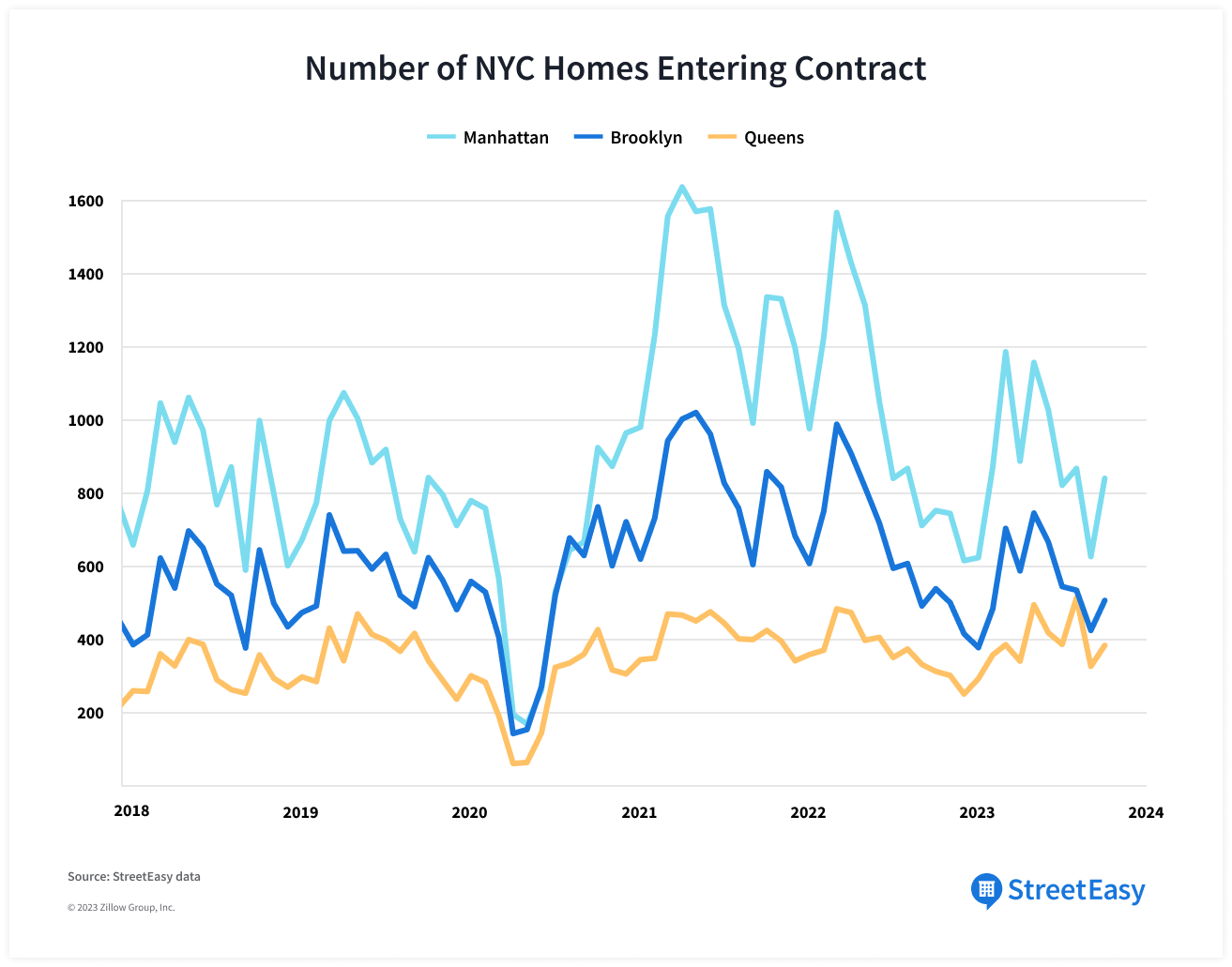

Despite 30-year mortgage rates close to 8%, the NYC sales market has shown resilience. Homes entering contract jumped strongly in October after a sharp decline in September, as buyers quickly adjusted to much higher mortgage rates than earlier this year. A total of 1,858 homes entered contract in October, a sharp increase of 23.6% from September and 8.1% from October 2022. More homes tend to enter contract in October than in September as home shoppers return to the market from summer travels. Surprisingly, the jump in new contracts between October and September this year was not far off from the five-year (2018-2022) average of 26.7%, despite mortgage rates rising to a 23-year high.

