Key takeaways:

- The FARE Act is estimated to have increased rents by just 1.1%, with long-term structural forces like a decades-long undersupply of rental housing remaining the driving cause of NYC’s stark rent growth.

- One in three renters reported experiencing a violation of their rights from July to September, most commonly related to broker fees, showing that proactive enforcement of the law remains a challenge.

- A symptom of the city’s housing shortage, Manhattan experienced its 21st consecutive month of rental inventory decline in November.

Six months after the FARE Act’s implementation on June 11, incoming data continues to indicate that rent trends in New York City are predominantly shaped by long-term structural forces, in play since well before the new law: an undersupply of new rental housing, and demand pressure from population and economic growth.

We estimate the FARE Act was associated with a 1.1% increase in average asking rents among units still represented by agents or brokers, accounting for the structural trends, any concessions, and property-specific differences such as the building, bedrooms, and amenities. The net effective average asking rent of these broker-represented rentals in November was $3,559. The estimated 1.1% impact implies the asking rent for these units would have been $3,521 without the FARE Act in place, a small difference of $38.

While the FARE Act has not come without cost for tenants, its impact on rents is modest compared to the significant savings upfront. In exchange for $38 more in monthly rent, renters save an average of $5,454 at lease signing. The substantial savings are driven by the absence of broker fees, a commission renters were previously asked to pay a broker to secure an apartment — the largest component of upfront expenses. This year prior to the FARE Act, upfront costs averaged $13,076.

Manhattan Rentals Under $3,500 on StreetEasy Article continues below

The limited impact of the FARE Act on asking rents is consistent with our view that property managers are still pricing units according to market conditions, rather than adding the full costs associated with the new law to base rents. Had property managers been able to fully pass on broker fee costs to renters, typically about 12% of annual rent, the average asking rent would have been $3,948, 11% higher than the current average. This substantial gap is consistent with the key takeaway from our analysis one month after the FARE Act’s implementation.

That said, NYC is one of the largest rental markets with more than 2.3 million rental properties across the five boroughs. Our estimates may be updated as more homes are listed on the rental market following tenant turnover. We will assess additional data in 2026 to measure any discernible long-term impact on rents from the FARE Act, along with evolving market conditions.

Proactive Enforcement is Essential to Protecting Tenants’ Rights

The FARE Act requires that a rental broker in New York City be paid by the hiring party. Brokers can no longer require renters to pay a fee if the broker is representing an apartment on behalf of the property manager. Renters still have the option to hire an agent directly to represent them, in which case they would pay for the agent’s services.

A recent StreetEasy survey conducted in September indicates the majority of renters (75%) are highly aware of their rights under New York City and State law, but violations are still common in the rental market. About one in three renters (38%) reported experiencing a rights violation between July and September 2025, most commonly around being charged a fee for an agent or broker they didn’t specifically hire. Meanwhile, 16% of renters who experienced a violation reported being asked to hire the broker before they could receive more information or tour the apartment. See Methodology section for more information on the survey.

Moreover, renters commonly reported being charged undisclosed fees. Among those who experienced a violation, 21% reported a fee for an agent they did not hire themselves, 19% reported other fees previously undisclosed in the listing, and 16% reported a higher first month’s rent than the subsequent months for the rest of the lease, possibly as an attempt to recoup the broker fee from tenants.

In the event renters are asked for a broker fee in violation of the FARE Act, they should report incidents to the NYC Department of Consumer and Worker Protection (DCWP), the agency responsible for enforcing the law. File a report via this form or by calling 311. When reporting the suspected violation, it’s important to be as detailed as possible and provide screenshots of the listing and any messages you received, the date the screenshots were taken, the listing URL, contact information for the agent, and any other information that might be useful to regulators. A detailed report will aid in the investigation and enforcement of violations.

Brooklyn Rentals Under $3,000 on StreetEasy Article continues below

A Decades-Long Housing Shortage Defines NYC’s Rental Market

Beyond the FARE Act, a severe housing shortage continues to define the NYC rental market. Across the city, there were 28,080 homes available on the market in November, an 8.4% decline from a year ago. A portion of this decline may be a direct result of the FARE Act, as property managers continue to reevaluate their marketing strategies since the new law took effect. However, the underlying cause of the fall in inventory remains the city’s decades-long housing shortage.

