At $1.088M, the citywide median asking price set new records in June for the third consecutive month, after rising above $1M in April for the first time since 2018. While rising asking prices suggest heightened confidence among sellers, buyers are still finding room to negotiate discounts.

In June, a typical seller in the city received 96.5% of their original asking price, mostly in line with the three-year average (2017-2019) before the pandemic. The sale-to-list price ratio compares a home’s final recorded sale price to its initial asking price. When buyers took the upper hand in the sales market in 2020 and 2021, this ratio dropped to an average of 93% in both years. While lower than 2022’s ratio of 97.7%, the current ratio of 96.5% is relatively high, and suggests sellers are still holding the upper hand in the sales market.

Although soaring mortgage rates have priced out many would-be homebuyers, an average listing still received 13.4% more inquiries in June compared to June 2019. In addition, the drought of new inventory is sustaining today’s seller-friendly market. The number of newly listed homes in the city declined 20.7% year-over-year in June, marking the 13th consecutive month of annual declines. With mortgage rates still close to 7%, homeowners remain hesitant to list their homes for sale.

Buyers with larger budgets are actively shopping despite elevated mortgage costs. The most in-demand homes in NYC now have been those priced between $700,000 and $1.6M — roughly the middle third of the city’s sales listings by price point — since April this year with an average listing receiving 17.6% more inquiries compared to June 2019. However, the number of newly listed homes in this price range has been declining annually since April 2022 and is down 19.5% compared June 2019. Declining new inventory despite strong demand has been fueling competition among high-budget buyers, particularly in brownstone Brooklyn, the Manhattan condo market, and waterfront neighborhoods in Brooklyn and Queens.

Brownstone Brooklyn Is Most Sought-After by Buyers

Brooklyn remains the most competitive sales market since the pandemic, with an average listing receiving 34.2% more inquiries in June this year compared to June 2019. The median asking price in Brooklyn increased 0.5% year-over-year to $999,999, just shy of the $1M threshold for New York’s mansion tax. The competition among buyers is partly due to a sharp decline in inventory. In June, for-sale inventory in Brooklyn was 24.7% below the inventory in June 2019.

