building at 35 Sutton Place

Started by ben_1529874

about 10 years ago

Posts: 0

Member since: Oct 2014

Discussion about 35 Sutton Place in Sutton Place

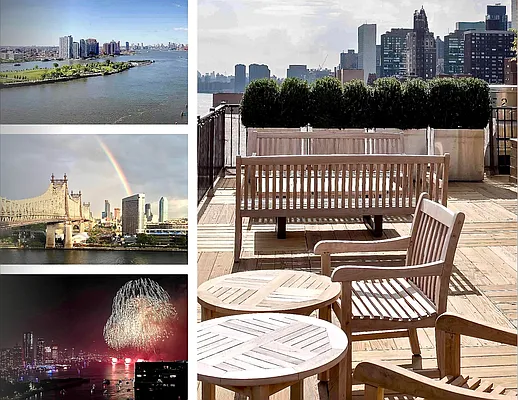

Having been a broker for more than twenty-five years and having sold in this building, I take exception to some of the comments made here about 35 Sutton Place. Not only is the building extremely well run and maintained by a very reasonable, fair-minded and capable Board, but the apartments are among the most well designed, beautifully proportioned and flexibly configured in the city. And those apartments which have terraces and river views are spectacular. I believe the lobby is soon to undergo a renovation and the exterior brick work is to be completed very soon. In short, 35 Sutton marries classic design with contemporary living and I never hesitate to bring my customers to this great building. It's the best value in town!

Add Your Comment

Most popular

-

16 Comments

-

24 Comments

-

13 Comments

-

25 Comments

>@Krolik - come to my building!

With the right coaching and now a board connection :-) I might try in 2-3 years, especially if we have more children and fail to buy an adjacent unit in the current building. I am one of those people with a sub 3% mortgage, so no frivolous moves at the moment.

However, I must warn I am very cheap! I would scrutinize monthlies, and wouldn't pay much per square foot. We bought a 2/2 in a building with excellent financials for under 1M!

@etson: I'm in a similar boat: I'd love a 2 BR, and keep half an eye out for 'traditional' 2 BRs (but somehow missed MCRs listings). But my timeline for staying in NYC on a partial to full-time basis is probably a maximum of 10 years, and the issues you cite are factors that may reduce that further.

The work of selling, buying, and renovating just doesn't seem worth it for what is, given my life, a luxury good.

On congestion pricing, as a car owner with a garage in the proposed zone, my pocketbook is not thrilled about the additional cost (It will probably run me $1000/year), but I believe in the concept, so support it. Although I think the city should have significantly raised on-street parking costs first.

Classic 6 in the neighborhood market-clearing price: $1,495,000: https://streeteasy.com/building/20-sutton-place-south-new_york/19c?featured=1

It's not pet friendly. Buildings that aren't pet friendly also aren't people friendly.

Aaron2, Maybe we can help each other out! I'll sell you my 2 bed / 2 bath for cheap and you *might*make a bit of money on it over your remaining 10 years here ;-)

It's fairly ordinary though and don't think it would meet your "traditional" criterion (1950's building)

For George,

https://youtu.be/6ALod2XWaQ4

Not selling at the top of the market and getting out with a fat profit because you have a 2.5% mortgage is a hobgoblin of small minds which is going to end up causing a significant amount of pain to a lot of people in this country.

MCR

"They couldn't sell when they were asking $1,536,000 so I don't understand why they aren't selling now that they raised the price to $1,650,000"

I never get those price hikes.

Realtor wanted to list it at $1.5 and thought the client agreed. Client saw the listing or (worse) got an offer and said "wtf - I said 1.65. Set the price at 1.65."

@etson: I'm in an undistinguished 1960s building at the moment (though it is solidly built, quiet, and has lots of closet space), so 1950s isn't an impossibility! I do love my building supplied a/c though (cold water circulated through the heating units), so that's a 'must have', or the ability to install real central air (no PTACs!).

Argh, guess I am SOL. Only window units or thru wall in my building

"Realtor wanted to list it at $1.5 and thought the client agreed. Client saw the listing or (worse) got an offer and said "wtf - I said 1.65. Set the price at 1.65.""

So there's no written listing agreement with a price on it?

It is not clear why there is any surprise or hate about the composition of residents and buyer pools in certain areas. Sutton and Beekman to me have always been for the most part an unwritten 55 and over community. Hope it stays that way. With limited exceptions, prices were always comparably lower in those environs, and the resident composition presumably is in part due to the lack of subway access and limited school options, proximity to the UN, and high maintenance.

Frankly, I would welcome a few coops in Manhattan fully embracing the 55+ model, rather than the handful of cookie-cutter rentals in BPC and uptown. I suspect such a building would find huge demand, and outsized price appreciation. The house my mother bought in a 55+ community in NJ has tripled in value since 2006, and available units sell in 48 hours. People tape unsolicited purchase offers to her mailbox.

I fully intend to sell in the next year or two the 4,000 sq foot Village loft we have owned for 25 years and move into a tranquil unit half the size and perhaps one-quarter the price in some genteel uptown building of the sort everyone bashes here, likely on Beekman or Sutton. I hope they keep their standards for entry high.

I think there will be no shortage of genteel uptown buildings with nicely priced units over the next 3 to 5 years. Beekman / Sutton and all those UES buildings from 59th to the low 100s.

nyc_sport is going to do what New York Magazine described as the the Yuppie paradigm:

Move into large open lofts downtown in the 1980s and put up a bunch of walls, and then in the 1990s move uptown into Classic 7s and knock all the walls down.

>Sutton and Beekman to me have always been for the most part an unwritten 55 and over community. Hope it stays that way. With limited exceptions, prices were always comparably lower in those environs, and the resident composition presumably is in part due to the lack of subway access and limited school options, proximity to the UN, and high maintenance.

