If there is a silver lining to the COVID-19 pandemic, it’s that it has brought some much needed rent relief to New York City. For low-income New Yorkers who hold housing vouchers, however, accessing affordable housing is fraught with a different set of challenges. A new analysis of citywide rentals data from StreetEasy finds that the record-high rent drops and high inventory levels from COVID-19 have more than doubled the number of homes on the market that are affordable for “Section 8” Housing Choice Voucher participants. In the second half of 2020, over 40,000 more units were affordable compared to the same time in 2019. This means a wider range of choices for voucher apartments in NYC. It also gives voucher holders the potential to move to an apartment in a more convenient location, or to upgrade to a rental with more space or amenities.

More rental options for voucher holders is good news, but the core challenges have not budged. Getting a voucher can be nearly impossible, with a waiting list lasting multiple years. The new stimulus package that provides $5 billion in new vouchers may provide some relief. However, those with vouchers often cannot find housing that accepts vouchers as payments, especially in neighborhoods with higher demand. Voucher holders, landlords, and agents often don’t know their rights and responsibilities under the law, even though New York City passed laws against source of income discrimination in 2008. As a result, many renters with vouchers face discrimination based on their source of income.

Manhattan Rentals Under $2,200 on StreetEasy Article continues below

Voucher Holders Now Have More Options – But It’s Not Enough

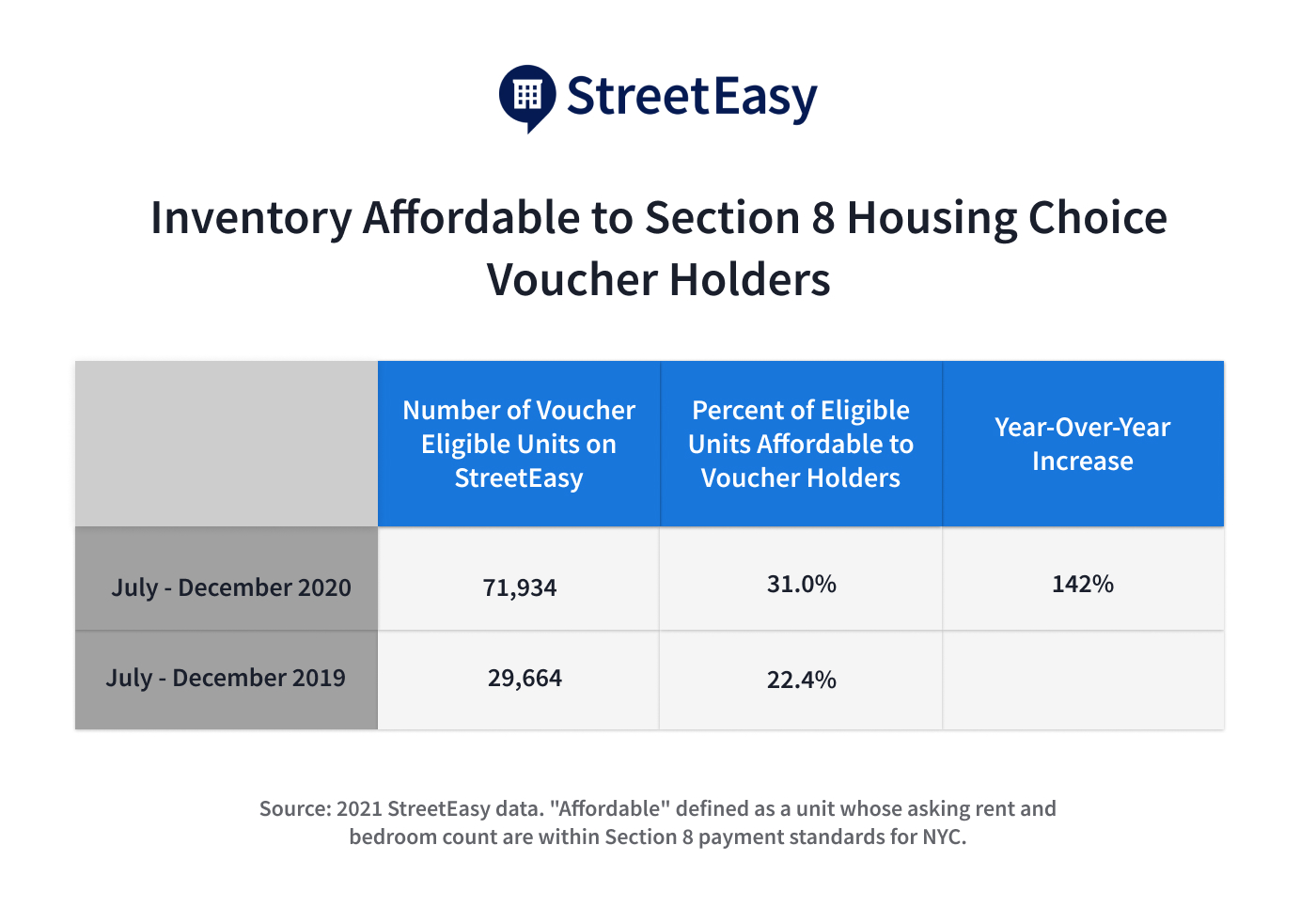

From July to December 2020, there were 71,934 rental units listed on StreetEasy that were affordable for voucher holders. That’s according to the Section 8 voucher payment standards, which are calculated based on the Fair Market Rent established by the U.S. Department of Housing and Urban Development (HUD) for each unit size. In comparison, there are 85,982 reported vouchers in use across New York City. Holders can move into NYC voucher apartments above these payment standards as long as their rent burden doesn’t rise above 40 percent, so the numbers in this analysis are a conservative estimate.

Two market trends resulting from COVID-19 – record high rent drops and inventory coming onto the market – have expanded the universe of affordable housing for voucher holders. Based on Section 8 Housing Choice Voucher payment standards, the number of affordable units on StreetEasy in the second half of 2020 increased by 142% from the second half of 2019.

The market trends of dropping rent and higher inventory could provide an opportunity for affordable housing programs in NYC to rise to meet this unique moment in the rental market. Rent drops in some of the city’s most expensive areas means that vouchers have new and improved purchasing power within the market.