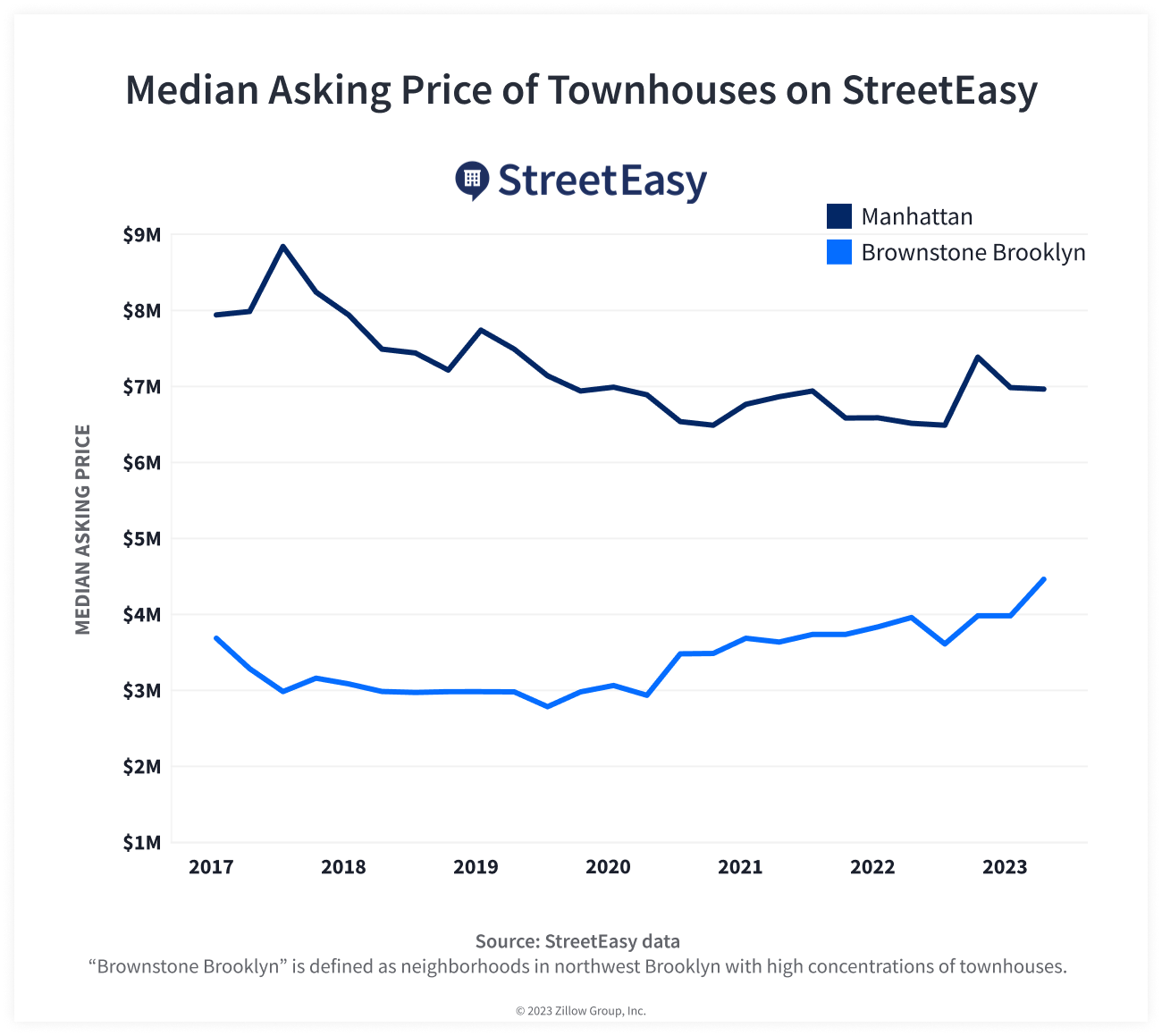

While more modest than last year, the townhouse market in Brooklyn remains strong as wealthy buyers turn to Brooklyn from Manhattan. Across “brownstone Brooklyn,” including Cobble Hill, Fort Greene, and Bedford-Stuyvesant, 197 townhouses entered contract in the first half of 2023, compared to 255 in the first half of 2022. Despite the slower pace of sales compared to last year, the current sales volume is nearly double the volume in Manhattan where 114 townhouses entered contract this year. The townhouses in brownstone Brooklyn are also selling three times faster than townhouses in Manhattan. The median time these listings spent on the market in the first half of this year was just 45 days, 9 days longer than last year. In Manhattan, townhouses spent a median of 142 days on the market, an increase of nearly two months from 81 days in the first half of last year.

The 5 Most Common Types of NYC Townhouses

READ BLOGThe rising popularity of townhouses in Brooklyn may be partly related to a lower price point compared to Manhattan. The median asking price of townhouses in contract in Brooklyn was $3M this year, unchanged from last year, with the median price per square foot of $1,130. By comparison, the median asking price of townhouses in contract in Manhattan was $6M this year with the median price per square foot of $1,393.

The most in-demand neighborhood in Brooklyn for townhouses was Boerum Hill, an area known for brownstones as well as 19th-century brick townhouses. An average townhouse on the market received 79.2% more inquiries from home shoppers in the first half this year compared to the same period in 2019. So far, 11 townhouses have entered contract in Boerum Hill, 4 fewer than the first half of last year. The median asking price of townhouses in contract rose 13% year-over-year to $4M. Townhouses in Boerum Hill are finding buyers quickly, with a median time on market of just 31 days this year.

Brooklyn Homes Under $1.5M on StreetEasy Article continues below

Cobble Hill was the second busiest market for townhouses in Brooklyn this year, with an average townhouse on the market receiving 68.9% more inquiries from home shoppers than in 2019. Just shy of a dozen (11) townhouses entered contract this year, and had a median asking price of $3.7M. Buyers snapped up townhouses in this sought-after neighborhood, resulting in a median time on market of just 23 days compared to the borough-wide median of 50 days.

Prospect Heights is the third most sought-after townhouse market in the borough, with an average listing receiving 35.1% more inquiries than it received between January and June 2019. A total of 9 townhouses entered contract this year in Prospect Heights, with a median asking price of $3.3M. The neighborhood’s townhouses spent a median of 64 days on the market before entering contract.

