Tenants priced out of their homes likely accounted for more than one-third of NYC rental inventory available in Q2, as landlords looked to make back what they offered in pandemic discounts

As we look to the second half of the year, renters should expect further increases in rents at least through this summer. NYC is rapidly adjusting to a new normal after the pandemic, but the rental market remains hampered by historically low inventory. Unusually tight rental market conditions suggest rents will continue to rise, at least until a seasonal slowdown in demand occurs for rentals after the summer.

Despite gradually improving inventory, asking rents are rising steeply as landlords seek to reverse pandemic-era discounts. Rental demand has remained strong as more people gradually return to the city after a jump in outbound migration during the pandemic. Disappearing rental concessions also suggest landlords remain confident about demand. Meanwhile, priced out of Manhattan, many renters are shifting their search to more affordable areas in Brooklyn and Queens.

Landlords are Making Up for Lost Revenue

Quarter-over-quarter, NYC rental inventory rose 14% to 65,697 available units in Q2. The strong increase may seem like a positive development for renters, but many of these rentals are expired pandemic-era deals that re-entered the market with significantly higher asking rents. Throughout 2020 and 2021, many landlords offered steep discounts and free months of rent – deals that have mostly lapsed by now.

Our analysis of repeat rentals suggests tenants priced out of pandemic-era discounted leases generated at least a third (34%) of the available inventory in Q2 2022. Landlords have been raising rents more aggressively on units they leased during the pandemic in effort to recoup the earnings they lost. On average, rentals that were listed in 2020 or 2021 and relisted in Q2 2022 showed a 20.4% increase in asking rents per year. In comparison, rentals that were listed in 2018 or 2019 and relisted in Q2 2022 showed a rent increase of 4.5% per year. The 20.4% jump in rent is nearly four times as steep as the yearly increase a tenant would have seen otherwise – which can mean the difference between losing and keeping their current home.

