building at 35 Sutton Place

Started by ben_1529874

about 10 years ago

Posts: 0

Member since: Oct 2014

Discussion about 35 Sutton Place in Sutton Place

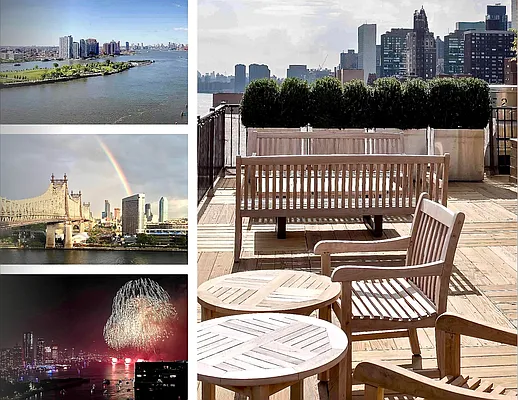

Having been a broker for more than twenty-five years and having sold in this building, I take exception to some of the comments made here about 35 Sutton Place. Not only is the building extremely well run and maintained by a very reasonable, fair-minded and capable Board, but the apartments are among the most well designed, beautifully proportioned and flexibly configured in the city. And those apartments which have terraces and river views are spectacular. I believe the lobby is soon to undergo a renovation and the exterior brick work is to be completed very soon. In short, 35 Sutton marries classic design with contemporary living and I never hesitate to bring my customers to this great building. It's the best value in town!

Add Your Comment

Most popular

-

23 Comments

-

68 Comments

-

17 Comments

-

16 Comments

-

13 Comments

Great news , thx for the update

Why is 16A on the market for almost 9 months?

Was in contract for a 100% cash offer to purchase a unit - denied by the board. Zero debt, strong financials. Enough liquidity to pay maintenance for decades. Not even invited for an interview! I am a POC and can only speculate. Speaks wonders about the board!

Maybe not - we have an applicant right now who is cash purchaser with enough liquidity to cover maintenance for decades. 5/7 of us on the board have voted to approve; a sixth is requesting more information that leaves the 5 of us who have already approved scratching our heads - bias against inherited money? The applicant is an establishment New Yorker to the core - all

the right schools and clubs. It will be interesting to see what on earth the concern is.

We wanted to look at 35 Sutton 5F. We ended up passing because the seller couldn't explain why the previous applicant was denied. It was clear even if we could "just" be able to pay all cash it wasn't nearly enough. In a market with hundred of available apartments where you aren't wedded to Sutton Place (Sutton was 'hot' but that was 50 years ago), life is too short to waste being in contract all summer on a unit where you are ultimately going to get rejected.

I get the appeal for units with terraces facing the water. What doesn't make sense to me is he market for the low floor non-waterfront units which we were considering. Hence 5F is on the market at what looks to me to not be above "normal market" with 400+ days on market.

I understand that the financial profile the board is looking for is more than $1 million cash after an all-cash purchase. Who with $3 million+ liquid is looking for a 1960s building under the bridge and smokestack with no view?

Hmm. Was given first crack at a listing at 35 SPS, and turned it down because the seller didn't have a connection to the board ...I don't know that I think the board's requirements are unusual, but communication of those requirements might be clearer at some times than others. For example, there appears to be some confusion on what the building's P-A-T policy actually is.

NYC249, I am sorry to hear that, especially as this sounds like a personal residence purchase.

WP, did you see 5F pre-renovation?

MCR, when you have an answer, I'm dying to hear it.

ali r.

{upstairs realty}

@woodsidepaul - exactly. Our building should count its blessings that someone with the money to maintain the less-than-hot product wants to live there. In our building's case, it is a former resident returning home as an adult.

@ali - will do.

I only started looking this year and saw the listing. I like very much what they did with the place.

Ali, can you spell out what P-A-T stands for and your experience with what buildings on Sutton Place are looking for?

I understand that many building have these types of requirements, but I think that the value has held up better on prime Park Ave, 5th or CPW so those requirements still make sense while my impression is Sutton Place is a step below its former glory.

oh, sorry, WP, "pied-à-terre" -- I don't want to discuss this specific building too much in public, since I might well take a listing in it in the future (it's the kind of building where more than one of my friends grew up) -- so let me just say, some of the turndowns that we are seeing in general in different buildings are a divergence between buildings that want owner/occupants and buyer candidates who they think will use the city places as a second home.

Which is somewhat a problem of the buildings' own making, because, as you've pointed out, anyone who walks in with 40% or 50% down plus renovation money plus maintenance reserves plus whatever extra post-closing dollop the buildings are looking for might choose instead to buy something different in a 20% down situation.

