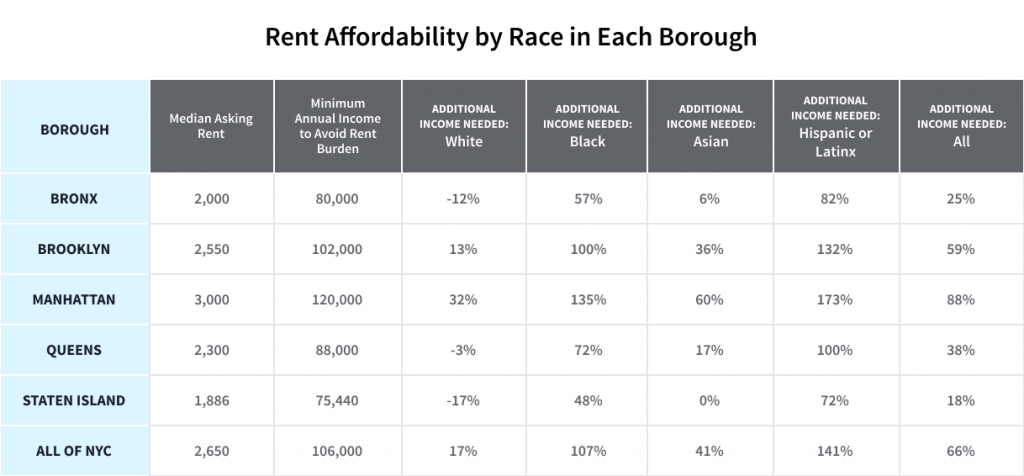

It’s no secret that NYC is an expensive place to live. With the recent increases in rent amidst a still struggling economy, it has become clearer than ever that rents are rising at a faster pace than many households can keep up with. To not be considered rent-burdened, a renter must spend no more than 30% of their income on rent. Thus, to afford the median market-rate apartment in NYC, the average NYC household would need 66% more income than they currently earn. Based on median household income data from the Census, earnings would need to increase by 141% for a Hispanic or Latinx family, 107% for a Black family, and 41% for an Asian family. Meanwhile, the typical white family would only need a 17% increase in earnings.

Key Takeaways

- Black and Latinx households in New York City would need more than double their income to comfortably afford the median rental.

- Asian households would need a 41% increase.

- White households would need only a 17% increase.

- The pandemic exacerbated this uneven rent burden.

Uneven Rent Burden Becomes Starker

When it comes to housing affordability, the rent-burdened disparities grow as we look into specific boroughs. The typical white household could live comfortably in Queens, Staten Island, and the Bronx even with reduced income. Meanwhile, on average, Black, Latinx, and Asian families need additional income to affordably live in all boroughs. Manhattan and Brooklyn, the boroughs with the highest median asking rents, would require additional income for all.

Pandemic Rent Drops Widened the Racial Affordability Gap

The pandemic both revealed and exacerbated the uneven rent burdens across New York City. Throughout the pandemic, rents rose more than twice as quickly in the communities hit hardest by the pandemic. Many of these are predominantly communities of color — and are also the more affordable neighborhoods.

Meanwhile, rents dropped across the city in the most expensive neighborhoods. These areas are predominantly white, and also had the lowest rates of COVID-19 cases. So people seeking housing affordability had a doubly hard time.

Many Families Struggle in the Most Affordable Areas

Even in the most affordable neighborhoods, Black and Latinx families need significant additional income to be able to afford market-rate apartments. For example, in Bensonhurst, Brooklyn, the median asking rent is $1,623. (Of the neighborhoods on StreetEasy with at least 200 listings in Q2 2021, Bensonhurst had the lowest median asking rent. That makes it the most affordable neighborhood in the city during that time.) On average, Latinx families need 48% more income and Black families need 27% more income to comfortably afford this amount.

According to Census data, the typical Black and Latinx households have a maximum monthly housing budget of $1,418 and $1,218, respectively. The maximum budget for typical white and Asian households is $2,515 and $2,087, respectively.

Let’s say the typical Black and Latinx households were able to spend up to 45% of their income on rent. Even then, they would still have fewer affordable listings to choose from than the typical Asian or white household spending just 30% of their income on rent. As is clear from this data, spending only 30% of income on housing is not doable for many in New York City. Many, if not most, are forced to stretch their budget and spend more than that on housing.

What About More Expensive NYC Neighborhoods?

In the most expensive neighborhood, Central Park South, the ratios are much higher. On average, Latinx families would need five times their income to comfortably afford a median-priced unit here. Meanwhile, Black families would need more than four times their income.

How Does Rent Affordability in NYC Compare to National Averages?

National comparisons reveal the severity of the affordability crisis in NYC. According to Zillow data, on average, the typical household of any race spent roughly one-third of their income on rent in the United States in July 2021. The average Asian and white households were not rent burdened, spending 26% and 28% of their income on rent, respectively. Black and Latinx households were able to find rentals while spending just over 30% of their income on rent: 36% and 33%, respectively.

It is important to keep in mind, however, that these numbers are averages. Many households, regardless of race, are spending far above these shares of income on rent. And of course, New York City is far from typical. It’s no surprise that New Yorkers face much higher rents, are more likely to be rent burdened, and would have more rentals to choose from with additional earnings.

NYC Renters Make It Work

Obviously New York City is an expensive place to live, consistently ranking among the nation’s priciest rental markets. Many renters will spend more than 30% of their income on a place to live. But clearly, for millions, the pros of living in the city outweigh the cons and expense. Plenty of people find ways to make it work, including living with roommates to help share the burden or finding side hustles to earn a little extra cash.

Moreover, most New Yorkers don’t pay current advertised market rates for their apartments. Some tenants’ rents are lower, whether it’s because they have been there a while, they share a unit, they have rent stabilization, or other reasons. In other words, the median actual rent paid by New Yorkers is not necessarily the same as the median asking rent for rental units advertised.

Housing Affordability Tools for New York City Renters

The fact of the matter is that many renters in NYC have to stretch beyond the ideal budget to spend on their rent. And renters of color are impacted the most. However, there are many resources available that offer help finding affordable housing in the city. These include the following: