How to Sell Your NYC Home

It happens: you manage to finally buy a home in New York City, and then, for any number of reasons — a new job, new love, new priorities — you need to move out. Of course, you can sell the home, but it can be difficult (and maybe even foolish) to give up your slice of NYC real estate. That’s when you have to face the question: should I sell or rent my home? Before you decide, read this blog.

Manhattan Homes Under $1M on StreetEasy Article continues below

Can You Rent Out Your Apartment?

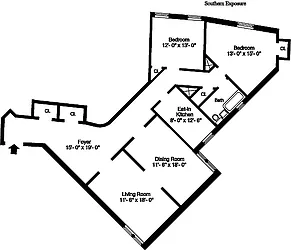

First thing’s first: find out if it’s even possible to rent out or sublet your apartment. Subletting policies vary from building to building, with condos generally being more permissive of it than co-ops. That said, some buildings forbid it entirely, while others limit the duration or frequency. There may also be a minimum residency requirement, e.g. you can only sublet after you’ve lived in the building for at least two years.

Co-op rules commonly require the board to approve your subletter — just because you vouch for someone, doesn’t mean your board will. These kinds of restrictions can shrink your pool of potential renters. On the contrary, if you own an entire single- or multi-unit residence, congrats! You get to call the shots on renting the place out.

Do You Have the Time and Patience to Be a Landlord?

If you do have the go-ahead to rent out your place, think about whether you’re up to the task of being a landlord. If a faucet leaks or something in the apartment breaks, your tenant will be calling you. Will you be available? Will you have the time and skills to address the situation promptly? If not, consider hiring someone to support you (perhaps an all-around handyperson), but of course, that expense affects your net income from the rental.

Brooklyn Rentals Under $2,500 on StreetEasy Article continues below

In some co-ops, the superintendent will only take repair requests from the homeowner, not the subletter. Are you willing to be the go-between for all communications? And if your tenant is less than ideal — creating issues in the building or being late with payments — are you prepared to deal with the repercussions, and potential damage to your credit? When it comes to rent vs. sell, lastly, it’s important to understand the legal aspects of being a landlord, and the city and state tenants’ rights you must comply with.

What Is Your Home Worth?

If you need cash right away for a down payment on another home, selling your apartment makes the most sense. (You may also want to read our guide to buying and selling a home at the same time). However, if you’re not in a hurry, it pays — literally — to dig deeper. To figure out if it makes more financial sense for you to rent or sell, let’s investigate what your place is worth in either scenario.

How Much Would You Get If You Sold Your Home Today?