Especially because, the way careers are going, it's hard to make $2mm. But if you're in the kind of job where you can amass $2mm, you are probably in the kind of job where you have a real shot at $5mm, $10mm...

I digress. The buildings in that area really seem to be looking for MCR (I mean, MCR's terrific, so who wouldn't be?) but I mean specifically, someone who says, "I looked all over New York and I want to live "here.'" They still see themselves as Fifth- or Park- Avenue equivalent (or nearly) and they want buyers who will feel that have arrived if they get in.

And lots of people just aren't like that anymore.

Thanks Ali. Very insightful.

MCR, isn’t this the board prez’s unit? Maybe the issue is price, but request for additional info is a roundabout angle?

No - The one that is in contract the wife was the board member, but she has not been on the board since 2020. Current board president's apt is the other one that has been for sale off and on (rented in between active listings) for 4.5 years but is not in contract.

The buyer seems like a good match for the building, hopefully it goes through. Where is the offer, somewhere around ~10% below ask?

Exactly. Now you can calculate how much worse off this particular seller was buying vs renting. A virtual bloodbath in loss of capital alone, not to mention maintenance and opportunity cost of that portion of capital they will ultimately recover. Imagine what they could have rented over the actual time they lived in NY (2014-2018) for the amount of cash they ended up laying out for the luxury of ownership. Ouch.

You know I can’t resist…

It looks like they did a modest amount of renovation? Between maintenance, capital loss, and transaction costs, they will have spent half the price they paid for the apt for 4.5 years of living. I think I spent slightly less than that for 9 years of living over the same timeframe, except in 3x nicer accommodations on average. To say *nothing* of cost of capital over those 9 years.

Well, hopefully the psychic benefits were worth it for them. I’m but a simple hedonist, only the material ones matter to me when it comes to RE…

Here's where the permabulls step up, deny they are permabulls, bitch about being called permabulls, exercise a little name calling, and then explain to us why the joy of ownership exceeds any possible financial losses.

@multicityresident: Why is your buyer not approved if 5/7 Board members are in favor of them? Do you have a requirement for unanimity? We always just went with majority vote when I was on my Board

@WoodsidePaul: Why the all cash bid when the building allows 60% financing? High mortgage rates? Did the building have different post closing liquidity requirements if the purchase involved financing?

MCR

I don't understand, do your buildings bylaws require a unanimous vote?

I've combed over my docs and don't see any reference at all to procedure for our board and see its one more thing to add to the list for us updating our legal docs.

Anytime there is a reference to our votes in the bylaws it consistently only requires a 66 and 2/3 % vote but we haven't had a dissenting vote for any prospective buyers for the decade I've been on the board.

Though if one member had issues we would certainly indulge ( of course understanding my board doesnt have the same politics issues as yours)

@etson and @truthseeker - you are spot on. We are trying to organize a meeting to take formal vote where we have agreed to hear questions from fellow board member as a courtesy prior to formal vote. For reason I cannot fathom, said fellow board member is not amenable to putting questions/concerns in writing to the group. Not cool on so many levels.

@eaton: we didn't get as far as making a bid, to be clear, but it seems that, for any permutation of down payment, $1.3 million liquid with $400k income wouldn't be enough to buy a $1.3 million apartment here. Regarding making a high down payment: I don't have any other meaningful tax deductions so each additional dollar I make in downpayment reduces my interest expense by 4.5-5%, which meets my hurdle rate for where I am willing to tie up risk free money 'permanently'. If mortgage rates were much lower or the married-jointly standard deduction was much lower (with interest deductibility capped at $750k mortgages) then it would be much more attractive to take a max mortgage.

Thanks both!

@MCR

Thats all you can do.

Occam's razor tells me its monetary. Either doesnt like the comp for the unit's sale price as maybe they want to sell as well and/or the lower sale price = lower flip tax to the building.

@truthskr10 - I will report back. The board member raising the question does, in fact, have his apartment on the market. So ridiculous that this sale is being held up, and the way the scheduling discussions are going, we may not get a meeting before mid-June. This type of nonsense is exactly what gives coops a bad name.

@WoodsidePaul why this unit and not another unit in the building with a better view?

@Krolik it is well renovated while some others near this price need substantial work. The layout is ideal for making it a 3BR. The size is bigger than most. We don’t care to pay for a view.

>> For reason I cannot fathom, said fellow board member is not amenable to putting questions/concerns in writing to the group.