Feel like this is a provocation, but will respond anyway :-)

Although lack of schools is indeed an issue, there is nothing about this area of town that makes it fit only for retirees. There are a lot of younger people living in this area because it is quite convenient to midtown offices, but they are renters. My younger sibling purchased a condo on lex in the 50s and loves the location.

A policy that denies younger (low assets/high income) people in order to keep prices low for the older generation is another one of many redistributive programs in the US and in New York City that take from the young and give to the old. And this is really unfair. Not only the old bought NYC real estate when it was cheap and are now reselling it to the young for millions to fund retirement, but the old also have most of those rent stabilized/rent controlled apartment leases, as well as HDFC units that typically require low income and high assets. The city also has huge pension obligations that are underfunded and are being covered by the current workers to so that past generations can retire in style. Hello, tax hikes.

A typical younger person with no trust fund is screwed in the city, with no hope of home ownership, paying ridiculous rents and property prices.

I am mostly perplexed by this thread. Can people enlighten me to the extent they can?

MCR>> I told her that was a hard pass because of her stated "right schools/right clubs" preferences.

Why do these people care? Why is it important to them?

nyc_sport>> I hope they keep their standards for entry high.

What does this mean? As far as I can tell, these are dated, low-ceiling buildings from the 60’s with lots of pedestrian apartments that span the typical spectrum of studios / 1BRs / 2BRs you see in Manhattan at typical price points. The “fancy” apts approach comical. MCR’s building has one with a name evoking its height and views, except it’s not very high at all and faces buildings on all but one side. Fine apts, but none of these would make for a set location on Succession. How can standards for entry be kept high for something so unremarkable?

Krolik>> A policy that denies younger (low assets/high income) people in order to keep prices low for the older generation is another one of many redistributive programs in the US and in New York City that take from the young and give to the old.

While I hear you in theory, I don’t understand in practice. As far as I can tell, these places suffer from the same crappy economics as the rest of Manhattan. MCR’s coop president’s unit has a cap rate of 3%, established by rents for the actual unit on and off over ~15 years. It’ll be 2% once they remove the “discount” on maintenance in the next year or two. The rent is no better than what I’ve seen elsewhere over the past ~15 years.

For the privilege of being from the right clubs/schools and putting down (say) $1M on a $2M apt 13 years ago, the president has been rewarded imputed rent that has been precisely offset by maintenance, interest payments, and the $300k loss. The beloved youth, blocked out of homeownership by the “right school/club” policies was relegated to the horrors of flushing the same amount of money down the toilet in rent, all the while watching their $1M grow into $5M in the S&P 500.

Of all the injustices in the world, do we really need to expend so much oxygen on this one? I think it’s stupid too, but why does it animate you so?

> While I hear you in theory, I don’t understand in practice. As far as I can tell, these places suffer from the same crappy economics as the rest of Manhattan. MCR’s coop president’s unit has a cap rate of 3%, established by rents for the actual unit on and off over ~15 years.

I won't speak for the president and why he grossly overpaid. At that price/low cap rate/high mortgage rate I would not have been a buyer. When I was looking, my attention was on 2/2s that are ~$1m, with ~$2500 in maintenance, and can be rented for about $6000-7000 based on size and location, and that's a higher cap rate, closer to 4-5% which at the time was higher than treasuries. Yes, these are not the nicest apartments in Manhattan architecture-wise, but I am looking for square footage and location, for now. My partner is dreaming of floor to ceiling windows and views. One day...

>Of all the injustices in the world, do we really need to expend so much oxygen on this one? I think it’s stupid too, but why does it animate you so?

Firstly, because I spent a bunch of time and money applying and got turned down with no explanation from a purchase I could clearly afford. Almost missed my pandemic buying window, too. Secondly, it's a matter of principle.

>> I won't speak for the president and why he grossly overpaid.

I don’t think he overpaid. MCR, do you think he overpaid? This is not the one where MCR thought the buyer overpaid, it’s the other one. Below $1000 ppsf, river views. You’d approve. The rent was just not where you think it is. On one occasion (2019), it tested the market with an asking rent that would have placed it at a cap rate of 4-5%. But the market didn’t bite, so it dropped to 3%.

>> At that price/low cap rate/high mortgage rate I would not have been a buyer.

You were a buyer at a 3% cap rate in 2021, no? This apt was on offer at the same at time for the same cap rate. You wouldn’t have approved of the monthlies, though. As MCR has stated before, hers is a high-service building that she likes but others may not.

====

Larger point being this… On the one side, you’re saying these apts are underpriced. Except when you’re saying the president overpaid. I’m kinda looking at the right schools/clubs buildings, and I just don’t see the amazing deals. Like the rest of the market, some people overpay somewhat while others underpay. The only amazing deals I ever see in Manhattan are on rent. Everything else seems on the margins.

It is a buy vs. rent point, and it is a good one.

However, if you decided to buy, and if you valued square feet and convenience more than finishes, then these coops are the best deal in Manhattan.

And even if I am wrong and these are not amazing deals, however defined, I still don't get why some board should decide how I spend my money and where I live.

Krolik, What happens to coop prices if they used condo rules for everyone not just for you? Just assume that you don’t own one right now. Aren’t the futures coop buyers going to be get “fairly” screwed due to average coop price going up?

Apartment I bought had about 3.5-4% cap rate based on 2021 rents, which I hypothesized would go up once rents recover (it did). Think of it as a hedge on Manhattan rent prices while getting a low single digit return on capital. Useful in a high inflation scenario, and when your investment alternatives are not particularly lucrative.

I only looked at doorman places with attractive maintenance. I think market does not properly take high maintenance into account.

