New York City’s rent growth is showing signs of slowing, as the median asking rent fell to $3,775 in August from $3,795 in July. While a modest decline of 0.5%, it marks the first monthly decline of the year. The median asking rent in August was still close to the record high in July, but year-over-year rent growth in August was only 6.6%. That’s almost five times slower than August 2022, when the median asking rent rose 31.1%.

Inventory shortages continued to fuel competition for rentals on the market, thereby driving up asking rents across the city. An average rental listing on StreetEasy received 36.6% more inquiries in August this year compared to August 2019, before the pandemic disrupted the market in 2020. That said, the rental market this summer was less competitive than summer of last year. In August 2022, an average listing received 70.4% more inquiries compared to August 2019.

Summer is usually more competitive for renters, when many rental leases in the city lapse. As fewer renters move in the fall and winter, however, competition will continue to ease for the remainder of this year. Besides the seasonal slowdown, the recent increase in rental inventory from a very low level last year will ease competition among renters further. There were 39,300 rentals on the NYC market in August, 15.4% higher than 34,056 in August 2022 — the lowest summer inventory since 2014. Rental inventory will continue to rise in 2024, slowing further rent growth.

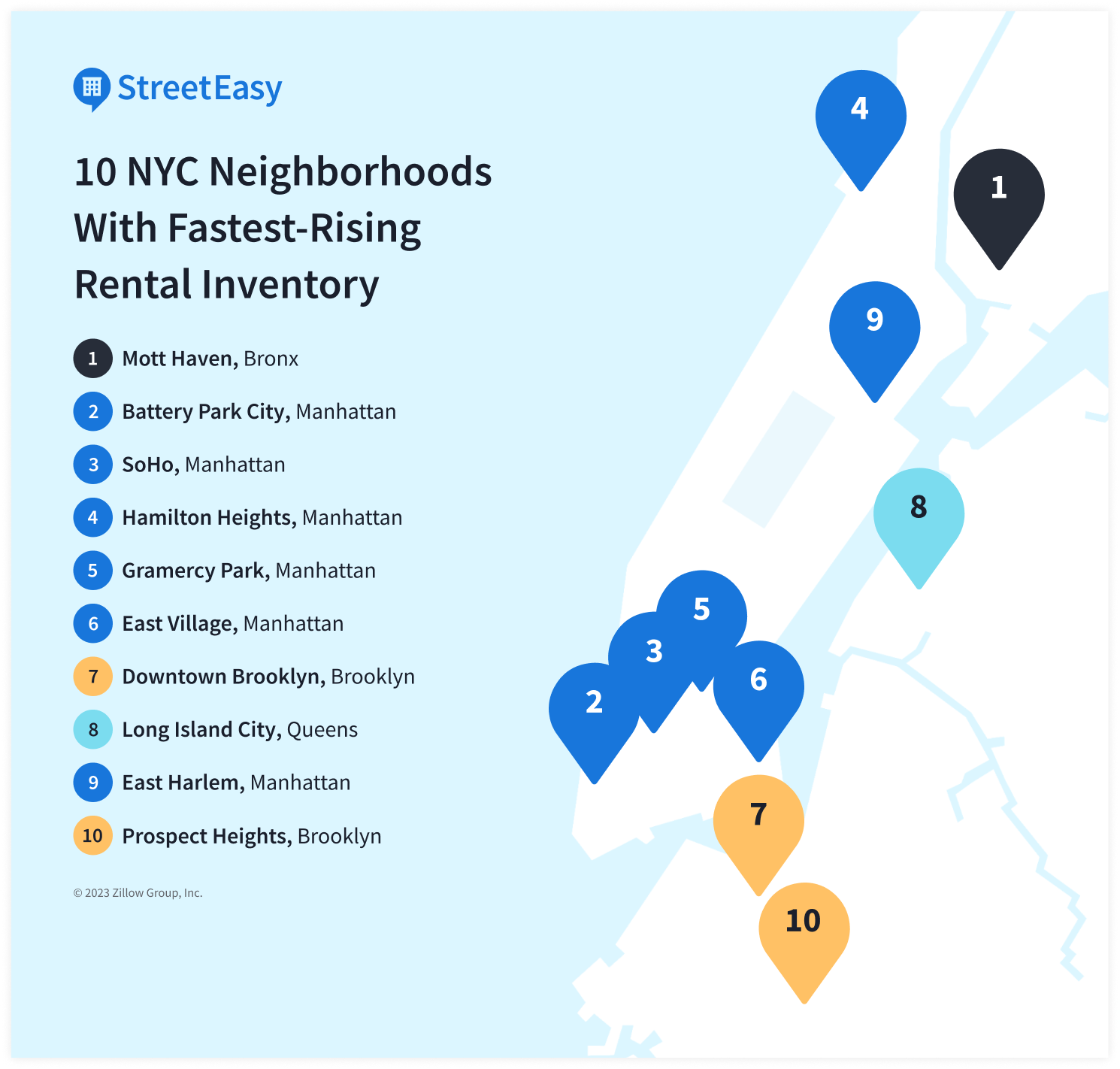

For renters looking to find a new home in the Big Apple, StreetEasy identified 10 NYC neighborhoods where rental inventory is rising the most.