Manhattan Inventory Rose Quickly, But Expensive Units Abound

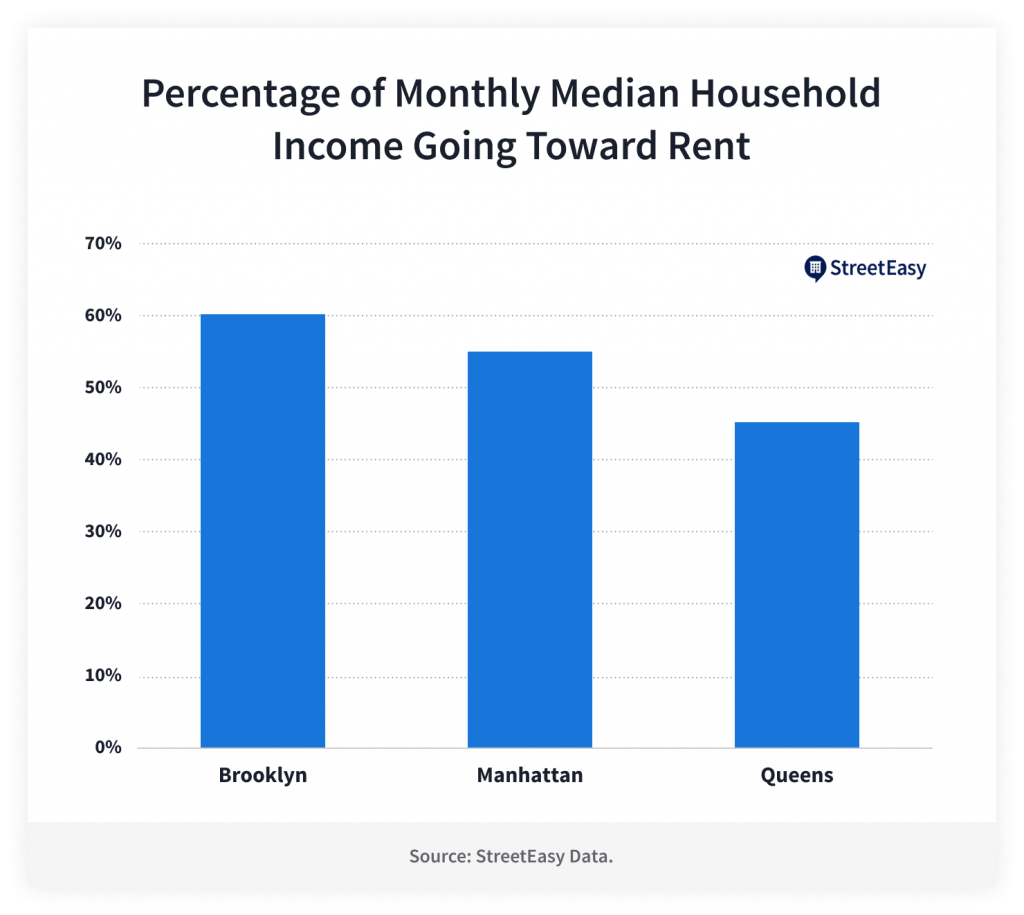

Manhattan rental inventory jumped 33% to 31,412 in Q2 from Q1, a stronger than usual quarterly increase. However, about 44% of this inventory was likely made available due to tenants being priced out of their no-longer-discounted apartments. It’s also possible that some tenants decided to leave for non-financial reasons but would be faced with one of the most competitive rental markets in more than a decade. Meanwhile, Manhattan’s median asking rent soared to $4,100 by the end of Q2: the highest on StreetEasy record and equivalent to 55% of the borough’s monthly median household income.

Manhattan Rentals Under $4,100 on StreetEasy Article continues below

With Low Inventory, Affordability Is Deteriorating in Queens and Brooklyn

As priced-out renters looked for more affordable units in the outer boroughs, rental inventory in Queens declined for the fifth consecutive quarter. The number of available units in Queens fell 9% to 8,984 from the previous quarter. The median asking rent in Queens rose to $2,600 by the end of Q2, a 13% jump from the end of Q1. This is the highest on StreetEasy record and equivalent to 43% of the monthly median household income for the borough.

Queens Rentals Under $2,600 on StreetEasy Article continues below

Brooklyn saw a modest rebound in rental inventory, rising 5% to 23,130 in Q2 from Q1, but still down 48% from what was available in Q2 2021. Rent growth accelerated in Brooklyn as well, with median asking rent reaching $3,200 by the end of Q2, up 12% from Q1. $3,200 is equivalent to 60% of the monthly median household income for the borough – a staggering financial burden for a household.

Brooklyn Rentals Under $3,200 on StreetEasy Article continues below

Elevated rent burdens pose a severe challenge to low- to moderate-income New Yorkers. According to StreetEasy data, median asking rents in June were well above 30% of household income in all boroughs, a rule-of-thumb threshold for being rent burdened. In Brooklyn and Manhattan where this ratio is well above 50%, households would have much less income left to afford other necessities.

Meanwhile, the share of rentals on StreetEasy offering concessions of at least one month of free rent fell to 7%, the lowest level since 2015. Disappearing concessions reflect landlords’ confidence in rental demand as workers continue to return to the office at least part-time.

Final Thoughts

Unfortunately, the recent improvement in rental inventory has been largely driven by households being priced out of increasingly unaffordable rentals. In addition, as interest rates rise, more would-be homebuyers may be forced to resign themselves to renting, pushing up the demand for rentals even further. During this transition in the NYC market, we foresee rent increases continuing at least through the end of this summer.

The rebalancing of the NYC housing market could take months to play out, so we recommend renters who have some flexibility to wait a few months and broaden the scope of their search. The recent rent growth in outer boroughs, while negative for affordability, could encourage more homeowners to list their homes on the rental market. Moreover, the prospect of softening sales activity may incentivize current owners to offer their homes for rent instead of selling. This suggests more options will be available in late summer or early fall.

In the meantime, StreetEasy can help renters stay informed on the changing market dynamics of the neighborhoods they’re interested in by exploring the data from our Market Reports on our Data Dashboard. In addition, home shoppers can now use augmented reality to easily search on the go with StreetScape. This new feature in the StreetEasy iOS app allows users to point their phone’s camera at NYC residential buildings and instantly see what’s available inside, giving them a leg up in this competitive market.

Editor’s Note: In March 2020, New York City’s housing market temporarily froze as the COVID-19 pandemic reached the U.S. In 2021, the real estate market roared back to life, with demand returning to both the rentals and sales markets. Year-over-year data comparisons over the next few months will be made against the housing recovery that began in early 2021. Assuming 2022 is more typical of a “normal” year in housing than 2020 or 2021 were, with times of little to no activity followed by massive spikes in demand, we expect many of our year-over-year measures will show significant losses over last winter and spring. We urge you to use caution in extrapolating too much from year-over-year measures in the coming months, and we will always try to provide appropriate context to anchor reported changes in metrics to what is normal or expected.