Maybe you’ll get some good gossip about the old days??? “The kid was slinging drugs on the corner back in the day, and word on the street is that he’s now a drug kingpin re-establishing Tudor as his turf. Lotta money in statins…”

This is one for the "what gives coops a bad name" pile: Re the cash purchaser with decades of maintenance in post-closing liquidity that 5 of us immediately approved, the question one of the remaining two had that he wanted to send back to the applicant: "Please explain the valuation method on Asset X" where Asset X is a small portion of applicant's overall net worth. (Asset X is fine art). Those of us who had already approved voted to spare the applicant the nonsense and just schedule and interview already. Just bizarre. If anybody can think of anything that will lessen my wonder at the question, I'd love to hear it.

The "Personal Property and Furniture" line on the REBNY balance sheet is always BS, people usually just plug a random number to make their overall net worth look higher.

That said it should never be the basis for, or even a material part of, a decision on an application.

@etson - exactly.

" If anybody can think of anything that will lessen my wonder at the question, I'd love to hear it."

Yeah its not the real reason or question he had, just the only one he could have "recorded" at a board meeting.

I wouldnt dwell on it, but Im speculating... he doesnt like the sale for a soon to be used comp against his .

He's probably thinking to stall the recording of the sale price and have the extra time to find his own buyer uninfluenced by a comp sale price.

@truthskr10 - That explanation makes sense to me. The bizarre thing about this guy is that he has been trying to sell his place for 4.5 years and will not accept market clearing price. Makes no sense for someone who markets himself as a finance genius. All the 80-year-old children of robber barons (not kidding) in our building think he is the bomb, which is why he is president of our coop board. They cannot see the red flags. Professionals look at the resume and see one thing; people who have never worked a day in their life see another. Guy's current gig is for the poor man's SVB, and he seems to specialize in off-balance-sheet financing. Is it possible that his apartment is under water despite our max 65% financing policy? I just cannot understand why this guy can't lower his price $300K to get rid of the unit; current seller lowered his $1.5M to move it because that is what it took and he can bear the loss.

*90-year-old (they were 80 when we moved into the building)

@MCR

OMG the Pres is behaving this way? Thats nuts.

Are you long for the building?

If so I would start strategizing with other like kind members and neighbors to work on "who's the next president." It doesnt have to be combative or malicious.

Its logical.

The President is selling and your going to need a new one.

Once there is a strong consensus on the NEXT president....then maybe you can start chirping about making it happen before the sale.

People, especially older people are uncomfortable with change. It takes time to sink in. Once pre polling has people comfortable with change coming regardless, then the board can bring up issues with the presidents action(s) and maybe jump ahead of a sale and at next annual meeting ....vote.

I know, its a lot of moving parts. But the NYC coop world has a lot more important and expensive decision making issues coming in future years. You want the board running well and competently.

Of course.....if your staying

@truthskr10 - You have no idea. I got off the board a few years ago when we started spending more time in Columbus. I got back onto the board a few weeks ago (via contentious election) in response to cries for help from within the building, and I am already regretting it. I am pushing for a new president, and my preferred choice would be excellent and obvious to anyone who understood anything about the building's finances, but none of the other board members have any real professional experience to speak of and are taken in by the guy with the sketchy resume who won't sell his apartment (he lives in Connecticut and his current gig is headquartered in Canada FFS). I am going to do what I can over the next year from afar (I am rarely in NY and have given up on ever making NYC our home - life has intervened), but I have already told Mr. MCR that we are dumping this apartment next year if I can't turn this board around. It is awful. For those of you who lament your inability to get past these absurd boards, count your blessings.

@ MCR

OUch...good luck

My parting words on the subject are....try and make it non combative.

Get the branch davidians on the board at least in the frame of mind of someone else.

{bad example Im not very good at this ...}

"If so and so finds a buyer, we are going to need a new president. "

"They are very big shoes to fill." (Yes say it with a straight face)

"Im concerned about who will guide us."

"Ive been thinking about so and so because they are good at this and that"

"What do you think"

"Or do you have someone else in mind"

Gotta plant the seed

And agree with your comment about getting past absurd boards...the easy ones end up no picnic either

*none of the other board members except the one I am supporting for new president. My candidate is an accomplished professional single woman who attended schools unknown to the older shareholders. Guy who won't leave is old establishment. The "private school" thread comes to mind here for many reasons. Form over substance is very much alive in my building.

