Rising mortgage rates are not only pushing buyers to the sidelines, but also causing more deals to fall out of contract. Over the past nine months, the average 30-year mortgage rate nearly doubled, reaching 6.7% by the first week of October. The last time it rose this rapidly was the spring of 1980.

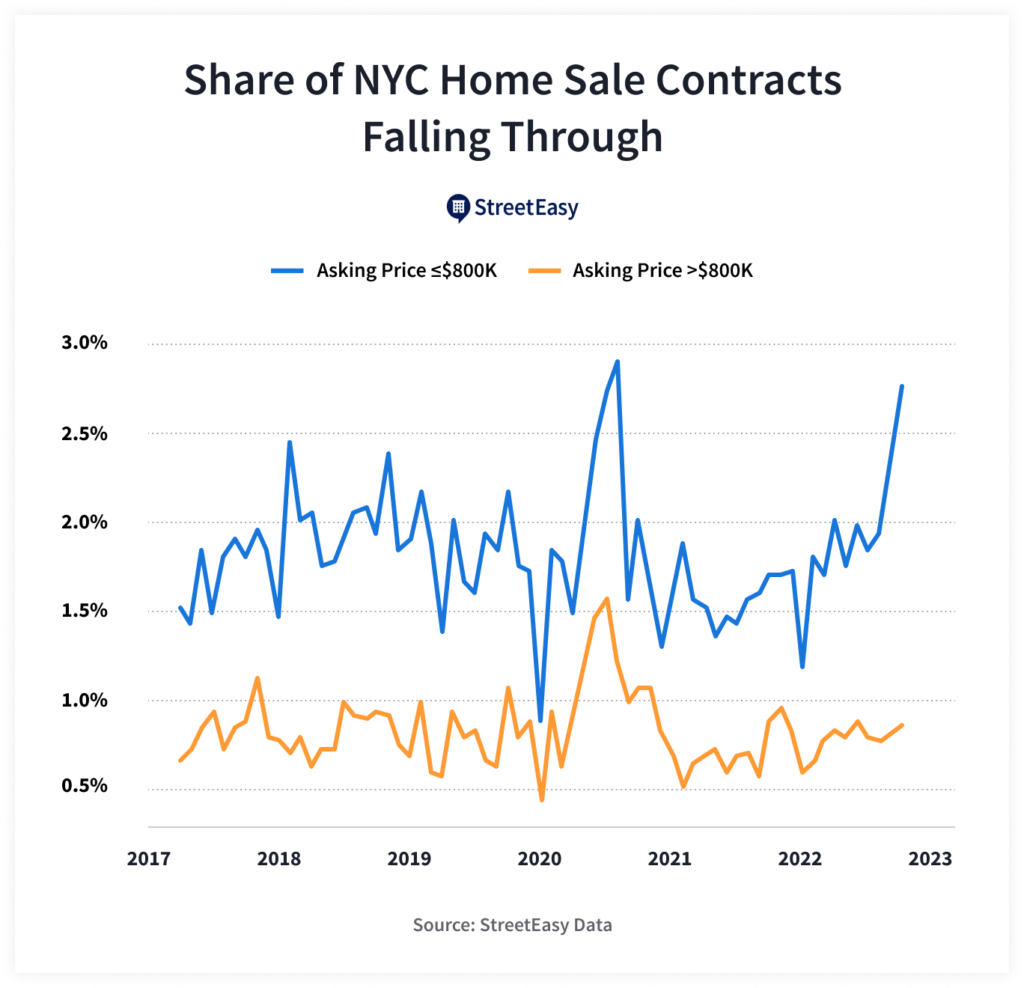

StreetEasy data shows the cancellation rate – listings under contract that have gone back on the market without closing, as a percentage of all in-contract listings – jumped to 1.7% by September, the highest level since the start of the pandemic. The spike in the cancellation rate in early 2020, which reached 2.1% by June of that year, was an anomaly when the NYC real estate market came to a halt as the city grappled with the arrival of the COVID-19 pandemic. In 2021, when mortgage rates remained mostly below 3% (a historically low level), the cancellation rate averaged just 1%.

Buyers with lower budgets, especially first-time buyers, have been hit hardest by the recent whiplash in mortgage rates. The cancellation rate for deals below $800K – the median closing price of all NYC sales so far this year – rose to 2.8% by September. That’s double what the rate was in 2021 for this segment, and more than three times the cancellation rate for in-contract sales above $800K.

However, two data points suggest we’re still in a seller’s market: the median number of days listings are spending on the market remains low, and the share of listings offering price cuts is in line with seasonal behavior before the pandemic. Despite falling prices, homebuyers should not expect a buyer’s market anytime soon. The recent recovery in inventory is due to homes sitting on the market slightly longer after an unusually competitive shopping season this spring, as buyers tried to get ahead of rising mortgage rates. Although many buyers have been pushed to the sidelines, any meaningful drop in mortgage rates will lead them to rejoin the market. In addition, fewer new listings are entering the market, as homeowners who scored low mortgage rates during and prior to the pandemic have few incentives to sell. This rising seller hesitation will limit how far home prices can fall.

Buyers Eyeing a Starter Home Are Faced With Mounting Challenges

At 2.8%, the cancellation rate for deals below $800K was unusually high in September, and the highest since the start of the pandemic in 2020 when the NYC market came to a brief halt. The sharp rebound this year is due to soaring mortgage rates, in addition to declining new contract signings. The 30-year mortgage rate has nearly doubled since December 2021, reaching 6.7%. In September, 24% more deals under $800K fell through, compared one year ago. The current cancellation rate of 2.8% is one percentage point higher than between 2017 and 2019, when it averaged 1.8% with mortgage rates ranging between 4% and 5%.

This recent jump in the cancellation rate for deals below $800K reveals the vulnerability of New Yorkers with lower income and savings to the recent increase in mortgage rates. In NYC, a starter home typically ranges between $400K and $800K and has at least one bedroom. By contrast, the cancellation rate for the segment above $800K remained stable this year, although slightly higher than last year.

Why would a signed contract fall through before closing?

The most likely factor is the rapid increase in mortgage rates this year. In the first week of October, the 30-year fixed mortgage rate averaged 6.7%. This high of a rate is not unprecedented: between 2006 and 2008, mortgage rates routinely hovered above 6%. However, the speed at which the rate increased this year was unprecedented in recent history. Over the nine months since December 2021, the mortgage rate rose 3.6 percentage points. The last time it rose this rapidly was the spring of 1980 when the Federal Reserve, led by Paul Volcker, raised interest rates aggressively to fight soaring inflation.

NYC Homes Under $800K on StreetEasy Article continues below

Don’t buyers usually obtain mortgage preapproval from a lender?

When making an offer, buyers are expected to provide a preapproval letter: an official document indicating the lender is willing to lend up to a certain amount to the buyer, tentatively, sometimes with an offer to guarantee the interest rate on the loan for a period of time. When mortgage rates rise quickly, buyers are often forced to make a larger down payment to reduce their loan amount, so that their future monthly principal and interest (P&I) payments stay within their budget. Preparing such a large sum of money on short notice is not an easy task. Although lenders check the buyer’s tax returns, pay stubs, bank statements, and credit report during the preapproval process, the money for the down payment may not materialize by the closing date.

