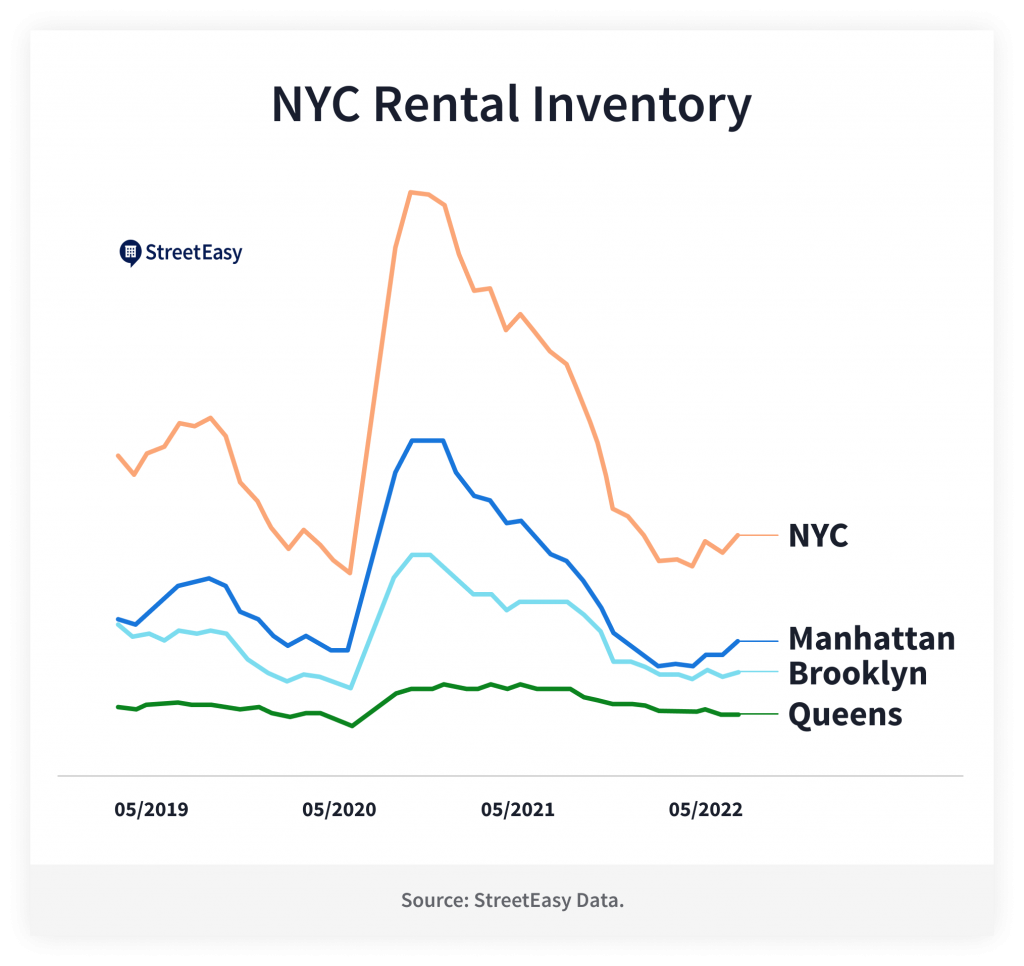

New York City renters may soon be able to breathe a (small) sigh of relief — the number of available rentals is starting to increase after 18 months of declines.

Citywide, there were 28,325 rentals listed on StreetEasy in May. That’s the highest it’s been since October 2021 when there were 30,977 rentals available. This is welcome news, especially for prospective renters who have recently struggled to find available units, attended crowded rental open houses, or even experienced bidding wars.

Unfortunately, rent prices are still climbing. In May, the citywide median asking rent hit a record high $3,349, a 34% increase from the near record lows seen last year during the height of the pandemic. So while supply is increasing, it has not increased fast enough to meet demand, and prices have continued to rise.

For this month’s market report, we uncovered where NYC rental inventory is increasing the most, to help renters determine where they are most likely to win the rental they want.

Manhattan Sees Most Significant Inventory Comeback

Manhattan rental inventory bottomed out in December 2021 when only 10,433 rental units were available in the borough. In May of this year, there were 13,933 units available — a 33.5% increase since the low. For context, in May 2019 (a year before the pandemic), Manhattan had 21,881 rental units available, so inventory is still significantly lower than what would be considered a normal spring season.

Downtown Manhattan Inventory Jumps 20% in One Month

Comparing inventory from April to May, there was an increase across every Manhattan submarket, but Downtown Manhattan saw the biggest jump. In April, there were 4,090 units available in Downtown Manhattan (which includes neighborhoods such as SoHo, Battery Park City, West Village, and Flatiron), and in May, that number rose to 4,928. The East Village has seen a particularly significant increase in rental inventory, up 32% from 798 rentals in April to 1,054 available in May.

Downtown Manhattan Rentals Under $3,000 on StreetEasy Article continues below

Brooklyn Rental Inventory Rises Slowly

Rental units are opening up in Brooklyn, but at a much slower pace than in Manhattan. There were 9,598 Brooklyn rentals available in May, up from 9,021 in April, and just over 10% higher than February when Brooklyn inventory reached its lowest point with 8,719 rentals available.

