Buying Your First Home in NYC

Buying a home in NYC is complicated, but rewarding. If you're a first-time home buyer, or even a returning buyer who needs a refresher, this guide will provide you with tips and strategies for your home-buying journey.

A few of the topics covered in this guide include: how to find your dream home, how to find a buyer's agent, how to prepare for a co-op board interview (and what even is a co-op vs. a condo?), information about home inspections, home loans and mortgages, and much more! We hope these articles will help you make educated decisions and feel a little more confident as you begin this journey — whether you're a first-time home buyer or a real estate veteran. Happy home shopping!In the city that never sleeps, New Yorkers still find time to dream — of the perfect apartment.

After much consideration of whether you should rent or buy, perhaps you’ve decided to buy. It’ll cost you a pretty penny, and it can be elusive even for those who can comfortably afford it. Maybe you have a vision of your NYC dream home, and it’s filled with exposed brick, private outdoor space, and in-unit laundry. Or maybe you’re not quite sure what you’re looking for. Either way, you’ll have to search for it, and you can do that on StreetEasy®.

We can’t make all of your dreams come true, but we can provide you with this guide. Here’s how to zero in on your dream digs, how to use StreetEasy to search for homes like it, and how to find an agent to help you start the buying process.

Manhattan Homes Under $1.5M on StreetEasy Article continues below

Location, Location, Location: Choosing Your Neighborhood

Finding your dream home in NYC usually starts with finding your dream neighborhood. In any city, it’s one of the most important factors for home buyers. For some, it’s a matter of lifestyle, while for others it’s one of convenience. But for many, it’s a combination of the two.

“Location matters to different people for different reasons — whether you want to be close to the action, like restaurants and museums,” says Mihal Gartenberg, a licensed associate real estate broker with Coldwell Banker Warburg. “Others may want to live near a park or the subway.”

With over 300 neighborhoods spread across five boroughs, there are a lot to choose from. Think about your day-to-day, and what’s important for you to have nearby. Also keep in mind that this is New York, and there are unique things to consider: subway stops, laundromats, noise levels, etc. Some key factors:

- Public transit: Which subways, buses, ferries, etc. serve the area?

- School districts

- Parks

- Noise levels

- Grocery stores

- Nearby conveniences: bodegas, drugstores, laundromats, banks, etc.

- Restaurants, bars, and shops

- Gyms and fitness studios

- How dog-friendly is the neighborhood?

- How bike-friendly is it?

- Parking

(You can filter for some of these in your StreetEasy search — learn how!)

You can learn about dozens of NYC neighborhoods through StreetEasy’s Neighborhood Guides. But before you get your heart set on anything, check the StreetEasy Data Dashboard for median asking prices by neighborhood, and see what’s realistic for your budget. You may also want to look at total sales inventory based on the type of home you’re looking for.

Just remember that online research can only tell you so much, and the best way to get to know a neighborhood is to spend some time there and get a feel for it. You may also want to check out StreetEasy’s Know the Neighborhood video series, in which residents and experts tell you what it’s really like to live in one of the featured neighborhoods.

Another piece of real estate wisdom: buying a home is all about compromise, and location is one element you can trade off. In fact, many New Yorkers are trading off proximity to Manhattan for affordability and more space.

“For example, the Upper East Side area east of Third Avenue is less expensive than the part west of Park Avenue or even the Upper West Side,” says Gartenberg. “So, do you care about getting more bang for your buck or the zip code? By compromising, you can find some deals that might not come to your attention otherwise.”

Condo, Co-op, or Townhouse? Choosing a Property Type

Is your dream home a condo, co-op, condop, or townhouse? These are different types of properties commonly found in NYC. What’s the difference between them? Is one better than the others? Which one is right for you? Here’s what you need to know.

Co-op: Pros and Cons

Co-op is short for “cooperative.” A co-op is a residential building in which a corporation owns the building, and each apartment owner actually owns shares of the corporation. The larger the apartment, the more shares you own, and the more shares you own, the more taxes you’ll pay. This handy guide dives into specifics, as does this video from StreetEasy Home School, our educational video series for NYC buyers and sellers.

Most for-sale residential units in NYC are co-ops. The city estimates there are twice as many co-ops than condos at a given time, so you’ll have plenty of options to choose from. However, if you’re searching for a home on StreetEasy, you’ll notice a more even split between co-op and condo listings.

When thinking about co-ops, it’s important to weigh the pros and cons. “Co-ops come with restrictions. Many buildings don’t allow subletting, for example. But they are typically cheaper than condos,” says Gartenberg. Most co-ops allow a 20% down payment and 80% financing, and have lower closing costs than condos. On the flip side, some require up to 50% down and substantial liquid assets after purchase — which can rule out many buyers.

Other things to note about co-ops:

- Usage rules: Each co-op building has rules restricting how the apartments can be used, like whether it can be a pied-à-terre (secondary residence), or if it can be subleased.

- The co-op board: A co-op board is a volunteer organization of shareholders, elected by fellow shareholders, that oversees the purchases, sales, and house rules for the building. Potential buyers must be approved by the co-op board, and they can reject purchasers without a specific reason. “The buyer does not fit the financial profile of the building” is a common one.

- Maintenance fees: Co-ops require you to pay monthly maintenance fees, which cover the building’s operational expenses.

Bonus Tip: Looking for a better deal on a co-op, and a simpler buying process? See if you can get your hands on a sponsor unit, which is a unit that’s on the market for the first time. Though hard to find, sponsor units allow you to sidestep the usual co-op board approval process. You can filter for sponsor units in your StreetEasy search.

Understanding Maintenance Fees

If your NYC dream home might be a co-op, this is something to be aware of when thinking about cost. Maintenance fees cover a co-op building’s operational expenses, such as paying the staff, property taxes, and upkeep. It also typically includes insurance, heat and hot water, gas, decorations, pest control, trash, snow removal, and more, as well as the underlying mortgage (and interest) on the building.

“At year’s end, the shareholders receive a statement revealing the interest expense they paid toward the underlying mortgage, providing them a tax deduction from their income taxes,” says Gerard Splendore, a StreetEasy Expert and agent with Coldwell Banker Warburg. “This is a benefit of living in a co-op.”

How much your maintenance fees cost is based on several things, including the size of the apartment (square footage, number of bedrooms, and number of rooms), floor level (the higher, the more costly), and views from the unit.

Condo: Pros and Cons

Condos put the “real” in real estate, in that each unit has its own deed — and tax bill. As a condo owner, you own the apartment free and clear. “Since condos have few (if any) ownership restrictions, it’s the easiest real estate asset to own and manage, but it’s also the most expensive,” says Gartenberg. They have higher closing costs than co-ops, too.

