NYC essential workers were hit hardest, with many only able to afford less than 10% of rental inventory available this summer

Rent growth outpaced wage growth by 23% in NYC in August after adjusting for inflation – the widest gap since the 2008 financial crisis (aside from another sizable gap in 2020 which was caused by a temporary but unprecedented disruption in real estate activity due to the COVID-19 pandemic). Real wages in NYC were down 9.1% year-over-year in August, while rents were up 13.4% year-over-year, based on the StreetEasy Rental Index and adjusted for inflation.

Many New Yorkers have had to stretch their budget to afford rent unless they make other compromises such as adding roommates or looking to more affordable neighborhoods, as StreetEasy’s rental search data suggests. It is generally recommended that renters keep rental expenses below 30% of their income to avoid being “rent-burdened.” The 2021 NYC Housing and Vacancy Survey (HVS) indicates half of renters in the city are spending above this threshold, and therefore considered rent-burdened.

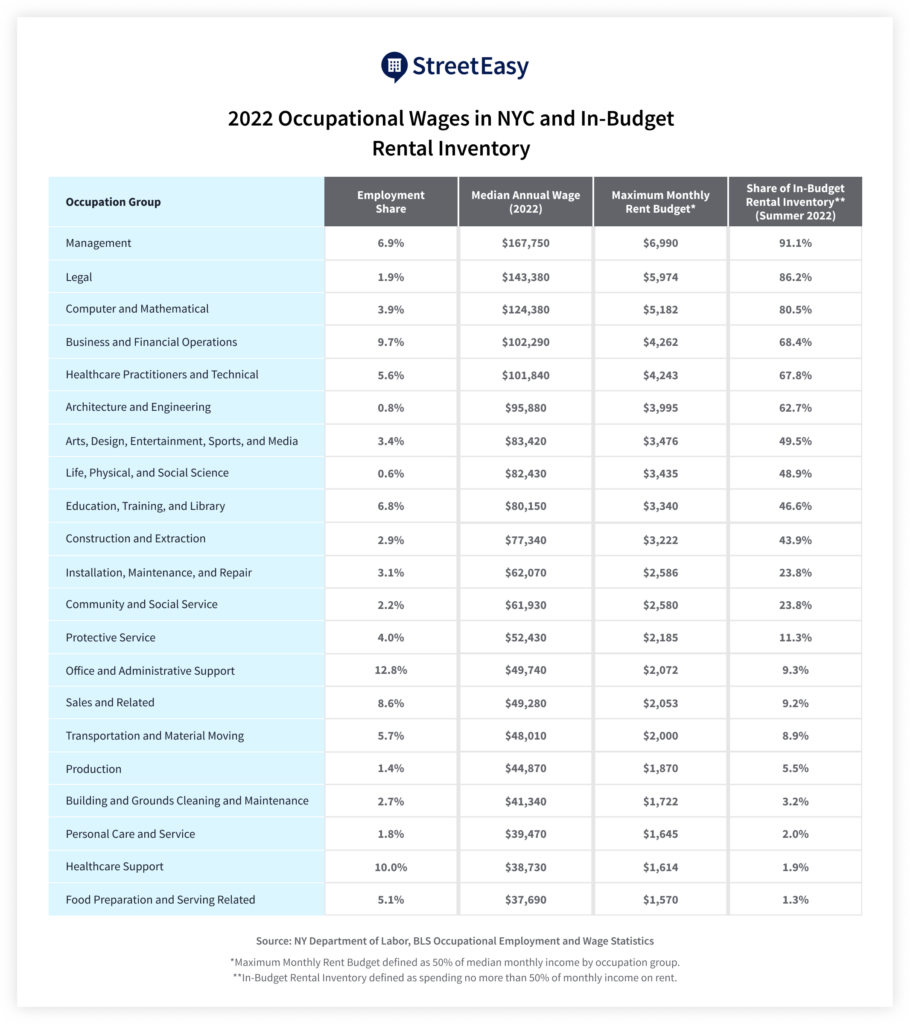

For those earning lower wages, affording NYC rents became much harder this year. Just under half (48.2%) of NYC’s four-million-person workforce earned enough in typical annual wages to afford just 10% of the rental inventory available this summer, unless they spent more than half of their income on rent. As StreetEasy’s analysis of New York State Department of Labor data shows, many of these people provided essential services to the city throughout the pandemic such as healthcare, food preparation, and transportation.