The return of renter demand since the onset of return-to-office policies in 2022 has intensified competition for the limited number of units available. The latest NYC Housing and Vacancy Survey shows the city’s rental vacancy rate fell to 1.4% in 2023, the lowest ever recorded since the survey began in 1968.

This trend is particularly evident in Manhattan, which experienced its 21st consecutive month of annual inventory decline in November 2025. There were 12,307 rentals in Manhattan in November, down 10.8% from a year ago. As renters had to compete for fewer available listings, asking rents have been rising faster in the borough, jumping 8.3% year-over-year to $4,550 in November.

As priced-out Manhattan renters looked to Brooklyn and Queens, competition started spreading to these boroughs. The median asking rent in Brooklyn rose 6.7% year-over-year to $3,695 in November, while the median in Queens also increased 6.7% to $3,200. The citywide median asking rent was $3,875 in November, up 7.6% from a year ago.

NYC Renters Are Unlikely to Catch a Break Next Year

As renters’ budgets continue to be stretched, asking rents are poised to grow faster in NYC next year — one of StreetEasy’s five predictions for 2026. Despite recent declines, elevated mortgage rates will likely keep many potential buyers on the sidelines, forcing them to remain in the rental market. High down payments and mortgage obligations have made homeownership unattainable for all but those in higher income brackets. Based on the citywide median asking price and the average 30-year mortgage rate in November 2025, the income needed to afford a mortgage with a 20% down payment was $206,608, well above NYC’s median household income of $81,228, according to U.S. Census Bureau data.

Moreover, structural issues such as overly restrictive zoning, lengthy approval processes, and high construction costs have been constraining the city’s rental supply. As a result, NYC still has a large gap to fill despite a post-pandemic surge in new rental developments. While the City of Yes zoning reforms and tax incentives, such as 485-x for affordable housing and 467-m for office-to-residential conversion, will help address the supply deficit, it will take more time to see the intended results as new construction catches up.

Queens Rentals Under $2,500 on StreetEasy Article continues below

Methodology

How we calculated average upfront costs

We calculated the upfront cost of each rental listing that was on the NYC market. Following common industry practices, we assumed each rental requires a tenant to pay the first month’s rent in advance, one month’s rent as a security deposit, and 12% of the annual rent as a broker fee, unless a listing was marked as a no-fee rental before the FARE Act. We then took the average of the upfront costs of all listings that charged a broker fee and were on the market between January and May 2025 to get $13,076. We excluded rentals with unusually high or low prices to estimate the average upfront costs New Yorkers are likely to encounter. The methodology in this report is the same as our previous report on upfront rental costs.

How we fielded a survey on renters’ rights violations

We surveyed 773 likely renters via an intercept survey on StreetEasy platforms between September 10 and 22, 2025, and reached statistically significant estimates. We split the sample into two groups who either answered questions on their awareness of renters’ rights or the frequency of violations. Measures were taken to prevent duplicate responses.

