Key Takeaways

- Brooklyn’s sponsor condo market outperformed other boroughs in Q4 2023, with a typical sponsor condo selling at 100% of its asking price

- The upper hand shifted quickly from sellers to buyers in the luxury sponsor condo market, with a typical sale receiving 92.3% of its initial asking price

- Median asking rents for amenity-rich rentals declined for the first time since 2021 as inventory rose sharply

- As wealthy New Yorkers increasingly consider renting over buying, the luxury rental market is heating up in NYC with Manhattan amenity-rich rentals taking the lead.

Brooklyn Is the Most Competitive Sponsor Condo Market

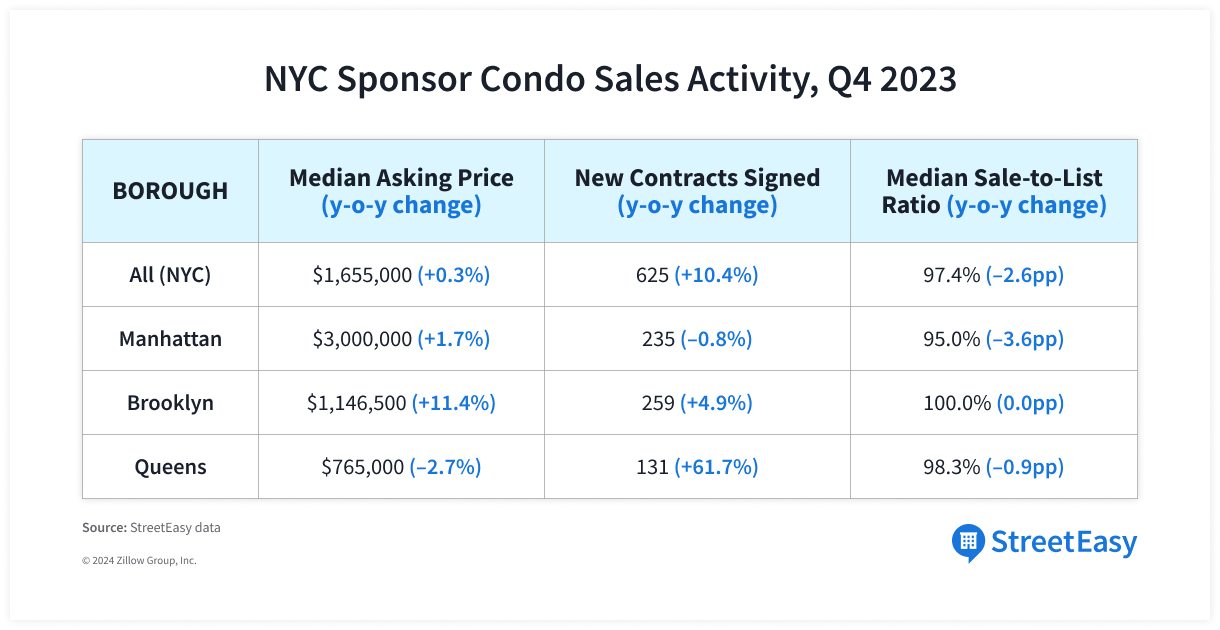

Across New York City, 625 sponsor condo units on StreetEasy® entered contract in Q4 2023 — 25.2% fewer than the previous quarter, but 10.4% more than a year ago. The decline from Q3 was broadly in line with the typical seasonal slowdown in sponsor condo sales activity.

The median asking price of all sponsor condos on the NYC market was steady at $1.655M in Q4 2023, a 0.3% increase from the year before. In Brooklyn, the sponsor condo median asking price soared 11.4% year-over-year to $1.147M, a stronger increase than in Manhattan (up 1.7% to $3M) and Queens (down 2.7% to $765,000).

Tight inventory and rising demand will support a strong sales market for sponsor condos in 2024. There were 2,371 sponsor condos on the market across the city in Q4 2023, down 5.7% year-over-year. In 2024, would-be buyers will increasingly consider new developments amid rising renovation costs, but new sponsor listings entering the market will remain low. As a result, sponsor units will be a hot commodity this year — one of StreetEasy’s NYC housing market predictions for 2024.

However, elevated mortgage rates and asking prices in the overall sales market have been limiting the pool of buyers who can afford to stay in the market. As a result, the remaining buyers in the market are gradually regaining negotiating power. A typical NYC sponsor condo sold in Q4 2023 received 97.4% of its initial asking price, slightly below 99.9% a year ago. That said, sponsor listings in Brooklyn continue to outperform those in other boroughs, with a typical sponsor condo receiving 100% of its initial asking price, the same as the year before.

Buyers Are Finding Most Room for Negotiation in the Luxury Sponsor Market

The city’s overall luxury market, including resales and sponsor unit sales, is rebalancing. Defined as the most expensive 10% of for-sale listings, the starting price of the luxury market was $4.95M in December 2023, up 10% from a year ago. Buyers are finding room for negotiation in the greater luxury market, but they’re finding even more room in the luxury sponsor condo market. Fewer listings are entering contract in this particular sector, with 51 new contracts in Q4 2023 — down 25% from a year ago — giving buyers extra leverage.

