The New York City housing market was slow in July as more New Yorkers continued their summer travels. Despite the typical seasonal slowdown, StreetEasy® data shows the number of listings entering contract is rising compared to last year. In July, 2,002 listings on StreetEasy entered contract, up 4.3% from a year ago. This follows a 2.2% year-over-year increase in June.

As StreetEasy predicted a year ago, the city’s housing market avoided a crash despite higher mortgage rates pushing many would-be buyers to the sidelines. While modest compared to the overheated market last year, the current market is simmering with buyers with higher budgets competing for declining new listing inventory. With resilient buyer demand and limited inventory, sellers remain in the driver’s seat and asking prices will likely rise throughout 2023. In July, the median asking price of all for-sale listings was $1.08M, unchanged from June. This is 11.3% higher than a year ago and 8.8% higher than July 2019, before the pandemic market disruption. Asking prices are rising even faster in the priciest segment of the market, redefining the threshold for what’s considered luxury real estate in New York City.

Manhattan Homes Under $1.5M on StreetEasy Article continues below

Despite Summer Slowdown, Luxury Sellers Maintain the Upper Hand

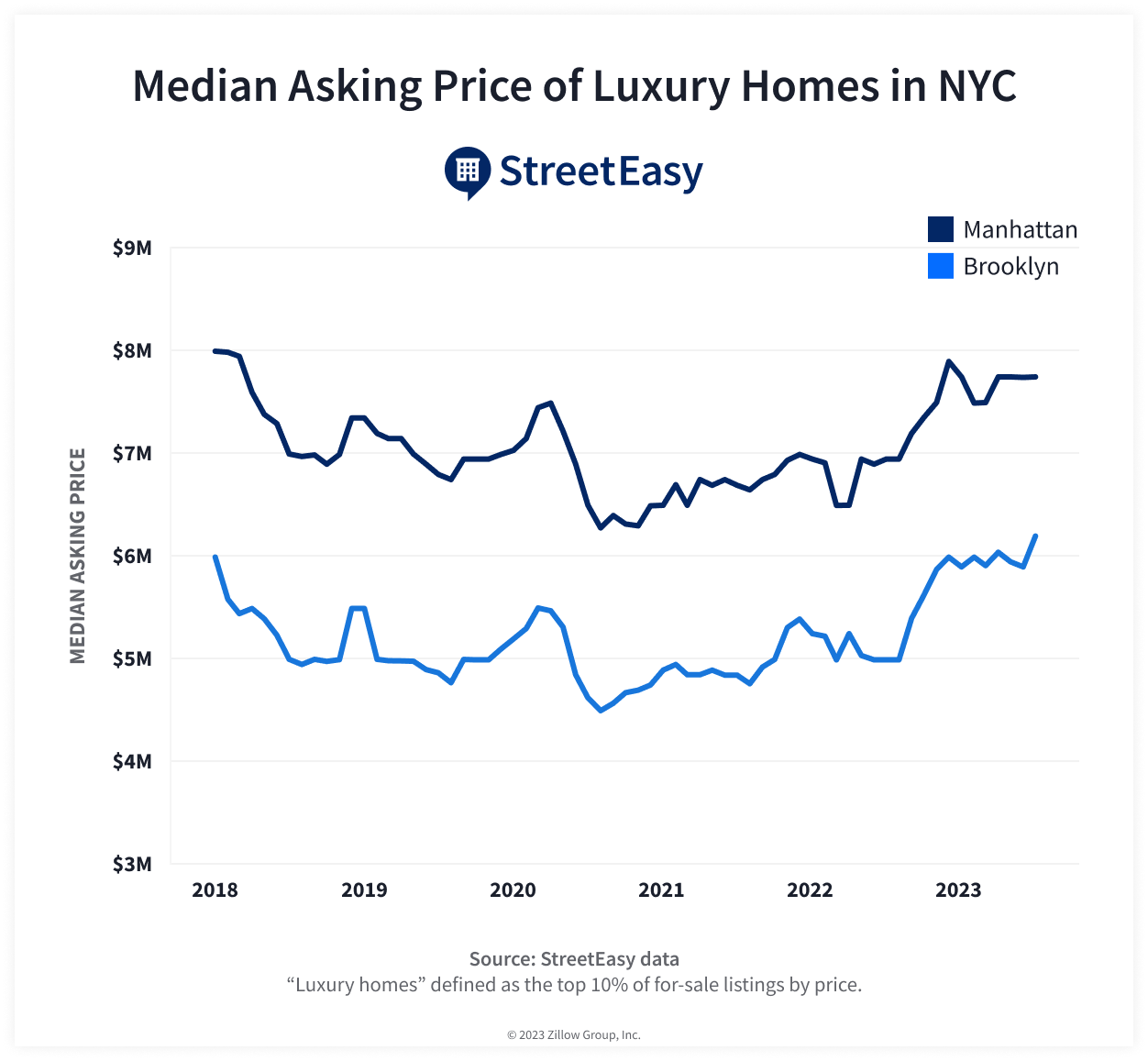

At StreetEasy, we define the luxury market as the top 10% of for-sale listings in each month. The starting price of the luxury market was $4.5M in July this year, 12.5% higher than $3.999M a year ago and 14.8% higher than $3.92M in July 2019. In Q2 2023, 382 listings on StreetEasy above this threshold entered contract, a solid increase of 29.9% from Q1 2023. While lower than a year ago by 16%, 382 contracts is a substantial recovery from the second half of 2022, when 283 contracts were signed in Q3 and 239 in Q4 — the slowest quarter since 2020.

After a strong Q2, luxury sales took a pause in July. Across the city, 89 luxury listings entered contract, a far more modest number compared to 114 in July 2022. That said, the slowdown will likely be temporary. Discounts are hard to find with only 5.2% of luxury listings lowering asking prices in July this year, compared to 7.3% in July 2022. The low share of discounts in July suggests sellers are still seeing interested buyers in the market, and the decline in sales compared to a year ago will likely be short-lived. With the stock market’s rebound this year and strong economic data indicating lower risk of a recession in the US, wealthy buyers — likely including many international buyers — are increasingly looking past the risk of entering the market at the wrong time.