Newly Affordable Inventory Opens Up New Areas for Voucher Holders

The rental market softening over the past year has had a massive impact on the number of NYC voucher apartments, based on the minimum payment standards. However, the areas that had the largest uptick in voucher-affordable housing does not match with where most voucher holders currently live, as shown in the maps below. This is in large part because rents have dropped by over 16% year-over-year in some of the pricier parts of the city, such as Manhattan and waterfront Brooklyn. Rents did not drop as much elsewhere.

Currently, the Bronx has the highest reported Section 8 housing choice voucher use. Manhattan has the lowest. But Manhattan is the borough that gained the most eligible voucher apartments in NYC between 2019 and 2020. This opens up opportunities in new neighborhoods that are now affordable to voucher holders. Research from the Center on Budget and Policy Priorities finds that low-income families using federal housing vouchers are concentrated in high poverty, racially segregated, “low opportunity” neighborhoods. With transparent information on voucher-affordable housing, renters can take advantage of a wider range of locations. This could help offset the disparities in where voucher holders currently live.

Increase in Market Options Does Not Help Those Without Vouchers

The voucher’s purchasing power is only part of the story. A looming problem remains: There are simply not enough vouchers to meet the need. According to Zillow research, in the New York metropolitan area, there are 6.7 times as many severely cost-burdened renter households as there are vouchers.

Actually getting an apartment voucher in NYC is more challenging ever. NYCHA stopped accepting voucher applications back in December 2009. Many who applied in time are still on the waiting list. As of May 2018, there were 148,000 households on the waiting list.

Even those with vouchers face difficulties finding housing. Many voucher holders report discrimination when attempting to use their vouchers during an apartment search. Furthermore, even if they don’t face explicit discrimination, voucher holders may have trouble finding an available unit. In tight markets, three out of 10 voucher recipients fail to successfully rent a unit with their vouchers. Restrictive tenant screening and security deposit requirements are additional barriers for low-income households, even if rent is within the payment standard.

Brooklyn Rentals Under $2,200 on StreetEasy Article continues below

Expanding the Supply of Affordable Voucher Apartments in NYC

The fact that housing vouchers are not widely available is not the only barrier. They also aren’t valued competitively in the market. Payment standards are still low when compared to market rate rents in NYC.

