How will COVID-19 impact NYC home prices? We looked at how Manhattan prices fared during the last recession for a few clues. (Getty Images)

Key highlights:

- How will COVID-19 impact NYC home prices? Looking at what happened during the Great Recession can be helpful, though the market is different now. Prices reached a peak in 2008, just before the financial crisis began. Today, prices have been falling for three years.

- Supply and demand have slowed due to COVID-19. Home prices have not changed so far, but the two weeks from March 16 to March 27 saw a 75 percent drop in new sales inventory compared to the same period in 2019.

- Home prices generally react more slowly to bad economic news than stocks. The stock market crashed in 2008, but housing prices didn’t hit bottom until 2011, by which time prices had fallen 15% in Manhattan.

- Prices still have room to fall. Prior to COVID-19, inventory in NYC was at an all-time high. Homes were spending more time on the market and selling for below asking price. Some 81 percent of Manhattan homes closed below ask in 2019.

- Buyers are in a good position. Mortgage rates have hit record lows, and prices are no longer at their peak. Those who can wait could see even lower prices in the coming months.

~

The NYC housing market was already slow going into the spring home-shopping season, with inventory at record highs citywide and Manhattan prices falling for the third year in a row. Then COVID-19 hit the city, containment measures upended daily life, and the sales market began to see contractions in both supply and demand. All of which is making for a spring sales market unlike any other.

The two weeks from March 16 to March 27 saw a 72 percent decline in new sales listings from the previous two weeks, and a 75 percent drop from the same period in 2019. In the present environment, with the city effectively on pause, fewer buyers are looking for an apartment, and fewer homes are hitting the market.

The disruption, plus historically low mortgage rates, have many wondering if COVID-19 might bring a chance to buy a home at a relative bargain. To answer that, it may be helpful to consider the last time the New York real estate market faced a major economic disruption: the Great Recession that followed the stock market crash of 2008.

With so many variables — including how COVID-19 may spread, and other policy and economic reactions to it, predicting what will happen in the present crisis is impossible. And there are many differences between the last economic disruption and this one. But the past can teach us something.