@truthskr10 - current president has told other board members he is not going anywhere and has convinced them he is doing them a favor by not accepting market clearing price because it bolsters the value of their apartments, and one of the publicly thanked him on coop electronic bulletin board! The good thing is that my openly challenging him on trying to hold up current sale with fake question did get other board members' attention. He was trying to get MA to send his question to buyers without sharing with other board members because prior to my coming back on he was able to get away with "this is sophisticated finance that you wouldn't understand." Truly bizarre. I jumped for joy when his usual cronies looked askance at him and dismissed his "concern." I just need to question him openly in a professional manner in front of other board members and hopefully they will get a clue that something is not right here. For my part, I don't know what is not right; the only thing I know is that a number of things aren't adding up such that I need this guy out of the captain's chair.

>> Guy who won't leave is old establishment. The "private school" thread comes to mind here for many reasons. Form over substance is very much alive in my building.

Indeed. Here’s one lesson you may not learn in private school. There’s an entire world out there that is not seeping with generational has-beens jockeying for more crumbs at the trough. If you find yourself seated at a table with them, politely extricate yourself from the room as soon as possible.

"The "Personal Property and Furniture" line on the REBNY balance sheet is always BS, people usually just plug a random number to make their overall net worth look higher.

That said it should never be the basis for, or even a material part of, a decision on an application."

Except when it is a material percentage of the total worth. I got an offer on my own apartment several years back where 90% of the purchaser's worth was in a "car collection" with no backup.

>My candidate is an accomplished professional single woman who attended schools unknown to the older shareholders.

It did cross my mind that partner and I were possibly denied at a 30% down Sutton Place coop because we went to public secondary schools and state schools for college... Did my graduate degree from a "fancy" school not count because it wasn't a birthright?

The same coop sold a 1br unit to a junior colleague of mine with only 3 years of work experience, but probably the "right" college or maybe even high school? The board president of that coop attended Dalton and Yale... Her husband's first job out of Yale was President of daddy's firm.

I used to go through these "hold the line on prices" issues all the time dealing with foreclosures in the 1990s. What's worse for a building's reputation: a "low" sale (which once it actually closes and is in the past, creeping towards the generally accepted 6 months cutoff for comps) or to have a pile of listings on the market for years not selling?

As far as Board shenanigans regarding this, I had more than a couple of foreclosures in buildings with "floor prices" where Board members purchased the units at the actual prices the banks were willing to sell at as investment properties even though the buildings had strict "no investors" policies. So not only did they buy outside the price structure they set, but also outside the purchasing guidelines. Total self dealing. The worst offender was 148 West 23rd Street where I understand multiple Board members engaged in this.

"There’s an entire world out there that is not seeping with generational has-beens jockeying for more crumbs at the trough."

That is our world in Columbus, Ohio, and I love it.

@krolik - entirely possible. I have gotten involved again to help the woman in our building who should be president. I am horrified and disgusted by how she has been treated by many in the building. She bought one of the smaller apartments totally on her own, with money she earned the good-old fashioned way. The only good thing I will say about the guy who won't leave is that he got her on the board because he needed someone with a brain to do all the work. She does all the work; he takes all the credit.

>The worst offender was 148 West 23rd Street where I understand multiple Board members engaged in this.

Shareholders that were foreclosed on could not sue? What is the reason board approval is not needed for bank sales?

Krolik,

I know we disagree on this, but these old line Coops are not Real Estate, they are country clubs. The whole reason the prices are attractive is because they are so restrictive. From where I sit you seem to want them to be less restrictive so that you and others could join the club, but if that were actually the case the prices would be higher and you would find joining those clubs much less attractive.

My personal opinion is let these people self segregate, diminish the value of their holdings, and make each other miserable in their ghetto.

You can see how absolutely terribly these ultra exclusive 5th Avenue/Park Avenue/etc are doing now that similar Condo options are available.

https://www.urbandigs.com/forum/index.php?threads/mastodons-on-park-avenue.673/

@30yrs - Agree on all fronts.

> The whole reason the prices are attractive is because they are so restrictive. From where I sit you seem to want them to be less restrictive so that you and others could join the club, but if that were actually the case the prices would be higher and you would find joining those clubs much less attractive.

I don't want to be in their club, I want their square footage on Park Avenue at a great price. :-) If they sold freely at market values, prices at coops would go up, but also there would be more actionable inventory on the market in NYC, and average prices would come down, which would make living here more affordable. Why should the rich people get all the good deals?

Similar story with private colleges that have massive endowments, supported by generous tax exemptions (for schools and for donors). It bothers me that public goods (tax money) is distributed to some club members and not to the general public in some more equitable way.