The Manhattan Condo Market is Heating Up

The market for condos is heating up across NYC. The citywide median asking price for condos was about $1.6M in June, up 6.9% year-over-year. But condo asking prices are rising the fastest in Manhattan, where overall price points are traditionally higher. The median asking price for condos in the borough rose 12.8% year-over-year to $2.3M in June as more expensive listings joined the market. That said, compared to the heated market last year, it now takes longer for condos to sell in Manhattan. The median time condos spent on the market before entering contract was 86 days in June, four weeks slower than a year ago.

Workers returning to the office are driving up demand for condos across Manhattan, particularly in neighborhoods near the city’s major office hubs in the Financial District and Midtown. Battery Park City saw the strongest increase in competition for condos among buyers in Manhattan, with an average condo listing receiving 30.8% more inquiries from buyers this year compared to 2019. The median asking price for condos in the neighborhood was $1.1M in June, down 8% from a year ago. The rising demand for condos in Battery Park City is likely due to the lower price points compared to the rest of the borough, and proximity to the Financial District.

Manhattan Homes Under $1.5M on StreetEasy Article continues below

In Midtown South, an average listing received 22.2% more inquiries from buyers this year compared to 2019. With more New Yorkers returning to the office at least part time, a walking-distance commute to work has become a major selling point for apartments in Midtown. In addition, easy access to Grand Central Terminal, Penn Station, and Port Authority makes Midtown condos attractive to out-of-town buyers looking for a pied-à-terre in the city center. With renewed interest in this area, the median asking price for condos in the neighborhood rose 6.3% year-over-year to $1.6M in June.

Condos in Waterfront Neighborhoods Are Popular in Brooklyn and Queens

In Brooklyn and Queens, waterfront neighborhoods — which traditionally offer more condos for sale in addition to convenient commutes to Manhattan — have risen in popularity this year.

Williamsburg was the most sought-after market for condos in NYC, with an average listing receiving 64.4% more inquiries in the first half of this year than the same period in 2019. The median asking price for condos on the market in Williamsburg was $1.4M in June, up 11.4% from a year ago. This is 38.9% higher than the borough-wide median of $995,000. Condos in the neighborhood sold quickly, with a median time on market of 35 days in June — 15 days faster than condos across all of Brooklyn.

Queens Homes Under $1.5M on StreetEasy Article continues below

Long Island City was the most in-demand sales market in Queens this year. This waterfront neighborhood has been a popular market for home shoppers looking for condos, with an average condo listing receiving 35% more inquiries than in 2019. The median asking price for Long Island City condos was $1.2M in June, unchanged from a year ago. Condos in the neighborhood spent a median of 42 days on the market, 27 days faster than the borough-wide median of 69 days.

In addition to a convenient commute to Manhattan, buildings in Long Island City are mostly new developments that offer coveted amenities. Nearly two-thirds (64%) of condos on the market in Long Island City this year were in buildings constructed since 2019. For the same reason, it’s also one of the most popular neighborhoods for renters in Queens, which came ahead of Brooklyn as the most competitive rental market in the city in May.

Looking Ahead

July and August are typically slow months compared to the first half of the year, but the ongoing drought of newly listed homes for sale will continue to fuel competition for relatively well-priced homes. In June, there were 20.7% fewer newly listed homes for sale across the city than a year ago. With mortgage rates close to 7%, homeowners who are locked into much lower mortgage rates obtained before or during the pandemic will remain reluctant to list their homes for sale.

In addition, the city’s labor market, which is supporting demand from aspiring buyers, shows no sign of weakening. In May, private sector employment in New York City increased by 29,000 jobs, fully recovering its losses during the pandemic. While employment in information technology and financial services is declining amid waves of layoffs, the city’s otherwise strong labor market will continue to support demand for housing.

Low inventory and resilient buyer demand suggest sellers can still expect strong offers this summer. The StreetEasy Concierge for sellers can be a valuable resource for giving a home a competitive edge. Despite the overall fortitude of the sales market in NYC, the market can differ block by block, even within the same neighborhood. Working with a real estate agent with deep, hyper-local expertise and knowledge of relevant housing types (co-op, condo, townhouse, etc.) — like the agents in StreetEasy’s Experts Network — is a great way to understand the local NYC market.

Disclaimers: The information provided was extracted from StreetEasy listings and its expansive internal database. The contents of this article are intended for informational purposes only and not intended as a complete recitation of the market.

StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property. StreetEasy earns a referral fee from successful Experts’ transactions, at no cost to you.