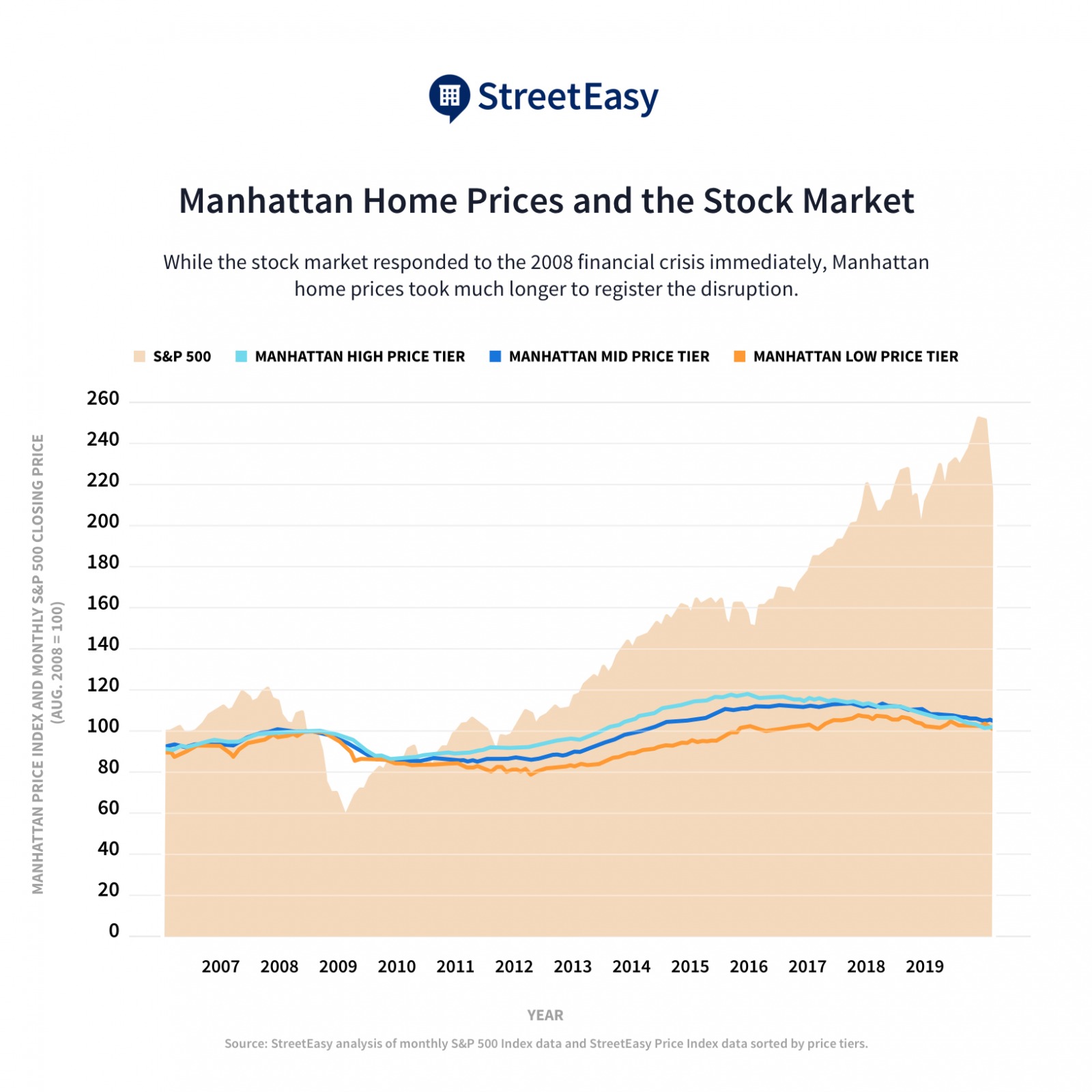

To illustrate how home prices changed in the last recession, and how they were linked to other economic measures, StreetEasy divided up the Manhattan homes sales market into three different price indices, representing the high-, low-, and middle-priced thirds. Then we compared those indices to the S&P 500 over time. Here’s what we found.

Home Prices Adjust to Bad Economic News More Slowly Than the Stock Market

There are important differences between today and 2008, but generally, the housing market adjusts to economic downturns considerably more slowly than the stock market.

The Great Recession decimated the financial industry in New York City, and the resulting mass unemployment, income loss, and outmigration drove a major downturn in the city’s housing market. New York City lost 98,600 jobs in 2009 because of the recession, sending the unemployment rate from 5% in 2007 to 10.3% in 2009.

Prior to the crisis, Manhattan home prices peaked in summer 2008. Even amid months of financial calamity, the borough’s sales market did not hit bottom until March 2011, by which time prices overall had fallen some 15%. Manhattan homes in the lowest-priced third of the market fell the most and took the longest time to hit bottom, declining by more than 21 percent overall by April 2012. Mid-priced homes hit the bottom in March 2011, falling by 15 percent. The highest-priced third of the market hit the bottom the earliest, falling 13 percent by November 2009, and recovered the fastest.

Rent levels also declined significantly in this period, though by substantially less: 10% across Manhattan, and 11% for the lowest-priced third of apartments. And it makes sense that demand, and thus prices, would fall more among sales than rentals, as homeowners owners felt the financial impacts of the crisis and found relief by moving to cheaper rentals in Manhattan or the outer boroughs.