Here are examples of the kind of apartments I would have gone for (the first apartment is ~1500 sq ft and the second one is ~1100 sq ft)

https://streeteasy.com/building/plaza-400/5l

https://streeteasy.com/building/the-dorchester/4e

You had said 3.1% before:

https://streeteasy.com/talk/discussion/46917-new-purchases-arm-rate-expectations

>> Based on my estimates, my apartment has a cap rate of ~3.1%, and since mortgage is at 2.9%, I should earn some return just by levering up.

But if you’re now saying 3.5-4%, that just makes my point stronger. On that basis, the potential buyer of the 3% cap rate apt is paying a premium relative to you to live in MCR’s coop.

>> I still don't get why some board should decide how I spend my money and where I live

I dunno, but it’s not my system to defend. You, on the other hand, bought into the system, so now it’s on you!

>> However, if you decided to buy, and if you valued square feet and convenience more than finishes, then these coops are the best deal in Manhattan.

Finishes are easy to handle: just a small matter of $$$ to change. But location & bones, not so much. So if the location & bones work for you, this is definitely a good place to get lots of sq ft for your dollar.

I don't think our board president overpaid for his place; unfortunately, as matters stand, I think he paid more than he could/can afford, but that is neither here nor there with respect to the overall market. Regardless of

the effect that the coop system of ownership has on prices, I am with Krolik in terms of objecting to existing owners having the final say over who gets to live anywhere. And for those who have been paying attention to my posts over the many years, yes, I have changed my position on this issue. In retrospect, I should have just embraced the $4M condo that would have been Mr. MCR's choice.

It’s more than a little ironic that the coop board mechanism that ostensibly exists to protect shareholders from incorporating financially unsound members has been co-opted (pun intended) by a financially unsound member to the detriment of the shareholders.

Right?!

inonada,

The most exclusive country clubs don't necessarily have the best golf course.

People forget that the entire purpose of Coops is discrimination.

>Krolik, What happens to coop prices if they used condo rules for everyone not just for you? Just assume that you don’t own one right now. Aren’t the futures coop buyers going to be get “fairly” screwed due to average coop price going up?

If that's what the market dictates, I don't see any issues. If coops become more accessible, prices of condos might go down due to new accessible supply, so other people will be less screwed. And at least people won't be locked out of entire neighborhoods and buildings if they have the money.

Also, 30yr made a point that people are overpaying for coops now due to boards denying applications with

"too low price" and buyers/sellers engage in price-inflating shenanigans. So maybe it would have the opposite effect.

>You had said 3.1% before

Good memory! At the time, I think I underestimated what a 2/2 in my building would rent for. My apartment was actually rented furnished (full of antiques and old and crappy stuff) in 2019, and that was the number I used in calculations, but now I think it could have been rented for more if it was unfurnished.

>You were a buyer at a 3% cap rate in 2021, no?

Yes, also it was when treasuries were paying nothing, so 3% made more sense to me than keeping cash in the bank or buying stocks at peak valuations. I am like those troubled banks that locked capital in LT treasuries, ignoring interest rate risk and now have to write down assets. Let's say my apartment is now "held-to-maturity" and not "available-for-sale". I sleep at night better that way :-) And in my defense, most of the capital wasn't mine, I got a cheap mortgage ;-)

Why apartments trade at 3% cap rate when mortgage rates are 6-7% is beyond me, but somehow this is normal in NYC. I guess this is another luxury good that does not have to make sense.

Nah, you’re much better off than the troubled banks. Your mortgage is an interest rate hedge that writes up as the asset writes down. Although rate risk was not top-of-mind for you, like nearly everyone, you were still wise enough to lock it up for 30 yrs rather than taking out an ARM. Now all you have to do is stay in your apt for 30 yrs… ;)

>> Why apartments trade at 3% cap rate when mortgage rates are 6-7% is beyond me, but somehow this is normal in NYC. I guess this is another luxury good that does not have to make sense.

I’m not sure. Over-supply and under-demand for renting, I suppose. And the higher-end it gets, the worse the cap rate becomes. I try not to over-think it, I just borrow the apts and express gratitude to Mr Market.

> Over-supply and under-demand for renting, I suppose. And the higher-end it gets, the worse the cap rate becomes.

This probably nails it. This probably applies to any luxury product, which does not make economics sense (such as the private school, or the expensive car or the trophy apartment). For these people who can spend anyway they want, the emotional benefits are priceless, LOL.

>Over-supply and under-demand for renting, I suppose.

NYC rents are so high, it is ridiculous to talk about under-demand. It is something else, maybe costs to operate (taxes, maintenance).

>Your mortgage is an interest rate hedge that writes up as the asset writes down.

The mortgaged part is hedged. But I still had to put about 30% down, and that is a lot of money for me (that I stand to lose if interest rates drive down apartment costs).

However, historically Manhattan market has been quite stubborn and resilient (even if irrational), and has not gone down much at any point on my memory. So that is some downside protection.

Manhattan market hasn't gone down, but it hasn't gone up either. Since late 2014, the SE pride index has been at or below $1.1m. Considering that inflation is up 30% and closing costs top 10% round trip, I'd say that's a rather meaningful decline in the value of NY resi RE.

However, the Manhattan rent goes up from 3000(2015-01) to 3718(2023-01) from the past 8 years, ignoring the COVID19 recession, about 24% increase, or about 2.8% each year, probably the same as the inflation.

If the sale price and CAP has not changed during the past 8 years, I guess part of the rent increase can be explained by the maintenance increase, the other increase is probably due to the different housing stock (the coop/condo tends to be more expensive so the price has not changed much, while rental tends to be on the cheap side, so the price has increased a little bit). The evidence that the cheap apartment has increased during past 8 years is to check the streeteasy price index of Queens

Even the % increase with the rental is the same as the maintenance, it is still be better to do the purchase to keep the mortgage with zero increase.

