Key Findings:

- Rents in New York City have increased 31 percent since 2010, according to the StreetEasy Rent Index. Some neighborhoods saw rents rise as little as 15 percent, while rents in others rose as much as 45 percent.

- Rents in neighborhoods where at least a quarter of residents are families with children grew 5 percent faster than rents in neighborhoods in which less than a quarter of residents have children.

- Rents in neighborhoods with a median household income below New York City’s 2010 median grew 6 percent more than rents in areas with a household income above the citywide median.

- A household spending $2,000 per month on rent in 2010 would be paying an additional $620 per month or $7,440 per year in 2018.

Boosted by strong economic growth, rents have increased across New York City since the end of the 2008 financial crisis — but they have done so unequally. Throughout the recovery, resilient financial, media, and healthcare sectors, along with a burgeoning technology sector, have created numerous high-paying jobs for young professionals, helping to push rents higher. However, a close analysis of more than a decade of listings on StreetEasy shows that the burden of rent increases in New York has fallen disproportionately on the city’s lower-income neighborhoods, and on areas where families with children make up a substantial portion of the population.

Rents for New York City apartments listed on StreetEasy have increased by 31 percent overall between January 2010 and January 2018.[1] Yet when we use more than a million rental listings on StreetEasy to measure the increase in rents in 88 different city neighborhoods, we find that growth rates within individual neighborhoods have ranged from as little as 15 percent to as much as 45 percent. The areas experiencing the fastest rent growth are largely the less-dense, outlying areas of Manhattan and Brooklyn, such as Inwood and Ditmas Park. The neighborhoods with slower rent growth tend to be far more dense — and while they’re not necessarily the most expensive areas of the city, they are expensive relative to their boroughs.

This analysis leverages StreetEasy’s uniquely rich dataset, and uses an advanced statistical process that builds on the methodology behind the StreetEasy Rent Index. It provides a window into the evolution of rents that is not captured by looking at market medians, and is less susceptible to bias from the types of units available at a given time. This new approach also allows us to better track correlations between rents and other variables in a given neighborhood, isolating factors that can vary widely within a borough.

Further Reaches of Manhattan and Brooklyn See Fastest Rent Growth

The neighborhoods that have seen the highest growth in rents over the last eight years are low- to middle- income areas in Brooklyn and Upper Manhattan.[2] Some have seen rising rents for years, though many of these neighborhoods — the South Brooklyn ones in particular — were not thought of as highly desirable until recently. In Prospect Lefferts Gardens and Midwood, for example, many apartments are now asking for rents more than 40 percent higher than they were at the beginning of the decade.

High-End Neighborhoods See Slowest Rent Growth

High-end Manhattan neighborhoods have been the biggest beneficiaries of slowing rent growth. Rents are similarly sluggish in Dumbo and Riverdale, both relatively pricey and desirable areas of their respective boroughs. Long Island City rents rose steadily through 2017 before actually declining over the past year. The construction boom in LIC means that many units available today did not exist even a few years ago. Even so, it was possible in early 2018 to find a luxury 1-bedroom apartment listed for only $5 more than in 2011, after concessions.

Ridgewood, Queens is something of an outlier among the list of low-growth neighborhoods; its presence is mostly due to a very sharp run-up in rents at the beginning of the decade that was seemingly speculative on the part of ambitious developers but has since abated significantly. The neighborhood remarkably now has luxury 2-bedrooms listed for 20 percent below what the same unit asked in 2012.