@krolik - The great paradox of NY real estate is that the more money you have, the less you have to pay for housing via these old line coops. The old money is dying out and these old coops are literally crumbling. I cannot wait until the real estate is liberated, but it still has a ways to go before it hits rock bottom as exemplified by the trust fund kid who is coming back home to our building. Not thrilled to have a kid who has never had a real job and at this point is unlikely to ever had a real job occupy one of the most heavily-shared apartments, but few accomplished professionals with the money to afford the apartment would choose it, so it is what it is.

"Shareholders that were foreclosed on could not sue? What is the reason board approval is not needed for bank sales?"

I'm not sure why they would sue? Once they are foreclosed on they have no dog in the fight. There are no deficiency judgments on co-op foreclosure sales.

Your second question is more complicated and there has been quite a bit of litigation on the subject (including multiple suits involving yours truly). Almost every Offering Plan, in the Financing of Shares Section, states that in case of foreclosure the bank will have the right to sell the shares without Board Approval, but subject only to the approval of the Managing Agent *which shall not be unreasonably withheld*

However, in practice this is not what happens. Especially in Manhattan where many judges are Coop owners there have been what I consider odd rulings, including when the purchaser sues to enforce the clause in the Offering Plan that they don't have privity.

In one case where I represented myself pro se, the judge held the hearing in camera and refused to allow me into her chambers to be heard, so that there wasn't even a record of her nonsense to appeal.

However, different departments have ruled inconsistently. Like in Brooklyn where judges own single family houses and most Coops were historically lower class.

Krolik,

I have more bad news for you:

They generally pay less Real Estate Tax as well.

>I'm not sure why they would sue? Once they are foreclosed on they have no dog in the fight. There are no deficiency judgments on co-op foreclosure sales.

Could they have sold the apartment at a market price and avoided foreclosure if not for the board rules?

>They generally pay less Real Estate Tax as well.

How?

Because Co-ops are still assessed as if they are "comparable rental buildings."

Well, I live in a coop (just a less fancy one not in Sutton place or on Park Avenue). I think I pay too much taxes, about $1600 per month for a 2br in an old, no amenity building.

A colleague bought a large townhouse in UES and is paying less taxes than me! I also plenty of listings for multifamily houses in Brooklyn that cost twice the amount that my apartment does, and pay $300 per month. That is who I think is underpaying, not coops.

Agree with Krolik re relative taxes, as someone in a very similar situation

Re the east side coop discussion, I live in a non old money 30% down coop near the initial subject of this discussion. I think the ongoing existence of some delusions-of-grandeur buildings nearby brings down values for all of us as some buyers just don't look at the neighborhood at all.

The other factor that depresses values is that there is a consistent largeish supply of estate sales: poor condition apartments with non-price sensitive sellers

Good thing I love the neighborhood!

I recently curled up with the 2nd grade address list of a famously old-money NYC private school. Saw some recognizable names (and figured out who pretty much everyone was with some googling), but not a lot of recognizable addresses. The most obvious name (a celebrity) has a sparkly new condo address. Several others were in celebrity-studded condos. Several townhouses. And a surprising number of rental buildings (think Glenwood-style buildings). Not a single address on Park or Fifth (and not much in between), no Beekman or Sutton either.

Just 40 observations, maybe 35 excluding the handful of families on financial aid, but a lot more diversity in housing than I expected. I guess the denizens of Park or Fifth don't have 2nd graders, or maybe they send them to PS6 or Le Rosey. But if people who can afford $60/yr tuition at one of the city's biggest name schools aren't buying old-school coops, who is?

Buyer pool over the past few years in my non old-school coop:

40-50% empty nesters / retirees

30% pied a terres

20-30% younger families / singles / couples

The trend has been slightly towards younger folks and away from pied a terres lately but not enough to shift the overall shareholder mix

With their requirement of millions in post-closing liquidity, the only people who can pass the board are retirees and trust fund babies. Younger middle/upper middle class families are getting left out despite being easily able to afford the price tag.

George>> a lot more diversity in housing than I expected

What were you expecting? I have no clue what to expect, as I don't rub elbows with the old-money NYC crowd.

I expected more of the old money buildings between Fifth and Park, Sutton, etc. Instead saw a lot of condos. I guess if you're an empty nester it's not such a problem to tie up your liquidity in your "box house", especially if Le Perigord is down the street

Le Perigord has been closed for around 6 years now lol

Really? You could have fooled me. Every time I pass it going to River Club, it looks the same as it always has.

They have not taken down the sign, but it has been closed for years. And yes, it looks the same closed as it did when it was open - zero energy, so I can see how George might not notice the difference.

