Key Takeaways:

- Since 2019, rents have grown faster than wages in 44 of the 50 largest metros.

- In 2023, rents grew faster than wages in about half of major metros.

- NYC rents grew more than seven times faster than wages last year — the largest gap in the country.

Rent growth has surged across the country in recent years, and wages simply haven’t kept up.

An analysis of Zillow® and StreetEasy® rental data, combined with wage data from the U.S. Bureau of Labor Statistics, shows that since the pandemic, rent growth has far outpaced wage growth in 44 out of the 50 largest United States metros. While rents nationally have grown 1.5 times faster than wages on average since 2019, they’ve shot up three times as much in some areas.

Manhattan Rentals Under $3,000 on StreetEasy Article continues below

Though the trend has cooled in the past year, it has left a large gap in many areas between the housing renters can afford and the housing that is on the market. The most glaring example is in New York City, where wages rose 1.2% from 2022 to 2023, but rents shot up more than seven times faster. In several of the country’s largest metro areas, wage growth actually declined in the past year while rent growth continued to rise.

NYC Has Greatest Gap in Rent Growth Relative to Wage Growth

Amid surging demand and record-low vacancy rates, rents in NYC have increased the most dramatically relative to wage growth, with rents growing more than seven times faster than wages in the city since last year alone. Despite NYC’s strong job market propping up demand — and therefore prices — in the rental market, the mere 1.2% year-over-year increase in wages has not been enough to counter the 8.6% increase in asking rents.

NYC saw the biggest year-over-year jump in asking rents of any market in the country, followed by the Cincinnati and Providence metro areas — both at 7.2%. Meanwhile, declining wages in the Memphis, Boston, and Chicago metro areas have made slightly more modest increases in asking rents even more challenging.

Florida markets occupy three of the top five spots where rent growth has most dramatically outpaced wage growth since pre-pandemic. Florida has been a migration hotspot since the pandemic, with new residents attracted by the possibility of year-round outdoor living and relatively affordable housing compared to many coastal markets. This surge in demand has led to skyrocketing rents, while wages in the state struggle to keep up. Even in Miami, where wage growth has been slightly above the national average, a greater than 50% increase in rents — the most dramatic jump of any US market — has left a huge gap between the income residents are earning and the income they need to afford to live in the area.