Here are some other important things to consider about condos:

- Rules and regulations: Condos do have boards, and owners are subject to its terms, rules, and regulations. They’re usually much less strict than co-op boards, though.

- Flexibility: Condos may require as little as 10% down, can be used as part-time residences, and can be subleased to renters. Condo boards also have less ability to reject purchasers than co-op boards.

- Modernity: If you prefer a brand new unit or a more recently constructed building, a condo is your best bet.

- Amenities: Condo buildings, especially new developments, tend to have more numerous and modern amenities than their co-op counterparts. They’re also more likely to have contemporary sought-after features like central air conditioning and in-unit laundry.

Condos also come with what are called common charges.

Understanding Common Charges

Like maintenance fees, common charges are what condo owners pay to fund the building’s day-to-day operations. But unlike maintenance fees, they don’t include taxes, which condo owners pay directly to the city or through their mortgage lender.

Before you get comfortable with the monthly mortgage payment and common charges for a building, heads up: operational expenses tend to go up over time, according to Gartenberg. “As union contracts get renegotiated and the city needs more money, the bills will ultimately go up. Don’t buy thinking that the cost will remain static,” she advises.

Condop: Pros and Cons

A condop, as the name implies, is a hybrid of a co-op and a condo.

“Urban first-floor housing units are less desirable, less sellable, and less profitable than higher floors due to noise, security concerns, light, and privacy,” says Splendore. As a result, “many residential buildings will house commercial space such as physicians’ or professional offices, retail space, or a parking garage on the first floor, requiring a condo for the commercial spaces and a co-op for the residential spaces above.”

In a condop, the residential units function as a co-op, and the commercial spaces are administered like a condo. So, the pros and cons are similar to those of co-ops, including the application and approval process. Condop owners own shares in the building — just like co-op owners — and pay maintenance fees that include taxes.

Townhouse: Pros and Cons

If you dream of a city residence that feels most like a traditional home, a townhouse is the way to go — if you can afford it. Townhouses are the closest thing NYC has to single-family homes, but at least one of the walls is shared with another building. The townhouse market is very expensive and competitive, so make sure you have an experienced buyer’s agent at your side, perhaps even one who specializes in townhouse purchases.

The major pro of owning a townhouse is that you own the entire building. That means you make the rules, there’s no board to deal with, and you have the utmost privacy and autonomy. However, owning the building also means you’re fully responsible for it, financially and operationally. That means taxes, fees, trash removal, maintenance, shoveling snow, etc. all fall on you.

How New — or Old — Is Your Dream Home?

New York City has a rich history spanning nearly 400 years, and its diverse architecture reflects that. Amidst the shiny new condo buildings, much of the city’s housing stock is very, very old — and in the world of NYC real estate, that’s not necessarily a bad thing. When searching for your dream home, it helps to determine what its age might be, which is often a matter of personal taste. Is it a classic beauty, a contemporary marvel, or something in between? Let’s find out.

What “Pre-War” Means in NYC Real Estate, and Why It’s Coveted

As you browse listings, you may notice some described as “pre-war.” This means the home was first constructed before WWII, typically between 1900 and 1939, although sometimes as far back as the 1880s.

While you may think a nearly 100-year-old home would be less desirable, pre-war apartments are highly coveted in New York City. They’re widely considered to be charming, classic, and elegant.

Pre-war homes contain many sought-after features and characteristics, such as:

- Spacious, well-proportioned layouts with formal living and dining rooms, a large foyer, wide hallways, larger bedrooms, and higher bedroom counts

- High ceilings

- Original hardwood floors

- Large windows

- Ornate architectural details, such as crown molding and ceiling medallions

- Built-in bookcases and shelves

- Brass fixtures

- Wood-burning fireplaces

If a pre-war home contains a lot of these features, plus generous square footage, it tends to come with a high price tag. However, not all pre-war units are created equal, and there are modestly priced ones out there to be found. On StreetEasy, you can filter for pre-war properties in your search.

That said, pre-war homes aren’t for everyone, and there are drawbacks of owning one. Their unique layouts can be downright bizarre and tricky to furnish and design. The kitchen, bathrooms, and closets are often small, and modern features like central air conditioning are rare. With all those years and history also comes the need for renovations and repairs, so be sure to factor that into your calculations.

Looking for a Newer Apartment? Buying in a New Development

A pre-war home appeals to many people for many reasons. But, if you’re the kind of buyer who prefers a newer place with a modern look and feel, your dream home may be in a new development.

There are advantages to buying in a newly constructed building, and the barriers to entry can actually be lower. To entice buyers, some developers offer in-house financing options and lower down payment requirements (as little as 10%), especially if the building hasn’t been completed yet. That’s right — you can even buy a unit in a new development before construction is finished!

That said, you’ll want to consider these factors:

- Uncertainty: What’s the reputation of the developer? “There have been situations with boutique buildings where the developer does not maintain their own financial obligations,” says Gartenberg. “If that happens and the developer no longer pays their share toward common charges on the unsold units, the current residents will need to pick up that burden.” You can read up on various developers in sources like The Real Deal and Crain’s New York.

- Construction: There may be ongoing construction, and all that comes with it, when you move into the building. Also, brand new buildings are not always free of structural flaws. “Buildings settle, and it can take some time for cracks and defects to appear,” adds Gartenberg. “It does not mean someone should not buy in a new development, but rather that they should go into it with their eyes open.”

- Property type: New developments are much more likely to be condos, so make sure you’re open to buying a condo.

- Timing: Are you on a specific timeline for buying and moving in? Timing can be an issue with new construction. There can be delays that push out the project’s completion date, setting back your timeline by months.

In short, there can be a few unknowns when purchasing in a new development, but many buyers still find it to be worth the investment. If you think that’s you, you can filter for new developments in your search on StreetEasy.

Brooklyn Homes Under $1.5M on StreetEasy Article continues below

Setting Your Budget

Obviously, we all have a dream home in mind if money were no object. But here in the real world, home shoppers need to determine what they can actually afford before falling too much in love with anything.

StreetEasy has various resources to help you come up with your dream home budget. For one, our StreetEasy Home School video series contains an installment on Buying a Home in NYC for the First Time, with a section on budgeting:

Furthermore, our guide to Buying Your First Home in NYC contains sections on how much an NYC home costs; closing costs, taxes, and fees; timing the market; and down payment.

You may also want to check out the following relevant articles:

Once you’ve identified what you’re looking for in your dream home, and what you can realistically afford, it’s time for the fun part: finding it!