With resilient buyer demand, the citywide median asking price in October was $1.1M, a record high since 2017 and 10.6% higher than a year ago. In all five boroughs, median asking prices are up from last year, with Brooklyn showing the strongest increase due to competition for limited homes on the market. Rising asking prices across the city, despite elevated mortgage rates, suggest sellers listing their homes continue to feel confident about the market.

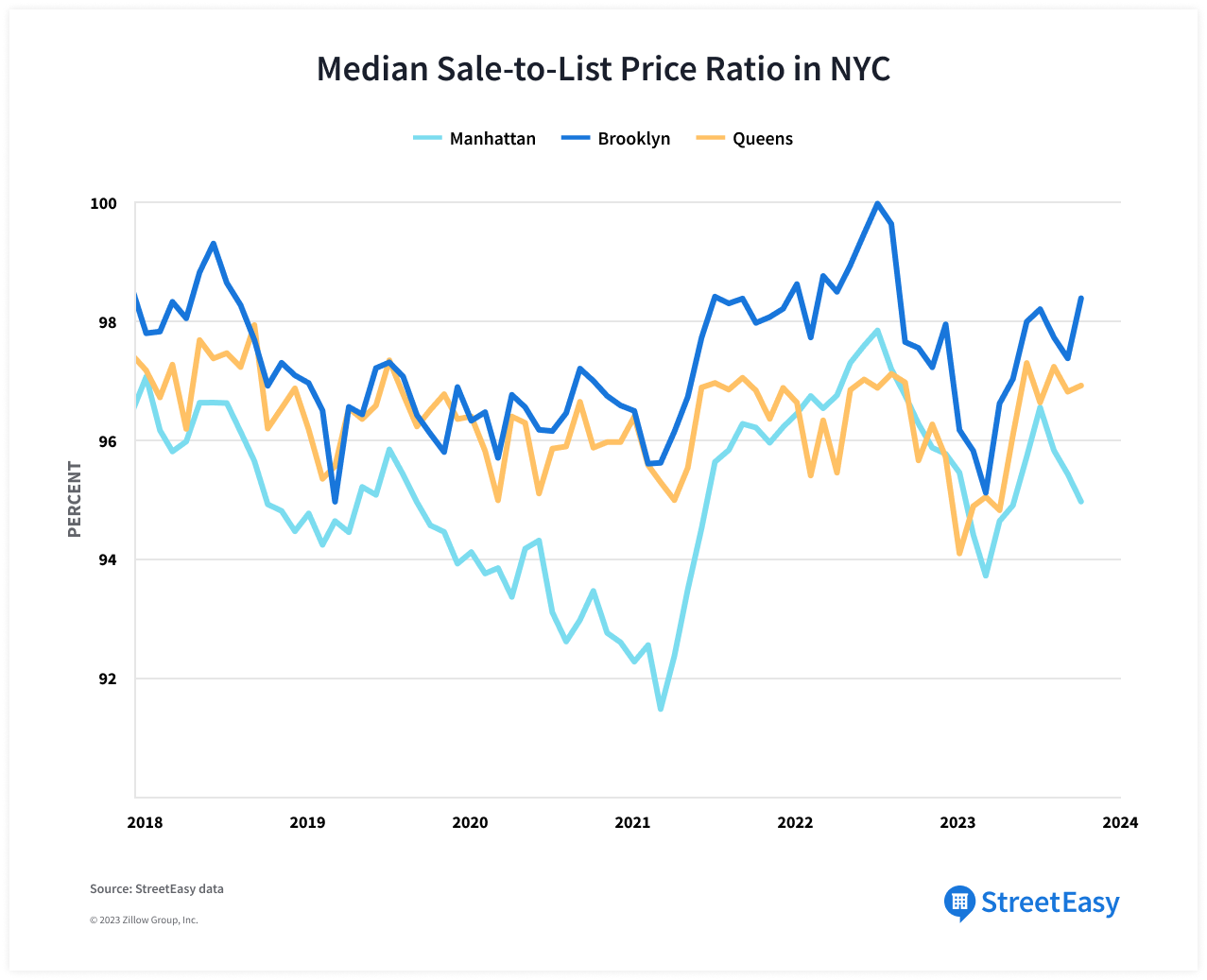

A declining number of newly-listed homes is keeping the market in balance. The city saw 35,749 homes listed for sale so far this year, 15% fewer than the same period last year. As a result, buyers are finding little room for negotiation on prices. A typical NYC home that sold in October received 96.3% of its initial asking price, mostly the same as 96.5% in October of last year. The median sale-to-list ratio was broadly consistent across price tiers: homes priced below the citywide median asking price of $1.1M in October typically received 96.8% of their initial asking prices, slightly higher than 95.3% for homes priced above or equal to the citywide median.

However, mortgage rates will remain volatile and stay elevated above 6% through at least the end of 2024. Rising mortgage rates have cut into would-be buyers’ budgets substantially. To keep their monthly mortgage payment the same between September and October, a buyer in the market for a median-priced home would have to cut their budget by at least $70,000. If mortgage rates continue to rise, even more home shoppers would be pushed to the sidelines, thus raising the pressure on sellers to lower asking prices to attract buyers.

Manhattan Median Asking Price Holds at Highest Level Since 2019

