If you can make it here, you can make it anywhere, and that certainly goes for real estate too. And while selling a home anywhere is challenging, it’s especially true in New York City. A StreetEasy® survey conducted by The Harris Poll found that NYC sellers are more likely to be stressed about selling their home than they are about other life events like planning a wedding (76%), finding a job (70%), or even getting a root canal (65%).

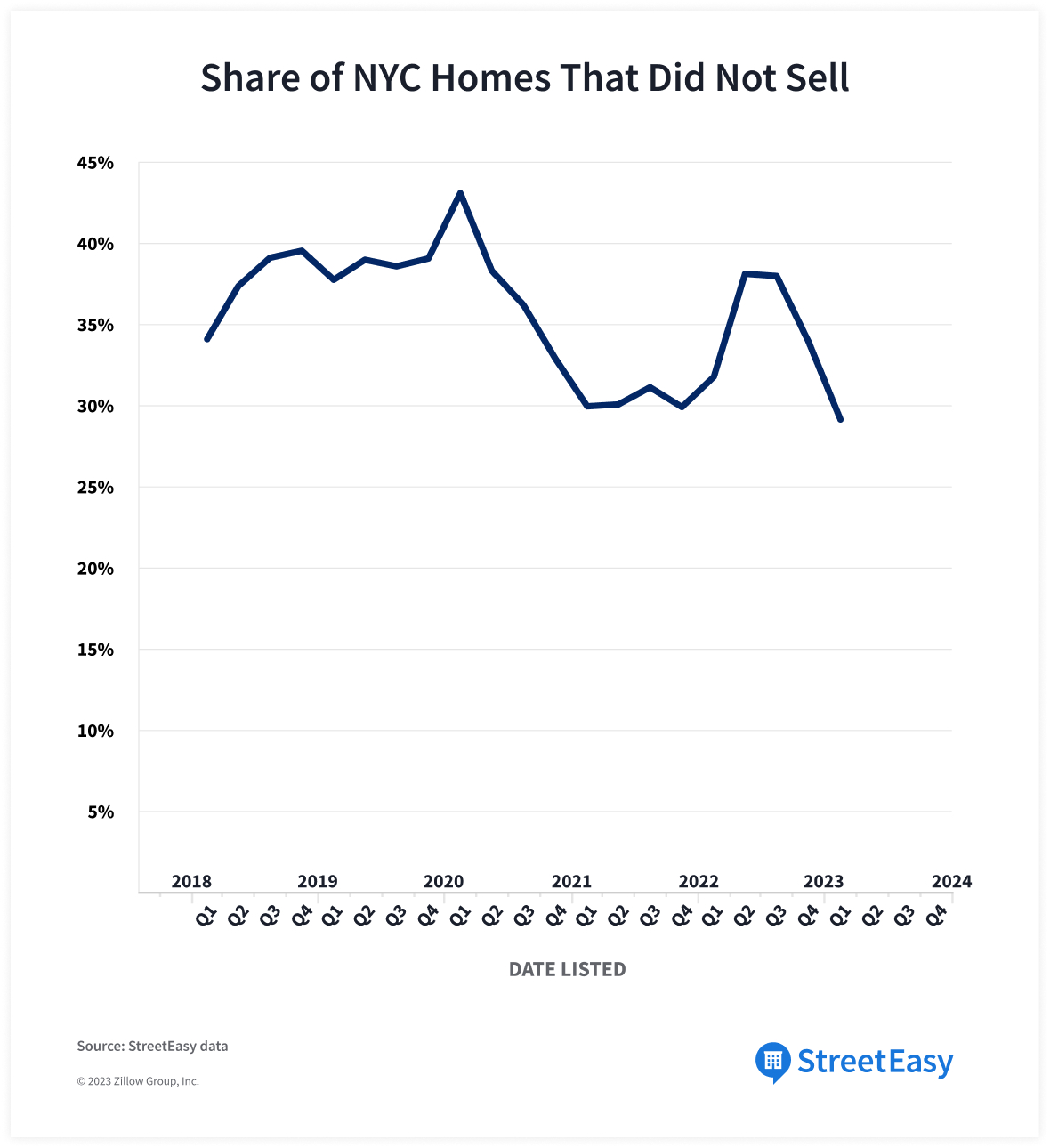

What’s more, in 2022, out of 39,845 previously-owned New York City homes listed for sale on StreetEasy, 35.7% — a little more than one in three — were taken off the market without finding a buyer.