A typical luxury sponsor listing was sold at 92.3% of its initial asking price in Q4 2023, compared to 98% for non-luxury sponsor sales. It’s typical for highly priced homes to sell with larger discounts. However, the luxury sponsor market’s current median sale-to-list price ratio is far lower than its 97.1% in Q2 2023 and 98.7% in Q4 2022, suggesting the upper hand shifted quickly from sellers to buyers.

The median asking price of luxury sponsor condos on the NYC market was $7.95M in Q4 2023, up 10.4% year-over-year as expensive homes lingered on the market. Considering the widening gap between sale price and initial asking price in the luxury sponsor market, asking prices in this sector will likely decline this year.

The Luxury Rental Market Is Heating Up

As wealthy New Yorkers increasingly consider renting over buying, the “luxury” rental market is heating up, defined as the most expensive 10% of rental listings. The median asking rent of this segment was $8,750, up 2.9% from a year ago. Of the 6,317 luxury rentals on the market in Q4 2023, 41.7% were “amenity-rich” rentals, defined as those that offer in-unit laundry, a dishwasher, an elevator, and a doorman — the top four must-have amenities in NYC, based on StreetEasy search data — as well as a fitness center or pool in the building. This highly popular set of amenities is most often found in newly developed rental buildings and luxury condos.

The median asking rent of luxury amenity-rich rentals in NYC rose 2.9% year-over-year to $8,900 in Q4 2023, while the median net-effective rent — a calculation that distributes the discount from free months of rent across all other non-free months of a lease — jumped 2.5% to $8,671.

High asking prices and mortgage rates, in addition to continued economic and geopolitical uncertainties, are shifting potential buyers with high incomes into the rental market. This has led to enduring demand for luxury rentals in Manhattan, while in the sales market, luxury homes are taking longer to sell. As a result, there were fewer concessions in the borough’s luxury rental market: just 25.9% of these listings offered concessions in Q4 2023, compared to 33.3% among non-luxury rentals.

Median Asking Rents for Amenity-Rich Rentals Dipped for the First Time Since 2021

Unlike the luxury segment, the overall rental market is rebalancing in NYC. The median asking rent for all amenity-rich rentals in NYC fell 1% year-over-year to $5,000 in Q4 2023, the first decline since 2021.

Rising inventory is poised to ease competition among renters this year. There were 63,367 rentals on the market in Q4 2023, up 8.6% year-over-year. The number of amenity-rich rentals in particular is rising more rapidly than others, soaring 19.7% year-over-year to 9,393 units in Q4 2023. As a result, asking rents for amenity-rich rentals will continue to moderate this year, after peaking at $5,250 in Q2 2023.

In an early sign of rising competition among landlords, more amenity-rich rentals are offering concessions. In Q4 2023, about one in three (34.9%) amenity-rich rentals offered at least one month of free rent, the highest since Q3 2021. By comparison, only 14.1% of the remainder of rentals on the market offered concessions in Q4 of last year. When renter demand peaked in Q2 2022, just under one in five (19%) amenity-rich rentals offered concessions — although these types of rentals are generally more likely to offer concessions than others.

These rising concessions, combined with a decline in gross asking rents, are resulting in lower net-effective rents for amenity-rich rentals. They dropped 2% year-over-year to $4,880 in Q4 2023.

Manhattan Is the Most Competitive Borough for Amenity-Rich Rentals

Manhattan neighborhoods comprised five of the top 10 most competitive NYC neighborhoods for amenity-rich rentals in Q4 2023: Upper East Side, Flatiron District, Central Harlem, Tribeca, and Upper West Side. With the exception of Central Harlem, these Manhattan neighborhoods boast median net-effective rents well above the citywide median ($4,880) and fewer listings offering concessions compared to the city’s overall amenity-rich rental market. Brooklyn had four neighborhoods on the list, while Queens had one.

We ranked the neighborhoods based on: share of rentals that offered at least one month of free rent, share of rentals that reduced asking rents during their listing period, and year-over-year change in median net-effective rent. Neighborhoods with fewer concessions or price cuts and stronger growth in net-effective rents scored higher on our list, indicating landlords in these areas are likely seeing strong demand for their amenity-rich rental listings from prospective tenants.

The Upper East Side claimed the top spot and was the second most expensive neighborhood on our list. Its median net-effective rent was $8,295, up 6.4% year-over-year. One in five (19%) amenity-rich rentals in the neighborhood offered concessions, compared to one in three (34.9%) across all of NYC. Tribeca was the number one most expensive neighborhood on the list, with a median net-effective rent of $9,500. Just 4.5% of amenity-rich rentals in Tribeca offered concessions, suggesting landlords continue to feel confident about renter demand despite the neighborhood’s high prices. Amenity-rich rentals in these neighborhoods are attractive options for New Yorkers prioritizing modern amenities in newer buildings over the higher upfront costs and potential renovations required to buy a similar home in NYC.