The median asking price in Manhattan held steady at $1.595M in October, unchanged from September. The October median is up 6.7% year-over-year, as mortgage rates reach close to 8% — the highest level in the last 20 years.

There are two reasons for Manhattan’s steady prices. First, high-budget buyers — who can often make a larger down payment, or buy in cash — aren’t as impacted by mortgage rates. In October, 845 homes in Manhattan entered contract, up 11.6% from a year earlier. The Upper East Side, one of the city’s more expensive areas with a median asking price of $1.899M, was the busiest neighborhood in Manhattan in October. One in four (24.9%) homes entering contract in Manhattan were in this area.

Manhattan Homes Under $1.5M on StreetEasy Article continues below

Second, the price point of new listings has been rising as owners of more expensive homes have more financial flexibility, and therefore may be more willing to list their homes for sale. There were 9,304 homes for sale in Manhattan, up 9.4% year-over-year — the strongest increase in any borough. Of the total inventory, 1,683 homes were new to the market, an increase of 1.4% from October of last year. About half of them were on the Upper East Side and Upper West Side, and in Midtown East. Typical new listings on the Upper East Side and Upper West Side were priced well above the borough median asking price, at $1.718M and $1.425M respectively. Buyers can find more affordable new listings in Midtown East, with a median asking price of $895,000.

Amid Severe Inventory Shortages, Sellers Kept the Upper Hand in Brooklyn

Due to low inventory and strong buyer demand, sellers maintained their leverage in Brooklyn, increasing asking prices and leaving limited room for negotiation. Homes that sold in the borough in October received 98.4% of their initial asking prices — the highest sale-to-list price ratio in all of NYC. The median asking price in Brooklyn was $1.095M, up 15.3% year-over-year.

