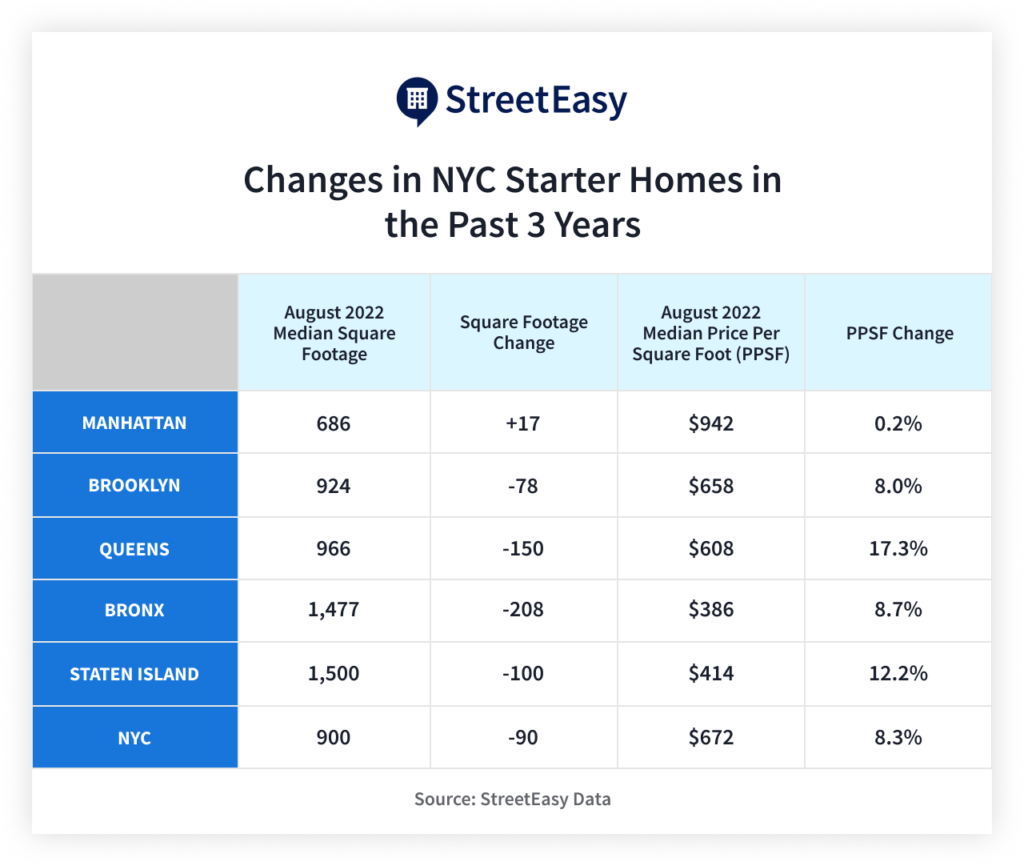

StreetEasy data shows a typical starter home in NYC today is 9% smaller than it was in the summer of 2019. Starter homes in Queens and the Bronx have shrunk the most, by 150 sq ft and 208 sq ft, respectively. Steep increases in mortgage rates and home prices have made it more challenging for buyers to find their first home (see our analysis on the interest rate impact on a homebuyer’s budget). Our data indicates these buyers, who often have smaller budgets, have to compromise on space in order to stay within their budgets.

Typical Starter Homes Are Smaller in Most Boroughs

A starter home is often considered a place where young adults can put down roots with their acquired income and savings after several years of working. In NYC, a starter home typically ranges between $400K and $800K and has at least one bedroom. Indeed, affordability depends on personal income and savings. The $400K-800K range is consistent with the median annual income of young adults in NYC at $83,313, according to the latest data from the Census Bureau, and recent 30-year fixed mortgage rates ranging from 5% to 6%.

Shrinking starter homes reflect worsening affordability in the city. By August 2022, the median footprint of a typical NYC starter home had shrunk by 90 sq ft to 900 sq ft – 9% smaller than three years ago. Queens, Staten Island, and the Bronx, traditionally considered more affordable, led the decline in median square footage. Regardless of borough, buyers hoping to purchase their first home now must compromise on space to keep within their budget.