More options on the market would mean a higher chance for voucher holders to find housing. Current payment standards are determined using the Fair Market Rent, which is the 40th percentile of homes across the New York City metropolitan area. That includes lower priced homes in the Hudson Valley, Long Island, and New Jersey. Raising the payment standards according to the 40th percentile of rents in NYC itself, rather than the wider metropolitan area, would bring 18,548 more units to New Yorkers, when looking at rents and inventory in the second half of 2020. This increase is even more dramatic if applied to CityFHEPs, a program for individuals who are in shelters or at risk of entering shelters. That would raise the number of affordable units by 89,918.

On June 30, Mayor De Blasio adopted the city’s new budget, which included a bill bringing CityFHEPS voucher payment standards up to those of Section 8 vouchers. This means CityFHEPS-eligible units on StreetEasy would rise to 71,934 (the same number as Section 8), versus 564 before. Between July and December 2020, there were 127 times more available units based on Section 8 standards than CityFHEPS standards. According to StreetEasy April market report data, there were 0 neighborhoods where the median asking rent for a market-rate 2-bedroom could house a family of four under previous CityFHEPS payment standards ($1,580 for a family of four). Raising the payment threshold to Section 8 standards ($2,217) now opens up availability for the same family in 37 neighborhoods.

One caveat: Raising the payment standards requires more funding. And there’s an important tradeoff to consider. Increasing the value of a voucher without increasing the agency funding may lead to the unintended consequence of housing fewer people, rather than more. To get around that, further funding may be required in order to allow more NYC apartment vouchers that are more competitive in the marketplace. Alternatively, greater granularity for how voucher values are calculated, like in the SAFMR program, would allow more access to higher-cost areas with fewer tradeoffs. SAFMR should also be rolled out more widely, because right now it’s only in certain markets.

Current payment standards for Section 8 are close to market rate rents for apartments with lower bedroom counts. But generally, the larger the apartment gets, the less likely it is that a voucher would be able to cover the cost. This means that voucher holders with larger families are less likely to find a home without being overcrowded.

It is also important to note that a large component of the current market’s rent drops come from concessions. These rentals may not be accessible to voucher holders. Apartments with concessions make up over a quarter of the inventory on the market in Brooklyn and Queens, as of Q1 2021. They’re nearly half of Manhattan listings. Voucher holders still need to meet the landlord’s minimum income requirement, which includes the income from the voucher. The often-used 40x income requirement is based on gross rent, not the deeply discounted net-effective rate. So many still won’t meet the unit’s income requirement, even with the voucher.

Bronx Rentals Under $2,200 on StreetEasy Article continues below

Where Do We Go From Here?

Affordability, while a grave problem, is not the only barrier against voucher holders finding housing. Especially since the pandemic. Another barrier is the unlawful rejections of vouchers as payments by landlords and agents. The reality is, no matter how many NYC voucher apartments are technically affordable to holders, the likelihood of a voucher holder actually getting a unit is diminished because of discrimination. The problem can’t be solved without addressing this source of income discrimination.

Methodology

StreetEasy used the Housing Choice Voucher payment standards to calculate affordable properties listed on StreetEasy from July to December 2019 and July to December 2020. Affordable properties are defined as any rental property in a building of at least one residential unit, with rents that are less than or equal to the payment standard determined for each respective bedroom size.

Many voucher holders can afford a bit more than the housing payment standard if they have additional income. They can pay out of pocket above the payment standard, but it is limited to 40% max of their household income.

This analysis does not account for the Exception Payment Standards, which makes our estimate conservative. According to the New York City Department of Housing Preservation and Development (HPD), “HPD also uses Exception Payment Standards (EPS). EPS is set at the zip code level and allows for subsidy levels that more closely match the local market. EPS is intended to expand housing opportunities in zip codes that have lower rates of poverty and crime and have well-resourced schools.” Therefore, the actual number of voucher-affordable apartments in NYC will be larger than what’s included in this analysis.

CityFHEPS is a program designed to get the formerly unhoused into stable residences. We used CityFHEPS program’s maximum apartment rents to calculate the number of affordable apartments, assuming that a household size of 1 would live in a studio, a household size of 2 in a one bedroom, and so on.

[This post has been updated and republished.]

—

Whether you’re looking to rent or to buy, find your next NYC apartment on StreetEasy.