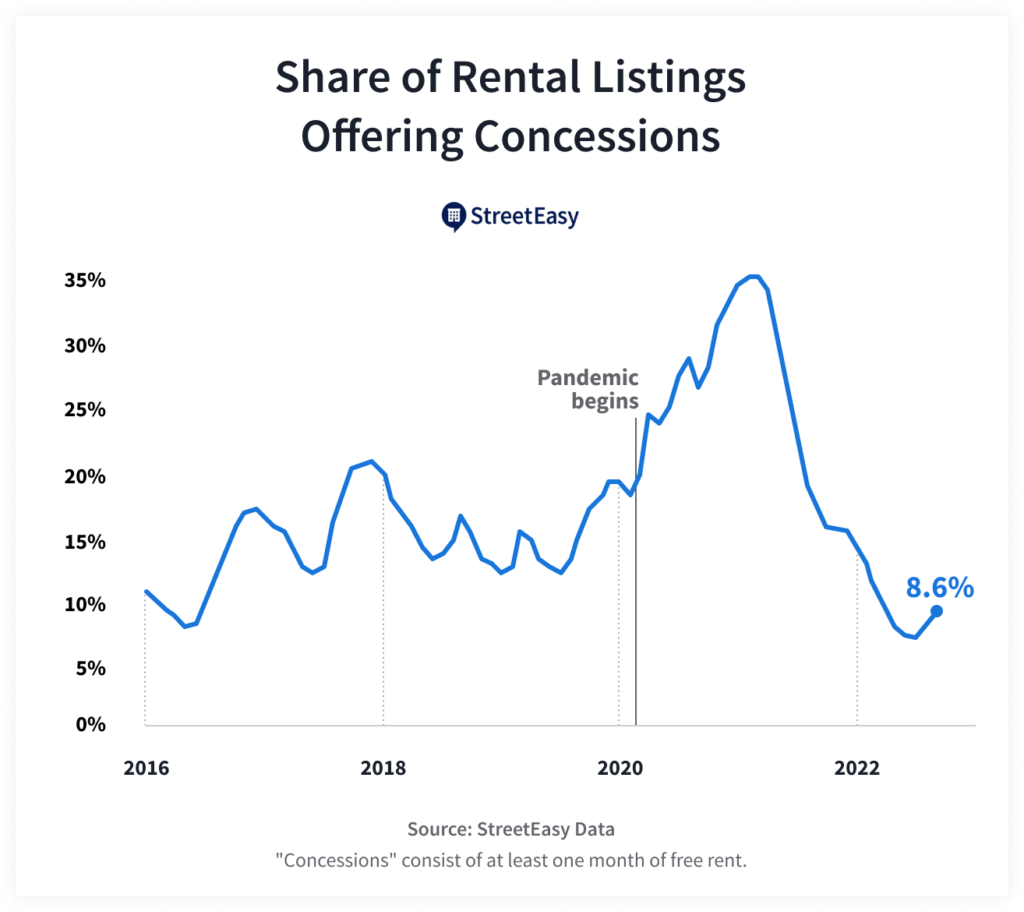

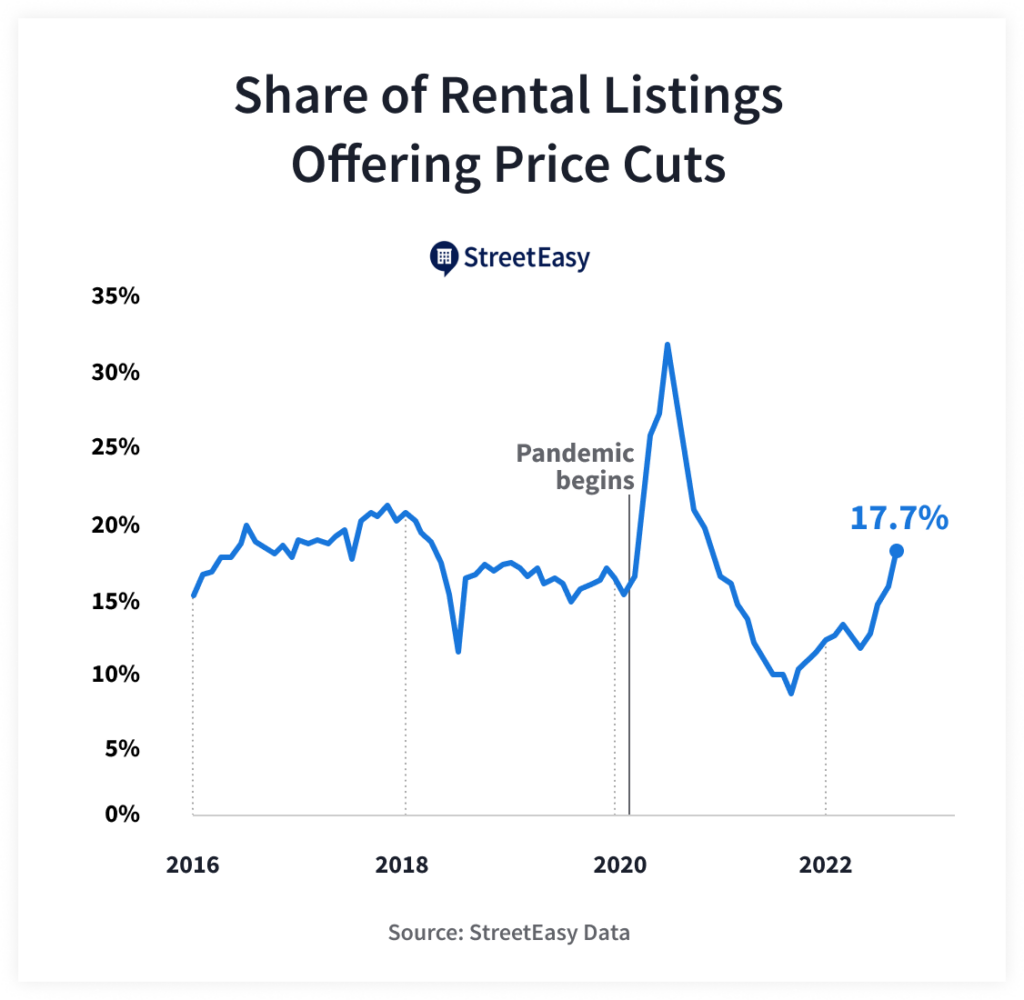

A silver lining for renters is that the NYC rental market is rebalancing, although still highly competitive. Asking rents are still rising, but at a rate that appears to be slowing. Moreover, rental concessions have started to pick up, and the share of listings offering price cuts is rising.

The Widening Gap Between Wage and Rent Growth

Inflation, excluding housing costs, in the NYC metro area as measured by the Consumer Price Index was 8.9% year-over-year in August, after peaking at 9.6% in June 2022: the highest level since 1981. In the same time period, NYC residents’ wages fell 9.1% year-over-year after adjusting for the steep rise in inflation. Rents, tracked by the StreetEasy Rental Index, were up 13.4% year-over-year after adjusting for inflation. The gap between wage growth and rent growth is now the widest it’s been in at least 14 years.

The strong recent growth in sale prices and rents this spring reflect NYC’s housing market bouncing back from the effects of the pandemic. The city has been gaining private jobs steadily, and as of this August, total employment was just 3.4% below its peak of 4.1 million jobs in February 2020.