How to Use StreetEasy to Find Your Dream Home

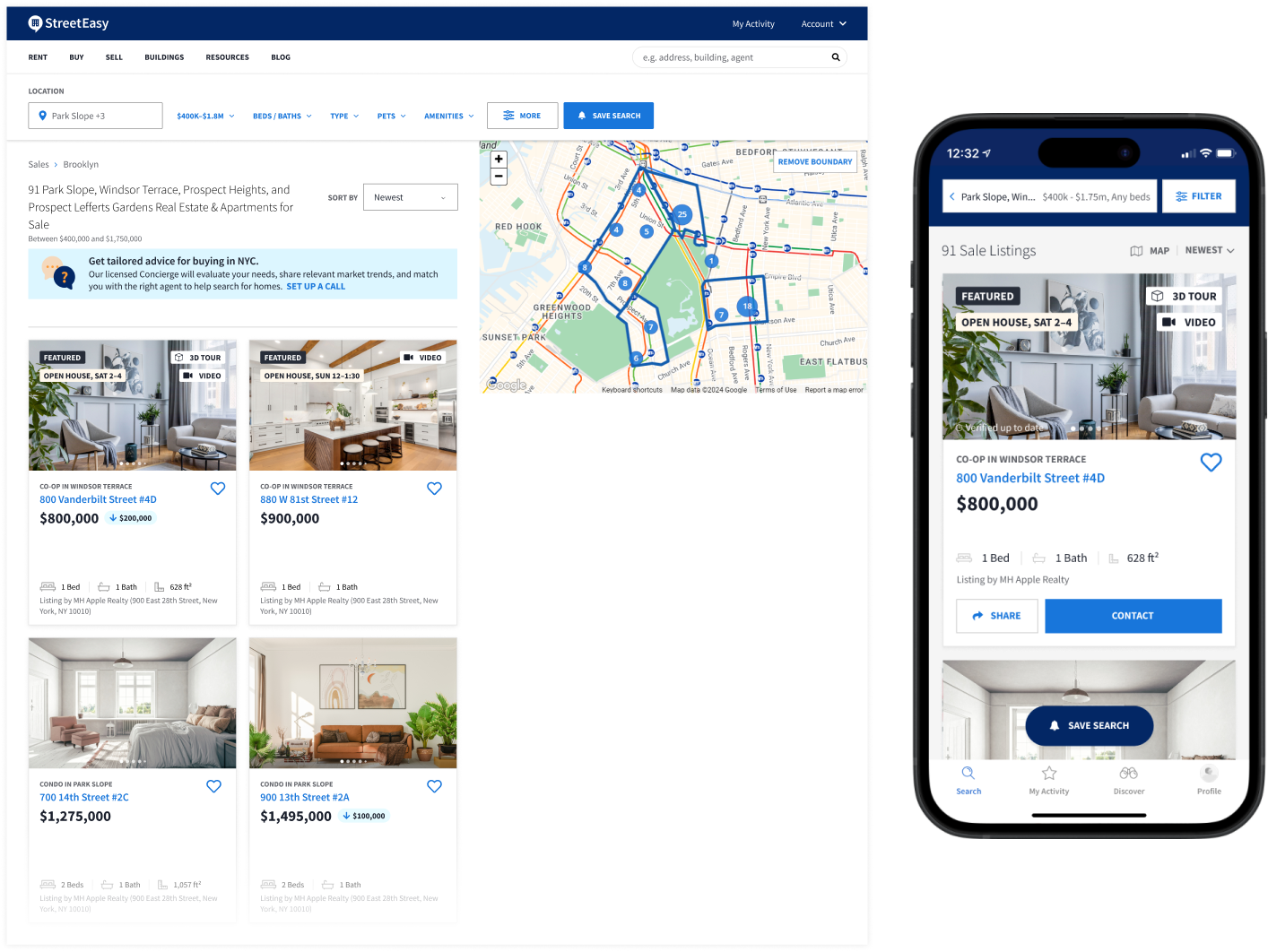

You can very much find your dream home right here on StreetEasy. In fact, StreetEasy and Zillow Group’s other consumer brands have, on average, 70% of the market share for the online real estate category in New York.* You can use the StreetEasy website, or the app for iOS or Android, to browse thousands of NYC homes for sale.

Here’s how to do it.

1. Create a StreetEasy account (if you haven’t already)

The best way to personalize your search is by creating a StreetEasy account, if you don’t already have one. Just go to the StreetEasy site, click Sign up / Sign In and follow the instructions.

