Key takeaways:

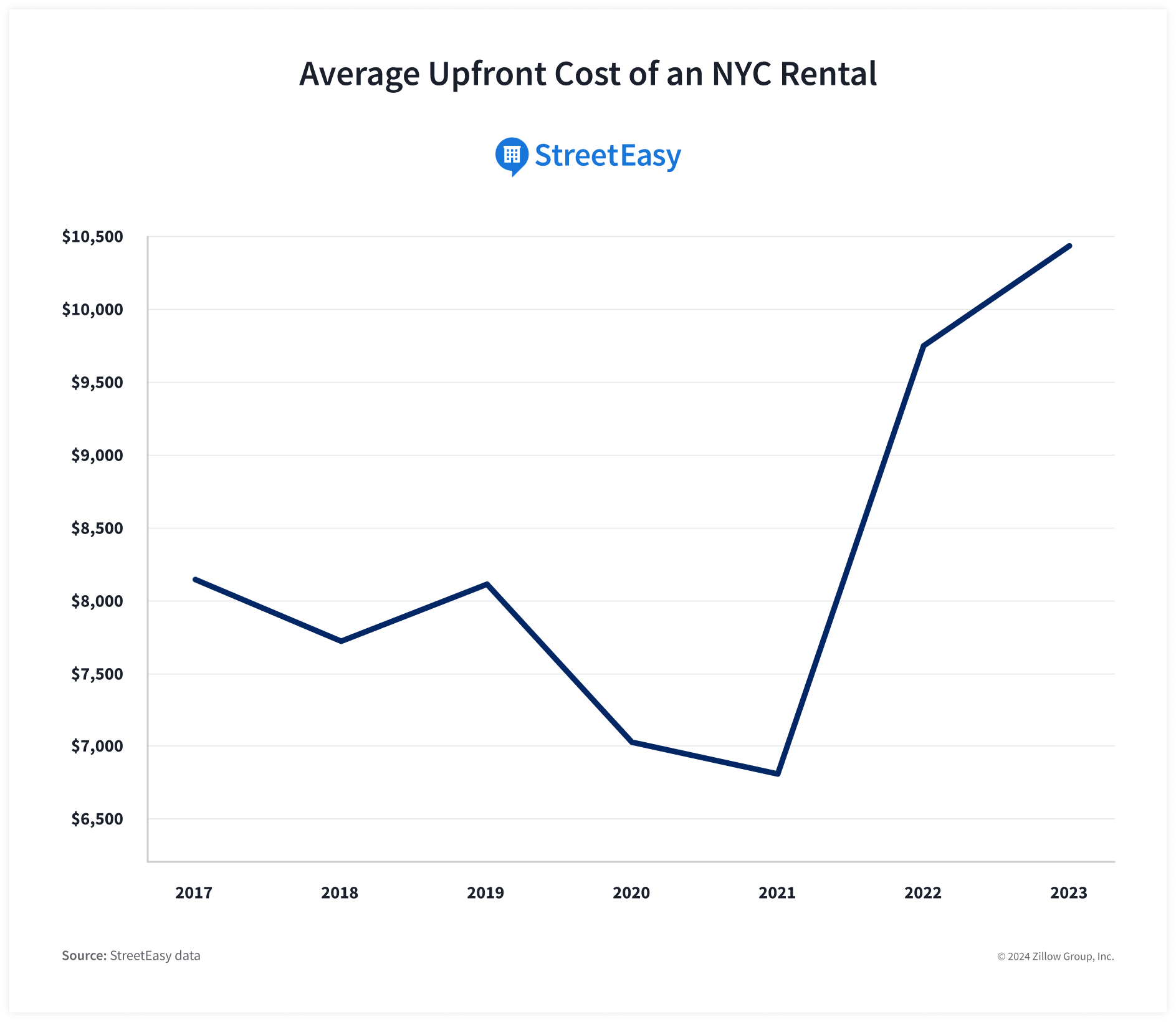

- StreetEasy® rental listing data shows the average upfront cost to move into a rental was $10,454 in 2023, up 29% from 2019 before the pandemic disrupted the market.

- The average $10,454 in upfront costs amounts to 14% of the city’s median annual household income, creating a “lock-in” effect for many renters that makes moving to or within New York City a major challenge.