As to who is buying the paces in Beekman and Sutton, the 2/2's go to high net worth empty nesters; the larger apartments just sit . . . for years . . . on and off the market.

@George - It is too bad you view your home as an investment; were you willing to light money on fire, I suspect you would sail past these coop boards with ease. If only you were willing to accept a negative ROI, your wife could have that classic 6 for a song!

@Krolik - that is the crime and the death of the neighborhood. It makes me sad because I love the neighborhood and angry at the inequity and the absurdity. Young professional families could bring the neighborhood to life, but instead many buildings are doubling down on keeping it as it is - G-d's waiting room.

P.S. - One of my neighbors in my building who is not on the board openly advocates for disregarding all financial requirements for any young professional who went to the "right" schools and who belongs to the "right" clubs. She says that is how she and her husband (now deceased) got into their 5th Ave coop back in the day. She openly states that objective requirements are there only to keep "people we don't like" out of the building; no such requirements for "people we like." She asked me when I got off the board a few years ago if I would support her getting on the board. I told her that was a hard pass because of her states "right schools/right clubs" preferences. She laughed and marveled at my bizarre outlook.

Sounds like an objective requirement. Can the board please share the list of schools/clubs so we can start working on our applications? LOL

Unless the schools/clubs are a front for "no brown people" and other kinds of discrimination.

Definitely not a front for no brown people, but certainly a disparate impact. I believe the most awesome young family in our building may have come in this way (Dalton and some British boarding school) and might well be regretting their good fortune as they see the equity they have in their apartment decrease. I believe they love the building but I do not believe they expected to lose any part of their hefty downpayment. Similarly the guy who is our coop board president who won't (can't?) leave came in with the right schools almost 20 years ago as a newly wed and had all four kids in the classic 6 that he cannot sell. I am curious as to whether you have checked out the trajectory of the coop that turned you down. I suspect you dodged a bullet.

I like this idea of accepting people based solely on schools and club memberships. Princeton + Meadow Club = good e light for us. Yale + Southampton Bath & Tennis = really???

At least these are objective criteria.

*good enough

The Old Guard in our building is partial to Maidstone, Piping Rock and Southampton Bath & Tennis, plus the Island Club in Hobe Sound. As for schools, generations of Deerfield for the men, Farmington, Madeira and Foxcroft for the women. A skilled equestrian, regardless of any other background, would be welcomed with open arms. I will say that to our building's credit, there have been no board turndowns for at least 10 years.

Regarding the couple in your building, I think this is not just a fancy coop phenomenon, my understanding is RE prices in Manhattan have been trending down overall for a few years.

The coop apartment where the board turned us down went into contract again about 9 months later, but 4 months after that, it was back to market after another board turn down. According to the seller's broker the next buyer was super-solid and she has no clue what happened. The apartment is still on the market, now listed for under 1M, about 100k below our contract price!

What do you all think *should* be the financial requirements for a coop application to be approved?

Btw, I have heard of some of the places on multicityresident's list, but under half. The closest I have been to any was visiting Deerfield town as a tourist.

I don't think there is anything inherently wrong with Coops having differing financial requirements. They should just realize what the consequences are, and reasonably often revisit their requirements to determine how they fit with current market conditions and reasonable building objectives.

The clubs and schools supported by MCR's board suggest that they're a mixed building

We are a mixed building; if you have money and want to live there, hooray! If you don't have money but went to the right schools, that's fine too, as long as you can make the downpayment. The Old Guard has the deepest of pockets; newer shareholders, not so much. Personally I'd welcome anyone who wanted to live in the building who could come up with the downpayment (and I'd lower DP from 35% to 25%), was gainfully employed at a salary level that could handle the maintenance, and had six month living expenses liquid post-closing. I am pretty sure newer shareholders feel the same.

although the more I think about it, I suspect when George said "mixed," he was referring to Locust Valley's having one culture vs the Hamptons having another. Or maybe he was even distinguishing within the Hamptons culture between East and South. Each enclave does have its own thing, and we have them all in my little building.

>> Regarding the couple in your building, I think this is not just a fancy coop phenomenon, my understanding is RE prices in Manhattan have been trending down overall for a few years.

I think it’s worse at fancy coops. The sale under board approval at MCR’s building is for a sale price that is ~25% below the Jan 2014 purchase price. It also had a modest degree of renovation work. The SE index is up ~5% between Jan 2014 and Mar 2023, but perhaps that becomes ~0% if we adjust for where the trajectory is heading by the time of this to close. Anyway you cut it, it’s meaningfully worse.

