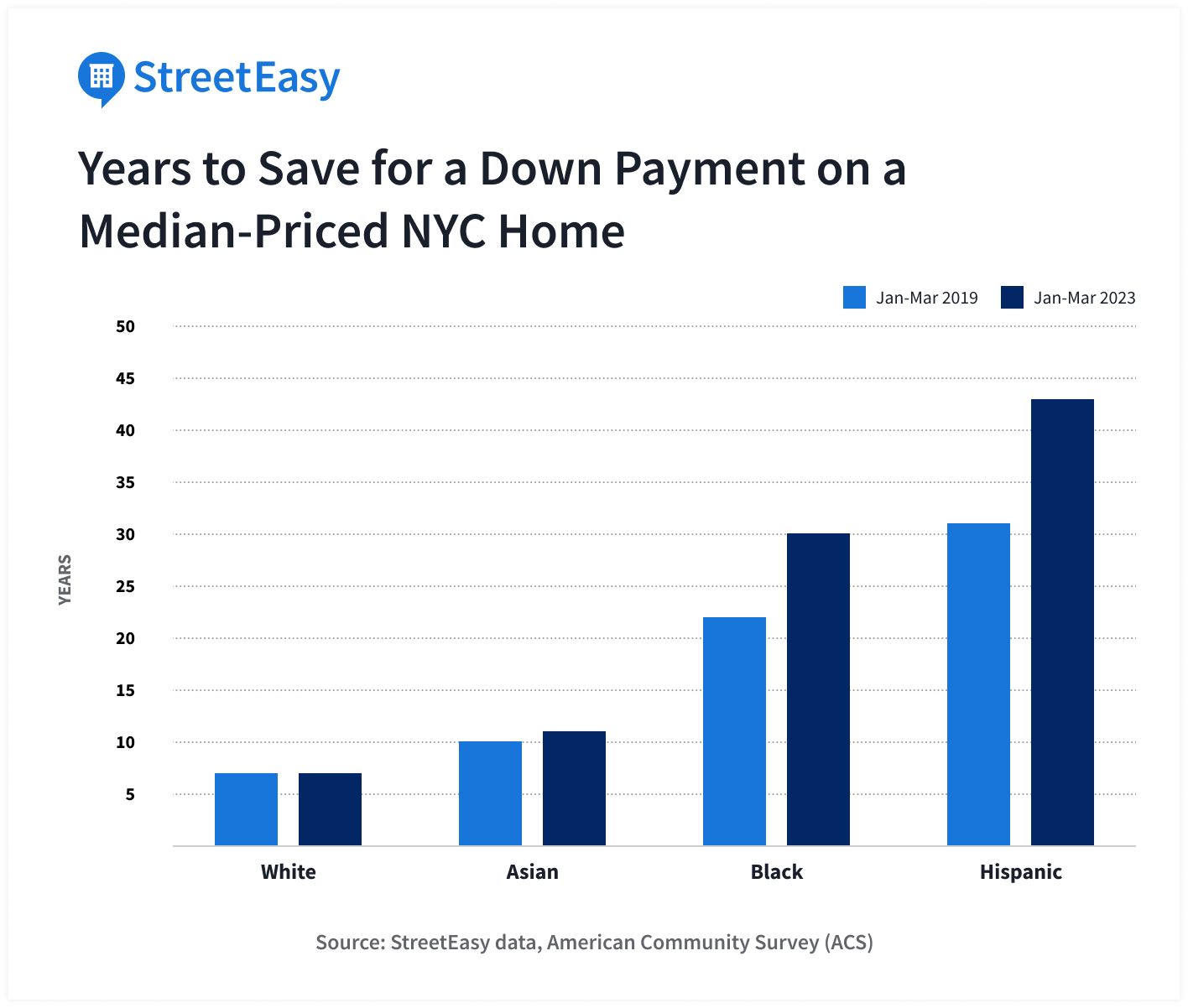

As higher rents eat up larger shares of New Yorkers’ incomes, saving for a down payment has become even more difficult. The latest StreetEasy data shows that, after paying rent, it would take seven years for those earning the median white household income in NYC to save for a 20% down payment on a median-priced home in the city. Compared to white households, it would take Black and Hispanic New Yorkers earning the median household income 30 and 42 years, respectively, to save for a down payment on the same median-priced home. With elevated rent burdens, homeownership has become increasingly out of reach for Black and Hispanic households in the city relative to white New Yorkers.

The Racial Gap in Homeownership Is Many Years in the Making

Years of systemic inequities in the housing market have led to a wide racial gap in homeownership. Decades ago, institutionalized redlining laid the foundation for a deeply unequal housing experience for non-white and white Americans.

Moreover, disparities in mortgage issuance play a role in the racial homeownership gap to this day. An analysis of Home Mortgage Disclosure Act (HMDA) data showed the mortgage denial rate across the country was 84% higher for Black applicants than white applicants in 2020. Today, 39% of white households in NYC are homeowners, compared to 27% of Black and 17% of Hispanic households.

Lower homeownership rates for Black and Hispanic households contribute to further widening the racial wealth gap, by locking them out of the opportunity to accumulate family wealth through real estate. Research by Federal Reserve staff recently estimated that average Black and Hispanic households have only about 15 to 20% as much net wealth as the average white household in the United States, and that intergenerational wealth transfers make up a large share of total household wealth. This disparity makes it more difficult for parents to pass down homes to their children or provide them with down payment assistance, widening the racial gap in homeownership across generations.