- The lock-in effect is more pronounced for lower-income New Yorkers. For instance, those earning the median household income in the Bronx can afford fewer than 1% of rentals on the market outside the borough.

- Reducing the lock-in effect by lowering upfront rental costs will give all New Yorkers expanded choices in the rental market and improved financial ability to move, leading to a healthier marketplace where renters can afford more homes, and more homes become available as more renters choose to move.

- Renters need transparency around the upfront costs required to sign a lease and awareness that these costs are negotiable. Passing legislation that would require tenants to compensate an agent only when the tenant hires the agent to represent them, and ban the practice of single agent dual agency, will provide renters with increased transparency on upfront rental costs and significant financial relief from these costs.

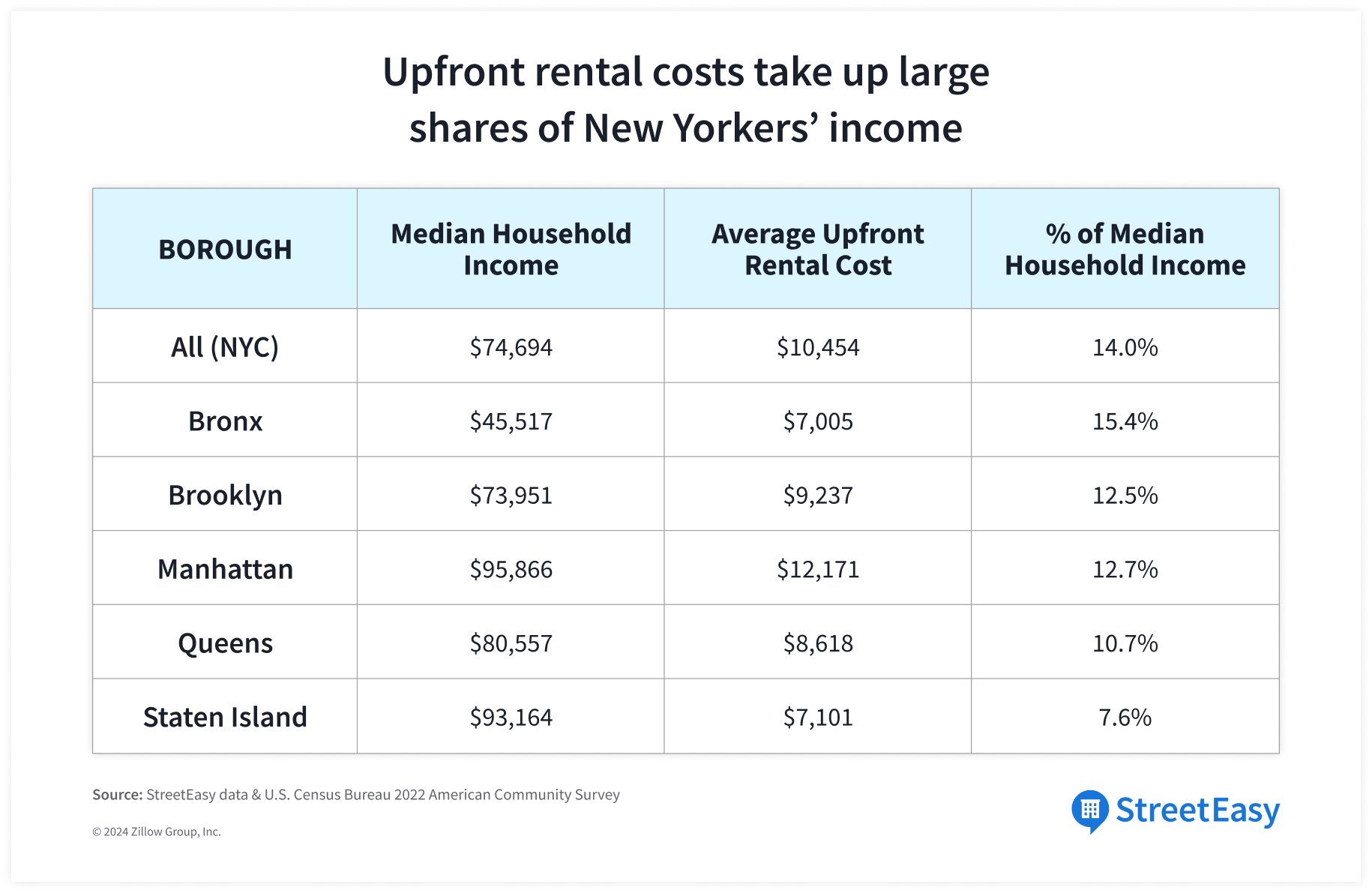

New York faces an urgent rental affordability crisis, driven largely by heated competition for limited homes pushing asking rents to all-time highs. Making matters worse, NYC renters are facing sharp increases in the upfront costs required to move into a new apartment. In 2023, the average New Yorker spent $10,454 in upfront costs for a rental — a significant financial burden amounting to 14% of the city’s median household income of $74,694, according to the Census Bureau’s 2022 American Community Survey. This is the highest average upfront cost recorded in NYC since 2010, when StreetEasy started tracking this data, up 7.1% from $9,763 in 2022, and 28.7% from $8,125 in 2019 before the pandemic disrupted the market.

The typical upfront cost to move into a rental in NYC is the sum of three amounts: first month’s rent in advance, security deposit, and broker fee. We calculated the upfront cost of each rental listing on StreetEasy and took the average to estimate what New Yorkers might encounter.

The largest upfront expense is often the broker fee, a commission the renter is asked to pay the broker (or simply “agent”) to secure the apartment. Unless marked as a “no-fee” rental, we assumed a renter would be required to pay 12% of the annual rent as a broker fee. Broker fees typically range from one month’s rent to 15% of the annual rent, but can be higher when there is more competition among renters. As the broker fee amount is tied to the rent on the lease, upfront costs have been ballooning along with rising rents since the pandemic began.

In addition to the broker fee, our calculation assumes the legal maximum amounts for security deposit (one month’s rent), advance payment of rent (one month’s rent), and application fee including credit and background check ($20 total). These maximums are set by the Housing Stability and Tenant Protection Act of 2019 (HSTPA). However, actual upfront costs may be higher due to additional charges such as pet fees, amenity fees, and move-in fees. These potential added costs were not included in our calculation.