If the CAP rate is the same as the interest rate (30 year fixed) from the mortgage and one can stay there for a long time, then buying the apartment is definitely a good hedge against the potential rent increase.

The story goes that too many people have been locked into the under 3% mortgage interest rate, which becomes a gold cuff that reduces the mobility. It is probably not too bad since a lot of people can still work from home post pandemic, so moving to a better job without moving home does not seem to be a big obstacle.

Woodside, The rent increase does not factor in the change in mix and new building inventory. Think about all the luxury rentals which have come up. In addition, the rents at the very low end have gone up a lot as you point out. The SE price index compares the same unit repeat sale to calculate the index change.

>> This probably nails it. This probably applies to any luxury product, which does not make economics sense (such as the private school, or the expensive car or the trophy apartment).

I don’t think that’s quite right. Sales prices do not vary much on a ppsf basis, once you compare apples-to-apples, based on apt size. Larger apts tend to cost more ppsf because they have the better placement/view/bones/etc., but when you find equivalent smaller apts, they tend to be at a similar ppsf. So from that perspective, it makes economic sense. Now, does it make financial sense for a couple to live in a 2500 sq ft apt when a 1250 sq ft apt would function? Maybe, maybe not, but that’s more a question of personal finance — the size of the couples’ wallets and their spending preferences — than market economics.

Referencing a recent building discussed elsewhere, here’s the trophy unit for sale in the ballpark of $2K ppsf with $38/sf in cc+tax per year:

https://streeteasy.com/building/morton-square/sale/1569676

Here is the most recent sale of a less-luxury unit at 1/5th the size:

https://streeteasy.com/sale/1627430

Similar ppsf and monthlies. You want 5x the space, you pay 5x as much. That’s economic sense.

Meanwhile on the rent side, the trophy unit could not find a taker at $94/sf/yr and has dropped to $73/sf/yr. If you take out cc+taxes, it’s a drop from netting $56/sf/yr to $35/sf/yr:

https://streeteasy.com/building/morton-square/rental/4024642

Meanwhile, recent rentals at 1/4th to 1/2 the size have gone for asks of $100-120/sf/yr. Give some room for negotiations and subtract cc+taxes, and it’ll come out in the ballpark of $60-80/sf/yr:

https://streeteasy.com/building/morton-square/6fw

https://streeteasy.com/rental/4052846

>> NYC rents are so high, it is ridiculous to talk about under-demand. It is something else, maybe costs to operate (taxes, maintenance).

Perhaps one could say proper-demand for renting but over-demand for purchasing? But I don’t think that really captures it. Since the step-up increase in prices circa 2005, developers have relentlessly increased supply. Economically, providing this supply made sense for the developers. I don’t think they can provide this supply for (say) half the price, or whatever it’d take to get to the point where cap rates make sense.

@300_mercer

The number I quoted was from streeteasy rent index, which is based on the repeated-rental.

https://streeteasy.com/blog/methodology-streeteasy-rent-indices/

Here is their description

"To cut through the noise and to provide an accurate account of price growth across time, we built the StreetEasy Rent Indices. Similar to the StreetEasy Price Indices which track resale values across Manhattan and Brooklyn, the Rent Indices use a repeat-sales methodology but with rentals instead. In short, we track the changes in rent price across several years among unique rental properties that are listed on StreetEasy. This produces a smoother and far less volatile time series compared to median asking rent,"

> Perhaps one could say proper-demand for renting but over-demand for purchasing? But I don’t think that really captures it. Since the step-up increase in prices circa 2005, developers have relentlessly increased supply.

So interestingly, supply of owned units has increased, but not supply of rented units (p4):

https://www.nyc.gov/assets/hpd/downloads/pdfs/services/2021-nychvs-selected-initial-findings.pdf

For developers, clearly it makes much more sense to sell than to rent given 3% cap rates. And for professional landlords, it does not make sense to add to the portfolio.

For those units that continue to be rented (instead of sold off at the current ridiculously high prices), my guess there are two reasons:

1) About 60% of all rental units are regulated and probably cannot even be converted to a residence

2) Professional landlords are not going to readily exit a profitable business they know how to run, because they don't necessarily have anything better to do. But they don't seem to be growing units under management.

Most other people, like the sellers of the apartment I bought, decide to sell after they rent for a year or two, because they realize it is just not worth it. The cap rate is even lower than 3% when taking into account various penalties that coops charge for the privilege.

Also interesting, there are some stats on p34 on unoccupied units in NYC that are not available for rent or sale and are held for seasonal, recreational, or occasional use: 102,900 units, up from 74,950 in 2017.

Good find, Krolik.

I believe a lot of “professional landlords” are just really managers acting on behalf of regular folk. E.g., pension funds buying a building and handing it to someone to manage. Or else, people buying a REIT because a 3% cap rate looks attractive in a ZIRP world, especially one that historically goosed some degree of appreciation from ZIRP. Better yet, lever up to a 5% yield with cheap floating financing. Throw in a little story about how rents will grow at a rapid above-inflation pace, and how the building values are an inflation hedge…

FWIW, many individual owners remain LLs for long periods despite the low cap rates. That’s been the story with many of my former LLs, anyways. And I see a lot of repeat condo rentals over the years.

Equity Residential public REIT reports a 3.5-4% cap rate on their newest acquisitions, and negative cap rates on dispositions. They occupy the very luxury segment. Cap rates are probably higher for a professional landlord with market rate apartments, and lower for those who have the misfortune of owning a rent regulated unit.

I think most NYC landlords are not public REITs, but rather family businesses with a few buildings. These people have been landlords all their lives and do not not necessarily have any other marketable skills.