With mortgage rates rising rapidly in the first half of 2022, an increasing number of homes were falling into this category. Of the resale listings that entered the market in Q2 2022, 38.2% did not enter contract, followed by 38.1% of homes listed in Q3 2022. By the end of the year, as sellers adjusted to a new market characterized by higher mortgage rates, the share of homes listed in Q4 2022 that did not sell declined modestly to 34%. This continued as buyers returned to the market earlier this year: of 9,108 homes listed in Q1 2023, 29.2% went without a sale.[1]

It’s important to note that a seller may remove a listing for reasons unrelated to its performance. Perhaps their timeline changed, they didn’t find a new home to buy, or they decided not to move altogether. But what do we know about why NYC listings fail to sell? The answer partly involves market dynamics and the one-of-a-kind selling landscape of New York City. But the good news is that if you’re a seller, there are things you can do — and not do — to help your home find a buyer.

Before we dive into the data, watch this clip from our StreetEasy Market Talk, in which StreetEasy Economist Kenny Lee chats with SERHANT’s Ryan Serhant about the challenges of selling in the current market and what makes some sellers more successful than others.

Manhattan Homes Under $1.5M on StreetEasy Article continues below

With Higher Price Points and Unique Property Types, Selling in NYC Is a Challenge

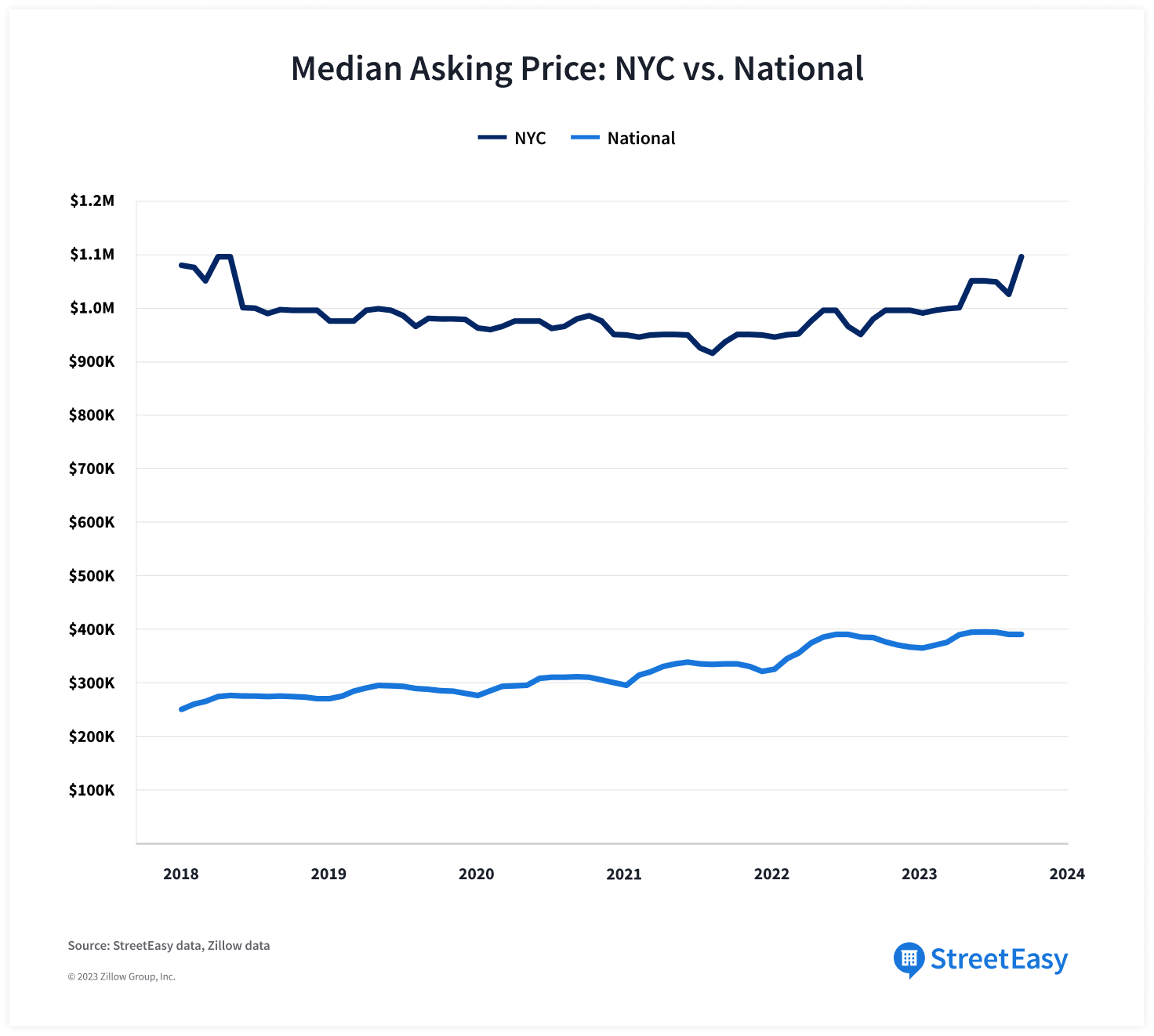

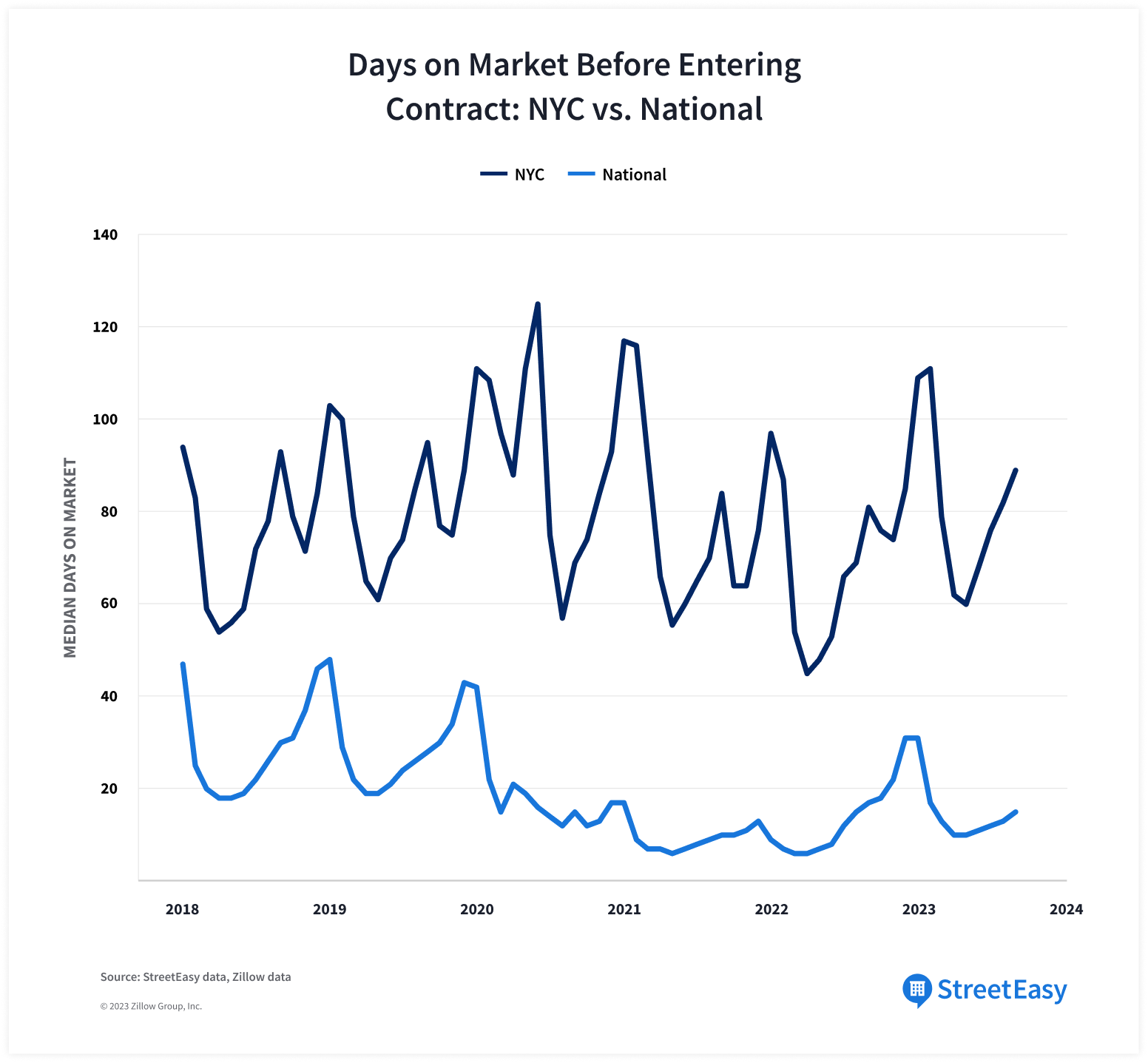

Selling a home in the city has never been easy. For one, price points are significantly higher than the rest of the country. As of September 2023, the median asking price of an NYC home was $1.095M — nearly triple that of the national market, according to our colleagues at Zillow®. In addition, New York City homes take nearly six times longer to sell on average, spending a median of 89 days on the market before entering contract compared to 15 days nationally.

NYC is also unique in that most homes for sale fall into one of three categories: co-op, condo, or townhouse, all with vastly different price points. The latter two types of properties were less likely to sell in 2022. Of all co-op listings that year, 31.7% didn’t find a buyer, compared to 41.6% for condos citywide and 50.1% for townhouses in Manhattan and “brownstone Brooklyn” neighborhoods. In general, the higher the price point, the smaller the pool of potential buyers. Although co-ops typically have stricter financial requirements, condos and townhouses tend to have higher price points. In 2022, the median asking price of all co-ops on the NYC market was $599K — less than half the median asking price of condos ($1.385M), and less than a tenth that of townhouses in Manhattan and brownstone Brooklyn ($6.595M).

That said, with low inventory of NYC homes for sale, buyers who can afford to stay in the market are competing for well-priced listings. As a result, most sellers have been able to receive offers close to asking. A typical home sold in September received 96.4% of its initial asking price. This median sale-to-list price ratio suggests sellers are still able to hold firm (and in some boroughs more than others).

Brooklyn Homes Under $1.5M on StreetEasy Article continues below

Market Conditions Such as Mortgage Rates Affect the Likelihood of Selling

With the average 30-year fixed mortgage rate approaching 8% — reaching 7.53% in the last week of September — an increasing number of would-be buyers are staying on the sidelines. Affordability is a foremost concern for many home shoppers in the city, with little room to stretch their budgets. A rise in rates to 8% would increase an average buyer’s potential mortgage payment by $285 to $6,428, assuming they buy a median-priced NYC home with 20% down. When fewer shoppers can afford to stay in the market, sellers are more likely to pull their listings after struggling to find a buyer. On the contrary, amid much lower interest rates in 2021, the likelihood of going without a buyer was the lowest in recent years at 30.4%.