One area of Brooklyn that has seen a small yet steady increase is Northwest Brooklyn, consisting of neighborhoods like Downtown Brooklyn, DUMBO, Fort Greene, and Boerum Hill. In May, there were 1,379 units available for rent in Northwest Brooklyn, which is up from 1,239 in April and 1,046 in December 2021 (the low for inventory during the pandemic).

Northwest Brooklyn Rentals Under $3,000 on StreetEasy Article continues below

Queens Rentals Becomes More Scarce

Queens was the only borough StreetEasy analyzed where rental inventory declined month-over-month. There were 3,749 rental units available on StreetEasy in May, down from 3,917 in April. All submarkets in Queens experienced a month-over-month decline in inventory, with Northwest Queens — which includes Astoria, Long Island City, and Sunnyside — saw the most significant drop. Northwest Queens inventory has been falling steadily since March 2021, and as of May was down to 1,593 units: the lowest since April 2020 when the market was at a standstill amid the pandemic.

Queens Rentals Under $3,000 on StreetEasy Article continues below

What Is This Data Telling Us?

According to Zillow senior economist Josh Clark, these inventory trends make a lot of sense given what has transpired over the last year.

“During the pandemic, the biggest deals were happening in the most expensive parts of the city, especially Downtown Manhattan. Fast forward to now, those pandemic deals have dried up, and renters who were able to afford living in the city’s most expensive neighborhoods are now being faced with the reality of a fully recovered market,” says Clark.

“Those renters are now looking for more affordable places to live, especially in Brooklyn and Queens, which is why inventory is not recovering as quickly in those areas. My advice for potential renters this summer: if you have the flexibility to wait it out a couple of months, there will be more options available in late summer or early fall. But if you aren’t able to be flexible, my biggest recommendation is to be realistic about your trade-offs and what you can afford. Perhaps you can forego the in-unit laundry or sacrifice a bit of commute time for a more affordable home.”

A Final Tip for Renters: Use Technology to Your Advantage

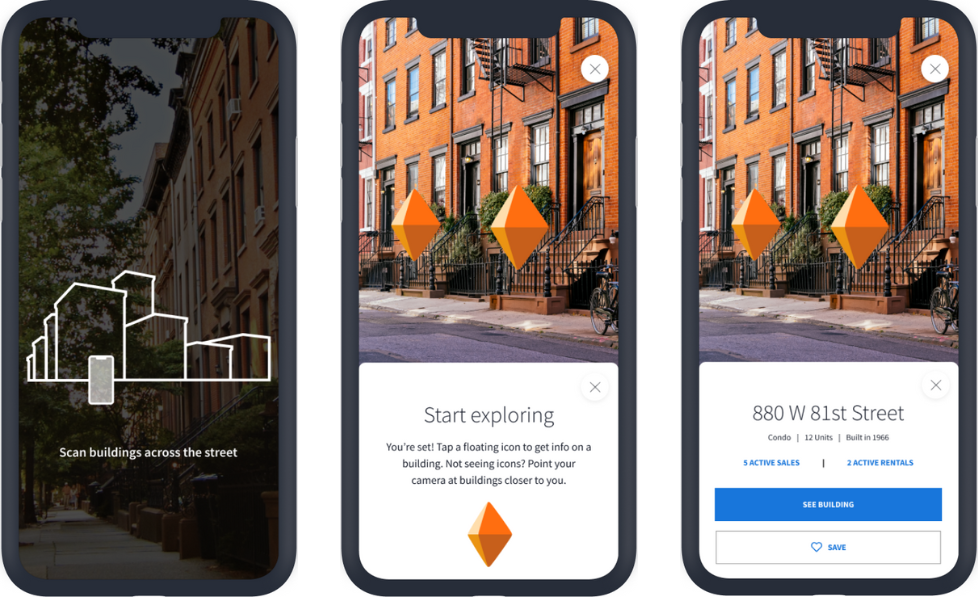

Rising inventory means a higher chance for renters to find a home that fits their criteria, and they could be walking by a great apartment for them every day without even knowing it. Starting this week, home shoppers can use augmented reality to immersively home shop while on the go with StreetScape. StreetEasy’s latest feature in the iOS app lets users point their phone’s camera at NYC residential buildings, then instantly see what’s available inside, giving them a leg up in this competitive market.

For more data to help navigate the NYC home shopping process, view all StreetEasy Market Reports for Manhattan, Brooklyn, and Queens, with additional neighborhood data and graphics. Definitions of StreetEasy’s metrics, monthly data, and interactive charts from each housing market report can be explored and downloaded for free via the StreetEasy Data Dashboard.

Editor’s Note: In March 2020, New York City’s housing market temporarily froze as the COVID-19 pandemic reached the U.S. In 2021, the real estate market roared back to life, with demand returning to both the rentals and sales markets. Year-over-year data comparisons over the next few months will be made against the housing recovery that began in early 2021. Assuming 2022 is more typical of a “normal” year in housing than 2020 or 2021 were, with times of little to no activity followed by massive spikes in demand, we expect many of our year-over-year measures will show significant losses over last winter and spring. We urge you to use caution in extrapolating too much from year-over-year measures in the coming months, and we will always try to provide appropriate context to anchor reported changes in metrics to what is normal or expected.