For example: Rose associates, family of a colleague that owns and manages about 10 mid-rise UES buildings, or families mentioned in the Post article.

https://nypost.com/2023/03/20/new-ny-rent-control-bill-would-drive-out-small-landlords/

By the way, this has a good illustration of non-sense with rent control:

https://static1.squarespace.com/static/621fad26551e96051ddd54da/t/63e3a31513f8eb46e495b11d/1675862808230/CHIP+Report_Housing+Solution+for+NYC.pdf

>FWIW, many individual owners remain LLs for long periods despite the low cap rates. That’s been the story with many of my former LLs, anyways. And I see a lot of repeat condo rentals over the years.

Maybe they have a dream of living there someday? or capturing some tax benefit from depreciation?

Another variant of what I was talking about, but more direct than via a pension or a REIT:

https://www.wsj.com/articles/a-housing-bust-comes-for-thousands-of-small-time-investors-3934beb3

Seems similar to Fundrise and Yieldstreet, which have been inundating me with ads.

So the gist is that an IT consultant turned RE investor did not take into account interest rate risk? Guess, he is in good company, with all the banks...

>> Maybe they have a dream of living there someday? or capturing some tax benefit from depreciation?

I really don’t know, not exactly the type of conversation one has with a LL, so you have to read between the lines.

In one instance, I think there was a dream/hope of living there themselves. This was 16 years ago, after a heart-and-soul reno and a tenant prior to me. But it then turned into the main source of income. I don’t think the LL was gainfully employed, and the purchase seemed like family money or somehow otherwise “given”. The purchase probably made financial sense when it was made, but the cap rate wasn’t great by the time I arrived. Nevertheless, I think the low cap rate was a fine financial decision for the LL. The LL didn’t seem capable of making reasoned decision in personal life, finances, etc., was easily flummoxed, so not the type I think would do well investing elsewhere.

Another three cases were former pied-a-terres turned investments, mostly with a low basis set years before. Maybe they computed their cap rate using the original purchase price rather than current market price? I have no idea of the personal finances in these cases, but my sense is that they were doing well enough.

Then there are couple of cases where people bought and were unsure about selling (maybe they’ll wanna come back?) and were possibly unhappy about the current market price. In these cases, the LLs had plenty of money.

>> By the way, this has a good illustration of non-sense with rent control

Uh-oh, you posted CHIP material. You’re in for a earful from 30yrs…

I am all ears

I’m wondering if anyone here can share info on Board’s requirements for 35 Sutton? We got a turndown on our dream home and I’m brokenhearted.

Credit scores around 830. Zero debt. Paying all cash. Will have around 80% of the apartment price in post-close liquidity (after paying all cash). Maintenance + other living expenses = 15% of our income. No interview :(

I don’t know what else we could have done to assure the board that we are responsible buyers. Do boards ever change their mind if buyer appeals?

Who is your broker?

UESer, I expect to have a listing at 35 Sutton later this year. (An estate that will need a gut renovation). I have been in this job for closer to 20 years than not, and I tend to be very good with boards, but I am understandably daunted when I'm looking at a building where there have been units on the market for years.

Because of this, I am trying to talk to the board to see what they're looking for, and I haven't been given any hard-and-fast rules.

It is possible to reverse board turndowns -- I managed it last year for a Downtown purchase -- but it's an incredible amount of work, because you have to figure out what the disconnect is in the first place. I don't know you, and I don't know the brokers involved, so I can't comment on what went "wrong."

The buzz from the brokerage community, which I haven't dived into deeply yet, so take this comment with a grain of salt, would imply that you might do better taking a small mortgage and having more post-closing liquidity.

The one other thing that I would suggest in general -- I don't know if it would play to this particular building and this particular board -- is to look at your taxes and see if there are ways to increase your philanthropy. I do sometimes see a disconnect between recommendation letters that talk about an applicant's strong community involvement and that applicant's taxes which show charitable contributions of close to zero.

Anyway, I'm sorry this happened to you, and I wish you good luck wherever your housing journey takes you.

ali r.

{upstairs realty}

>> The one other thing that I would suggest in general -- I don't know if it would play to this particular building and this particular board -- is to look at your taxes and see if there are ways to increase your philanthropy. I do sometimes see a disconnect between recommendation letters that talk about an applicant's strong community involvement and that applicant's taxes which show charitable contributions of close to zero.

I know you’re saying this because it’s the way you’ve seen it to be, not because it’s the way you think it should be, but… what paternalistic horseshit. I suppose for some buildings, you better show the ACLU and for others the NRA.

And frankly, I am offended by the notion of associating charitable contributions with community involvement. You are probably 100x more community-involved than me, even if I write the bigger check. If there is to be a virtue-signaling purity test, there are surely better metrics than whomever has more money.

UESe should sue the board for discrimination as financials seem more than adequare as in cash purchase, plenty of liquidity post close and low expenses relative to income. If approved, should walk away as why have neighbors who don't like you.

Thank you all for your thoughts!

@ Rinette - I’m working with wonderful brokers at Douglas Elliman. They seem just as puzzled as I am.

@ front_porch - good idea about taking a mortgage to leave more in post close liquidity! Would you recommend to leave 100% of apartment value? Or more?

In general, how does one even attempts to get the board to reconsider their application? We can’t ask for the reason (I presume), so we would have to guess. What if the liquidity isn’t the reason?

@ inonada - at work I organize monthly volunteering events, fundraise and rally colleagues to give back to our community. My contributions are focused on donating time and effort, but unfortunately do not show up as huge deductions on my taxes :(

@ 300_mercer - I’m sure they would love me if they only got to know me :)

Wow, I'm with 300 & nada on this one .

There is no value in suing the board over a $1MM-ish apartment; cost, frustration and time to judgment make no sense. I understand the pain, but a board that turns down cash offers on units sitting for a year or more at $800/ sq ft (all listed below $1.35MM) has an amazing mis-perspective of self-importance, and you are better off moving on.