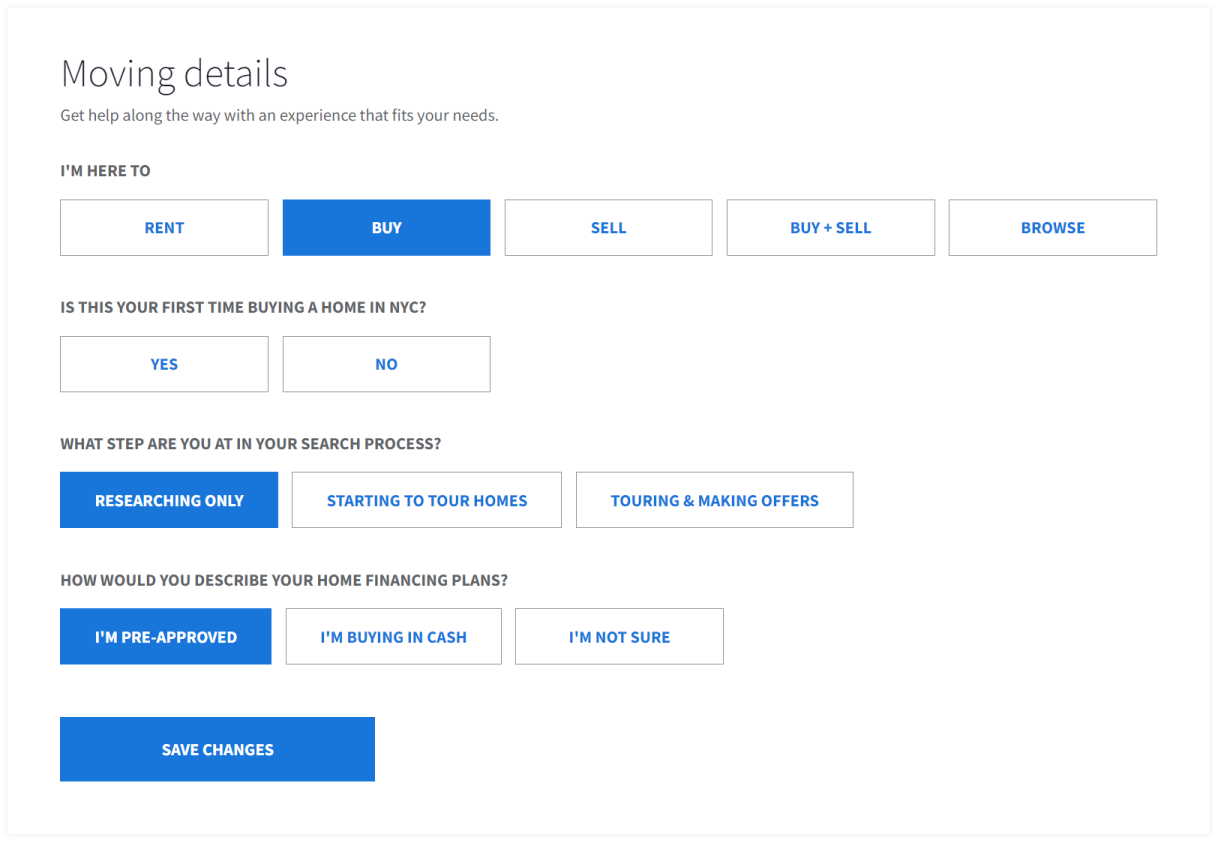

Once you’ve created your account and signed in, go to Account > Profile and scroll down to Moving details. The more information you provide in this section, the more we’ll customize your experience and point you toward StreetEasy products and services that will help you in your journey.

2. Select neighborhoods to search

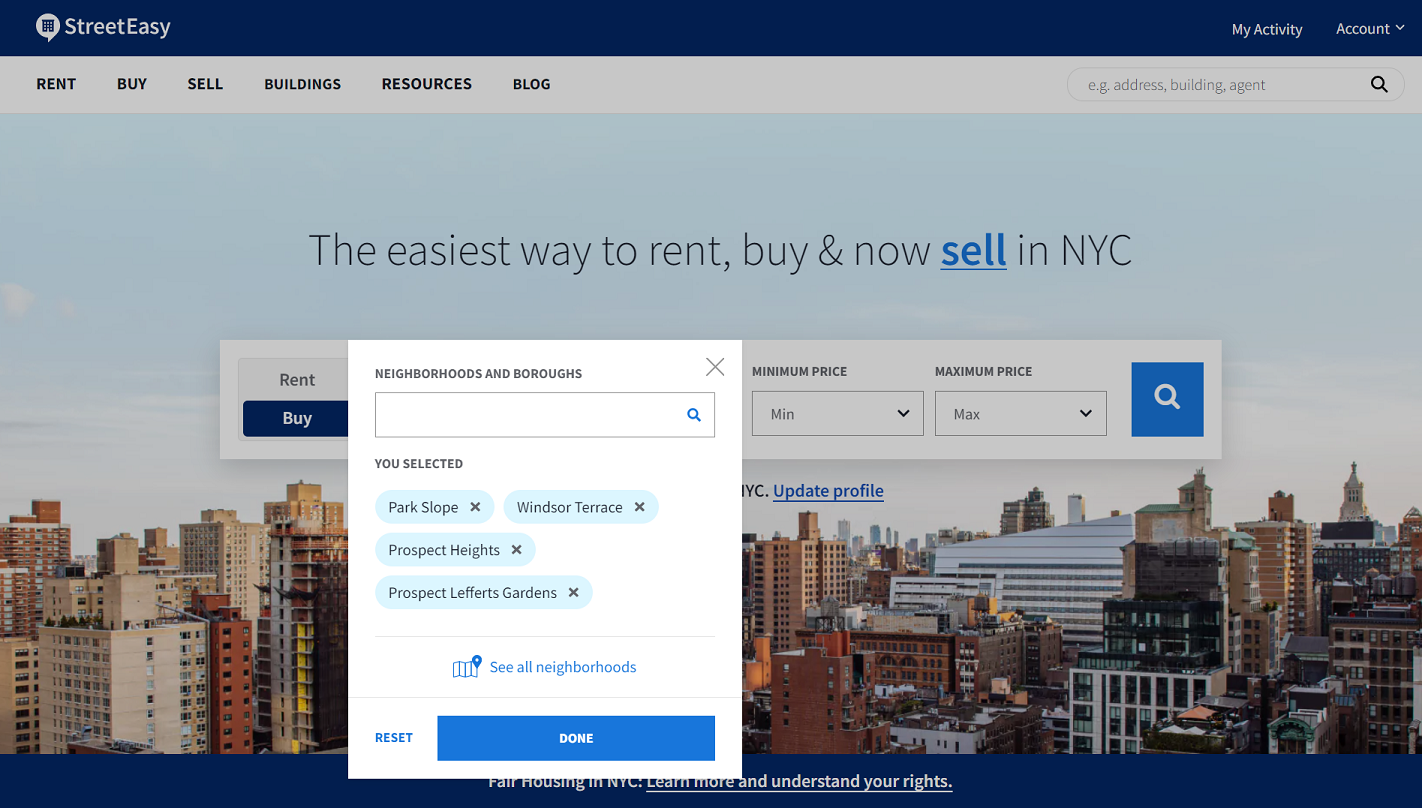

On the homepage, go to the housing search bar and make sure you’ve selected Buy. Then go to the Location box and select the neighborhoods or boroughs you’d like to search for homes in.