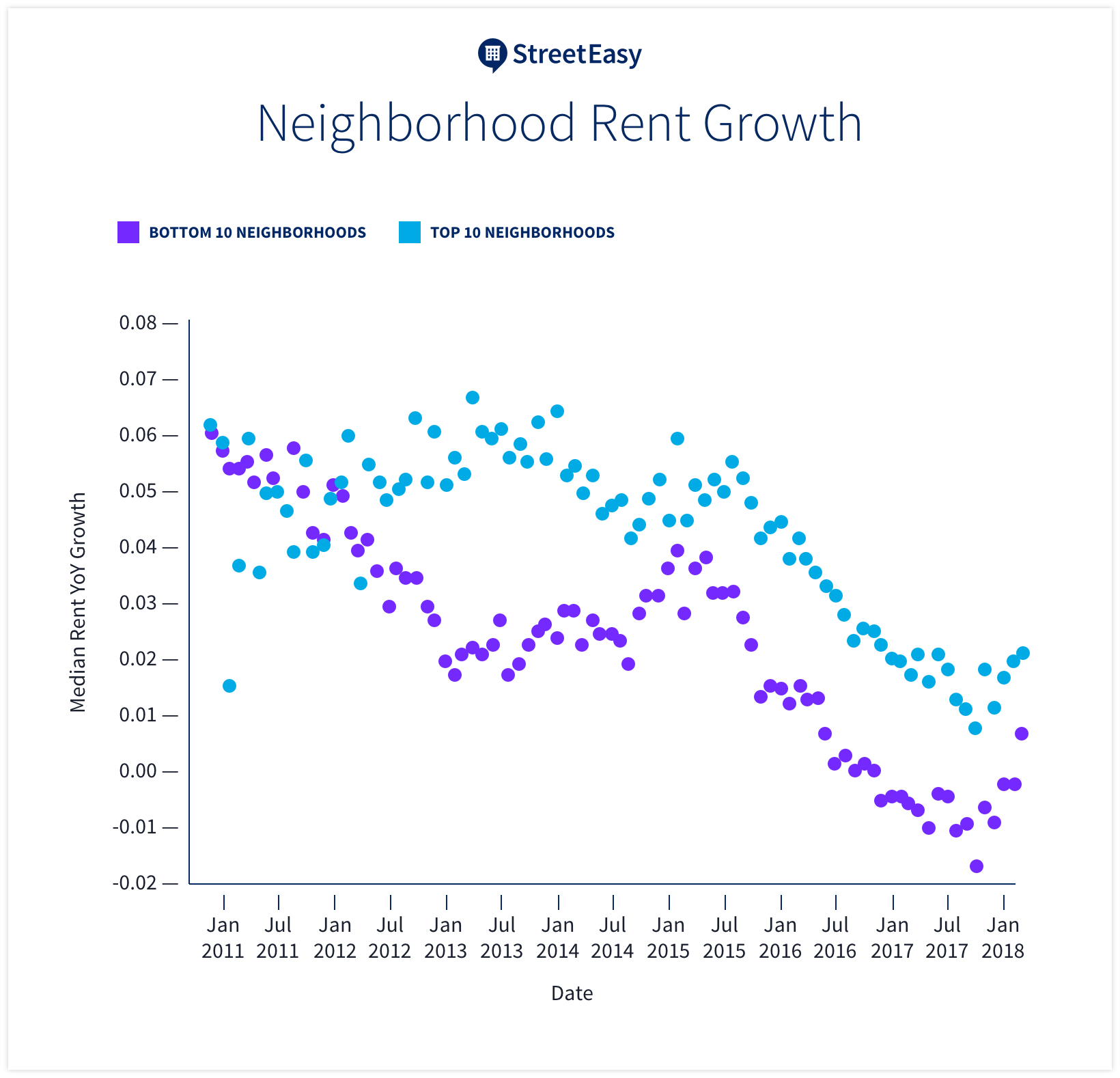

Trends Diverged in First Half of the Decade

Coming out of the recession, rent growth across most New York neighborhoods was comparable and modest. But starting in 2012, the trends began to diverge. Low- and middle-income neighborhoods saw rents begin to appreciate at a faster rate, while the pace of appreciation declined in higher-income neighborhoods. By the end of 2014, the lower-income, fastest growing neighborhoods had seen rents rise by a cumulative 11 percentage points more than the predominantly high-income neighborhoods with the slowest rent growth.

The pace of rent increases has declined citywide since its peak in 2014, corresponding with a boom in new construction. After development bottomed out in 2012, it has returned in force: more residential units have been built every year since, with more than 25,000 new units arriving in 2017.[3]

While the city as a whole is still getting more expensive, it is doing so more slowly than during the first half of the decade. However, even today, rent appreciation remains higher in low- and middle-income neighborhoods. As a result, whether individual renters will be able to see significant benefits from these trends depends largely on what they are already able to afford.

Rent Increases Affect New Yorkers in Different Ways

As we showed in our 2017 report on rent affordability, lower rents have grown at far faster rates than higher rents. Our neighborhood analysis highlights a similar dynamic: Neighborhoods with relatively low median rents in 2010 tended to see far higher growth than higher-priced neighborhoods. The average 2010 median rent of the 10 neighborhoods with the fastest growing rents was $1,695, compared to $2,800 for the 10 neighborhoods with the slowest growing rents. In fact, for every $320 increase in a neighborhood’s 2010 median rent, the neighborhood rent grew an average of 1 percent slower over the following eight years.

The faster pace of rent increases in lower-cost neighborhoods has hit low-income households the most. In the 52 neighborhoods with a household income above the city’s 2010 median of $50,285, rents grew by an average of 26.9 percent between 2010 and 2018. In the 31 neighborhoods with incomes below the city median, rents grew by 33.1 percent over the same period. For a household spending $2,000 per month on rent in 2010, this 6 percent additional growth adds up to an additional $125 per month —$1,500 a year — in 2018.

Families Face a Tougher Time

The burden of increasing rents has fallen particularly hard on areas with a large number of families. Cumulative rent increases between 2010 and 2018 are highly correlated with the share of renter households with children under the age of 18. Overall, rents in neighborhoods where at least 25 percent of residents have children grew 32 percent on average, 5 percent more than in neighborhoods where less than one quarter of residents have children.