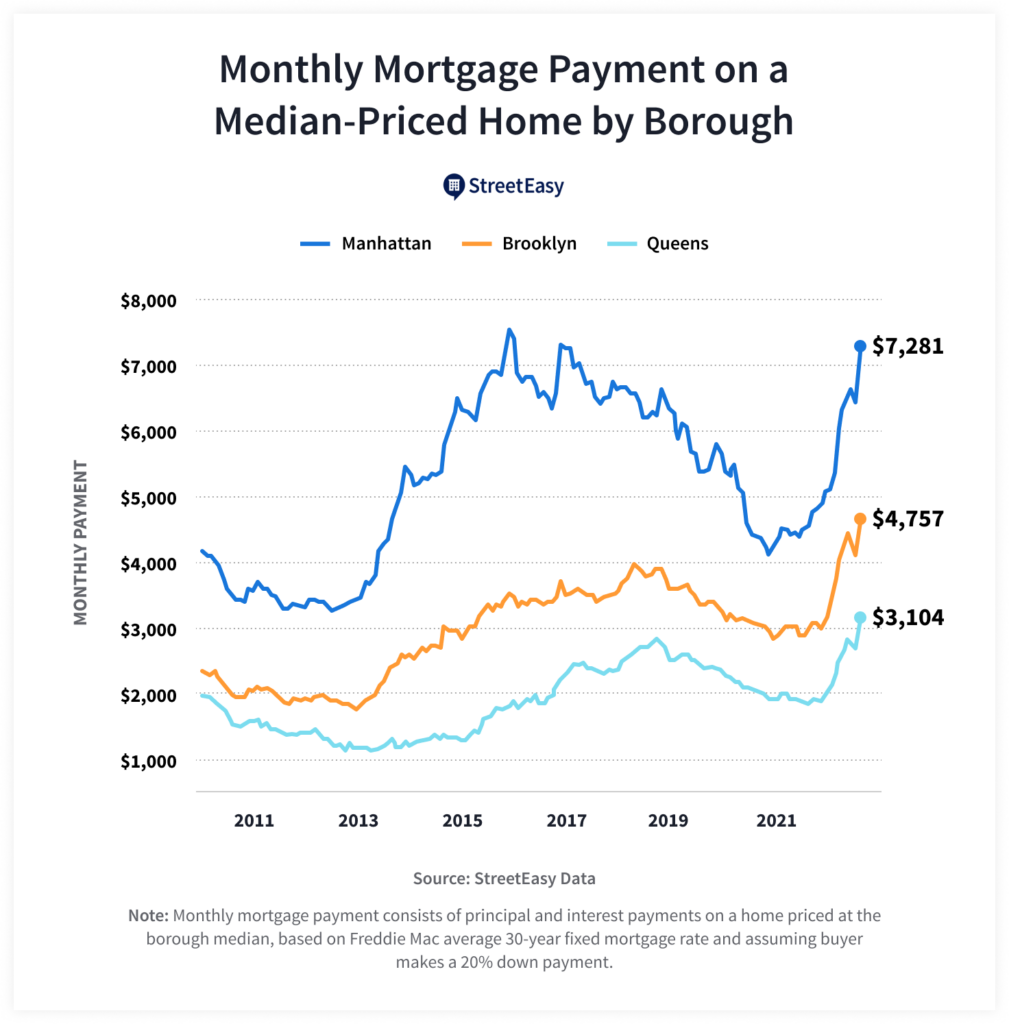

In addition, a sharp jump in carrying costs for the same mortgage may be giving more buyers cold feet. For many New Yorkers, the median asking price combined with higher interest rates means uncomfortably high monthly payments on their mortgage. For example, the monthly P&I payment for a median-priced home in Manhattan with a 20% down payment rose 56.8% year-over-year to $7,281 in September. Brooklyn saw a 55.6% increase to $4,757, while Queens saw a 58.8% increase to $3,104: the highest these figures have ever reached on StreetEasy record. Instead of dropping their budgets or looking in more affordable neighborhoods, many would-be buyers are choosing to withdraw from the market, leading to declining demand. For more on how rising mortgage rates impact buyers’ purchasing power, see our previous analysis.

Rebalancing Is Happening, But It’s Still a Seller’s Market

At 1.7%, cancelled contracts still make up a small fraction of total in-contract sales. The citywide contract cancellation rate remained low in 2021 due to unusually low mortgage rates, which led to a sharp rebound in buyer demand that lasted through this spring.

StreetEasy’s market metrics suggest we’re still in a seller’s market, although buyers are gradually regaining negotiating power. Listings in NYC sat on the market for longer, with the median days on market rising to 80 days in September from 69 in August, but entered contract 10 days earlier than the typical home around this time of the year between 2017 and 2019.

More listings are cutting asking prices in 2022 as homes sit on the market for longer. Close to one in four (24%) listings advertised on StreetEasy cut asking prices at least once in Q3 2022, noticeably higher than the one in five (19%) in Q3 2021. However, this is not a cause for concern. Buyer demand roared back in 2021, fueled by low interest rates, and more price cuts tend to occur in September when sellers try to get more interest in their listings still on the market from summer. The current share of price cuts is in line with sales market trends prior to the pandemic. Bidding wars with multiple offers above asking will be less common as the market continues to rebalance.

