While the Fed’s expeditious interest rate hikes have exacerbated affordability challenges in the NYC housing market tremendously, our key metrics indicate lofty asking prices may have gone too far. Strong growth in asking prices earlier this year, coupled with increases in mortgage rates, likely went beyond what many potential buyers can afford.

We do not think the slowdown this summer is a harbinger of a crash. Our data on unique buyer inquiries per listing indicates buyer demand is shifting to more affordable homes below $500K, as higher financing costs have pushed many would-be buyers to this segment of the market (see our analysis on the interest rate impact on a home buyer’s budget). Demand for slightly higher priced homes between $800K and $1.5M has been relatively resilient as sellers-turned-buyers who reaped profits at record-high selling prices remain in the market.

Home Shoppers Are Slashing Their Budgets

As higher mortgage rates take a bite out of home shoppers’ purchasing power (see our analysis), buyer interest has cooled significantly after a strong home shopping season this spring, our latest demand metrics show.

To measure demand on a weekly basis, we tracked the number of unique buyer inquiries per listing on StreetEasy. To mitigate seasonal changes in buyer activity and holiday effects, we calculated demand as the deviation from the corresponding weeks in 2019.

After a sharp drop in early 2020 related to COVID-19 impacts, buyer interest recovered quickly despite limited inventory. In 2021, as low interest rates strengthened home shoppers’ purchasing power, buyer interest in homes with higher asking prices surged. Listings with asking prices between $800K and $1.5M received the most buyer inquiries per listing while listings below $500K received fewer.

A strong jump in buyer interest in spring 2022 was likely related to would-be buyers rushing into the market as the prospect of higher mortgage rates loomed. However, this trend has mostly reversed over the past few months. Buyer interest in listings below $500K has accelerated while interest in listings above $500K has subsided from spring 2022, likely due to the impact of higher mortgage rates pushing down prospective buyer’s budgets.

First-time buyers were among those most impacted by the recent increases in mortgage rates. As a result, demand for homes priced between $500K and $800K – a segment popular among first-time buyers – is lagging behind the demand for homes below $500K as well as the tiers above $800K. Rate increases likely forced many first-time buyers to either decrease their overall buying budget or wait on the sidelines in hopes of asking prices dropping further.

Demand for homes priced between $800K and $1.5M – mostly searched for by repeat buyers and those with bigger budgets – remained relatively resilient after outperforming all other tiers this spring, as sellers who made a profit at record-high selling prices looked to buy their next home.

NYC Homes Under $500K on StreetEasy Article continues below

In addition, buyer interest in homes priced at more than $5M has been steady between 2021 and now, suggesting potential buyers for higher priced homes are relatively undeterred by changes in mortgage rates.

Agents on the ground are seeing this data come to life. Ryan Kaplan, an agent with Douglas Elliman and a StreetEasy Expert, acknowledged the slowdown but noted that bidding wars have not completely disappeared.

“The mad rush of New Yorkers returning after quarantine has largely been reabsorbed, and the frenzied markets of the first half of this year have tempered. Even so, I’m still seeing well-priced, well-located homes being fought over,” said Kaplan. “I expect we’ll continue to see action, especially from buyers who still possess the liquidity and means to purchase in the luxury market, and those seeking refuge from the competitive rentals market that may be after more affordable homes.”