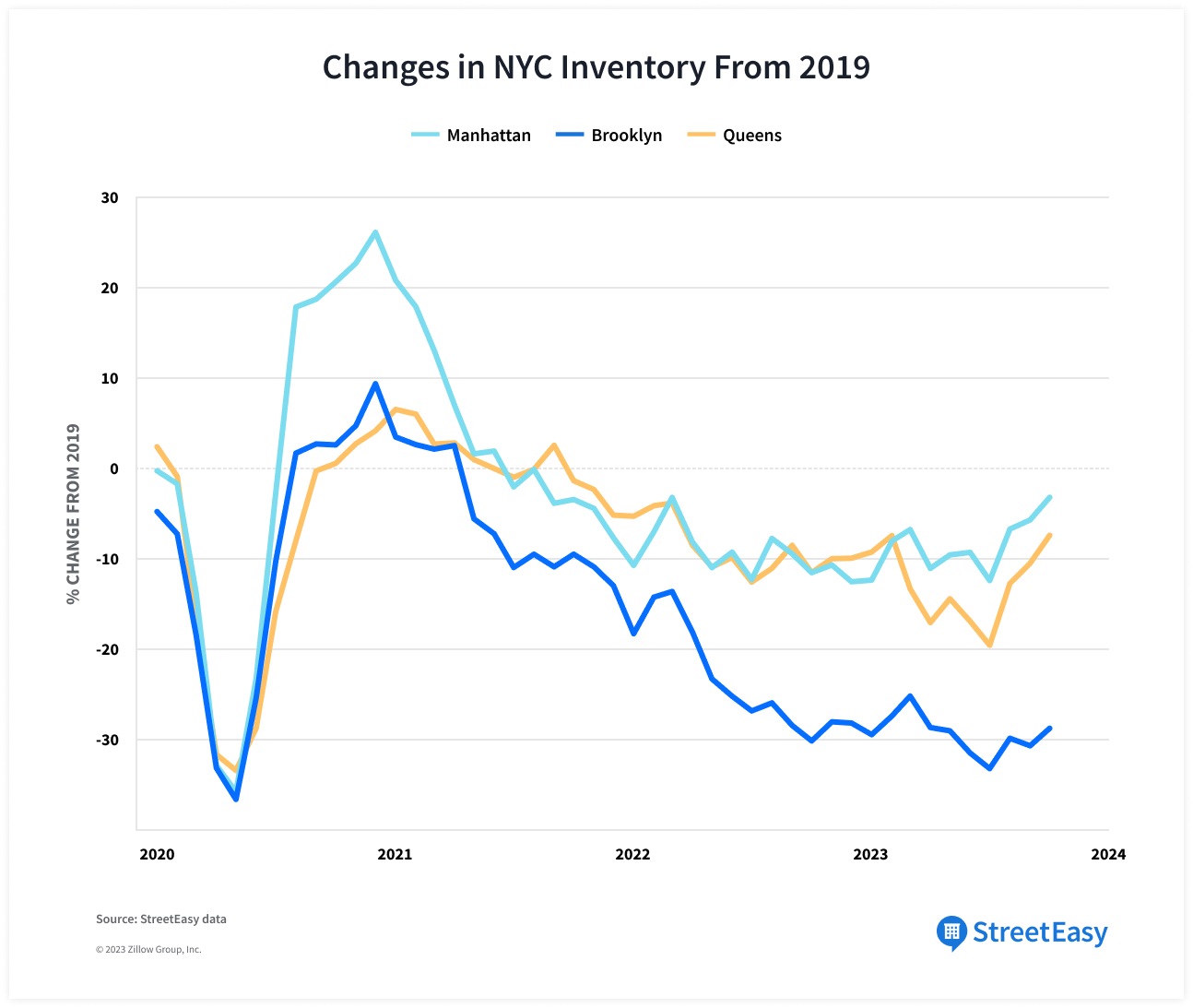

A total of 4,206 homes were on the Brooklyn market in October, up 2% year-over-year. However, the recent increases in listing inventory were not enough to offset the sharp declines in inventory during the pandemic. Compared to October 2019, the number of homes on the market in Brooklyn is down 28.5% — one of the sharpest inventory declines in NYC.