Soaring upfront costs have made it more challenging for New Yorkers to move even within their own city, causing a “lock-in effect” wherein renters who want or need to move are unable to leave their current apartments. A recent StreetEasy survey conducted by The Harris Poll* found that for nearly three in four NYC renters (73%), the upfront cost of moving impacted either the homes they were able to afford (43%), or their desire (25%) or ability (23%) to move.

Reducing the lock-in effect by lowering upfront rental costs will give all New Yorkers expanded choices in the rental market and improved financial ability to move, whether it’s to be closer to their workplace, accommodate a growing family, or even pay less in monthly rent. A lower barrier to moving will lead to a healthier marketplace where renters can afford more homes, and more homes become available as more renters choose to move. With more opportunities for supply and demand to balance, it would be far less likely to see a hyper-competitive rental market as we did in 2022 and 2023. This would benefit millions of renters in New York City.

Broker Fees Are the Largest Portion of Upfront Costs

Whether the tenant is required to pay a broker fee when signing the lease can make a significant difference in upfront rental costs. StreetEasy found that about half of rental listings on the market in 2023 were marked as no-fee, meaning no broker fee. In 2023, the average upfront cost among listings that did not charge tenants a broker fee was $8,576, while the average upfront cost of those that did was $12,367, assuming a 12% broker fee on a listing’s advertised annual rent.

This means New Yorkers who paid a broker fee as a condition to sign a new lease likely spent 42.9% more in upfront expenses, on average, than those who secured a no-fee apartment.

Unlike other cities, NYC renters are often required to cover the broker fee even though they did not formally engage the broker on their own prior to touring a unit — rather, the landlord did so. While the agent is ultimately providing services to the landlord, the landlord is able to have the fee passed along to the renter through what is called “single agent dual agency,” whereby the agent is theoretically representing both the landlord and renter in the transaction.

Often, in NYC, the renter is left paying the broker fee without clarity on the services they should be receiving from the agent. Ultimately, adequate and transparent representation is an important part of the housing transaction — whether you’re buying or renting — and all consumers have a right to independent representation.