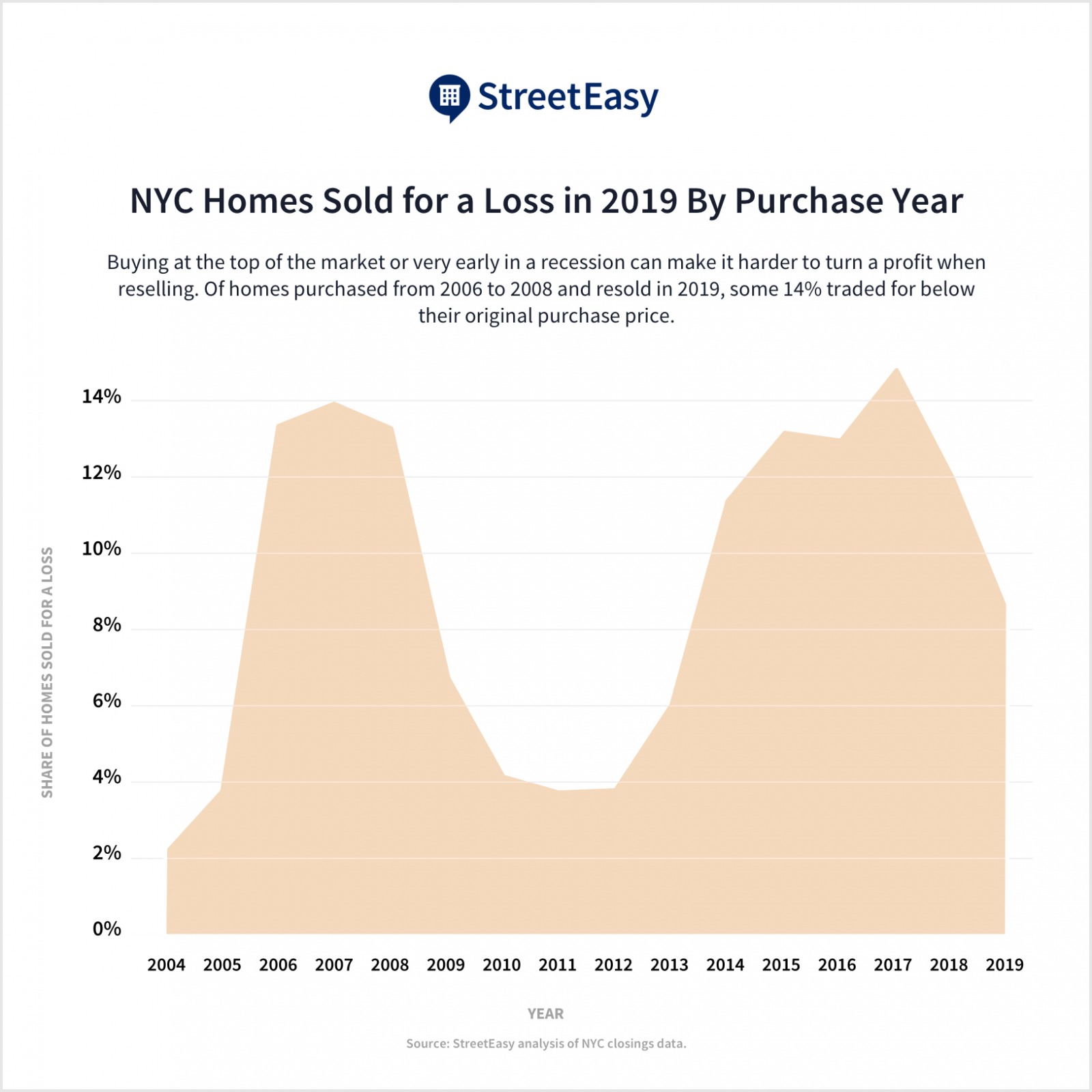

Notably, buyers who rushed into the market at the first sign of economic distress did not fare as well as those who waited a bit. In a separate analysis, we found that roughly 14% of homes purchased between 2006 and 2008 and sold in 2019 went for below their original purchase price. Meanwhile, of the homes purchased between 2010 and 2012 and sold in 2019, just 4% sold at a loss. (In a typical year, about 7% of NYC homes sell for a loss.)

Fortunately for prospective New York buyers, prices have declined from the market peak of 2015-17, and are dropping for the third year in a row. But whether they continue to fall, and by how much, remains an open question.

How Could COVID-19 Impact Manhattan Home Prices?

Ultimately, the impact of COVID-19 on NYC home prices depends on how the virus comes under control and how much the economic impacts of social distancing measures can be mitigated. Below, we outline some potential best- and worst-case scenarios for Manhattan home prices based on current data.