While less so than the heated market a year ago, luxury listings are still receiving most of their initial asking price. A typical luxury home sold in July had a 94.8% sale-to-list price ratio, just slightly lower than 97.2% in July 2022. The sale-to-list ratio compares a home’s final recorded sale price to its initial asking price. The current ratio for luxury sales is slightly below 97.2% for all homes sold in the city in July 2023, but remains above the three-year average before the pandemic (2017-2019) of 93.7%. This suggests sellers still hold the upper hand in the luxury market.

Luxury Buyers Are Shopping in Manhattan Again

Manhattan remains the biggest market for luxury homes. Out of 89 luxury contracts signed in July, 81 were in Manhattan and the remaining 8 were in Brooklyn. The most expensive contract was a $34M full-floor condo at 50 Central Park South with 9,455 square feet of floor space, 6 bedrooms, and 7.5 bathrooms in addition to a sweeping park view.

Wealthy buyers are snapping up condos in new construction buildings — primarily in Midtown — which is driving up the asking price of the overall luxury market. In July, the median asking price of the Manhattan luxury market rose 11.5% year-over-year to $7.75M. About two in five (38.3%) new luxury contracts in the borough were sponsor sales in new developments. The second most expensive sponsor contract on StreetEasy in July was a $19.5M 3-bedroom, 3.5-bathroom home in Central Park Tower, the tallest residential building in the world. The most expensive sponsor contract on StreetEasy was a $22.1M 3-bedroom, 3-bathroom condo at the Mandarin Oriental Residences Fifth Avenue.

As the share of high-priced homes on the market increases, the overall Manhattan market is becoming more expensive. The median asking price of all for-sale listings in Manhattan rose 11.9% from a year ago to $1.595M in July, the highest since December 2019. There isn’t a lot of room for negotiation for buyers — a typical home sold in Manhattan received 96.7% of its original asking price in July this year, slightly lower than the record high of 99.8% in July 2022. The decline in new listings on the market is helping well-positioned sellers keep their upper hand in the market. The number of new listings in Manhattan fell 18.8% year-over-year in July, the twelfth consecutive month of yearly declines.