In addition to being smaller, listings within the $400K and $800K price range are also harder to come by. In August 2022, there were nearly 4,500 listings for sale in NYC within this price range. Three years ago, prior to the pandemic, there were 5,300 listings at this price point. That means typical first-time homebuyers had 15% fewer listings to choose from this August.

Manhattan Starter Homes Are the Smallest in the City

Starter homes in Manhattan have long been the smallest in the city, at least since prior to the pandemic. Across all boroughs, a Manhattan starter home is the smallest at 686 sq ft. This is equivalent to about four and a half parking spots in NYC, given a typical parking spot measures roughly 153 sq ft.

Manhattan Starter Homes on StreetEasy Article continues below

However, compared to three years ago, buyers who don’t mind a tight space can now score a slightly larger starter home in Manhattan – with 17 more square feet of floor space – for the same budget. That’s because asking prices of homes below the median asking price in Manhattan have not recovered to their pre-pandemic levels, and as a result, there are more options for buyers eyeing this price range. Starter home inventory in Manhattan was up 3% in August from three years ago, but shoppers looking for a starter home still face high costs: $942 per square foot, the highest in the city.

Brooklyn Starter Homes Are Second Most Expensive After Manhattan

Typical starter homes in Brooklyn had a median of 924 sq ft in August, 8% smaller than three years ago. The borough’s starter home inventory in August was 26% below its pre-pandemic level, indicating there are far fewer options for buyers. Costing $658 per square foot, a Brooklyn starter home is the second most expensive after Manhattan.

Brooklyn Starter Homes on StreetEasy Article continues below

Queens Saw Strongest Jump in Price Per Square Foot

With steep increases in asking prices since the pandemic, Queens now has 11% fewer starter homes available. It’s also the borough in which the price home shoppers must pay for each square foot has risen the most. At $608 per square foot, that’s 17% more than three years ago. While still more affordable than Manhattan and Brooklyn, a typical starter home in Queens shrunk by 150 sq ft over the past three years.

Queens Starter Homes on StreetEasy Article continues below

Newer buildings that were built in Queens after 2010, most of which are condos, tend to have smaller units compared to older buildings. About 10% of starter homes in Queens were in new developments completed since 2010. However, regardless of how new the buildings are, the borough’s asking prices have risen sharply over the past three years. Across new and old buildings, a starter home in Queens shrunk by roughly the same amount of square footage.

The Bronx and Staten Island Offer Cost-Effective Starter Homes

The Bronx and Staten Island remain the most attractive options for first-time home buyers with the median price per square foot at $386 and $414, respectively. More homes in these boroughs are now asking more than $800K, leading to substantial declines in starter home inventory: by 51% in August from three years ago in Staten Island, and 23% in the Bronx.

Bronx and Staten Island Starter Homes on StreetEasy Article continues below

A typical starter home in the Bronx had a median of 1,477 sq ft in August. While still larger than typical starter homes in Manhattan, Brooklyn, and Queens, it has shrunk by 208 sq ft – the most in the city. A typical starter home in Staten Island was the largest in the city at 1,500 sq ft in August even though it was 100 sq ft smaller than three years ago.

Looking Ahead

Asking prices across NYC are moderating gradually after sharp increases this spring, as buyers jumped into the market to get ahead of rising interest rates. After a hyper-competitive market this spring led to the tightest market in six years by April, the median days on market rose modestly by three days month-over-month to 69 days in August. As the sales market continues to rebalance, some priced-out first-time buyers should be able to find opportunities to rejoin the market.

If possible, maintaining geographical flexibility during their search can help first-time buyers score more square footage with the same budget. StreetEasy offers extensive and hyperlocal filters that help home shoppers identify the right starter home across a range of neighborhoods. Moreover, StreetEasy can match shoppers with a verified Expert agent whose local expertise can help them win the right home that fits their budget.

Looking ahead, the sales market will likely remain competitive throughout the fall. Some potential sellers appear to be withdrawing from the market as home price growth moderates. The number of new listings for sale fell 13% year-over-year in August and 9% in July, after strong growth this spring. Today’s homeowners are paying lower interest rates that were locked in before the pandemic. In addition, with the strong labor market and low household debt burdens, not many homeowners are desperate to sell. If sustained, declining numbers of new listings suggest limited room for price cuts this fall, with home shoppers competing for still-limited options. This means well-positioned homes with the right asking prices can – and will – continue to attract competitive offers.