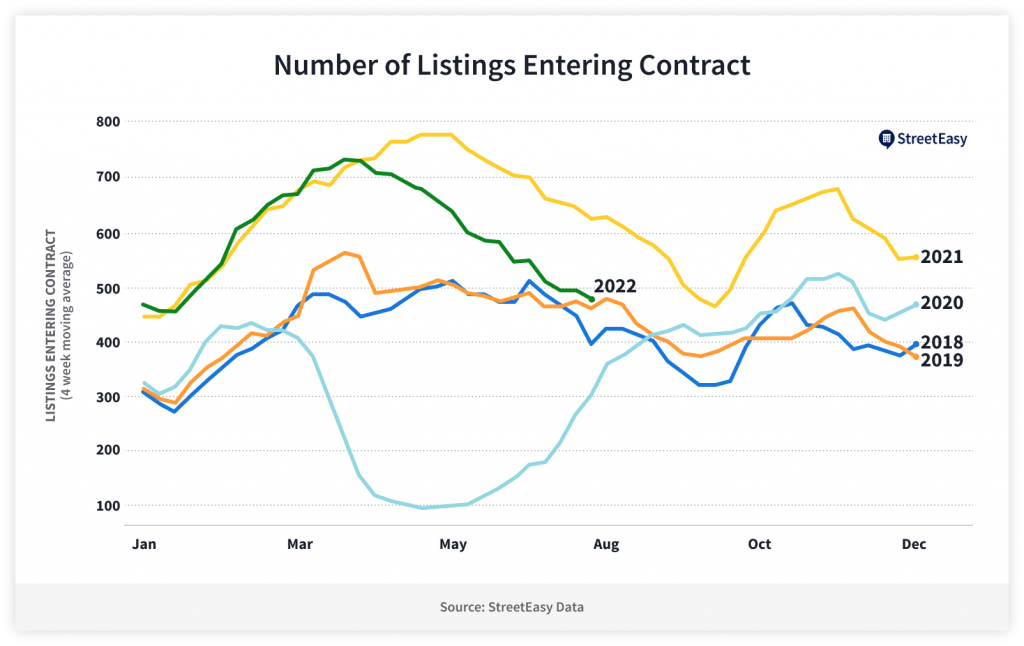

Weaker Demand Led to Fewer Contracts Signed

Reflecting slowing buyer demand, listings going into contract fell to their pace before the pandemic, suggesting a normalizing market following the pandemic. In July, in-contract sales fell 15.2% month-over-month to 2,053 in NYC – the fourth consecutive monthly decline since April. The recent declines have been steeper than the usual late-summer slowdown.

The median asking price for available homes in NYC fell 0.8% month-over-month to $990K in July after stagnating at $998K in June, suggesting asking prices likely peaked in May at $1M. The median asking price of new listings on the market has been falling month-over-month since April, indicating new sellers are entering the market with lower asking prices.

Combined with rapid increases in mortgage rates, the increases in asking prices earlier this year likely went beyond what most home shoppers can afford. Based on the historical 30-year mortgage rate and median asking prices, NYC buyers needed 45% more income in July than last year, equivalent to a $59,000 increase in annual earnings from $131,000 in July last year, to qualify for a fixed-rate mortgage for a median priced home assuming 20% down payment.

Sellers Got Overly Ambitious This Summer

Recent increases in listing price cuts and days spent on market suggest demand is likely to cool down beyond the seasonal slowdown in late summer. In July, 11.9% of NYC sellers lowered their asking prices, slightly below the 14.8% in June but higher than the 10.2% in July 2021. These price cuts indicate softening seller confidence as demand slows.

NYC Homes $800K – $1.5M on StreetEasy Article continues below

The median days on market is rising as more potential buyers sit on the sidelines, likely linked to elevated interest rates and asking prices. The median time on market for a home in NYC was 66 days in July, up 12 days from June.

Seller Expectations to Reset with More Opportunities for Buyers

The recent slowdown signals a rebalancing of the sales market rather than a full-blown crash. Although buyer interest, as indicated by our demand measures, declined from its peak in spring 2022, it remains elevated compared to 2019. Demand for more affordable units is accelerating while demand for higher priced units (between $800K and $1.5M) appears resilient despite higher mortgage rates.

In addition, renting is becoming more expensive, pushing renters with higher budgets towards buying. There was no sign of slowdown in rent increases in July. The median asking rent in NYC rose 34% year-over-year to $3,582 in July, with all boroughs tracked including Manhattan, Brooklyn and Queens setting new all-time highs. In particular, the median asking rent in Manhattan rose 40% year-over-year to $4,200 in July, above the then record-high of $4,100 in June.

NYC Homes $500K – $800K on StreetEasy Article continues below

Moreover, 30-year mortgage rates have come down modestly over the recent weeks as financial markets assess the national economic outlook. Home shoppers who have been priced out of the market may view lower rates as an opportunity to re-enter the market, supporting the overall sales market demand. Buyers can get additional monthly data and utilize interactive charts for free via the StreetEasy Data Dashboard to stay on top of the challenging market.

Looking ahead, as the market continues to cool, buyers will be able to take more time on the market without feeling pressured to rush into making offers above asking prices. Sellers will likely be forced to readjust their expectations as the number of inquiries decline within certain price tiers. At a minimum, it will no longer be realistic to price a listing based on last year’s market dynamics.

That said, well priced homes relative to comparable listings can still receive competitive bids. StreetEasy can match sellers with a verified Expert agent whose local expertise can help you navigate the changing market. We also offer a free tool to check your home’s valuation before starting your journey as a seller.

Disclaimers: StreetEasy Valuation is our estimate for a home’s market value and is not an appraisal. Use it as a starting point to determine your home value and monthly rental price.

StreetEasy earns a referral fee from successful Experts’ transactions, at no cost to the buyer or seller. Experts must meet StreetEasy’s standards of service and market expertise. Agents in our Experts Network have closed deals on homes similar to the seller’s or similar to homes the buyer is searching for. We measure their performance to make sure buyers and sellers get top-notch service.