Brooklyn Homes Under $1.5M on StreetEasy Article continues below

Brooklyn Joins the Million Dollar Club as Prices in the Borough Hit New Record

Across all price tiers, the Brooklyn market remains the most competitive. The borough’s median asking price rose to $1M in July for the first time on StreetEasy record dating back to 2010. This record is 5.3% higher than a year ago and 4.3% higher than July 2019. Rising asking prices in Brooklyn reflect the borough’s continued growth as a popular destination for the city’s buyers across most price tiers.

Limited inventory relative to demand is fueling competition in Brooklyn. In July, the borough’s listing inventory fell 1.9% from a year ago and 27.9% from July 2019. With many would-be sellers locked into very low mortgage rates, fresh listing inventory declined 23.2% from a year ago and 24.6% from July 2019. As a result, a typical home sold in Brooklyn received 98.4% of its original asking price, mostly unchanged from a year ago. With the current sale-to-list ratio higher than any other borough in the city, sellers in Brooklyn will likely keep the upper hand this year.

In Brooklyn, townhouses dominated the luxury market in July. Out of 8 new luxury contracts in Brooklyn, 6 were townhouses. The median asking price of these 8 contracts was $5.25M. The most expensive contract was a gut-renovated, 6,354-square-foot townhouse on 271 Hicks Street in Brooklyn Heights, a neighborhood famous for its brownstone townhouses, priced at $14M. Across “brownstone Brooklyn” — neighborhoods with high concentrations of townhouses, mainly in northwest Brooklyn — townhouses have been rising in popularity this year, both for the lifestyle they afford New Yorkers and their lower price points compared to similar homes in Manhattan.

Queens Remains a More Affordable Destination for Buyers, But Inventory Is Tight

Queens continues to offer more affordable homes for sale in the city. The borough’s median asking price was $648,000 in July, up 4.7% year-over-year. The increase in median asking price in Queens has been more modest than in Manhattan and Brooklyn. However, Queens is still a competitive market as home shoppers on a budget continue to flock to the borough. A typical home sold in Queens received 97.1% of its initial asking price in July this year, slightly lower than 97.9% in July 2022. The current ratio is the second highest in the city after Brooklyn.

Similar to Brooklyn, low inventory is helping well-positioned sellers keep their upper hand in the market. While for-sale listing inventory rose 1.2% year-over-year in July, it remained 11.3% below the inventory in July 2019. The number of new listings fell 18.7% from a year ago and 27.2% from July 2019, limiting the options that home shoppers can consider. Sellers who price their home well, relative to comparable listings on the market, will likely see strong interest from would-be buyers.

Queens Homes Under $1.5M on StreetEasy Article continues below

Asking Prices Will Rise and Sellers Will Stay in the Driver’s Seat This Year

In the second half of this year, asking prices in NYC will continue to rise across all price tiers compared to last year. The city will remain a seller’s market as home shoppers compete for declining new listing inventory. Across all price tiers, 21% fewer listings were newly on the market in July this year than last year. Many homeowners, locked into low mortgage rates from before and during the pandemic, remain reluctant to put their homes on the market. A recent survey by Zillow®, StreetEasy’s national counterpart, indicates homeowners with mortgage rates below 5% are nearly twice as likely to stay put in their current home. While inflation is cooling in the US, the slow progress suggests mortgage rates are unlikely to fall below 5% anytime soon. As a result, declining new inventory will help sellers hold onto the upper hand this year.

All of this means well-positioned sellers can continue to expect strong offers in the second half of this year – even if they do not own a luxury home. That said, the market can differ from neighborhood to neighborhood, even block to block. For sellers, the StreetEasy Concierge can be a valuable resource for giving your home a competitive edge, as well as our numerous seller tools. In addition, working with a professional with hyper-local expertise in the neighborhood and building, like the agents in StreetEasy’s Experts Network, is a great way to understand the local NYC market and get a leg up in today’s shifting market.

©2023 StreetEasy

Disclaimers: The information provided was extracted from StreetEasy listings and its expansive internal database. The contents of this article are intended for informational purposes only and not intended as a complete recitation of the market.

StreetEasy is an assumed name of Zillow, Inc. and registered trademark of MFTB Holdco, Inc. a Zillow affiliate, which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.