Rental Inventory Is Rising the Fastest in Manhattan

Rental inventory in Manhattan rose 22.1% year-over-year to 20,850 units in August, the fastest increase citywide. High asking rents make it more enticing for landlords and homeowners to list vacant units, pulling more rentals into the market and contributing to rising inventory. On our list of 10 neighborhoods where inventory is rising the most, five neighborhoods — Battery Park City, SoHo, Hamilton Heights, Gramercy Park, and the East Village — were in Manhattan.

With rising inventory, rent growth is slowing in Manhattan. The borough-wide median asking rent was $4,300 in August, declining slightly from $4,332 in July. While 4.2% higher than a year ago, the annual growth in August was eight times slower than the 33.1% increase in August 2022, when intense competition contributed to sharp rent increases. That said, the rental market in Manhattan is still hot with demand outpacing supply. In August, an average rental listing in Manhattan received 26.2% more inquiries than in August 2019. There were 2.6% fewer listings than in August 2019, but total inquiries from renters were up 22.7%.

One key source of rising rental inventory in Manhattan has been modern high rises that offer coveted amenities. These “amenity-rich” rentals offer in-unit laundry, a dishwasher, an elevator, and a doorman — four of the top five must-have amenities in NYC based on StreetEasy search data — in addition to a gym or pool in the building. Premium buildings with these popular amenities are taking an increasingly larger share of the Manhattan rental market. In August, the number of amenity-rich rentals rose 28.1% year-over-year to 3,481 units, making up 16.7% of the borough’s total rental inventory. This is an increase from 15.9% in August 2022 and 11.9% in August 2019.

These sought-after amenities come at a premium. The median asking rent for amenity-rich rentals was $6,630 in Manhattan in August, 54.2% higher than the median asking rent for all rentals in the borough. However, these rentals are attractive options for New Yorkers who prioritize modern amenities in prime buildings over the long-term commitment and higher upfront costs required to buy a similar apartment in NYC. In Battery Park City, second on our list, overall rental inventory rose 78% year-over-year to 240 units. One in five (22.5%) listings in the neighborhood was an amenity-rich rental, located in 14 high rises within walking distance to offices in the Financial District.

Manhattan Rentals Under $3,500 on StreetEasy Article continues below

The increase in inventory wasn’t just limited to neighborhoods known for premium rentals. Renters can now find more abundant options across Downtown Manhattan than last year. Three neighborhoods on our list are located downtown – the East Village, SoHo, and Gramercy Park. In the East Village, inventory rose 40% year-over-year to 1,656 units. With a median asking rent of $4,250, 13.2% below the median of $4,895 for all downtown neighborhoods, the East Village is a more affordable option. Only 6.3% of the neighborhood’s 1,656 rentals were considered amenity-rich, a smaller share compared to 16.7% for the borough.

New Buildings Are Expanding Renters’ Choices in Brooklyn

New developments are expanding the options renters have to choose from in Brooklyn. There were 12,791 rentals available in the borough in August, up 10.2% from a year ago. StreetEasy data suggests 7.1% of Brooklyn’s rental inventory in August was in new properties built within the last five years — almost triple the August 2022 share of new building rentals of 2.5%. However, despite the recent increase in inventory, demand continued to outpace supply this August. An average rental listing in Brooklyn received 52.1% more inquiries than in August 2019 with renters competing for scarce inventory. As a result, the median asking rent in Brooklyn remained at $3,500 in August, the same record high reached in July this year, according to StreetEasy data since 2010.

In Downtown Brooklyn, seventh on our list of neighborhoods with the strongest rises in inventory, rental units rose 36% from a year ago. New buildings have substantially increased the options for renters in Downtown Brooklyn. Close to one in ten rentals (8.8%) on the market in the neighborhood was in a new building, a notable increase from 2.7% a year ago. That said, these rentals often come at a premium, with a median asking rent of $4,631 in August, 8.4% higher than the neighborhood median of $4,272. In Prospect Heights, tenth on our list, about one in four rentals (27.5%) in the neighborhood in August was in a new building less than five years old, rising sharply from 2.7% in August 2022. The median asking rent of these units was $4,492 in August, 5.7% higher than the neighborhood median of $4,250.