The Best-Case Scenario: Home-Shopping Season Comes Late

In the best-case scenario, market activity would resume at a brisk pace as soon as social distancing measures lift, and this spring’s home-shopping season would simply have been postponed. Inventory would return to the market, and buyers would be motivated to purchase by low mortgage rates. In this case, we would expect the previous long-term trends to continue, with Manhattan prices continuing to fall while those in Brooklyn and Queens stay flat.

Bigger Impacts May Be More Likely

However, this best-case scenario may be too optimistic. The International Monetary Fund announced April 14 that the COVID-19 crisis threatens the stability of the global financial system. A month ago, S&P Global Ratings said that the global economy is slipping into a recession.

New York City, a global financial capital, will certainly feel these impacts, not just in the financial sector, but in hospitality, services, and other areas. The Independent Budget Office of New York City estimates that the city will lose 475,000 jobs over the next 12 months, which, if true, would plunge the city into the worst recession since the 1970s.

Factors That Could Drive NYC Home Prices Down

A major global recession could trigger an environment similar to what New York endured in the Great Recession. Under this scenario, there is potential for a drastic fall in home prices, driven by three main factors:

- Record levels of unsold inventory already on the market;

- Mass foreclosures after the national moratorium is lifted, further increasing the housing supply;

- Major declines in the stock market that wipe out the savings of would-be buyers and decrease economic confidence.

Unfortunately, New York may face worse chances for major housing decline today than in 2008. Last time, lax borrowing and an explosion of new construction contributed to the downturn elsewhere in the country, but less so in New York City.

This time, while there’s little evidence of lax borrowing, Manhattan prices are already moving downward, and the outer-borough markets have been slowing down. Easy money and overly optimistic new construction flooded the market in the years of strong economic growth, and to this day, 1 in 4 new condos built since 2013 remain unsold.

Highest-Priced Homes Could Face the Steepest Losses

Those high-priced condos could see some of the biggest fallout from a COVID-19-driven real estate decline. Much of the growth in the NYC sales market since the last recession relied on discretionary spending by the world’s ultrawealthy.

Yes, many New Yorkers will still need a place to live, and homes in all price tiers across the city still have more room to fall. But in a period of uncertainty, will global jetsetters still feel they need a sparkling condo in Central Park South or Midtown — especially if some travel restrictions remain in place?

Moreover, prices, especially in Manhattan, still have room to fall. While in many parts of the country, housing inventory has fallen to new lows, NYC inventory stood at all-time highs prior to COVID-19. Every year for the past two years, more NYC homes sold at a loss, and for the past five years, the average Manhattan home spent more time on market. The number of buyers coming to the market as a result of lower mortgage rates is unlikely to match the glut of new units.

Manhattan and Brooklyn 1-2BRs Under $1M on StreetEasy Article continues below

Many sellers have been unwilling to publicize price cuts — yet 81 percent of Manhattan homes closed below their asking price in 2019. New development condos in the most expensive neighborhoods will likely need to reduce prices significantly, whether in listings or negotiations, in order to sell.

What COVID-19 Means for NYC Home Buyers and Sellers

Ultimately, whether to buy or sell a home is a personal decision. Prospective sellers would be smart to consider what they can afford, other investment opportunities, and their larger needs. For anyone who does decide to sell this year, flexibility with pricing will be key.

Many sellers are simply waiting to list their homes instead of giving discounts to win a quick sale — but the wisdom of this strategy in an uncertain market remains to be seen. Trying to time the market for a profitable sale often means making a sunk-cost fallacy.

New Yorkers planning to buy this year are still in a good place, given that mortgage rates have hit record lows and prices were falling before the pandemic hit the city. Timing the market is almost impossible, but buyers can rest assured that home prices in New York City are no longer at the peak of the market, which increases their chances of selling for a profit down the road.

However, if buyers can wait, NYC home prices will likely drop further. Any negotiations should take this into account.

—

Whether you’re looking to rent or to buy, find your next NYC apartment on StreetEasy.