Meanwhile, NYC rental agents often find themselves providing landlords with unpaid labor and no guarantee of pay from a renter through the common practice of “open listings,” in which NYC landlords solicit more than one broker to advertise a single property. Agents generally pay for the cost of marketing, spend time touring units with prospective renters, and assist with applications. This open listing arrangement, in combination with single agent dual agency, leaves brokers competing for payment to recoup marketing costs on the same listing, as only the first broker who secures a tenant ultimately gets paid.

While no-fee apartments have lower upfront expenses, they can cost more in monthly rent, as they’re often found in luxury or new development buildings with desirable amenities such as doormen, in-unit laundry, and fitness centers. It’s also likely that marketing costs on these units are baked into the monthly rent. In 2023, NYC’s more expensive rentals were less likely to charge broker fees: three in five no-fee rentals (62.2%) on the market were priced above the citywide median asking rent of $3,490.

High Upfront Costs Are a Major Financial Burden to Renters

Based on the average upfront cost of $10,454, a renter earning the median household income in NYC ($74,694) would have to spend 14% of their annual income to cover the expenses required to sign a new lease. In reality, few renters find themselves ready to pay such a large sum. The average upfront rental cost in NYC is more than five times the median cash balance of $2,000 that US renters held across checking accounts, savings accounts, money market funds, call or cash accounts at brokerages, and prepaid debit cards in 2022, according to data from the Federal Reserve Board.

In StreetEasy’s recent survey, one in three renters (32%) adjusted spending in other areas of their life, one in five (21%) accepted money from a friend or family member, and one in ten (9%) took out a loan to afford the upfront costs of their new rental. Only one in five renters (22%) could afford these costs out of pocket.

The financial burden of upfront costs is significant for all New Yorkers, but especially for those living in boroughs with lower median household incomes. Renters in the Bronx earning the borough median household income of $45,517 would have to spend 15.4% of their annual income on upfront costs — the highest burden in the city. In Manhattan, where the median household income ($95,866) is significantly higher than other boroughs, a renter earning this amount still needs to pay 12.7% of their annual income to sign a new lease, due to higher average upfront costs in the borough.

Advance payment of first month’s rent counts toward the regular monthly rent, and security deposits are refundable. However, when combined with nonrefundable costs such as broker and application fees, these two large cash payments create sizable holes in renters’ budgets and require months or more of preparation and planning. From StreetEasy’s survey, 44% of renters reported saving for multiple months to afford the upfront costs of moving, while about one in five (18%) ultimately delayed the timing of their move due to these costs. Even more renters reported that upfront costs impacted their rental search, with some saying they had to move to a less ideal home (21%), sacrifice their preferred amenities (20%), or choose a place farther from their desired location (13%).

Have upfront costs like broker fees impacted your ability to move or to afford a new apartment in NYC? Share your story with us in a brief survey.

Lower-Income New Yorkers Face Higher Barriers to Moving Within the City — or Even Their Own Borough