Despite overall growth, employment in the sectors hit hardest by COVID has yet to fully recover. As of August this year, jobs in the retail trade sector remain 10.2% (35,000) below their pre-pandemic peak in February 2020. Jobs in leisure & hospitality and accommodation & food service remain 11.4% (52,000) and 11% (40,000) below their pre-pandemic peaks, respectively.

NYC Homes Under $1M on StreetEasy Article continues below

For Many Essential Workers, Asking Rents Were Too High This Summer

Renting in NYC has been expensive since long before the pandemic. According to the latest NYC Housing and Vacancy Survey (HVS), half of renter households spent more than 30% of their income on rent in 2021. One-third of the city’s renters spent over 50%, indicating a severe rent burden – an ongoing trend since 2011.

Depending on the renter’s occupation, affordable rentals can be much harder to come by. For typical workers across nine occupational groups including healthcare support; food preparation and serving; personal care and service; and transportation services; the majority (90%) of rental inventory this summer was out of reach unless they spent more than half their income on rent, assuming they earn the median wage and are the sole source of income in the household. Close to half (48.2%) of NYC’s nearly four-million-person workforce belong to these nine occupation groups whose median wages make it more difficult to find an affordable rental.

Unfortunately, healthcare support workers, including home health aides and nursing aides in hospitals and nursing homes, were squeezed the most. Typical annual wages in this field were $38,730 according to the NY Department of Labor. This was barely enough to afford only 2% of rental inventory this summer without spending more than half of their income on rent, even though they make up 10% of the total workforce in NYC.

How do the city’s renters make ends meet? Many young adults live with roommates who can bring in additional income. Those starting their careers in NYC can save $13,200 per year – more than a third of typical entry-level annual wages in NYC ($35,241) – by adding a roommate instead of living alone in a studio or one-bedroom apartment. For context, the median monthly asking rent for studio and one-bedroom apartments was $3,000 in Q3, while the median for two and three-bedroom apartments was $3,800, according to StreetEasy data. Dividing the rent in these cases would lead to a $13,200 annual savings per person.

NYC Rentals Under $2,000 on StreetEasy Article continues below

However, many renters facing financial hardship have had to resort to savings and loans to keep their home. The NYC Housing Vacancy Survey indicates 10% of renters tapped into their savings, 4% borrowed money, and 1% relied on other means such as selling something to cover rent. Renters struggling with rising rents have also had to look farther away from Manhattan, as StreetEasy’s recent rental search data suggests.

Silver Lining: The NYC Rental Market Is Rebalancing

Despite the historically wide gap between wage growth and rent growth, three indicators lead us to believe that a rebalancing of the rental market is underway.

First, the city-wide median asking rent has plateaued. The median asking rent in NYC was $3,500 in September, reflecting a slight decline from $3,575 in August. Compared to a year ago, the median asking rent was up 27% in September. Between August and June, the year-over-year growth rate averaged 33%. Slowing year-over-year growth is an early sign that the heated rental market may be losing its sizzle.

NYC Rentals Under $3,500 on StreetEasy Article continues below

Second, the share of rental listings offering concessions of at least one month of free rent rose to 8.6% in September, rebounding from its seven-year low of 6.6% in July. Some landlords appear to be re-introducing concessions to fill up vacancies – a sign of moderating confidence after an unusually competitive rental market this spring and summer. While still harder to find, concessions can open new opportunities for some renters by lowering net-effective rents.

Third, the share of rental listings with price cuts is rising quickly, indicating landlords are resetting their expectations as demand cools. Adjusting for seasonal fluctuations, the share of rental listings that cut asking rents rose to 17.7% in September, the highest since the pandemic. At its peak in July 2020, nearly a third (31.6%) of rental listings offered discounts.

However, the rebalancing of the rental market will likely take place at a gradual pace. It remains to be seen whether demand cools beyond a seasonal slowdown toward the end of the year. With elevated home prices and mortgage rates, many would-be buyers will likely remain in the rental market at least until the 2023 buying season, which may keep upward pressure on rents. While improving, rental inventory is still low compared to before the pandemic. As renters continue to seek affordability, the rental market will gradually reach a new equilibrium.