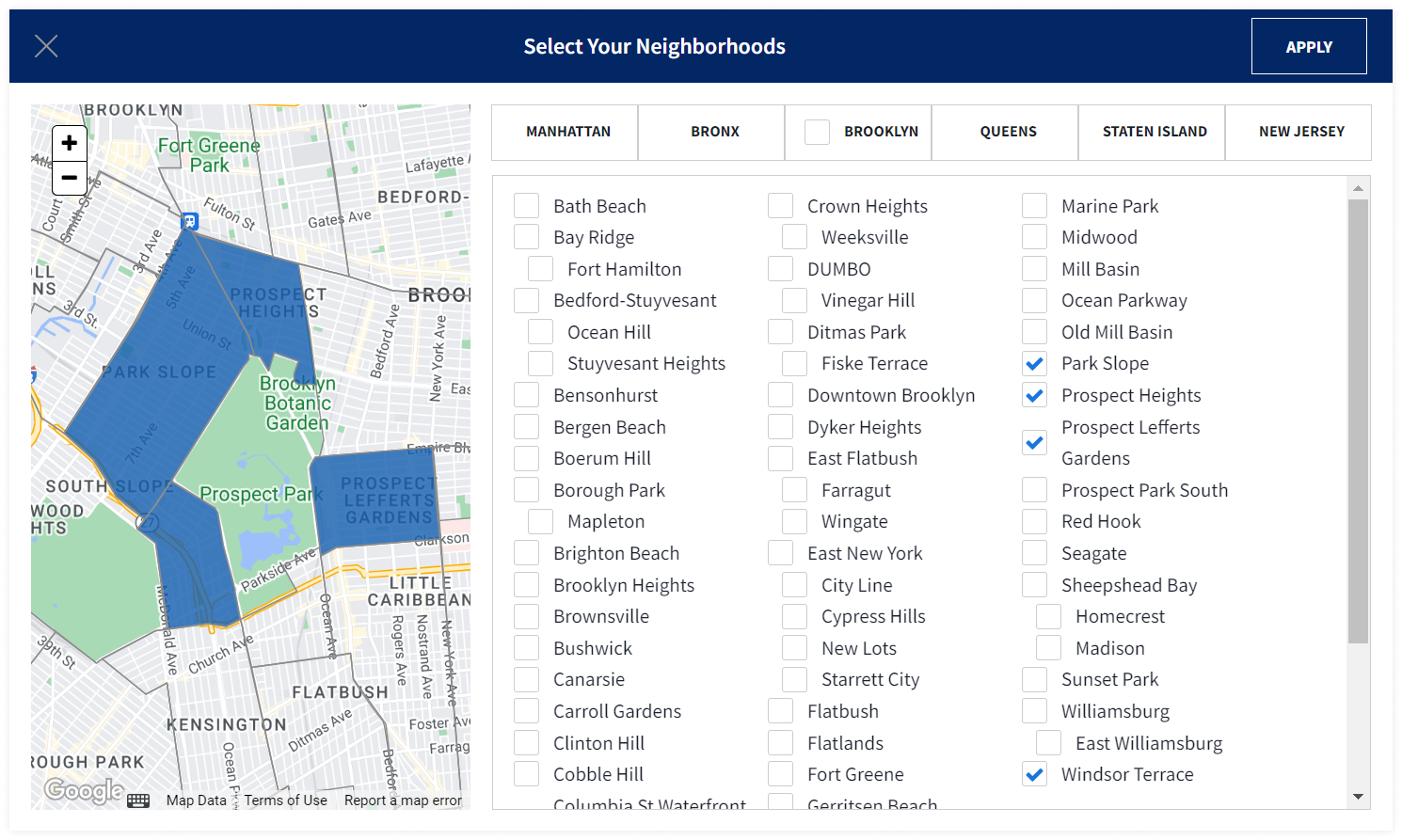

If you prefer to use a map view, click See all neighborhoods and select neighborhoods directly from the map, or from the list.

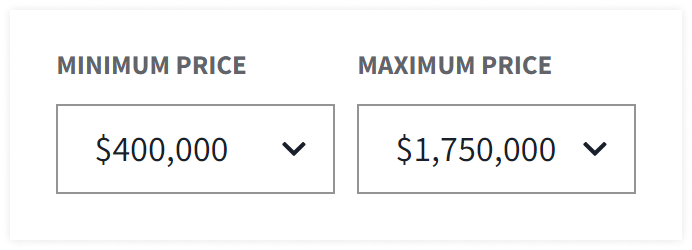

3. Set your price range

Select a minimum price (optional) and a maximum price. You can use the dropdown list, or type in your own precise numbers.

Click the search button to start browsing listings!

4. Further customize your search

Above your results, you’ll see a search bar with your selected neighborhoods and price range, plus some additional options.

Use these options to customize your results:

- Beds / Baths: Specify the number of bedrooms and/or bathrooms

- Type: Condo, co-op, townhouse, etc.

- Pets: Filter by the building’s pet policy

- Amenities: Select the amenities you’d like the building or unit to include. Toggle on “Must-have” to only see homes that have this amenity, or toggle it off if you’re more flexible.