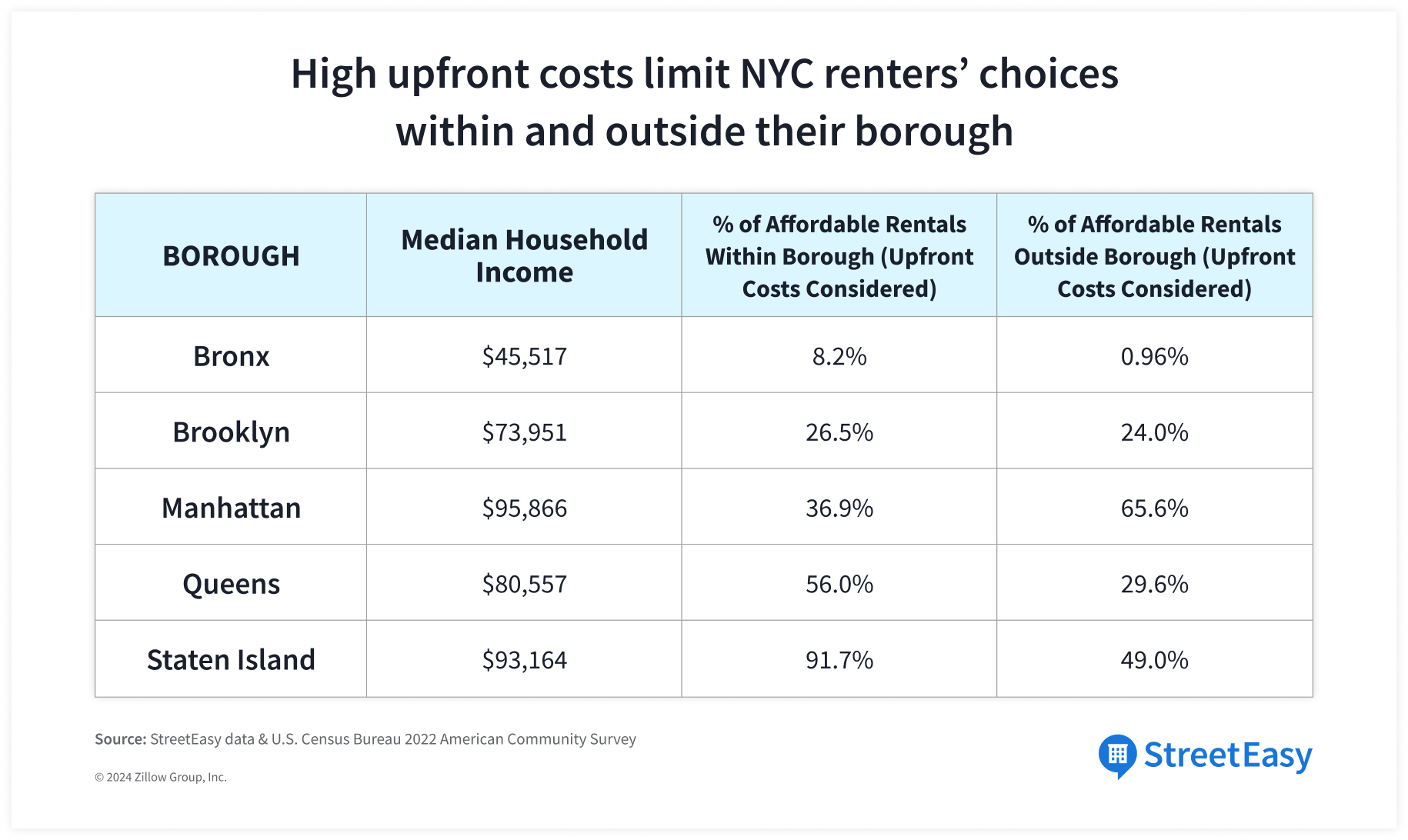

Elevated upfront costs make moving to or within New York City a major challenge for many New Yorkers. Factoring in upfront costs and annual rents, a New Yorker earning the citywide median household income of $74,694 could afford just one in four (24.8%) market-rate rentals within the city in 2023.

Many New Yorkers are already “severely” rent burdened: nearly one in three (32%) renters spent more than 50% of their income on rent, an ongoing trend since 2005 according to NYC Housing Vacancy Survey. Considering NYC’s already high rent burdens, we define “affordable” as rentals that cost less than 50% of a household’s combined annual income before taxes.

Unfortunately, many lower-income New Yorkers bear the brunt of the lock-in effect of upfront rental costs. Those in outer boroughs, where median incomes are lower compared to Manhattan, are faced with additional challenges when considering moving to other parts of the city, and even within their own borough.

For example, New Yorkers in the Bronx earning the borough median household income of $45,517 can afford fewer than one in ten (8.2%) rentals in the borough, based on estimated upfront costs and annual rents in the area. These Bronx renters have even more limited options in other parts of the city — where asking rents and upfront costs are much higher — being able to afford less than 1% (0.96%) of the rental inventory in other boroughs.

By comparison, New Yorkers in Manhattan earning the borough median household income of $95,866 can afford more than a third (35.5%) of the rental inventory in their own borough. Due to their higher median income and the relatively lower upfront costs of rentals outside Manhattan, they’d also be able to afford nearly two-thirds (65.6%) of the rental inventory in other boroughs.

Note: With StreetEasy data, we calculated affordable rental inventory shares by looking at the share of rentals that residents earning their borough’s median household income could afford in the borough of their residence and the rest of the city without spending more than 50% of income on security deposit, application fee, broker fee if applicable, and annual rent. Median household income is from the Census Bureau’s 2022 American Community Survey.

What Are the Other Upfront Rental Costs?

Besides a broker fee, the most common upfront costs are security deposit, first month’s rent, application fees, and any additional miscellaneous fees that some landlords or buildings may charge. Consult our guide to rental fees that New Yorkers commonly encounter in the city.