I don’t think it’s unique to MCR’s building. If you look at flagships like 740 Park, it’s the same story. People don’t care to live in such places as much as they used to.

George, is there a clearing price on such places for you? I don’t personally care for the location nor scene — I’m but a simple pleb who had to look up what the River Club, etc. referred to — so the answer for me is a pretty firm “no”. You, on the other hand, seem to be into both.

> Personally I'd welcome anyone who wanted to live in the building who could come up with the downpayment (and I'd lower DP from 35% to 25%), was gainfully employed at a salary level that could handle the maintenance, and had six month living expenses liquid post-closing. I am pretty sure newer shareholders feel the same.

Wow, you would really let in all sorts of riffraff.... and this would really help support the prices.

>I think it’s worse at fancy coops. The sale under board approval at MCR’s building is for a sale price that is ~25% below the Jan 2014 purchase price.

I guess, it is worse at some of the coops that were more overpriced to begin with during their glory days. When they get down to ~900 per square foot or less, I am very interested because while this location is not as great as living next to the Central Park, and there is a bit of a walk to the subway, it is still really convenient, and the neighborhood is great, and anything you need (gym, hair salon, yoga/pilates, restaurants, dry cleaners, shops) is available within a 5 block radius.

The 2014 sale that is now being sold in 2023 at a ~24% loss was a bit of an anomaly. The buyer was an out-of-town highly accomplished professional relocating to NY for a big job, and subsequent developments lead me to believe that said buyer did not understand the difference between a coop and a condo. Shocked to find such square footage in a charming neighborhood for a fraction of condo prices; I think it might have even been been sold as a whisper listing so the unsuspecting soul thought he was really getting something special.

In any event, the existence of such a buyer is what I believe keeps hope alive in all the sellers who list their classic sixes and sevens in the neighborhood at $2M+ when the market-clearing price appears to be more like $1,650,000.

Nevertheless, there will always be a market for special properties (none in my building) such as this one: https://streeteasy.com/building/1-beekman-place-new_york/535tr

Two weeks on the market. I would have been all over that in another life.

MCR, what is your estimate of the trajectory, percentage X since date Y, for the prez’s unit if it were to sell at a market-clearing price today? And how much, again percentage-wise, went to reno?

@etson: My problem is with the information asymmetry. How about some reciprocal requirements?: Co-op has to disclose detailed financials, show 3-5 year projected budgets, explain historical variances, have a rolling 10 year capital maintenance and improvement plan, commit to set maintenance charges for a rolling 3-5 years, and disclose board decision rationales for all unit sales and material expenses. For that, they can require 75% down, 1 year maintenance in liquidity, and restrict therapy pets to only purebred lines. For less, they should take the share price hit they deserve.

Seriously, buildings should run their financials and operations like the businesses they're pretending to be. And buyers need to do due diligence on the buildings like the illiquid and capricious investments they are.

When I look at sales in the last Coop I was in I am convinced that buyers/attorneys are doing close to zero due diligence.

@nada - I'd say ~15% loss w/r/t market clearing price with reno and transaction costs over 13 year hold period.

>When I look at sales in the last Coop I was in I am convinced that buyers/attorneys are doing close to zero due diligence.

People don't let buyers do proper due diligence: "your attorney will do sue diligence once you have an accepted offer". That's too late!

Most attorneys do bare minimum or less, are not in a position to really evaluate financials and advise on whether the price properly reflects a higher/lower than usual maintenance.

I just did a quick search and it looks like market-clearing price for a Classic 6 in the neighborhood is even lower than $1,650,000! I haven't been overly paying attention to the market, but I don't get why this one isn't moving: https://streeteasy.com/building/20-sutton-place-south-new_york/8c

Same with this one: https://streeteasy.com/building/16-sutton-place-new_york/2a

Those are both very nice and I have noticed both of them before. I don't know much about 16 Sutton, but I am fairly sure 20 Sutton South is not an "old school" coop / board

MCR, these are awesome finds. If only I was in the right clubs and rich, I would consider.

What is the profile of the buyer?

The typical coop buyer, an empty nester, probably isn't looking for this much space.

It is too big, expensive, and inflexible for being a second home for an out of town purchaser.

So it is probably a NYC family with kids under 18. The second listing allows 55% financing tops. So you need a couple with 2-3 kids and over 1M cash available (how much do they need to have in liquidity to pass the board?) It is really hard to save with 2-3 kids, for example, friends of mine with 2 kids in Manhattan spend 7600 per month on daycare, plus few thousand on a part-time nanny, for example, and these are after-tax dollars, so it is almost double the amount of income pre-tax.