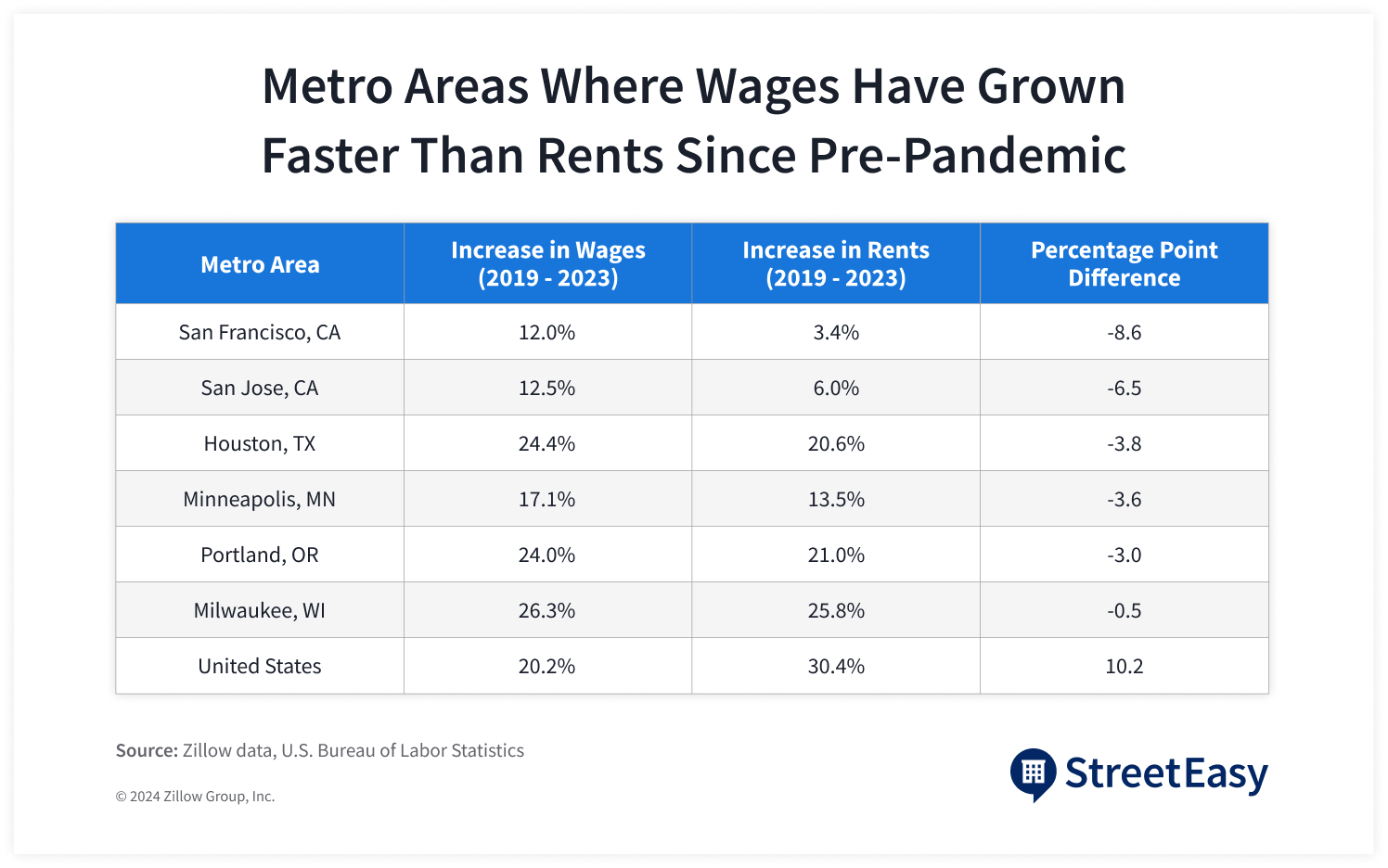

Areas Where Wages Are Growing Faster Than Rents

Rent growth has begun to moderate across much of the country, giving wages a chance to catch up and providing renters with some reprieve. In San Jose, wages grew an incredible 8.6 times faster than rents year-over-year in 2023. In three areas — San Francisco, Portland, and Austin — rents actually declined from 2022 as market heat began to moderate, while wage growth in those areas continued to climb.

Houston saw the greatest annual wage growth of any metro — nearly double the national average — and was one of only four markets where wages outperformed rents consistently both year-over-year and since before the pandemic. Wage growth above the pace of rent growth, in addition to strong job gains, helped the Houston metro area rank second in the nation for population growth in 2023, according to U.S. Census Bureau data.

While wages have grown faster than rents in nearly half of the 50 largest metro areas across the country in the past year, only six areas have seen wages consistently outpace rents since even before the pandemic. In San Francisco, wages have grown 3.6 times faster than rents since before the pandemic.

How Zillow and StreetEasy Are Helping Renters

Zillow and StreetEasy have a number of tools that help renters with affordability and access.

The upfront costs of finding a place to rent can add up, with Zillow research showing those costs tend to be higher for renters of color. In New York City, upfront costs average almost $10,500, with broker fees often being the largest expense. Lowering upfront rental costs will give all New Yorkers expanded choices in the rental market, which is one of the reasons Zillow and StreetEasy are advocating for broker fee reform.

Brooklyn Rentals Under $2,500 on StreetEasy Article continues below

For all apartment buildings, Zillow includes a “costs and fees” breakdown to help renters gauge the full affordability picture by highlighting certain one-time costs, such as application fees and security deposits, as well as recurring costs, such as parking. While the typical renter pays $60 in application fees across all rentals they apply for, Zillow offers a universal rental application that allows renters to apply to an unlimited number of participating rentals for 30 days for a flat fee of $35.

Zillow rental listings also include rooms for rent — individual rooms in units or homes — bringing more affordable rentals online. Renters using Zillow can include “room” listings in their searches alongside traditional “entire place” options.

Methodology

To capture rent growth, we measured the change in the Zillow Observed Rent Index (ZORI) nationally and for the 50 largest US metropolitan areas (excluding the New York City metro area) from 2019 to 2023 and 2022 to 2023. For the New York City market, we measured the change in citywide median asking rent according to StreetEasy data over the same time periods. To calculate wage growth, we analyzed the change in average hourly earnings from 2019 to 2023 and 2022 to 2023 using data from the Bureau of Labor Statistics for the United States, the 50 largest US metropolitan areas, and New York City proper.

Queens Rentals Under $2,500 on StreetEasy Article continues below

For more information on this methodology or to see a complete breakdown of wage growth and rent growth in the top 50 metropolitan areas, please contact press@zillow.com.

StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. All data for uncited sources in this presentation has been sourced from Zillow data. All third-party product, company names and logos are trademarks of their respective holders and use of them does not imply any affiliation. Copyright © 2024 by Zillow, Inc. and/or its affiliates. All rights reserved.