In October, 511 homes entered contract in Brooklyn. That’s 19% higher than 429 in September of this year, but 5.9% lower than October 2022. Condos are outpacing co-ops in Brooklyn as buyers continue to prize move-in ready homes in more modern buildings. Among 511 homes that entered contract in the borough, 183 were condos – outnumbering the 139 co-ops by 44. A few waterfront neighborhoods in Brooklyn — Williamsburg (27), Greenpoint (15), and DUMBO (14) — led the borough’s condo market in October. In addition, Park Slope (17) and Bedford-Stuyvesant (12) were two other areas among the top five neighborhoods with the most condo contracts in Brooklyn. Despite strong buyer interest, condos are increasingly hard to find in the area: there were 1,336 of them on the Brooklyn market in October, down 1.8% from last year. Compared to October 2019, condo inventory is down 33.4% in the borough — an enormous decline that limits buyers’ options.

Brooklyn Homes Under $1.5M on StreetEasy Article continues below

Buyers Can Expect More Room for Negotiation in Queens

Compared to Brooklyn, buyers can expect a little more room for negotiation in Queens. A typical home that sold in Queens in October received 96.9% of its initial asking price, slightly higher than 96.3% a year ago.

Queens, with a median asking price of $649,000 in October, offers a wider range of affordable homes for NYC buyers. A total of 48 neighborhoods in Queens had a price point below the citywide median asking price in October. With elevated mortgage rates constraining buyers’ budgets, many shoppers are considering homes at more affordable price points — like those in Queens. As a result, new contracts are rising in the borough and driving up prices: its current median asking price of $649,000 is up 3.2% from a year ago and at its highest level since 2020.

The number of homes entering contract in Queens jumped 22.4% year-over-year to 388 in October. Much of this increase came from the booming condo market in the borough. One in four new contracts in Queens last month was a condo unit, led by three neighborhoods: Long Island City, Flushing, and Woodside, which accounted for two-thirds (66) of the 101 condo deals in the borough. New developments in these areas are contributing to the borough’s steady inventory levels, despite the high number of homeowners locked into lower mortgage rates.

The rising supply of newly built condos in the borough is an ongoing trend. Since the pandemic, 18,249 new units have been created across 1,120 newly constructed buildings in Queens, according to the NYC Department of City Planning. That’s 12% more than the number of new homes built before the pandemic between 2017 and 2019. With fewer listings coming from homeowners, newly-built condos are fulfilling buyer demand for new, move-in ready homes.

Queens Homes Under $1M on StreetEasy Article continues below

What Does This Mean for Buyers and Sellers?

For home shoppers who can afford to stay in the market, this fall may be a great opportunity to buy in NYC. While inventory is still limited, elevated mortgage rates have kept many buyers on the sidelines and reduced competition for homes on the market. As summer listings continue to linger, sellers may become more willing to negotiate on price to get their home sold ahead of the winter holidays.

Buyers on the sidelines may see some relief in November after mortgage rates declined from their highest level in 23 years. While waiting for potential declines in mortgage rates can put more homes within reach, it would likely lead to even stronger competition from other buyers.

Selling a home in NYC? Our complimentary licensed Concierge

will match you with a top seller’s agent.

With a shrinking pool of buyers, a competitive pricing strategy is increasingly important for sellers. New York City is an especially challenging market to sell in due to its higher price points and unique blend of homes, such as condos, co-ops, and townhouses. Of the resale listings that entered the NYC market in 2022, a little more than one in three (35.7%) were taken off the market without finding a buyer as mortgage rates skyrocketed through the year. What set apart the homes that did sell was pricing: StreetEasy research shows that each additional percent above the price of comparable homes in the neighborhood led to a 9% increase in a home’s probability of not selling.

A skilled agent with a proven track record, like the agents in StreetEasy’s Experts Network, can make the selling process less stressful. Top Experts sell 1+ month faster than the market, at a sale-to-list price ratio that is around 14% better than the market.* Contact our Concierge to be matched with an Expert who’s well qualified to sell your particular home, or to discuss your various selling options.

*Source: StreetEasy (2012-2023). Market defined as borough, unit type, price point, and share of listings by year.

StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.