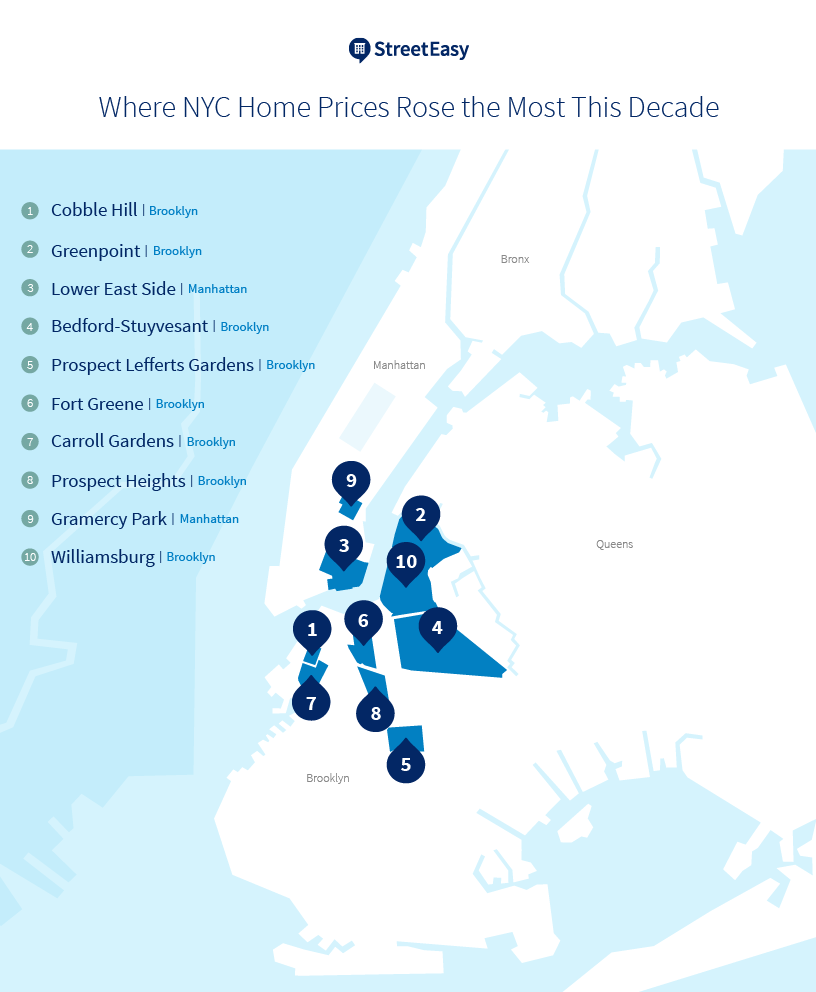

The list of NYC neighborhoods where home prices rose the most tells the story of city real estate over a decade. (Getty Images)

Many New Yorkers probably know that their neighborhood was quite different 10 years ago — especially if they’ve been living in it the whole time. One way to see that change is through median recorded sales prices, which show what homes actually sell for.

Looking at the 10 neighborhoods where median recorded sales prices rose the most in the 2010s shows just how much things have changed across NYC in a decade.

As of November 2019, citywide prices are 49% higher than in 2010, with the median recorded sales price jumping from $450,000 to just under $670,000. In many areas, this leap was even larger: The median sales price in the neighborhoods on our top 10 list has more than doubled since the start of the decade.

Where Home Prices Tripled: Cobble Hill, Brooklyn

In the leafy Brooklyn neighborhood of Cobble Hill, home prices have tripled since 2010, putting it at the top of our list. Most of this price growth occurred in the past five years, over which this low-rise, townhouse-filled neighborhood cemented its reputation as a high-status place to live.

Manhattan 1-2BRs Under $800,000 Article continues below

In 2010, the median home in Cobble Hill sold for $834,115. This year, the median recorded sales price in the area was $2,591,446, making it the fourth-most expensive neighborhood in all of NYC.

| Neighborhood | 2010 Median Recorded Sales Price | 2019 Median Recorded Sales Price | Percentage Change |

|---|---|---|---|

| Cobble Hill | $834,115 | $2,591,446 | 211% |

| Greenpoint | $539,713 | $1,578,287 | 192% |

| Lower East Side | $521,000 | $1,395,000 | 168% |

| Bedford-Stuyvesant | $363,000 | $938,486 | 159% |

| Prospect Lefferts Gardens | $373,195 | $865,000 | 132% |

| Fort Greene | $574,041 | $1,250,000 | 118% |

| Carroll Gardens | $715,000 | $1,540,000 | 115% |

| Prospect Heights | $535,791 | $1,125,000 | 110% |

| Gramercy Park | $694,500 | $1,450,000 | 109% |

| Williamsburg | $520,000 | $1,075,000 | 107% |

2010s: The Decade of Brooklyn

Eight out of the 10 neighborhoods on this list are in Brooklyn, showing how attractive the borough has become to homebuyers and developers alike. Areas like Greenpoint, Bed-Stuy, Prospect Heights and Williamsburg (which is our top Neighborhood to Watch in 2020) have all seen hundreds of new homes come onto the market, thanks to a boom in new condo buildings that’s also caused recorded sales prices to rise sharply.

Since 2013, when the condo boom really began in NYC, 25 new buildings with a total of 344 units have been built in Greenpoint alone. One of them is the boutique condominium at 174 West St., where 15 units have sold for an average price of $1,984,280, according to StreetEasy data — 26% higher than the median recorded sales price in the neighborhood in 2019.

Price Growth Is a Five-Borough Story

Buyers interested in Brooklyn can still find relatively affordable homes there compared to what’s available in Manhattan. As of fall 2019, the median recorded sales price in Brooklyn is $784,526, compared to Manhattan’s $1,105,000.

Brooklyn 1-2BRs Under $800K Article continues below

While Brooklyn and Manhattan are the only boroughs to make the top ten list, home prices in Queens, the Bronx and Staten Island have also been on the rise over the last ten years. Prices in the Bronx are 38% higher today than they were in 2010. In Queens, prices have jumped 30%, and Staten Island homes sold for 37% more than at the beginning of the decade.

But Price Growth Does Not Always Mean Profits

New Yorkers wondering if now is the right time to buy should understand that while home prices have clearly risen, this doesn’t mean that New Yorkers who purchased during the past 10 years saw such large increases in the value of their own homes.

More From StreetEasy’s One Block Over

Much of the price growth over the 2010s came as part of the recovery from the financial crisis — and recently, the NYC home sales market has been cooling. Unless homeowners and investors timed the market just right over the last decade, they may not even have made a profit.

To further temper expectations, we should point out that factors like mortgage rates, price appreciation, and the state of the economy are always difficult to predict. But given all that, we do still expect NYC home prices to rise over the long term.

If you’re looking to buy, know that while timing the market is nearly impossible, our tools and data can help you make an informed decision. For example, our Tipping Point analysis reveals approximately how long it will take for buying a home in any of these neighborhoods to make more financial sense than renting.

—

Inspired to find your next place in New York? Whether you’re looking to rent or to buy, search NYC apartments on StreetEasy.