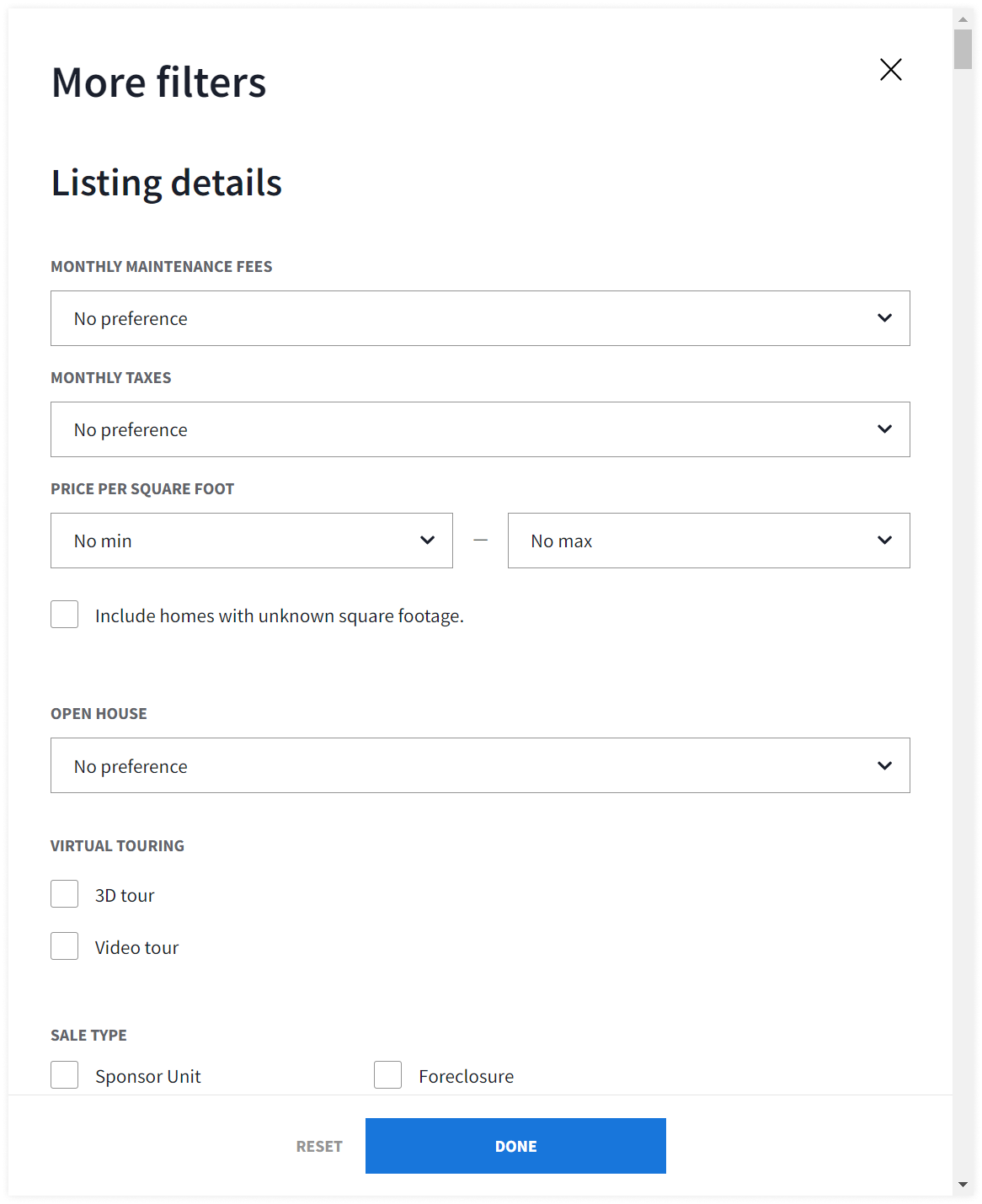

Click More to set advanced filters for things like square footage, maintenance fees, virtual touring, and much more. You can filter for pre-war or new development buildings, or set a range for the year built. Looking for a sponsor unit? Select it under Sale Type. Search by zip code or school zone, or draw your own custom boundary. Go to Transit to select the subway lines you’d like to be near. Use Keywords to find listings that mention a specific word or phrase.

5. Save (and track) your search

Once you’ve set your search filters, click Save Search. That way, you can come back to this search later without having to reenter all of the criteria. You can save multiple searches. To view or modify your saved searches, go to My Activity > Searches.

Want to keep track of the listings in your saved searches? You can receive an email whenever new listings in your saved search hit the market, or for important updates like price changes. Do this by going to Account > Notifications and opting into email notifications for your saved searches. If you’d like to receive push notifications to your phone, open the StreetEasy app and sign into your account, then go to Profile > Settings > Notifications and opt into push notifications for your saved searches.

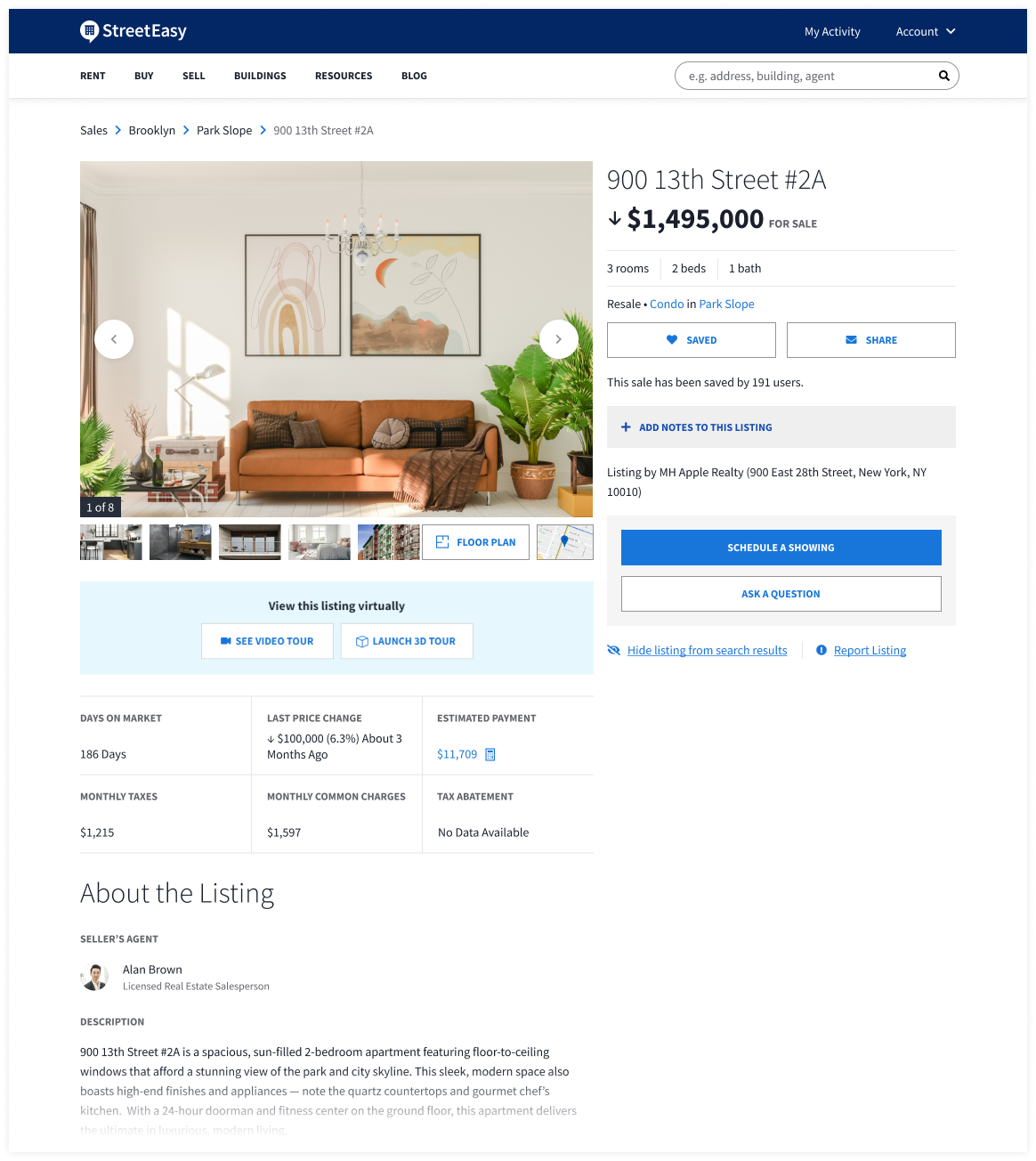

6. Evaluate listings

If a listing catches your eye, be sure to go to the full listing page and see if it’s a home you’d like to pursue further. Here are a few features and sections that may help you decide.

- View This Listing Virtually: You’ll see this section if the listing has a video and/or 3D tour. These viewing options can give you a better feel for the home than static photos.