While neighborhoods traditionally known for pricey rentals are in the lead, StreetEasy searches across Manhattan by renters seeking homes with a doorman and in-unit laundry jumped 13.1% year-over-year in Q4 2023. This year, StreetEasy predicts Manhattan will continue to lead in demand across the rental market, specifically in neighborhoods closer to midtown and downtown office hubs.

Waterfront Rentals Are Drawing New Yorkers to Brooklyn

Williamsburg, Bushwick, and DUMBO were the most competitive neighborhoods for amenity-rich rentals in Brooklyn. Williamsburg ranked third overall on our list, with relatively few concessions and discounts, after ranking fourth in Q2 2023. One in three (32.9%) amenity-rich rentals in Williamsburg offered concessions in Q4 2023, and about one in four (27.5%) lowered asking rents.

Another waterfront neighborhood in Brooklyn with strong demand for amenity-rich rentals is DUMBO, with just one in five (21.2%) listings offering concessions and one in three (36.3%) cutting prices. Median net-effective rents in both Williamsburg ($5,082) and DUMBO ($5,850) are significantly higher than the borough median of $4,125, highlighting the resilient demand in Brooklyn for new waterfront rentals with sought-after amenities.

Bushwick, often seen as a more affordable alternative to Williamsburg, ranked fourth on our list. Its median net-effective rent was $3,728 in Q4 2023, up 14.7% year-over-year. Concessions are the new norm in the new development rental market in Bushwick, with 81.8% of amenity-rich rentals offering at least one month of free rent in Q4 2023, up from 66.9% a year ago. However, price cuts were hard to find, with just one in ten (11.7%) amenity-rich rentals reducing asking rents. Across all of Brooklyn, 38.8% of amenity-rich rentals offered concessions, and about one in four (27.5%) lowered asking rents.

Long Island City Continues to Lead the Amenity-Rich Rental Market in Queens

Long Island City ranked fifth on our list, up from seventh in Q2 2023. The median net-effective rent in Long Island City — the only Queens neighborhood on the list — was $4,350 in Q4 2023, up 7.8% year-over-year and 20.8% higher than the borough median of $3,600. Just one in three (33.8%) amenity-rich rentals in this neighborhood offered concessions, compared to 41% across all of Queens.

StreetEasy searches in Queens by renters prioritizing a doorman and in-unit laundry jumped 14% year-over-year in Q4 2023, a stronger increase than in Manhattan and Brooklyn. Renters are likely drawn to the expanded options in Queens at lower price points, fueled by the recent increase in new developments in the borough. There were 1,375 amenity-rich rental listings in Queens, a 36.8% jump from a year ago. Long Island City remains the most prominent market for amenity-rich rentals in Queens, making up 47.9% of all rentals of this type in the borough. However, the sharp increase in inventory led to more listings offering concessions, causing the median net-effective rent in Queens to fall 5.3% year-over-year to $3,600.

The Top 5 Up-and-Coming Amenities for Renters

Amenities are increasingly important to New Yorkers. The most-searched amenities did not change from 2022 to 2023, indicating lasting popularity. However, some amenities saw stronger increases in demand during this period than others.

The top five up-and-coming rental amenities, ranked by increase in searches from 2022 to 2023, were:

- Swimming pool (in-building): +18.7%

- Children’s playroom (in-building): +16.6%

- Furnished units available +14.8%

- Fitness center (in-building): +14.2%

- Central air conditioning (in-unit): +7.3%

Searches for buildings with swimming pools soared 18.7% in 2023, pushing this amenity to the top spot on our list. Central air conditioning came in at number five, with renter searches up 7.3%. Renters likely prioritized amenities that help them cool down amid rising temperatures, as the Northern Hemisphere recorded its hottest summer on record in 2023.

The remaining amenities on the list — a shared children’s playroom, rentals that come furnished, and a fitness center in the building — suggest amenities that make everyday living easier took priority as well.

Give Your Building a Competitive Edge

In a shifting market, how can owners and developers give their property the edge it needs? Reach more renters and buyers with Building Showcase — our complete advertising solution that maximizes exposure for your building on StreetEasy, one of NYC’s top real estate platforms. You’ll get a premium building page, automated Featured Listings, email and display opportunities, personalized reporting and support, and more. Learn more and get started.

Methodology

Using StreetEasy data, we scored the competitiveness of the amenity-rich rental market in each neighborhood based on share of rentals that offered at least one month of free rent, share of rentals that reduced asking rents during their listing period, and year-over-year change in median net-effective rent. Each metric was assigned the same weight. A score of 100 means a neighborhood topped all other NYC neighborhoods in each metric. A score of 0 means a neighborhood was at the bottom in each metric. Renters can expect heightened competition for amenity-rich rentals in neighborhoods with a higher competitiveness score.

The information provided was extracted from StreetEasy listings and its expansive internal database. The contents of this article are intended for informational purposes only and not intended as a complete recitation of the market.

StreetEasy is an assumed name of Zillow, Inc. and registered trademark of MFTB Holdco, Inc. a Zillow affiliate, which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.

Copyright © 2024 by Zillow, Inc. and/or its affiliates. All rights reserved. All data for uncited sources in this presentation has been sourced from Zillow data.