Brooklyn Rentals Under $3,500 on StreetEasy Article continues below

Queens Is Still the Most Competitive Market for Renters

Queens is the borough where inventory shortages are most severe, fueling competition for rentals on the market. An average listing in Queens received 76.6% more inquiries in August than in August 2019 — a higher increase than the city’s other boroughs. Rental inventory rose 4.2% year-over-year to 4,467, but current levels are still too low compared to demand. The total number of inquiries on Queens listings was up 80% from August 2019, but the number of rentals on the market was down 10.4%.

Amid strong competition, the borough-wide asking rent rose 11% year-over-year to $2,900 in August, led by Northwest Queens neighborhoods like Astoria, Long Island City, and Sunnyside. The median asking rent in these three neighborhoods rose 6.3% year-over-year to $3,400, as renters prioritizing an easy commute to Manhattan look to the area.

Ranked eighth, Long Island City was the only Queens neighborhood to make StreetEasy’s list of where rental inventory is rising fastest. Inventory in the neighborhood jumped 31% year-over-year to 857 rentals in August. The median asking rent was $4,259, up 3.9% year-over-year, just shy of the record high for the neighborhood of $4,259 in May 2023. Many rental units in Long Island City are in modern buildings with sought-after amenities, with amenity-rich rentals making up 41% of the inventory.

Queens Rentals Under $3,500 on StreetEasy Article continues below

Mott Haven Topped the List, With Inventory Doubling from Last Year

Inventory in the Bronx has been rising steadily since the pandemic. There were 1,107 rentals on the market in the Bronx in August, a 10% year-over-year increase. About one in three market-rate rentals in the Bronx was in Mott Haven, where inventory more than doubled (110%) year-over-year to 412 units as new buildings entered the market. The median asking rent was $2,964 in Mott Haven, up 5.1% from a year ago, and 14% higher than the borough-wide median of $2,600.

Demand from renters has been soaring in the Bronx, similar to the city’s other boroughs. The total number of inquiries received by rental listings in the Bronx jumped 73.4% from August 2019. Rental inventory also rose substantially in the borough, up 4.2% from August 2019. By contrast, inventory in the three largest rental markets still remains below August 2019 levels: Brooklyn (-13.8%), Manhattan (-2.6%), and Queens (-10.4%).

Surging renter demand in the Bronx is consistent with the broader trend in NYC, as the city’s strong job market continues to support demand for rentals. However, rising inventory in the borough likely kept competition among renters in check. An average listing in the Bronx received 46.6% more inquiries in August this year compared to August 2019, indicating that competition was more tame compared to Brooklyn (52.1%) and Queens (76.6%).

Bronx Rentals Under $3,500 on StreetEasy Article continues below

Rising Inventory Will Put the Brakes on Rent Growth Next Year

With additional inventory, New Yorkers can expect a slower pace of rent growth next year. In addition to elevated asking rents, high mortgage rates will continue to pull more rental listings into the market this year and next. With the average 30-year mortgage rate expected to stay above 6% at least through much of 2024, renting out a vacant apartment for additional income will remain an attractive option for homeowners who are locked into much lower mortgage rates.

With more rental listings on the market, it will be more challenging for landlords to raise rents significantly above market rates for similar homes. Renters will see more listings to compare when considering whether to renew their current lease or find a new home. Already, an increasing number of rentals have been reducing asking rents this year: in August, one in five (20.5%) rental listings on the market did so. This is slightly higher than the pre-pandemic average of 14.6% for August between 2015 and 2019. The median reduction in rent this August was 4.2%.

That said, New Yorkers shouldn’t expect a steep discount. September and October are the months when landlords are most likely to reduce asking rents, as they look to maximize the remaining summer “peak” rental season. But based on historical data between 2015 and 2019, renters would typically see about a 4% price cut around this time of year. That equates to a yearly savings of $1,812 for a rental priced at August’s median asking rent of $3,775.

Moreover, NYC rental inventory is still 7.2% below its 2019 level before the pandemic disruption. The city’s job market is still on solid footing, and wages are rising again amid slowing inflation, supporting demand for rentals. While demand will continue to outpace supply, the imbalance between the two will ease more meaningfully next year, putting the brakes on rent growth.

The information provided was extracted from StreetEasy listings and its expansive internal database. The contents of this article are intended for informational purposes only and not intended as a complete recitation of the market.

StreetEasy is an assumed name of Zillow, Inc. and registered trademark of MFTB Holdco, Inc. a Zillow affiliate, which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.