And agree with Nada that the notion some board of fake rich people would pass judgment on charitable giving in tax returns is ludicrous, particularly since much "charitable" giving is not done out of charity but self-promotion, mandatory "donations" to private schools and efforts to grease junior's skids into a college to which they otherwise have no hope of acceptance.

@Sport - If someone is up for it, I'd be happy to see some suits.

This is a form of high end discrimination that we all shrug our shoulders at and say "it is what it is".

And one example of why it's discriminatory is that I am sure they are not looking for neutral apolitical donations. So you need to know what the politics of the board are before disclosing the correct donations to them on your board package.

There's likely a built in age discrimination feature as well.

It also feels like one of those subtle anti-immigrant type discriminations that only the "old money whites" know that this game exists and that they need to play it. Sure if you engage with a broker early and then start padding your charitable donations to the right places, maybe you can pass a board package in 2-3 years.? What board that cares about particular charitable cause donations is going to accept you dumping a bunch of money in as you submit your board package?

I also agree with your assessment "board of fake rich people". It is a very particular NY flavor of asset-heavy, income-lite "rich". Possibly inherited, or someone who got lucky once.. or people in their 50s who just slowly built it up over time. No one with $2M in the bank AND a high income is going to be particularly drawn to these units.

People only feel rich by comparison, and sitting on a coop board like this is very good for that sort of ego.

I wouldn't lament the turndown, I would consider it a blessing in disguise. Otherwise, you could be the one holding the bag for many years, enduring board turndowns with people that would qualify in 99% of other buildings throughout the world. Who needs that kind of headache?

Not to pile on, but just go buy a townhouse or a condo. Or a house in Bronxville. Nobody has any business seeing where you give charitable $$ much less judging you for it, or your skin color, or your religion, or the fact your kids go to Trinity not Chapin. Consider yourself lucky they saved you from the mistake of having your assets tied up in their miserable building.

These fake-rich boards are quite difficult for me to grasp.

I recently moved into a building where the board president is extremely rich and a true legend. A household name since I was a toddler, basically. I was mostly entertained by the notion that he’d be reading my board package for approval, a bit bizarre and “WTF, he really exists and will waste his time reviewing my lame ass?!???” Not once did I think he, or any other rich person reviewing my board packages over the years, gave a rat’s ass about the color of my skin, who I liked to sleep with, what my interests were, what charities I supported, the fraction of my income I donated, etc.

Reading FP’s frank post, it all seems quite horrendous.

>> Not to pile on, but just go buy a townhouse or a condo. Or a house in Bronxville.

That’s easy to say if you can afford it compared to these cheap prices.

On the one hand, I can sympathize with “But this cheap, discriminatory housing is all I can afford.” On the other hand, maybe you shouldn’t play into cheap, discriminatory housing that probably wouldn’t be cheap were it not discriminatory.

But that's the rub here, Nada. You've got to meet some ridiculously aspirational idea of wealth to to live in a building that trades at prices equivalent to Manhattan middle class and then perhaps spend $$600 to $800 a square foot to bring it up to what such a wealthy new occupant would require. There are plenty of affordable co-ops, reasonable boards to choose from, and if you can't afford it, just rent for now until you can. Maybe in 20 years these gilded age want to be's will have all moved on or smartened up.

A question: I get that this corporate ownership enables boards to discriminate. But as the President /board members,aren't you supposed to be looking out for the best interests of all shareholders? You would think there could be a revolution from inside? I'm sure some of the shareholders with multiple board turndowns and properties on the market for years don't feel like their best interests are being served.

Keith Burkhardt

Keith, I remind you of the other thread that discussed this building & board:

https://streeteasy.com/talk/discussion/378-building-at-35-sutton-place

The complaints we’re hearing about relate to the new & improved transparent board, in place since the scoundrels got the boot 5 years ago.

well, I love everyone thinks my "give to charity" tip is nefarious. It's not. Give to charity. It's a cornerstone of every religion I can think of, and it's enshrined in many moral nonreligious systems as well. A co-op is a group of people who are all jammed into the same boat, and it's perfectly reasonable to want the person next to you in the boat to have demonstrated some awareness of, and responsibility for, other people.

Whether a $1mm apartment is the majority of your assets or not worth your time, if you can come up with a million dollars to buy an apartment, you can come up with some money to help others.

I'm w/ f_p on this one, for the limited example given. A board is looking to verify whether you are who your application says you are: Can you afford the 200k assessment when the facade falls off? Are the police going to be called every week because your wife is having knife fights in the hallway? Are you the community-minded person you say you are (because, regardless of the *type*, a co-op is a community)?

If your application says you're deeply involved in charitable activities, does your package support that? Contributions (the easy way out), letter of recommendation from somebody senior in a known organization (harder), that NYTimes article about how many lives you saved... If you're not community minded, don't bring it up in the application.

Ali/Aaron, Didn't Bernie live in a coop? Believe he donated to charities as well who in turn may have given him money to manage. There is really no way for a coop to judge the future behavior. Past behavior only if someone got caught.

That is why some one should sue the board for justice and fairness even though financially and brain-damage wise - as nyc_sport says - it makes no sense. May be Fair Housing enforcers will do it for free - at least that is my wish but they are too busy enforcing rent-control.

fp/aaron - Charitable giving is great, I encourage everyone to give as much as they are comfortable. I don't know why its anyones business where a private citizen donates and don't give to organizations with an eye towards increasing my social credit score.

If an opaque board who won't disclose the basic outline of financials they want .. how does one infer the charitable donations that increase/decrease your chance of admittance? Do I get to ask what religion & political affiliation my board reviewers & where they stand on 5 hot button issues before choosing & disclosing my charitable giving?

What if I give to my local Catholic Church and volunteer with the Knights of Columbus? What if my community involvement talks at length about my experience proselytizing in South America as a member of the Church of LDS? What if I donate to Birthright or GLAAD or ADL or volunteer with Planned Parenthood? Political party donations? Particular candidates / PACs?

