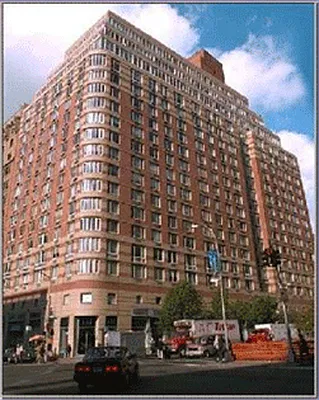

building at 2373 Broadway

Started by eabdesigns

over 18 years ago

Posts: 5

Member since: Apr 2007

Discussion about The Boulevard at 2373 Broadway in Upper West Side

Great apartments, just looked at them this weekend but man the maint is HIGH. An extra $1500 a month on the two bedrooms should be worth 350-400K of asking price.

High monthlies reflect condop economics, plus the building's own high expenses.

The turnover stems from several factors. The Boulevard has been popular among young professional/Wall St. families with high income. As they approach middle age - if they stay in the neighborhood - they tend to gravitate toward pre-war co-ops and sell to the next generation of Yuppies.

sales take a while to move in this building- things with huge outdoor terraces that are 2 beds priced very low dont move for a reason here- other than high carrying costs, the board had issues in the past- attorneys who read the minutes dont like the building...

West81st are you a broker? If not come work for me I'll offer you a 90% split you can work from home.

...and all it will cost me is my mortal soul. :o)

I'll think about it.

Lol. e-mail me when you are ready to talk.

Can someone explain the pros and cons of condop vs condo and co-op which I get...

What issues did the board have?

the turnover seems very much driven by 1.families growing out of their apartments 2. younger generation wall street parents that have done well and looking to trade up (in past markets)...maintenance a little high, but incredibly family friendly building

beastbron, in a cond-op the co-op corporation doesn't own the land and building. Instead, the co-op owns a condo unit. That condo unit consists of the apartments, lobby, etc. The condo's other units -- just a few of them -- consist of the commercial space. The Boulevard condo, for example, has three units: lots 1001 and 1002 for the retail and garage and lot 1003 for the co-op. The percentage-of-common-interest is divvied up between the three units just as it is when any condo is formed.

A cond-op structure, then, allows the sponsor to retain ownership of the commercial space.

I don't know why a sponsor wouldn't just structure a pure condo to begin with. Must've been due to regulatory, etc., conditions at the time. 1988, when the Boulevard went up, was sort of a transitional period when the sponsor's choice between co-op, cond-op, and condo was in flux. Conversions were mostly condo by then, but when the building had no commercial space it was still advantageous for the sponsor to go co-op.

@jlnyc50, do you have any additional info on this comment?

attorneys who read the minutes dont like the building...

It looks like there are some good deals in the building.

I agree High maint seems to be a deterrent for many buyers my slef included. AM i understanding correctly, the building does not benefit from the retail underneath it ? That would explain the high carrying costs

I understand that one factor contributing to the extremely high maintenance is that the building's developer experienced financial trouble finishing the building in the late 80s and had to agree to an unfavorable long-term loan with a huge prepayment penalty.

On top of the high maintenance there are regular monthly assessments, such they have now to upgrade the elevators.

It's hard to get a beat on StreetEasy on the pace the prices in the building are dropping, but it looks like they are still falling fast.

Not sure about what else is in the minutes . . .

EIH, correct that the co-op unit doesn't collect any commercial rents. That in itself is no reason for a co-op to be in financial trouble. Many if not most co-ops don't have commercial income; e.g. those on RSD, WEA, CPW, Fifth, Park, side streets, and so on.

Any new info on this building? Selection on the UWS for a building with a pool is extremely limited and this one comes up as a reasonable option. Yet the mtc is indeed still high and I don't see that anyone ever posted about what lawyers are uneasy about regarding the minutes of the board. Any insight appreciated!

Hey racerdave. Sprint sprint sprint. Fk yeah!!!!!

Big building mortgage with no income other than maintenance. On the pro-side, a not unattractive postwar co-op with pool, gym, squash court. B location. Most UWS co-op conversions don't own retail space. As a general rule, the later conversions have bigger mtges.

Is there any way to find out how long the mortgage is? Is it crazy to think that if that is the only reason for high mtc then one day it will be paid off and building financials will be improved with much lower mtc?

coops do not pay off mortgages. they typically are 10 year term mortgages with 30 year amortization. every time a new mortgage is taken out after the 10 yr period ends, it's for more money to cover closing costs and to take money out for immediate projects.

All on ACRIS.

Oddly, ACRIS can't seem to identify a BBL for 2373 Broadway.

Block 1234, lot 1003.

Thanks, NWT!

They started off with an 89 million mortgage in the late 80s.

Right, before it was split into $15,000,000 for the co-op unit and the rest for the commercial units. The http://a836-acris.nyc.gov/Scripts/DocSearch.dll/Detail?Doc_ID=FT_1650000290465 agreement has the history.

NWT: that doesn't sound right. The co-op unit has an 85%(?) interest, shouldn't it have the bigger chunk of the mtge. If so, a 70m-ish balance is really hefty and about twice the debt load of other heavily-mtged buildings on the UWS (even accounting for the apt count).

You'd think so, but the PCI is more about running costs rather than value. The commercial can carry the $70M, but vice-versa it would've rendered the apartments unsaleable. In any case, that split made the most sense for the developer back then.

Take the Laureate, where the commercial units now account for $65M of the original $114M mortgage, when the sale prices of the apartments could've paid off the whole thing.

Then the high monthlies might be a tax issue + high cost of maintaining the gym facilities, because a 14m+ mtge (that was the last filing I found) is not very much.

Now I think of it, that's too simple. It probably depends on how the developers' operating agreement splits the proceeds and debt. E.g., partner A might get x% overall, and retaining the commercial units counts toward that, but then takes on whatever percentage of the debt. I saw one somewhere for one of those partnerships, and the byzantine detail made my eyes water.

Right, the pool alone must be a big chunk, unless there's some system to charge the users.