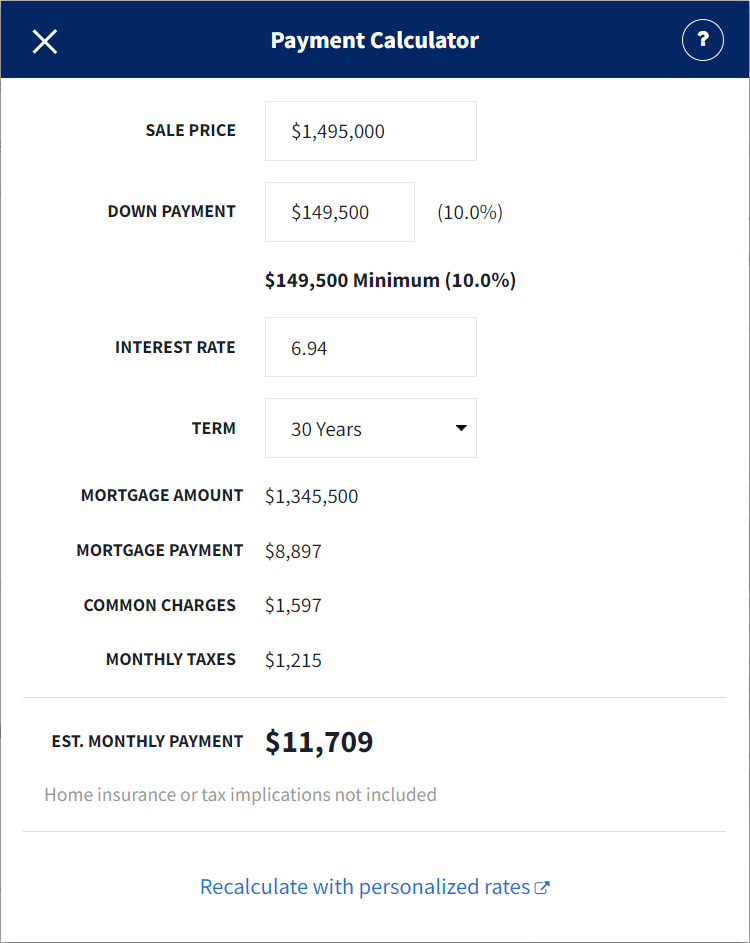

- Estimated Payment: Click the calculator icon to estimate what your monthly mortgage payment would be for this particular home.

- About the Building: Get to know the building and how many units it has, when it was built, past sales/rental activity, etc. Click the address or button to go to the building page and learn even more.

- Property History: See the home’s price history and past sales, including closing records and other documentation (if available).

- Similar Sales: Browse comparable homes that have sold, and how much they sold for.

- Nearby: Find out what’s nearby (subways, schools, parks, museums, and more).

- About the Neighborhood: Learn more about the home’s neighborhood by reading its StreetEasy Neighborhood Guide.

7. Save (and track) your favorite homes

When you come across a dream home contender, be sure to save it! Just look for the Save button on the listing page.

You can also track your saved homes through notifications. Go to Account > Notifications and opt into email notifications for your saved homes, or use the StreetEasy app to opt into push notifications. You’ll receive alerts when there are price changes, open houses, listing status updates, etc.

Bonus Tip: If you’re home shopping with another person, you can easily share listings with them. On the listing page, just click the Share button to send them the listing via email.

Learn more about how successful buyers use StreetEasy to find their ideal home.

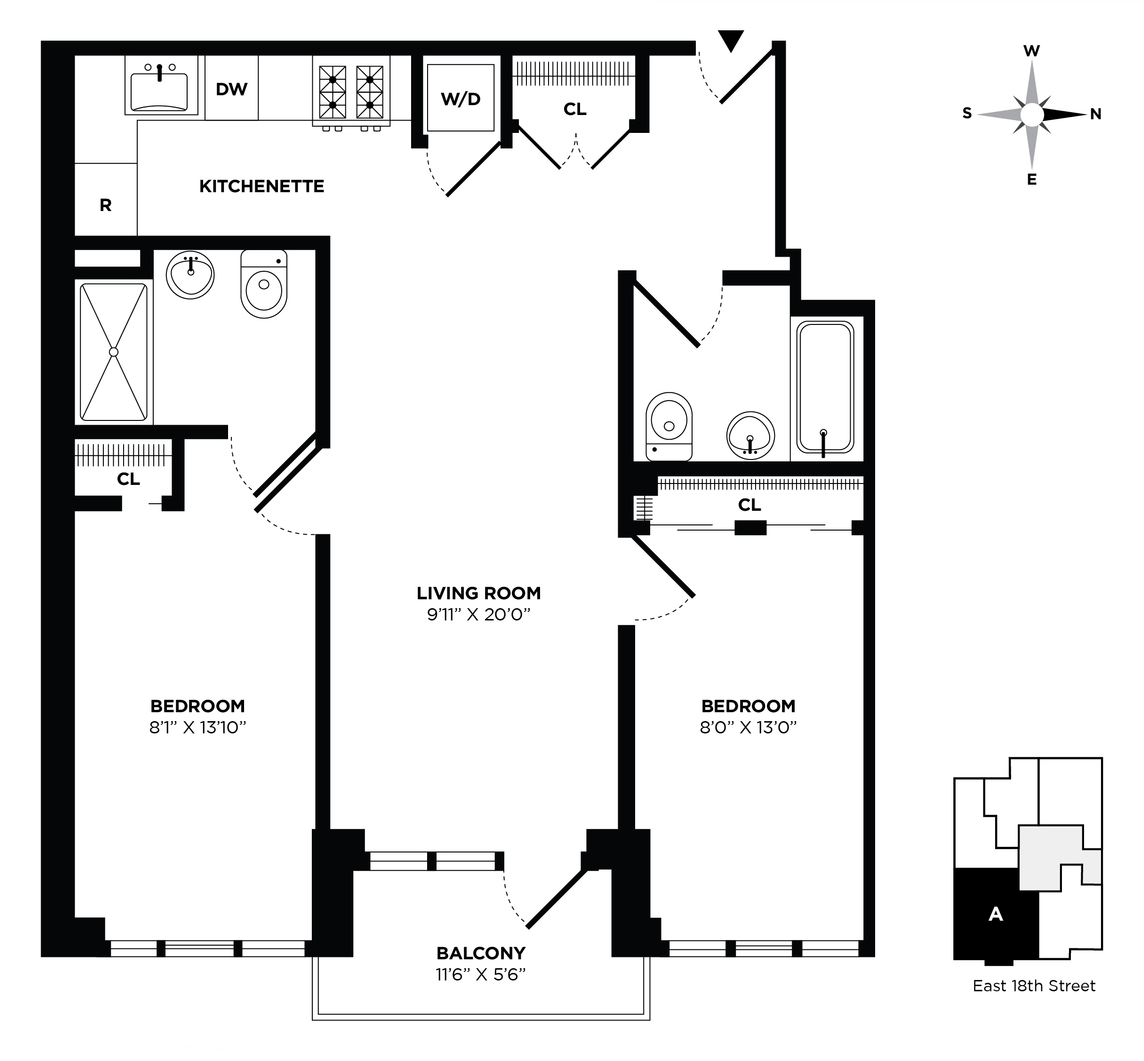

How to Read a Floor Plan

Knowing how to read a floor plan is also essential when evaluating listings. You may think you’ve found the one, but the floor plan can reveal important details — like potential noise levels, closet space, and how much natural light the unit will get.