So I think you are looking for someone old money, a cashed out entrepreneur, or a super successful financier (or a handful of other rich people, like actors). There are more of them in NYC than anywhere else on earth, but not an unlimited number.

These may be actually going for less than you think if you're basing it on recorded sales figures.

https://www.urbandigs.com/forum/index.php?threads/coop-sales-statistics-may-be-inflated.742/

I have noticed both apartments online before. Live very close by, like the look of both & considered viewing, but I would have to sell my nearby place first (no quick or easy feat).

Probably for a different thread, but I have very conflicted views about making a greater financial commitment to NYC at the moment. I love the neighborhood day-to-day, but pretty much every new policy / proposal out of the council & state legislature makes me want to vomit (congestion pricing, "good cause", lowering school standards, anti-police measures...). I am not sure whether it is sustainable for the city in general or my own remaining here longer-term. I change my mind every day about what I want to do....

@etson - right there with you.

@30yrs - right?

@Krolik - come to my building! Inonada will give you the address. :)

When I say "mixed" building, I mean one that allows non-Protestants - you know, Papists.

The point around the limited buyer pool with kids for Classic 6s is relevant to me. As everyone here knows, we blew our wad on a vacation house in Nowhere when prices bottomed out shortly after the outbreak of covid. It has since probably doubled in value with a 75% mortgage under 2.5%, and we are getting a healthy yield renting it when we're not there. Market is still strong (no inventory) but I see no reason to sell a winner and lose the great mortgage to put down a million or two on an NYC coop, a city whose prospects are iffy, and where we've gone 8 years without much appreciation of real estate despite inflation.

Yes at some point there's a price where a stodgy old coop is a fantastic deal, but it's not come yet. Those $1.6m places / 50% financing places probably need to fall below $1m before I'd be tempted. Meanwhile I'm happy renting and not having to worry about assessments.

>> @nada - I'd say ~15% loss w/r/t market clearing price with reno and transaction costs over 13 year hold period.

The SE index is up 22% over that same timeframe. Even if one removes transaction costs from the -15%, that’s still ~30% underperformance. Perhaps there’s an argument to be made for some amount of reno baked into the SE index’s rise, but even then I’d ballpark it as ~20% underperformance.

>> I haven't been overly paying attention to the market, but I don't get why this one isn't moving

Maybe it’s what Krolik & George say? The market everywhere seems gummed up. People with income but not cash cannot swing the downpayment. Existing homeowners with income and downpayment cash are “locked” into their existing place because of 2.5% mortgages. People with fresh cash and income gotta pay 6% mortgages. People with cash are earning 5% risk-free, to say nothing of opportunities to make more with a degree of risk. And no one seems to see appreciation on the horizon.

It feels like the market cleared pre-committed buyers over the past year — those who were going to buy despite the obviously deteriorated economics no matter what — and has moved onto the stage of attracting fresh buyers demanding prices more reflective of current conditions.

So let’s continue watching the paint dry…

@nada - All that sounds right. Looks to be a boring season in the spectator sport of watching real estate dry.

@George - My building has Protestant, Catholic and Jewish shareholders going back decades. And, at the moment we have a Muslim family renting one of the larger apartments and a Hindu family renting another.

>I love the neighborhood day-to-day, but pretty much every new policy / proposal out of the council & state legislature makes me want to vomit (congestion pricing, "good cause", lowering school standards, anti-police measures...).

NYC has always bounced back, but it is facing some serious issues now. I am just not sure what the solution is, as there is a deficit, a shrinking tax base, and so many issues, from homelessness and migrants to rats and crumbling infrastructure. Wouldn't want to be in legislators' shoes right now.

Congestion pricing is upsetting. I saw NJ is complaining most loudly. Similarly, I have family in Staten Island, and on a weekend, they can be in midtown by car in 30-40 minutes, to visit me, or to go to the opera, but by public transport, it is literally over 2 hours. And they are already paying an unreasonable amount for Verrazzano bridge, the money from which goes to the MTA and I believe subsidizes Metro North and other public transport. Only, Staten Island does not have a subway connection to the rest of the city, so SI residents are paying a lot into the system, see little benefit, and are about to be the borough that is hardest hit by the congestion charge.

>@George - My building has Protestant, Catholic and Jewish shareholders going back decades. And, at the moment we have a Muslim family renting one of the larger apartments and a Hindu family renting another.

And the building that turned us down had a mostly Jewish board. Many of them did go to Dalton and similar.