Purchasing a home in New York City can attract a lot of attention, which is why celebrities, foreign investors or any buyer who wishes to remain anonymous uses a Limited Liability Company (LLC). Forming a shell company (the LLC) to act as the buyer effectively shields buyer’s identities in public sales records and often makes it impossible to know who purchased a particular home.

Due to New York City’s high-end real estate deals and the allure of power brokers, investors, one-percenters and celebrities, we set out to find where these LLC purchases were happening the most in NYC and how they compare to all other homes in Manhattan and Brooklyn in terms of value and price appreciation.

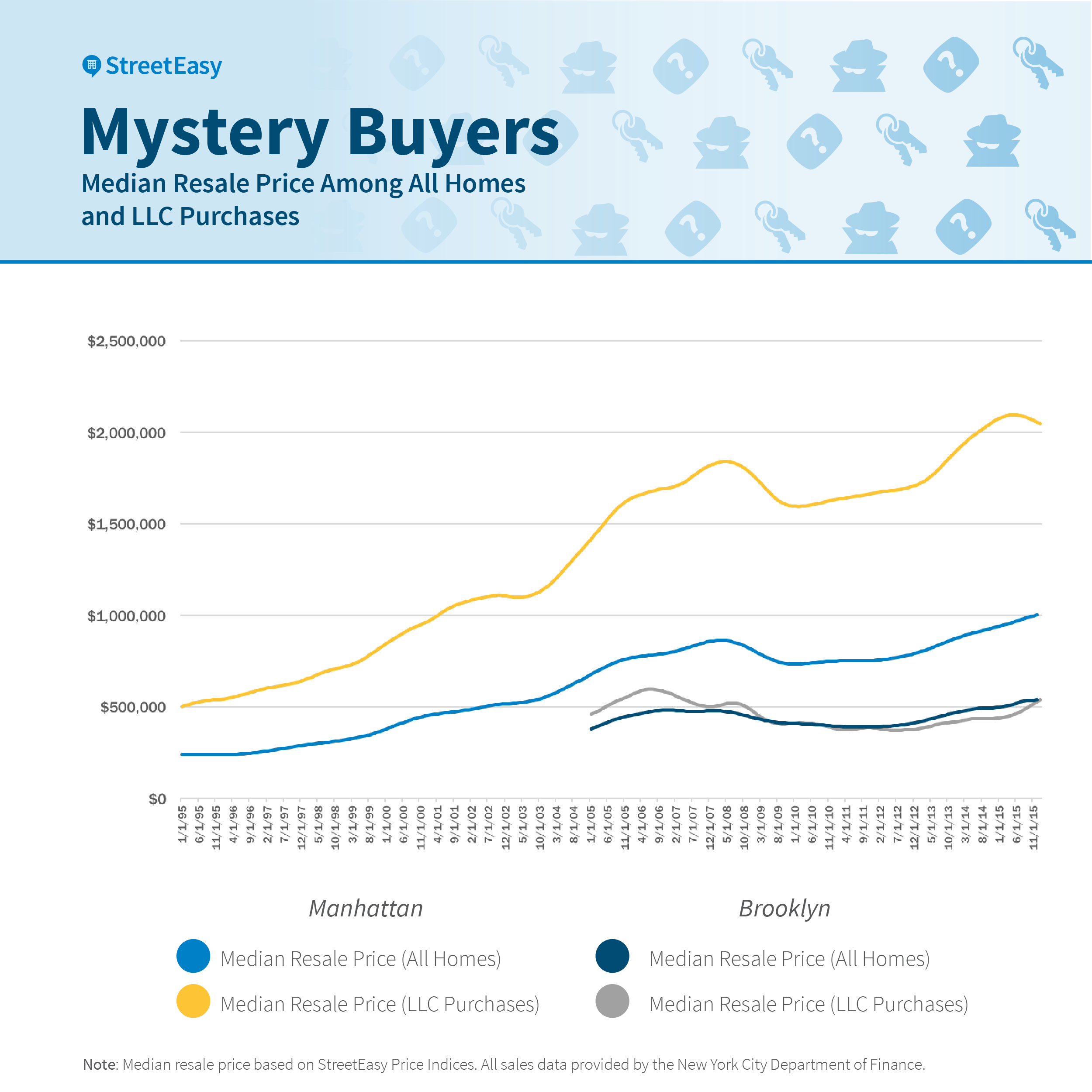

LLCs see slower price growth in Manhattan and Brooklyn than all homes

Using a custom repeat sales index, we found that Manhattan homes purchased with an LLC experienced slightly lower appreciation than all homes over the last 10 years. Between 2005 and 2015, the median resale price of homes purchased using an LLC increased by 26.1 percent, slightly lower than the 10-year price appreciation of all homes in Manhattan (31 percent), according to the StreetEasy Price Indices. The median resale price for LLC properties in Manhattan has also fallen each month since May 2015, declining 2.3 percent since May, which is similar to the recent phenomenon seen among Manhattan’s most expensive real estate, which we reported in February.