Plenty of hot button possibilities depending on boards.

What if I give to schools but not the right ones? Harvard could go either way these days, changes by the week.

What if my donations are more environmentally skewed? Or animal shelter/rescue organizations exclusively? Would a particular board prefer hearing about how I championed renewable energy use in my community or that I protested the attempts to install offshore wind turbines?

I see this as mostly sour grapes. Of some group of people decide they are willing to forego millions of dollars in equity so they can live in a building with like minded idiots who share their same twisted values, I say let them have at it. And to those who say "but I deserve the same bargain price even though I don't really fit"

I see this as mostly sour grapes. Of some group of people decide they are willing to forego millions of dollars in equity so they can live in a building with like minded idiots who share their same twisted values, I say let them have at it. And to those who say "but I deserve the same bargain price even though I don't really fit" I counter " So go start your own club!" but I doubt that they would be willing to put their money where their mouths are and forego the $.

>> it's perfectly reasonable to want the person next to you in the boat to have demonstrated some awareness of, and responsibility for, other people

And what if the cause of choice for them is the NRA? Is the board to read that as signaling responsibility or irresponsibility for other people?

Maybe coops should:

- Pay surprise visits to applicants’ homes, to ensure they are always perfectly neat and tidy, lest they take poor care of common elements.

- Have a PI follow you as you walk your dog, to ensure you properly clean up and never leave a smear.

- Inspect your closet, to ensure you own no clothes or jewelry beyond your means, in their estimation.

- Cross-reference your passport against airline and hotel receipts, to ensure you are not an overspender.

All those would more directly analyze the issues that play into what might make a good coop member than charitable contributions on a 1040.

Frontporch seems like a good person

Suing the board is a silly idea

Wife having knife fights in the hallway is funny.

Move on.

For all the talk of who lives next to you in the building, I've never had a problem with neighbors in all the condos and rentals I've lived in for the last 25 years.

I have had problems - sometimes big problems - with people who lived in neighboring buildings. I've had jackhammering at midnight in a building next door, loud parties at buildings next door that rock my windows, an assemblage turned into a giant construction site for years on end, a homeless shelter next door with sketchy people smoking weed day and night, and a next-door shell that sheltered rats (back in my uptown days). I'm a lot more worried about the neighbors *not* in my building than I am with people who share the elevator.

That said, for all the complaints I make about idiotic coops, the one place where I *might* prefer a coop is a 4-unit brownstone turned into a condo or coop. When there are only 4 families living in one small building, there's a bit more reason to be selective. And the board = all the residents, so there's less conflict between the Board's personal interests and those of other shareholders.

FP is a great person.

>> Whether a $1mm apartment is the majority of your assets or not worth your time, if you can come up with a million dollars to buy an apartment, you can come up with some money to help others.

But sometimes she says things that make little sense to me. A $1m apt is wonderful & all, but cash buyers might be short on income. Standard deduction for a couple runs at $28K these days, and if you have modest income but are a cash buyer, you might not be itemizing your charitable contributions since they are below $28K.

Even if you earn (say) $250k, enough to afford a $1m apt, take the SALT deduction of $10k, and tithe $15k, you still wouldn’t itemize to signal your virtue via a 1040. So the only acceptable people need to donate at least $18-28k/yr to pass the bar.

FP, do you itemize your deductions? If not, when reading your 1040, should I assume you to be a charitable contributor (a stingy sub-$18k one, anyway) or a non-contributor? Therein lies the rub. I’m not even sure the board members scrutinizing for this horseshit even understand basic tax code.

Or even better you set up a personal foundation or Donor Advised Fund. If you plan to contribute $10k a year for 10 years, you drop $100k into the DAF now. This puts all your deductions into a single year and then get the deduction instead of itemizing. And there's no need to share your DAF statements with some nosy coop board.

Exactly. Now you gotta time the years of your DAF contributions to align with your coop buying, to virtue signal properly to paternalistic yet tax-illiterate boards. Because that is so very much the point of charity.

No idea what happened to these bills.

https://www.sgrlaw.com/client-alerts/bills-pending-in-the-new-york-city-council-to-enact-laws-regulating-the-purchaser-approval-processes-of-cooperatives/

Agreed, from everything FP has shared she is a great person who behaves morally in a difficult industry and shares information here with grumpy forum posters likes us. I think a lot of our complaints about the structure of NYC RE market come across as personal criticism unintentionally. I wonder how much of this stuff is timeless, or how much the NYC RE market has changed in 20 years. Maybe time for another book?

> That said, for all the complaints I make about idiotic coops, the one place where I *might* prefer a coop is a 4-unit brownstone turned into a condo or coop. When there are only 4 families living in one small building, there's a bit more reason to be selective. And the board = all the residents, so there's less conflict between the Board's personal interests and those of other shareholders.

Funny thing on that is my buddy lives in a ~5 unit coop for almost 20 years and tells me stories. They have never rejected a buyer. You do have stuff happen like midlife crisis divorce where the family home becomes dads bachelor pad filled with smokers and call girls though.

A reminder why I think all these high bars on entrance are interesting since theres nothing after that other than house rules & fines to protect you. You need house rules, fines and board/mgmt with backbone to shame/bully these types of people into compliance or departure.

> I’m not even sure the board members scrutinizing for this horseshit even understand basic tax code.

Exactly.

Wow - Thank you all for responding, your ideas and support!!

Great idea on taking a mortgage to boost up liquidity. I’m willing to do that, just not 100% certain if that is what the board wants.

Re philanthropy. Every single month I organize a corporate “Give back day” where myself, my colleagues (and sometimes our families) go and volunteer at various charitable organizations. Most of the time I donate through my company’s fundraising efforts which allows for a matching donation from a corporation. I don’t deduct most of these things on my taxes, so you might be right if that was expected.