Other market forces aside from mortgage rates have likely had an influence as well. In 2019, the NYC market slowed due to a glut of unsold condo inventory and an increase in the mansion tax, a tax on homes over $1M that adds to buyers’ closing costs. Consequently, that year, 38.3% of homes listed citywide did not end up selling.

Queens Homes Under $1.5M on StreetEasy Article continues below

What Other Factors Impact a Listing’s Ability to Sell?

Some listings are less likely to find a buyer than others, and an individual listing’s chance of selling varies throughout its lifespan on the market. According to StreetEasy data from 2022, the following were contributing factors:

- Pricing relative to competition: Even a modest mis-pricing compared to similar homes on the market can lead to a higher chance of not finding a buyer. An asking price 1% greater than that of comparable homes in the neighborhood led to an 8.8 percentage point (pp) rise in probability of not selling.

- Days on market: Furthermore, the longer a home sits on the market, the less likely it is to sell. Each additional day spent on the market was associated with a ~0.1pp increase in probability of not selling. That means an additional month on the market can add 3pp to a listing’s likelihood of going without a buyer.

- Not using an agent: Sellers who partnered with a professional were more likely to sell their home. Compared to a well-priced listing represented by an agent, an average For Sale By Owner (FSBO) listing was 37.9% less likely to sell.

What Sellers Can Do

There are things about your home you can’t change to make it sell — where it’s located, if it’s a co-op or condo, etc. “Focus instead on the aspects under your control,” says Carlo Romero, Senior Strategic Partnerships Manager and licensed StreetEasy Concierge, “like pricing strategy, working with a well-qualified agent, and the quality of your listing.”

Against the backdrop of rising mortgage rates, having a competitive pricing strategy — from day one of listing your home — is increasingly important for NYC sellers. A skilled agent with a proven track record selling similar homes can help price your listing to sell, like the agents in StreetEasy’s Experts Network. Experts can also help you sell quicker and at a price closer to asking: on average, top Experts sell 1+ month faster than the market, at a sale-to-list price ratio that is around 14% better than the market.[2] Contact our Concierge to be matched with an Expert who’s well qualified to sell your particular home, or to discuss your various selling options.

Ready to start your selling journey with StreetEasy?

Contact the ConciergeLastly, “digital curb appeal” matters now more than ever. Sellers should prioritize creating a high-quality listing with great photos, a detailed description, a floorplan, and rich media such as a 3D tour. Our data shows that StreetEasy listings featuring a 3D tour receive 10% more views on the site than those without, while listings with a floorplan receive 69% more views.

Methodology

Using a probit regression analysis, we estimated the average impact of pricing and days on market (relative to comparable listings) on the likelihood of NYC homes that entered the market in 2022 to ultimately go without a sale. We only considered resale listings, also known as previously-owned homes for sale. This data excludes sponsor listings in newly built condos on the market for the first time. The estimated impact discussed in this report is the estimated marginal probability of an average listing being pulled off the market without finding any buyer. Time on market is measured as the number of days between the first listing date and the date when the listing went into contract or was taken off the market without finding a buyer. In our regression analysis, we introduced controls for the home’s price point, number of bedrooms, property type (i.e. condo vs. co-op), and location by comparing the listing’s price relative to similar properties in the neighborhood. We also included additional variables to account for the seasonality of the housing market.

[1] An exclusive contract with a listing agent typically lasts six months, limiting our ability at time of publication to reliably measure the share of homes listed in Q2 and Q3 2023 that did not sell within this typical contract period.

[2] Source: StreetEasy (2012-2023). Market defined as borough, unit type, price point, and share of listings by year.

StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property. For FSBO postings, the StreetEasy Concierge is meant to provide insight to improve your posting performance on StreetEasy and may refer you to a real estate professional based on your specific needs.