In Brooklyn, the results were even more interesting: Homes purchased using an LLC experienced negative price growth over the past 10 years. Between 2005 and 2015, the median resale price of all homes purchased with an LLC declined 5.6 percent, compared to a gain of 19.5 percent among all homes in Brooklyn in the same period.

The downside of a slower or negative rate of appreciation in Manhattan could be minimized if the owner’s home currency is not U.S. dollars. In Brooklyn, the negative appreciation suggests LLC buyers may have been significantly over-paying during the market boom cycle in the late 2000s.

Although the long-term price appreciation of LLC-purchased homes lags behind that of all homes in Manhattan, these homes are significantly more expensive. In Manhattan, the median resale price of all homes purchased using an LLC is currently more than $1 million higher than the resale price of all homes as of January 2015, according to the StreetEasy Price Indices.

In Brooklyn, the median resale price of LLC-purchased homes is slightly lower than the median resale price of all homes. The differences, when compared to their respective borough Price Indices, suggests that buyers use LLCs for different objectives in Manhattan and Brooklyn. The large premium paid for properties in Manhattan suggests owners are using the properties as a store of value — a case where more is better. The lack of a difference in Brooklyn suggests that those using an LLC have similar motives to the broader market and plan to use the property as a residence, a rental or a renovation project.

LLC purchases are concentrated in Midtown and Downtown Manhattan

Manhattan represents almost half of all LLC purchases made in New York City since 1995. The number of these purchases grew steadily between 2005 and 2015, rising from 442 to 1,449. Queens has the second-highest number of LLC purchases at 588, which is up from 51 in 2005. Brooklyn is third with 564 purchases, which is up from 77 over the past 10 years. The Bronx and Staten Island have fewer LLC purchases, at 164 and 132, which are both up from 31 and zero in 2005.

The number of LLC purchases seems to follow economic cycles, with the totals dropping in 2000 and 2009 by 27 percent and 19 percent, respectively. With respect to the U.S. Treasury’s initiative, LLCs were used to buy more than 540 Manhattan properties priced at least at $3 million in 2015, which is up from 233 in 2010 and 496 in 2014.

[tableau server=”public.tableau.com” workbook=”llcBuyers_v2″ view=”llcPurchaseWindow” tabs=”no” toolbar=”no” revert=”” refresh=”yes” linktarget=”” width=”600px” height=”970px”][/tableau]

In addition to neighborhood concentration, we also looked at how certain buildings have a large number of LLC purchases, which is especially common in Manhattan. Below is a list of the buildings with the most LLC purchases:

| Building | Purchases | Median Price |

| 15 Central Park West | 113 | $8,756,950 |

| Trump International | 107 | $1,981,200 |

| The Sheffield | 101 | $1,512,101 |

| Plaza Hotel | 98 | $5,845,292 |

| 20 Pine – The Collection | 87 | $967,337 |

Using an LLC as the owner of record for residential properties in Manhattan – and the rest of New York City – will likely continue to be popular. However, the U.S. Treasury’s recent announcement that requires the disclosure of buyer identities for transactions in Manhattan priced at or above $3 million may bring a chill to the high end of the market. With StreetEasy’s LLC price index for Manhattan already down 2.3 percent from a peak in May 2015, the market cooling may already be happening.

How We Did It

Our investigation into the practice of using an LLC as the registered owner of a residential property started with identifying purchases made by an LLC. Using recorded sale documents from the New York City Department of Finance, we looked for transactions where the buyer’s name is an LLC. We also excluded instances where the number of units purchased amounted to a majority of units in the building, which would indicate the LLC was a property developer.

The investigation then went in two directions. The first was how the purchases have changed over time, and the second was where the purchases have taken place. We reconfigured the StreetEasy repeat sales price indices to use properties where an LLC was used in at least one of the transactions to see how these properties have appreciated over time. We also mapped the purchases by coordinates, and aggregated them by buildings, to see which areas and buildings have more LLC purchases.