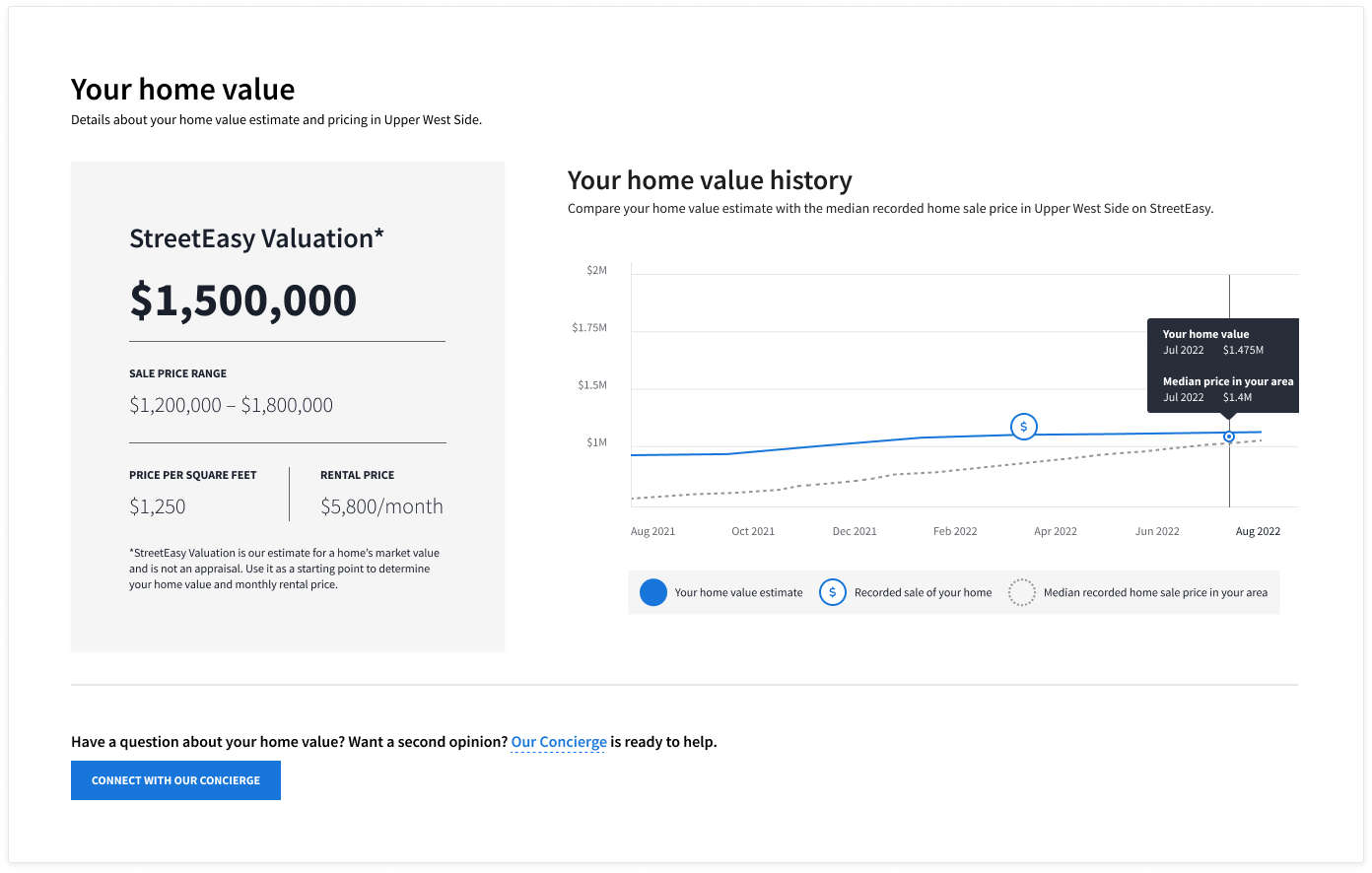

StreetEasy offers several free tools for NYC homeowners and sellers that help take the guesswork out of assessing your home’s value.

The StreetEasy Data Dashboard is a great starting point for sales market data in your neighborhood or borough. Take a look at metrics such as the median asking price, median recorded sale price, sale-to-list price ratio, and the StreetEasy Price Index.

Additionally, you’ll want to visit the Sell My Home page and claim your home on StreetEasy, allowing you to access your Owner Dashboard. This dashboard contains a wealth of information, tools, and resources regarding your home and the local NYC market, including your StreetEasy Valuation, an estimate of your home’s current market value powered by our expansive database.

When it comes to maximizing profits, how long should an NYC homeowner wait before selling their home? “In New York, the sweet spot for owning a property is about 10 years. If you can hold onto it that long before selling, you can usually see an excellent appreciation in value,” notes Danielle Rial, a licensed real estate salesperson with Brown Harris Stevens. In some cases, Rial has seen final recorded sales prices as high as 65% of the original purchase amount.

Here’s another useful tip: if you renovated your apartment, add those costs to your original purchase price, and compare it to current asking prices for comparable homes in your neighborhood. This can be a quick way to settle the rent vs. sell debate: will you make a significant profit, will you lose money, or will you break even? And don’t forget to include the additional expenses that come with selling a home in New York City, such as closing costs (yes, sellers pay them too).

Need a listing agent? Have questions about selling?

CONTACT STREETEASY CONCIERGEHow Much Would Your Home Rent For?

Renting out an NYC apartment can be lucrative, especially if it’s in a highly sought-after neighborhood. The StreetEasy Data Dashboard is a great tool for finding the median asking rent in your area. You can also search StreetEasy to see how much similar homes are currently renting for, and compare that to what you pay monthly for your mortgage.

NYC Rentals Under $3,500 on StreetEasy Article continues below

“You may also want to calculate an annual five percent rent increase,” says Rial, although she notes that sometimes private landlords prefer to keep the increase smaller to entice good tenants to stay longer.

Once you’ve factored everything in, take a look at the total. Is the price differential enough to make it worthwhile for you? This can be key in deciding not only whether to rent vs. sell, but also how much rent to charge.

Sell your home with StreetEasy

EXPLORE RESOURCESWhat About Housing Market Trends?

The New York real estate market can be unpredictable, which is why the question of whether to rent vs. sell can be difficult to answer. Housing market trends are in constant flux — ebbing and flowing, with prices rising and falling. If sales prices appear a bit flat, it may be your best bet to rent during a buyer’s market. “You could sublet your place for a few years and sell at a later date when sales prices go up,” Rial says. “That way, you reap the dual benefits of having income in the meantime while your apartment appreciates in value.”

On the flip side, if you can’t fetch a rent that’s profitable for you, or if your neighborhood is becoming a prime location for first-time buyers, it may be in your best interest to sell while the bidding is hot.

No matter what, it’s important to be educated about what’s happening in the NYC sales and rental markets. A great way to stay on top of these trends is through StreetEasy’s market reports, which offer easily digestible analysis on real estate in the city.

You’ve Made Your Decision to Rent or Sell — What’s Next?

Regardless of your decision to rent vs. sell, you should polish up your place to command the highest sale or rental price. Keep in mind that the improvements and upgrades you choose to do may not be the same, depending on whether you decide to rent or sell your home. For instance, a slightly outdated kitchen may be fine for a renter, but could be a dealbreaker for a buyer.

If you’re selling your place, know that an appraiser or inspector will need to assess your home, so be sure to complete any improvements or critical repairs before they come calling. Also, follow our tips on how to get your home ready to sell. If you’re subletting, make sure your apartment is a solid rental property. Thoroughly check for the basic requirements for habitability: working appliances, smoke detectors, hot water, etc.

Lastly, many sellers prefer to work with a real estate agent to help sell their home. You can do it yourself, known as For Sale By Owner (FSBO), but be aware that it requires lots of work, knowledge, and responsibility. Otherwise, contact our Concierge for sellers and have them match you with a StreetEasy Expert, an agent with experience selling homes similar to yours. On average, top Experts sell homes 1+ month faster than the market, and have a sale-to-list price ratio that is around 14% better than the market.*

Whatever you choose, StreetEasy is here to help you do it with confidence!

Get personalized selling guidance from the StreetEasy Concierge*Source: StreetEasy (2012-2023). Market defined as borough, unit type, price point, and share of listings by year.

Disclaimers: StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.

For FSBO postings, the StreetEasy Concierge is meant to provide insight to improve your posting performance on StreetEasy and may refer you to a real estate professional based on your specific needs.

StreetEasy Valuation is our estimate for a home’s market value and is not an appraisal. Use it as a starting point to determine your home value and monthly rental price.