Of course we could move on and look for another apartment. That said, inventory is rather low at the moment and finding an apartment that everyone in the family loves is rather hard. We have been looking since August.

I would love some guidance on how we can approach resolving this issue with the board. If my broker does not know board members, and seller is an estate, how can we find out what changes we would need to make to have the package acceptable to the board?

The bill to require coops to have a standard set of requirements made available upon request and to answer all applications within 45 days never even got a hearing. I imagine the affected council members heard an earful from racist coop Boards, and nobody outside Manhattan much cares. There's no constituency for fair housing on Park Avenue.

https://legistar.council.nyc.gov/LegislationDetail.aspx?ID=6013721&GUID=2A0595E2-0B04-44F8-B7A1-75921D9C4745&Options=&Search=

Amazingly it did not require a written explanation of where the application fell short of the requirements.

SMH at people going through life thinking they are owed explanations for everything that disagrees with them.

Perhaps it wouldn't be nearly as much of an issue if both courts and Coop attorneys weren't fairly consistently telling Coop Boards they can do WTF they want to with impunity.

There are over 300,000 coops in NYC, most neither rich people nor in Manhattan. No one in city government is legislating for the benefit of rich people or Manhattanites.

The "poor" Coops want to discriminate just as badly as the rich one's. Like famously the Grand Street one's.

We got turned down by a board a couple of years ago. Brokers all said it was “definitely” due to assets being “too low”. I suspected our financials were fine, and it might have been something else. Here you have a person with a lot of assets getting denied, in line with my argument that some other, potentially discriminatory factors are at play.

On the one hand, I am of the school of thought that anyone who is turned down by any given coop is better off just moving on. On the other hand, I do find it highly objectionable that entire neighborhoods are dominated by this form of ownership. Everyone says "just start your own club," but that ignores the most basic tenet of real estate: location is everything. Certain clubs everywhere on the planet are what they are primarily because of their location. Sure, you can start another club in Palm Beach, but it will not have the location of the Everglades. If you want to live on Sutton Place or in Beekman or on the Upper East Side, you are stuck dealing with the inefficiencies and horrors of coops. Were I foreclosed based on an immutable trait, I would be angry indeed. I don't know the extent that type of discrimination still goes on; I know it is not an issue in our coop, though the over-the-top financial discrimination remains real. However, discrimination based on the amount of money one has is not illegal.

P.S. to @krolik - I also think that many turn downs in coops are based on the contract price's being too low for the board's liking. Is there any chance that was the case with your first turn down? And didn't you learn that lesson and modify your behavior accordingly recently with another purchase?

I will note that while I would argue that any turn down based on low price gives rise to an antitrust cause of action for the seller against the board, no seller wants to be bothered. People seem to just opt for the kabuki of the renovation credit.

No, it was not the price. Identical units have been sold in that building for less. In fact, the unit is now listed for less than my contract price.

My most recent situation is different, and note that we got a clear signal from this board regarding the issue. And successfully resolved the issue, got approval and closed.

>> On the other hand, I do find it highly objectionable that entire neighborhoods are dominated by this form of ownership. Everyone says "just start your own club," but that ignores the most basic tenet of real estate: location is everything.

Exactly!!! If you want midtown in the fifties, its either old coops with those boards, or condos on billionaire’s row. If you are not rich, the natural choice has to be the coops. It’s not really a choice.

I’m with MCR and Krolik on this one. I hear “just start your own club” and can’t help but hear undertones of “separate but equal”.

Or this guy, who basically seems to view college admissions as a birthright club membership bestowed upon his bloodline for eternity:

https://www.nytimes.com/2023/07/30/us/politics/legacy-admissions-college-alumni.html

Some alumni agree, arguing that family tradition has encouraged them to earn the qualifications for admission and that a new generation can do the same.

“In the real world, folks, this is how things go,” said Rob Longsworth, an investment manager who was the seventh in his family to attend Amherst College. “But this is ultimately not a zero sum game. If other people want these things, go get them. Do the work to establish such a tradition in your family, if that’s what they want to do.”

I get family tradition working as a motivator, but what’s the chance somewhere across the 7 generations there weren’t one or more under-qualified laggards?

Maybe Marie Antoinette would’ve been spared the guillotine had she gone with “Start your own hereditary monarchy” instead of “Let them eat cake”.

Here's a nice fancy rental building in exactly the area you're talking about. Don't act like any group who wanted to couldn't buy it, or any number of other rental buildings in the area, and turn it into a Coop with whatever rules they wanted.

Oh....but the same people who want good deals to be handed to them without doing work want their club handed to them without doing the work it would take for that either.... Nevermind...

https://streeteasy.com/building/oriana-420-east-54-street-new_york

https://streeteasy.com/building/405-east-54th-street-new_york?gad_source=1&gclid=Cj0KCQiA2eKtBhDcARIsAEGTG42yLvYOutLP1JptirdoB2KPm7qowEttGerVfdVoD2tBK082fV_yioQaAm8NEALw_wcB

And I'll say it again for those in the cheap seats:

The entire purpose of Coops is discrimination.

BTW, the last sale of 420 East 54th Street was roughly $1 million per unit, so all these "high assets but still can't pass a stuffy Coop Board" could certainly handle it financially if they were actually interested in WORKING a solution rather than grumbling. Can't lives on won't street.

@30 - so you agree coops exist to discriminate, but you think our recourse should be to have to buy a 400 unit rental building to make our own non-discrimatory coop?

Looks like they were trying to get north of $500M for the building a decade ago.

https://therealdeal.com/new-york/2015/04/30/rivertower-could-go-condo-in-550m-deal/

Personally would like to disclose for the record - I'm not good for $500M myself.