Security deposits take up a large portion of upfront costs. The Housing Stability and Tenant Protection Act of 2019 (HSTPA) prohibits landlords from charging more than one month’s rent for a security deposit — a protection that was not in place prior to the act passing. While security deposits are refundable, they still require tenants to set aside a large sum of cash before signing and through the duration of the lease, creating a financial barrier for the average New Yorker. Landlords are also required by the HSTPA to return the security deposit within 14 days of the tenant moving out. Should the landlord take out any amount of the deposit for damages, they are required to provide an itemized statement describing the damage and its cost.

Another substantial component is the advance payment of rent before signing a lease. Per the HSTPA, landlords can only require one month’s rent to be paid in advance. Although it’s an amount the renter would have to pay at the start of their new lease anyway, this payment is often due weeks before the first of the month, which can be challenging for those living paycheck-to-paycheck or without substantial savings. Moreover, landlords may charge renters application fees to cover the costs of a background check and credit check. This fee is legally limited by the HSTPA to $20 per application. However, many condo and co-op boards request additional application fees, separate from the application fee collected by the property owner.

Resources are available to renters if they believe they’ve been overcharged for security deposits, advance rent payments, and application fees, or have not received their security deposit within the legally allowed time frame. Renters can call 311 and ask for the Tenant Helpline, administered by the NYC Mayor’s Public Engagement Unit, to understand their rights and be connected with housing-related resources, including free legal services. Additionally, renters may contact the New York State Homes and Community Renewal’s Tenant Protection Unit, the state arm responsible for investigating and enforcing compliance with New York housing laws and regulations.

Recommendations for Expanding Renters’ Choices

While it’s important to ensure landlords have adequate protections against unpaid rent and damages to a rental property, a system that creates substantial financial barriers to moving into a new apartment does not benefit the rental market as a whole. Along with the need for more resources and policies in place to manage their financial obligations to landlords, renters need transparency around the upfront costs required to move and awareness that these costs are negotiable. Such efforts can help renters avoid jeopardizing their financial health, and even expand their ability to move into a new apartment.

Impactful resources and policies could consist of:

- Broker fee and single agent dual agency reform: Passing legislation that would require tenants to pay a real estate agent only when the tenant hires the agent to represent them in a residential rental transaction, and banning the practice of single agent dual agency, whereby the agent is theoretically representing both the landlord and renter in the transaction, will provide renters with increased transparency and significant financial relief on upfront rental costs.

- Payment plans: Allowing tenants to pay their security deposit in installments rather than in full can significantly lower the upfront cost burden. In Seattle, for instance, renters are allowed to pay security deposits in four installments, according to a Seattle City Council ordinance.

- Tenant education and stronger enforcement of affordable housing policies: Increasing education and outreach to tenants regarding their rights and how to report violations would ensure renters remain well-informed in their search for new housing, and help strengthen the enforcement of the HSTPA.

- Increased resources that more broadly impact housing access and affordability: Adopting zoning laws and tax incentive programs can encourage and bolster housing development across income brackets, especially in hard-to-develop areas, including ADU/basement apartment conversion and commercial-to-residential conversion. Additionally, increasing resources to fund enforcement efforts would address housing discrimination that arises when a renter attempts to use their rental assistance.

New Yorkers can learn more about the tenant protections set in place by the HSTPA through the NYC Mayor’s Office to Protect Tenants website. Renters should also see StreetEasy’s explainer of what the 2019 law means for all New Yorkers.

*Survey was conducted online in the United States by The Harris Poll on behalf of StreetEasy among 506 U.S. adults 18+ who reside in the NY DMA and in one of the five NYC boroughs, and have rented an apartment or home in the past five years. Survey was conducted July 20-August 4, 2023. Respondents for this survey were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within + 6.0 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact press@streeteasy.com.

The information provided was extracted from StreetEasy listings and its expansive internal database. The contents of this article are intended for informational purposes only and not intended as a complete recitation of the market.

StreetEasy is an assumed name of Zillow, Inc. and registered trademark of MFTB Holdco, Inc. a Zillow affiliate, which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.

Copyright © 2024 by Zillow, Inc. and/or its affiliates. All rights reserved. All data for uncited sources in this presentation has been sourced from Zillow data.