How we estimated the FARE Act’s impact on asking rents

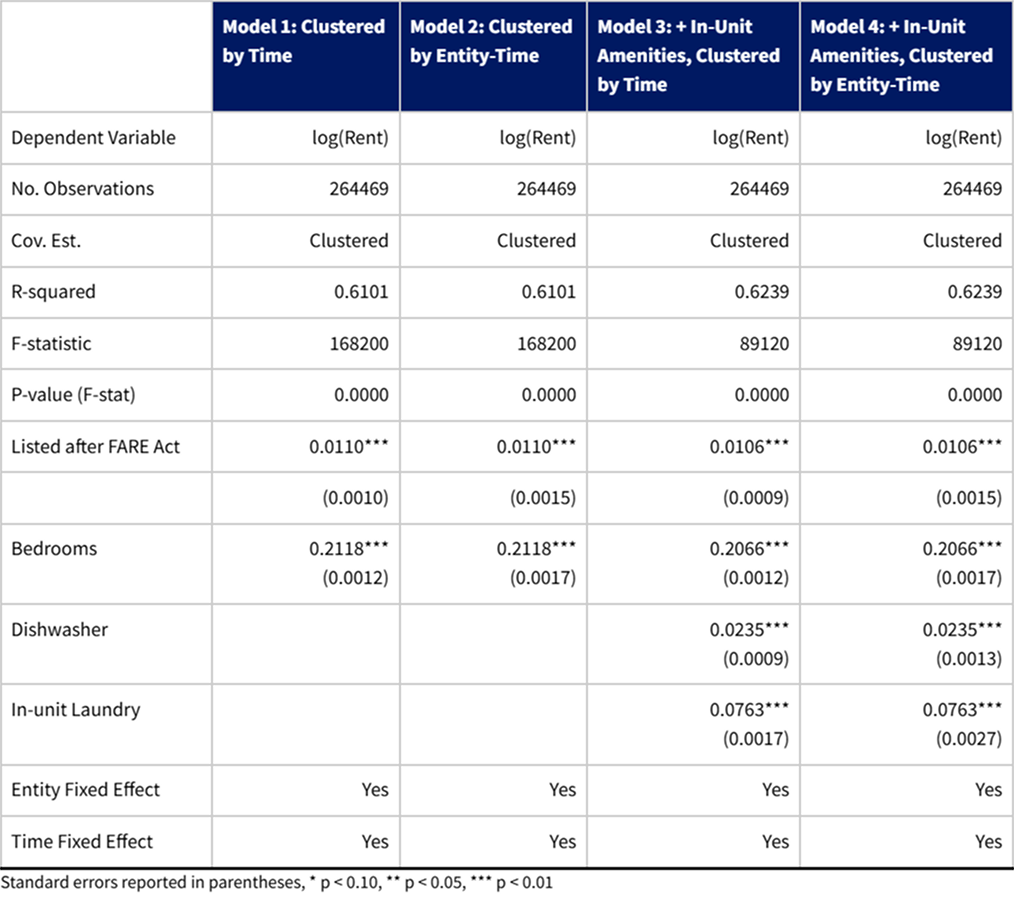

We estimated the impact of the FARE Act on asking rents in NYC since its implementation by a difference-in-difference analysis with two-way fixed effects. The model specification is as follows:

log(Rentpbt) = β1FAREpt + β2Xp + γt + γb + εpbt

In this specification, log-transformed monthly asking rents after accounting for any concessions are regressed on a binary variable indicating that a rental was listed on market after the FARE Act’s implementation on June 11, 2025. The coefficient on this variable measures the impact of the new policy on rents.

In addition, γt and γb represent time and building fixed effects, respectively. The building-level entity fixed effect ( γb ) controls for unobservable factors that differ across buildings but may not change over time, such as location, building amenities, and management. The time fixed effect ( γt ) was set as the first month on market for each rental to account for citywide factors that affect all rental properties in the same period, such as the shifting balance between supply and demand.

Additional controls represented by Xp were introduced to control for property-specific features that may affect asking rents. While there can be many aspects about a rental home that determine its quality, we use the most prominent features that renters care about during their search: the number of bedrooms, in-unit laundry, and a dishwasher.

The main model was estimated using 264,469 rental properties relisted as rentals by agents or brokers on StreetEasy between January 2021 and November 2025. We excluded rentals that cost more than $10,000 a month to exclude the impact of highly-priced rentals on the analysis.

We present the full panel regression result below with alternative specifications without in-unit amenities and bedroom counts. We show standard errors clustered by time and both time and entity. The coefficient of interest that identifies the impact of the FARE Act on rents does not meaningfully change across different specifications and is statistically significant under different covariance estimators.

StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property. The information contained herein is for informational purposes only and should not be relied upon when making a real estate decision. All data for uncited sources in this presentation has been sourced from Zillow data. Copyright © 2025 by Zillow, Inc. and/or its affiliates. All rights reserved.