Here are some things to keep in mind when examining a floor plan:

- Bedrooms: Where are they situated within the apartment? Do they have closets, windows, etc.?

- Windows: Note where they’re located, and find out the building’s orientation by looking for a compass on the floor plan. This will help you gauge how much sunlight the space will get, based on where the sun rises and sets. A room with south-facing windows will get plenty of light throughout the day.

- Doors: Which way do they swing? The floor plan should show you.

- Railroad layout: A unit with a railroad layout has all of its rooms in one straight line, including the kitchen and living area. The bedrooms are usually on opposite ends of the apartment, but if they’re directly next to each other, someone’s bedroom will become a walk-through to get to the other rooms.

- Dimensions: Floor plans typically include each room’s dimensions and, ideally, ceiling heights. However, don’t take it as a given that they’re correct. “Bring the floor plan to the residence and walk through the apartment, using it as a map, so you have an accurate understanding of the space,” says Splendore.

- Closets: “CL” indicates a closet. Note their relative size, location, and if any are walk-in.

- Features: Look out for features like a dishwasher (DW), bathtub, or the holy grail: an in-unit washer/dryer (W/D).

If you come across a listing that doesn’t have a floor plan, ask the listing agent or request a copy of a building’s floor plan online from the Department of Buildings.

Queens Homes Under $1.5M on StreetEasy Article continues below

Ready to Buy? Need More Help Searching? Get a Buyer’s Agent

You don’t have to go through the home buying (or shopping) process alone. A great buyer’s agent can help you find exactly what you’re looking for — and seal the deal. A buyer’s agent is a licensed real estate agent who represents you, the buyer, in the home purchasing process. The StreetEasy Home School video below explains more.

Even better, you can work with a buyer’s agent who is also a StreetEasy Expert. Experts are agents trusted by StreetEasy who have verified experience helping buyers like you, with deal history and expertise in your desired neighborhoods, buildings, or types of homes. We measure their performance to ensure you receive top-notch service.

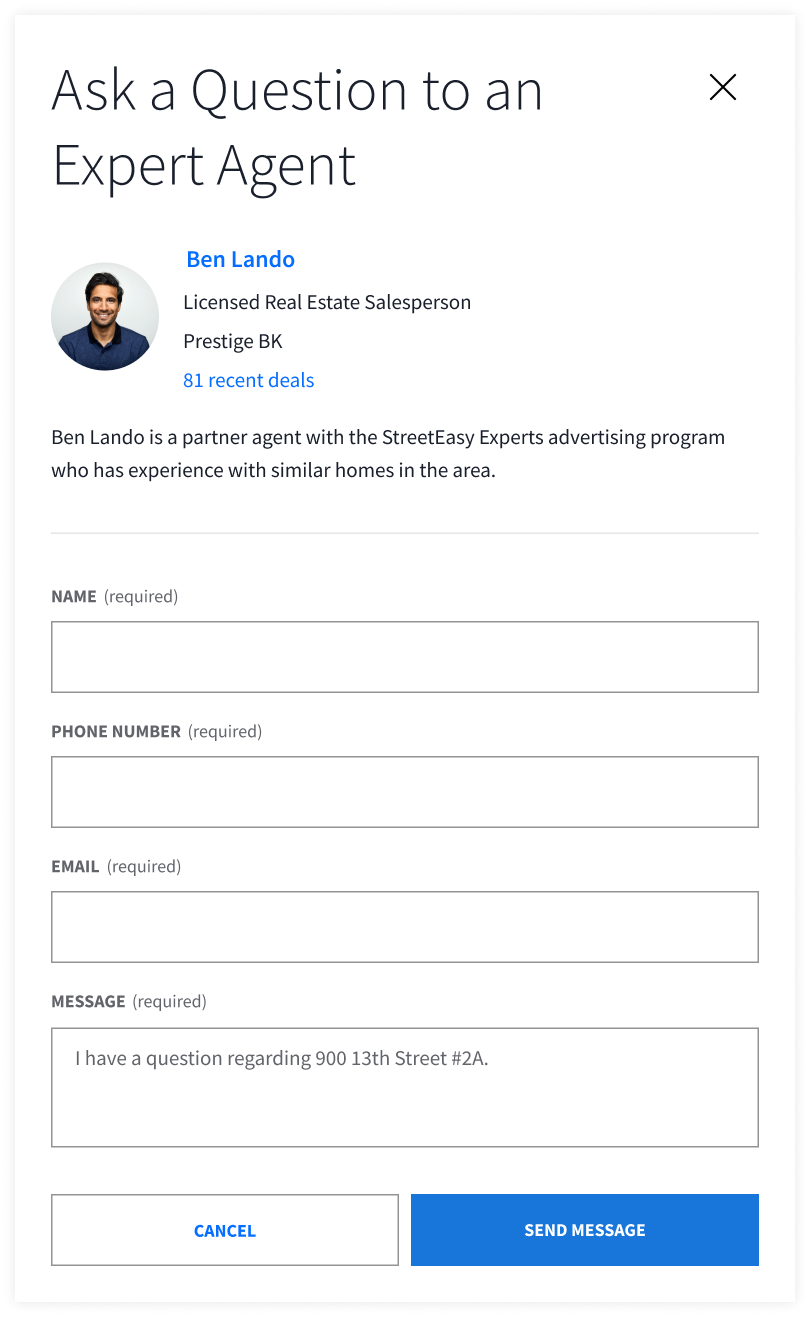

There are a few ways to connect with an Expert buyer’s agent. For one, on a listing you’re interested in, click Schedule a Showing or Ask a Question. This will bring up a contact form you can use to send a message to the Expert on that listing.

Or, on your search results page, scroll down and look for this banner:

Finally, for an even more personalized experience, contact the StreetEasy Concierge and tell them about your needs. Our Concierge will recommend an Expert who’s well suited to help you find and buy your dream home.

Get personalized help finding your dream home

CONTACT OUR CONCIERGE*Comscore Media Metrix®, Desktop Only, Key Measures (Comscore Market), Total Unique Visitors, 6-month average, July – December 2023, New York, NY, U.S.

StreetEasy is an assumed name of Zillow, Inc. which has a real estate brokerage license in all 50 states and D.C. See real estate licenses. StreetEasy Concierge team members are real estate licensees, however they are not your agents or providing real estate brokerage services on your behalf. StreetEasy does not intend to interfere with any agency agreement you may have with a real estate professional or solicit your business if you are already under contract to purchase or sell property.