Manhattan neighborhoods like Midtown, Gramercy Park, and the Financial District, where fewer than 10 percent of renters have children, were among the slowest growing neighborhoods over the period, while outer-borough neighborhoods such as Ditmas Park, Elmhurst, and University Heights, where more than a third of renters have children, saw rents rise most quickly.

The strong relationship between the share of renting families and rent growth does not imply that rent increases were a direct result of the presence of children, but rather highlights the difficulties that rising rents have posed for families in particular.

The Impact on Communities of Color

Fast-rising rents are also impacting the most traditionally diverse parts of New York City. Neighborhoods like Bed-Stuy, Prospect Lefferts Gardens, and Flatbush have large communities of color, and rank among the neighborhoods with the highest growth in rents over the last eight years. In fact, the five neighborhoods in which we found the highest rent growth are all historically black or Latino. Still, other southern and central Brooklyn neighborhoods, like Brighton Beach, Midwood and Sheepshead Bay — all of which have a much smaller proportion of residents of color — saw nearly comparable rent growth over the same period. These patterns indicate that high rent growth more closely tracks with a neighborhood’s income and geography than its racial makeup — but in doing so, it still heavily burdens the city’s most diverse communities.

Density and Development Slow Rent Growth

Overall, our analysis suggests that efforts to preserve the architectural makeup and character of neighborhoods have a strong impact on rent growth, particularly for low-density, low-cost areas. Many of the fastest growing neighborhoods feature smaller buildings and lower densities than the slowest growing neighborhoods.

These outcomes are not entirely an accident of history. Seven of the top 10 neighborhoods with the fastest growing rents were at least partially downzoned to limit the height and density of future development, from Midwood in 2006 to Crown Heights in 2013. Many of these rezonings explicitly sought to preserve neighborhood scale and character in electing to limit future development. The character and history of these neighborhoods is a key part of their identity, as it is for nearly all New York neighborhoods. But our analysis suggests that preservation has come at the cost of fixing supply in areas while demand continues to grow, thus pushing rents higher.

Many parts of the city have been upzoned over the past two decades to allow for larger, more dense residential development. Upzoning has been a prominent part of the redevelopment plans for neighborhoods like Long Island City, Downtown Brooklyn, and Hudson Yards. But while many opponents of upzoning have argued that new development drives even greater demand for housing in a neighborhood, our analysis suggests that rents in upzoned areas tend to rise at slower rates than areas without new development.

Three of the 10 neighborhoods with slowest rent growth — Long Island City, Dumbo, and the Upper West Side — were in part upzoned between 2007 and 2009, supporting the idea that additional supply helps limit rent growth. Other areas where zoning was changed to allow for more dense development — including Williamsburg, Downtown Brooklyn, and Chelsea — also ranked in the bottom half of the city’s neighborhoods in terms of rent growth from 2010 to 2018.

The Costs of Growth Are Borne Unequally

While rising rents are a direct consequence of the city’s economic growth, this growth also has more positive consequences. The city’s unemployment rate remains near an all-time low, and the job base has diversified to include a greater share of jobs in technology and health care, reducing the city’s reliance on the financial sector. The challenges presented by this growth are in many ways preferable to the economic declines the city experienced in the 1970s, though this comes as little comfort to those struggling to make rent each month.

While the city is right to celebrate its economic achievements, the pressures of rising rents on the neighborhoods highlighted here reveal the toll the city pays for growth. As this analysis shows, the burden of rent increases falls unequally on the city’s neighborhoods and residents.

There has long been a trend of New Yorkers fleeing further from job centers in Manhattan to find affordable homes. But this should not imply that high rent growth is purely a factor of geography. That so many New York neighborhoods with the fastest-growing rents were downzoned serves as a reminder that just as economic growth comes at a price, so too does the preservation of the status quo in terms of housing and neighborhood character. The fact that the city’s construction boom has so far failed to alleviate the housing crunch in many outlying neighborhoods illustrates the complexities of addressing rent affordability.

How We Did It

We used a hierarchical variation of a standard repeat-rent index model that estimates changes in rent values while controlling for intrinsic characteristics like number of bedrooms and building amenities. In this case, we fit separate Bayesian hierarchical models for each New York City borough. To estimate which areas had seen more or less rent index growth since 2010, each model predicted both a borough-wide rent index and individual neighborhood deviations from the borough trend. Only neighborhoods with at least 100 repeat-rent transactions on StreetEasy since 2010 were considered. As a result, many neighborhoods with predominantly owner-occupied housing, including those in Staten Island, were excluded due to insufficient data. We estimate neighborhood demographics and income using the U.S. Census Bureau’s American Community Survey tract-level data.

[1] According to our StreetEasy Rent Index.

[2] Income and demographic data in this analysis is estimated from the U.S. Census American Community Survey, five-year estimates.

[3] According to “State of New York City’s Housing and Neighborhoods in 2017,” NYU Furman Center.

—

Hey, why not like StreetEasy on Facebook and follow @streeteasy on Instagram?