The plateau apparent in the StreetEasy Price Index suggests NYC home prices are past their peak reached in July since the start of the pandemic. The index fell modestly by 0.7% month-over-month in September after staying essentially unchanged in August. The indices for Manhattan (-0.5%), Brooklyn (-1.1%), and Queens (-0.8%) also declined modestly in September from the previous month, while still being higher than one year ago.

The StreetEasy Price Index tracks the closing prices of repeat sales over time, to avoid distortions caused by compositional changes in the market such as unit types and bedroom counts. The median asking price, which is based on listing inventory, is an imperfect measure of home prices in the current market environment, as the higher-priced segment tends to be less sensitive to higher interest rates than the lower-priced segment. Therefore, the StreetEasy Price Index offers a more representative view of home values in NYC as the market continues to rebalance.

Highly Priced Listings Dominated New Inventory in September

The citywide median asking price rose slightly to $995K in September from $975K in August, just slightly below the mansion tax threshold of $1M, due to a large influx of higher-priced listings mostly in Manhattan after the Labor Day holiday.

Manhattan Homes Under $1.5M on StreetEasy Article continues below

The citywide median asking price of new listings in September was $999K, and 25% of these new listings were priced above $2M. Half of all new listings in September were in Manhattan, with a median asking price of $1.475M – 48% above the citywide median. As a result, the median asking price in Manhattan reached $1.5M, the highest level since the pandemic. The priciest listing in September was on Billionaires’ Row, asking for $250M.

The market for higher-priced homes remains relatively resilient compared to other market segments, despite elevated mortgage rates and financial market volatility.

Slowing Inventory Growth Will Limit Declines in Home Prices

Inventory, which tends to jump after the summer holidays, rose 5.9% month-over-month in September. However, adjusting for seasonal increases, it fell just 0.6% – effectively no change from August’s inventory.

Compared to 2021, fewer homeowners have been listing their homes for sale this summer, as it’s much more expensive to finance their next home with recent interest rates. In September, the number of new listings entering the market fell 6.2% year-over-year. Potential sellers also have few incentives to trade in their low mortgage rates locked in during or before the pandemic for today’s much higher rates. All of this means inventory growth will remain sluggish, with fewer listings coming onto the market unless mortgage rates decline substantially from now. The ongoing rebalancing of the market after an unusually competitive shopping season this spring means asking prices may decline further as sellers reset their expectations. However, unlike would-be buyers, it’s less painful for sellers to withdraw from the market as most of them are spared from soaring rents. This will prevent the market from tilting too decisively in buyers’ favor.

NYC Homes Under $995K on StreetEasy Article continues below

Looking Ahead

It’s a challenging time to stay in the market for many buyers. However, for those financially prepared for homeownership, the current environment opens a unique opportunity to enter the market. Homebuyers have stronger bargaining power now than they did this spring. Listings are sitting on the market for longer and price cuts are returning. Moreover, overall listing inventory stopped declining on a year-over-year basis in September for the first time since August 2021, due to falling sales outpacing new listings coming onto the market.

Additionally, there is still significant pent-up demand for home purchases in NYC. The strong home shopping season this year was cut short by the historically sharp rise in mortgage rates. Any meaningful decline in mortgage rates will prompt previously hesitant buyers to reenter the market, but sellers will be slower to respond, as it takes more time and resources to prepare a home for listing.

Sellers should note that the highest bid is not necessarily the best bid. The StreetEasy Concierge for sellers can match sellers with an Expert agent to best position their listing in a changing market, and choose the best offer that can reliably reach the finish line.

Despite the significant uncertainty around where prices and interest rates will go, it’s important to find a home you’d be happy to live in, rain or shine, for more than just a few years.

Disclaimers: StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.

For FSBO postings, the StreetEasy Concierge is meant to provide insight to improve your posting performance on StreetEasy and may refer you to a real estate professional based on your specific needs.

StreetEasy earns a referral fee from successful Experts’ transactions, at no cost to the buyer or seller. Experts must meet StreetEasy’s standards of service and market expertise. Agents in our Experts Network have closed deals on homes similar to the seller’s or similar to homes the buyer is searching for. We measure their performance to make sure buyers and sellers get top-notch service.