NYC Homes Under $750K on StreetEasy Article continues below

What’s Next?

A major contributing factor in the affordability crisis is the lack of housing supply, which has been driven by a chronic underproduction of new homes. New York City’s affordability crisis has been more than a decade in the making. The city added more than 500,000 private sector jobs but created only 300,000 homes between 2011 and 2021, according to the NYC Housing Vacancy Survey, meaning the city is currently missing more than 200,000 homes to meet demand — and this figure is only growing. In a survey by Zillow, StreetEasy’s parent company, economists and housing experts agree that zoning reform to allow more housing is one of the best long-term solutions to the affordability crisis. A previous analysis by Zillow found that creating more affordable homes in duplexes, triplexes, and small to medium-sized multifamily buildings — otherwise known as the “missing middle” — can create more racially diverse neighborhoods. Moreover, Zillow surveys have found that such measures are largely supported by New Yorkers and across the nation as a solution for creating more affordable housing in local communities.

Getting more people — especially Black and Hispanic individuals — into the formal credit system, allowing them to build a strong credit history, can help mitigate challenges faced by renters. A credit check is often a required step for those looking for a rental, and these communities have historically had a lack of equitable credit opportunities. Zillow research based on the credit insecurity data by the Federal Reserve Bank of New York showed 9.7% of Black households and 7.9% of Hispanic households nationwide live in areas with a high prevalence of low credit scores or no credit histories, compared to 2.7% of white households. According to Zillow’s Consumer Housing Trends Report, nearly half of white renters (46%) say they were completely certain they would qualify for a rental, compared to 38% of Hispanic renters and 34% of Black renters.

Strengthening rental assistance programs can help low-income New Yorkers access affordable housing in a neighborhood of their choice. The majority of the city’s rental assistance is provided through the Section 8 Housing Choice Voucher (HCV) program that extends federal subsidies to supplement rental costs. StreetEasy data indicates the number of homes potentially affordable to voucher holders in NYC has more than tripled since 2020 to 12,193 homes in January and February 2023.[1] However, many renters with vouchers still struggle to find rentals due to cumbersome processes and source of income discrimination.

NYC Rentals Under $2,500 on StreetEasy Article continues below

Saving for a down payment and budgeting for monthly mortgage payments can be daunting. While putting down 20% of the purchase price is common to lower monthly mortgage payments and build home equity, it is not mandatory unless specifically required by the building. New Yorkers struggling to break into homeownership should be aware of the numerous mortgage assistance programs that allow NYC buyers to put down less than 20% without extra costs. For example, the State of New York Mortgage Agency (SONYMA) offers a Low Interest Rate Program for low- and moderate-income first-time home buyers at a lower down payment requirement of 3%. SONYMA’s Homes for Veterans Program offers discounted rates and waives the first-time homebuyer requirement for veterans. And the city’s HomeFirst Down Payment Assistance Program offers qualified first-time buyers up to $100,000 toward a down payment or closing costs, with just a 3% minimum down payment required.

Data Sources and Methodology

To estimate the share of market-rate rentals that are affordable to New Yorkers, we used StreetEasy listing data and annual household incomes from the Census Bureau’s American Community Survey (ACS) five-year estimates. We define “affordable” homes as rentals that cost less than half of household income, which most federal and local housing agencies consider the threshold of severe rent burden. Household income includes pre-tax cash income of all people 15 years and older living together in the same housing unit, whether or not they are related to each other by family relationship.

We used median household income by race and ethnicity from the 2017-2021 ACS, the latest available survey, to calculate the share of affordable rentals this year (January to March 2023) for timeliness. Median is the point that divides all household incomes evenly into halves, above and below this halfway point. Given that we assumed household median household income remained unchanged from 2017 to 2021, the actual shares of affordable rentals by race and ethnicity this year may be higher. Rental affordability in 2019 was calculated with 2014-2019 ACS and StreetEasy data from January to March 2019 for comparability, as housing data tends to be highly seasonal.

The number of years to save is calculated as the total amount of time it takes to accumulate a 20% down payment on a median-priced home in NYC, for a household earning the citywide median household income by race and ethnicity. We assume that a household pays the citywide median asking rent and saves half their remaining income for the 20% down payment without any financial assistance.

We calculated the number of homes affordable to Section 8 voucher holders based on the Housing Choice Voucher payment standards published by NYC Housing Preservation and Development (HPD), which define the maximum amount of subsidy the city will pay in a particular zip code depending on the number of bedrooms. In this context, we define an affordable home to renters with vouchers as any rental property with asking rents less than or equal to the payment standards provided by HPD. To expand housing opportunities for voucher holders, HPD sets exception payment standards in zip codes that are traditionally more expensive to allow the subsidies to more closely match local markets. In these areas, we used exception payment standards according to the HPD policy.

Some voucher holders can afford more than the payment standard with additional income. They are permitted to pay out of pocket to rent a home with asking rents above the payment standard or exception payment standard. However, HPD does not allow the tenants to spend more than 40% of their income. In our analysis, we assume voucher holders rely entirely on the subsidy. Therefore, the actual number of voucher-affordable apartments in NYC will be somewhat larger than what’s included in this analysis.

©2023 StreetEasy®. StreetEasy is a registered trademark of MFTB Holdco, Inc., a Zillow affiliate

Disclaimer: The information provided is intended for informational purposes only. Although the information provided herein has been obtained from sources which the author believes to be reliable, there is no guarantee of accuracy, and such information may be incomplete or condensed.